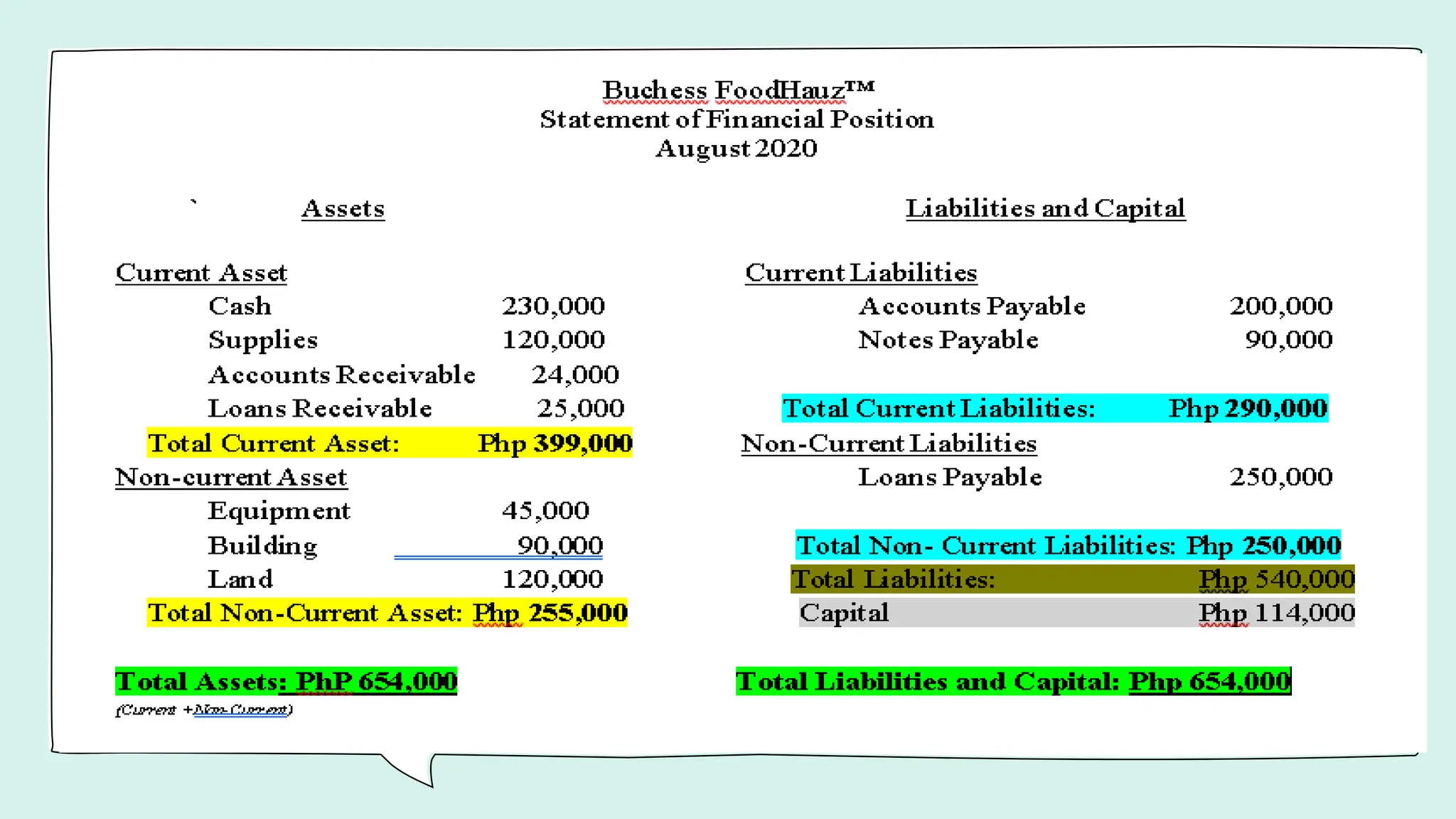

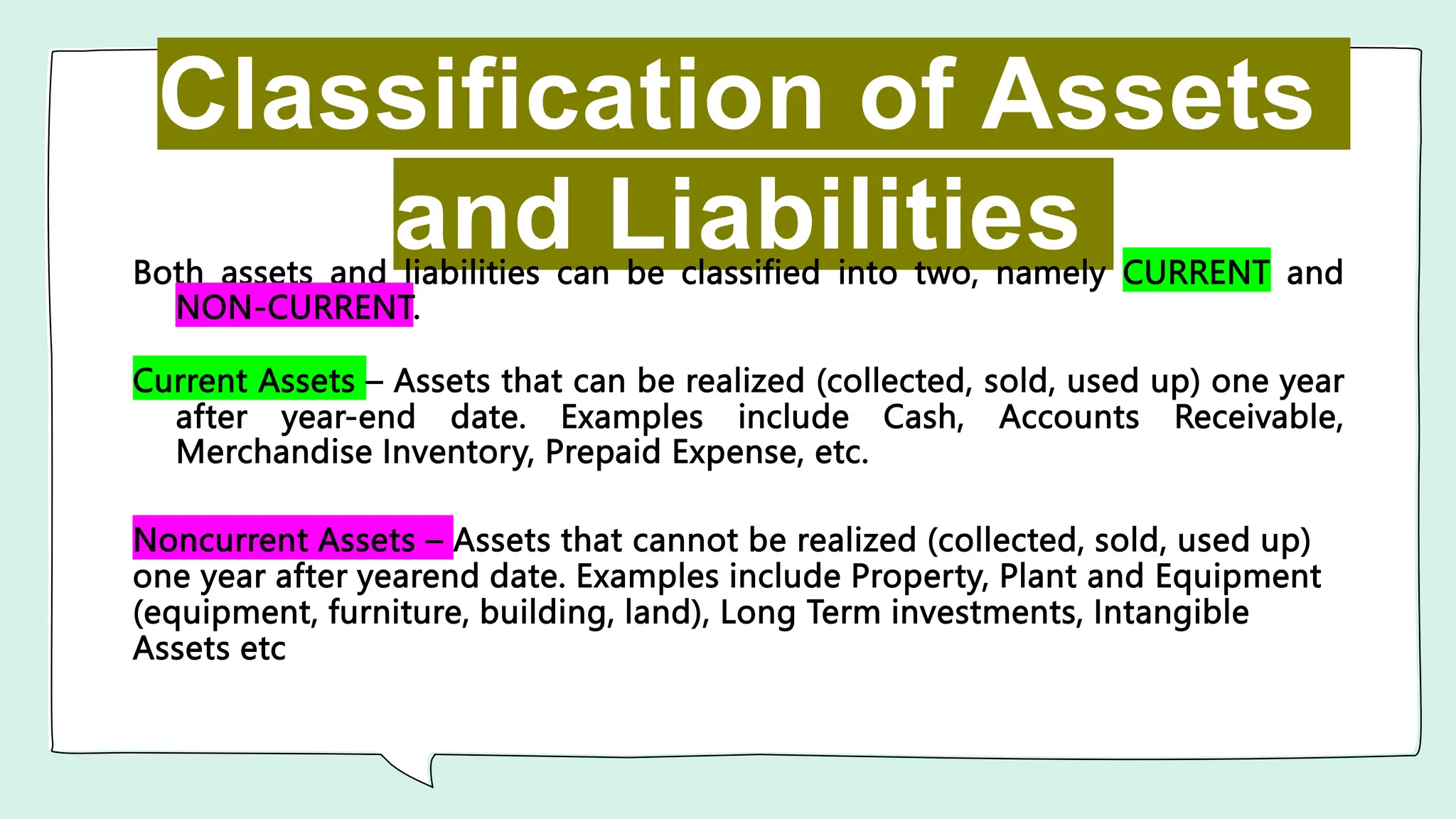

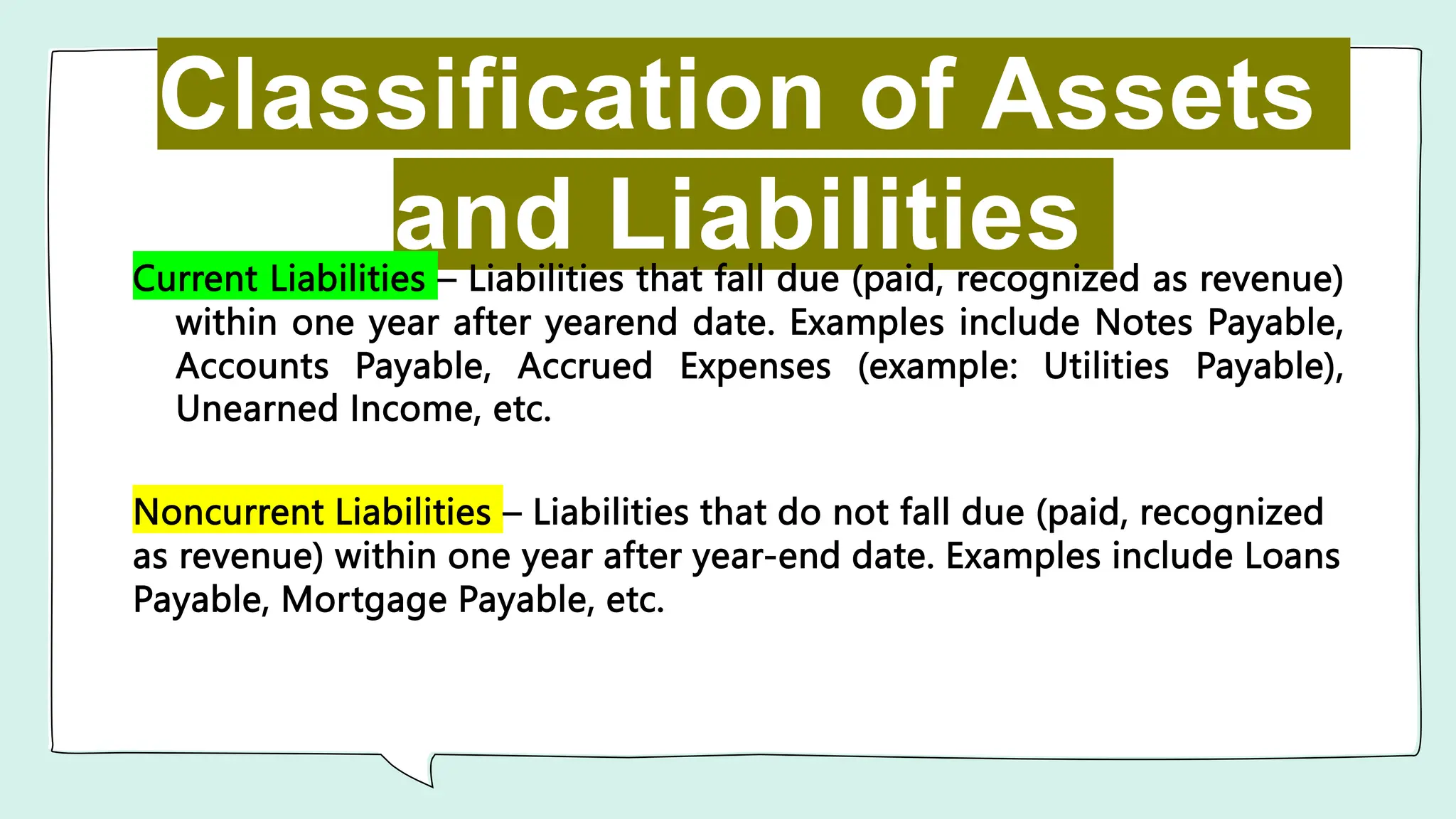

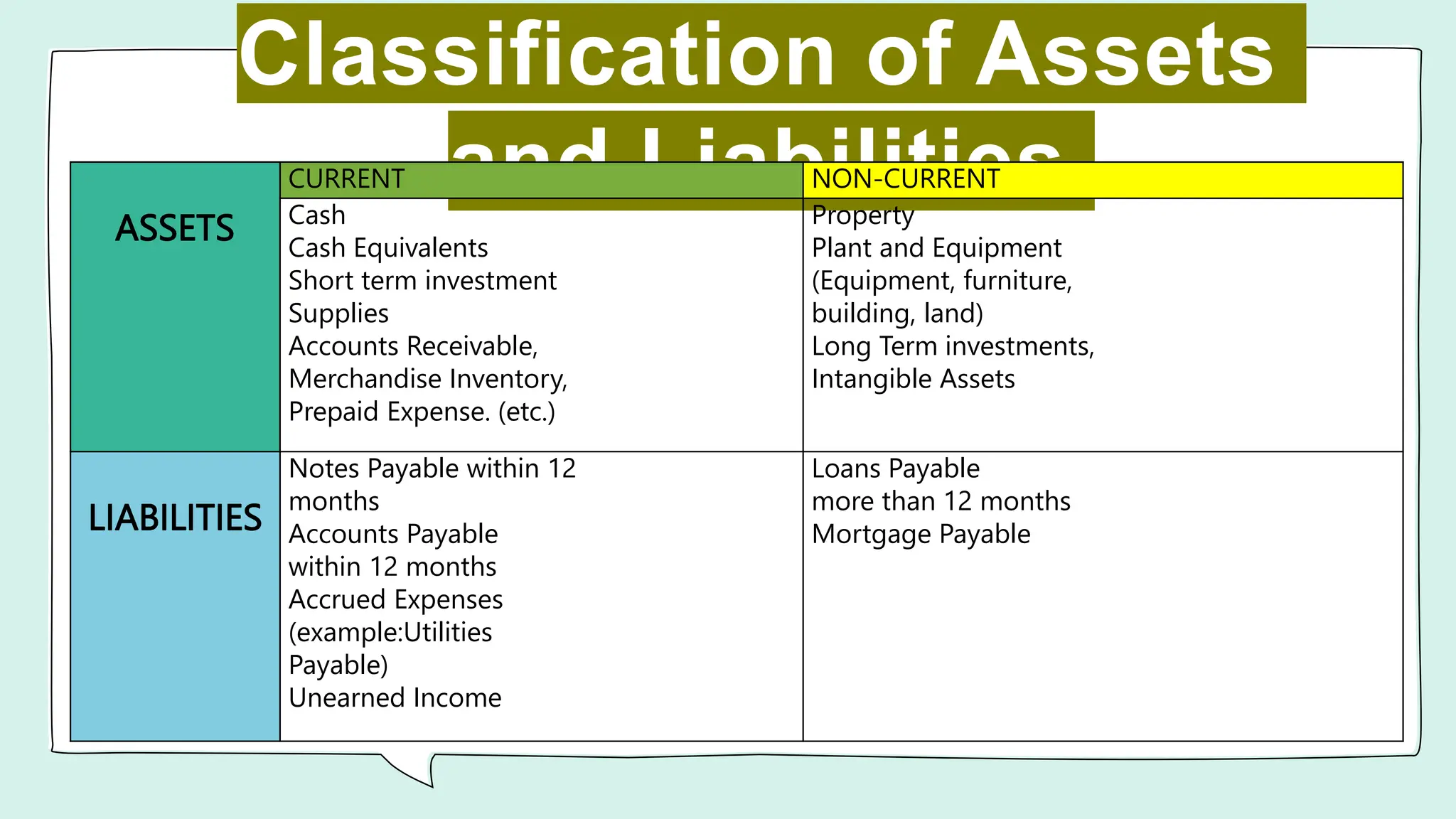

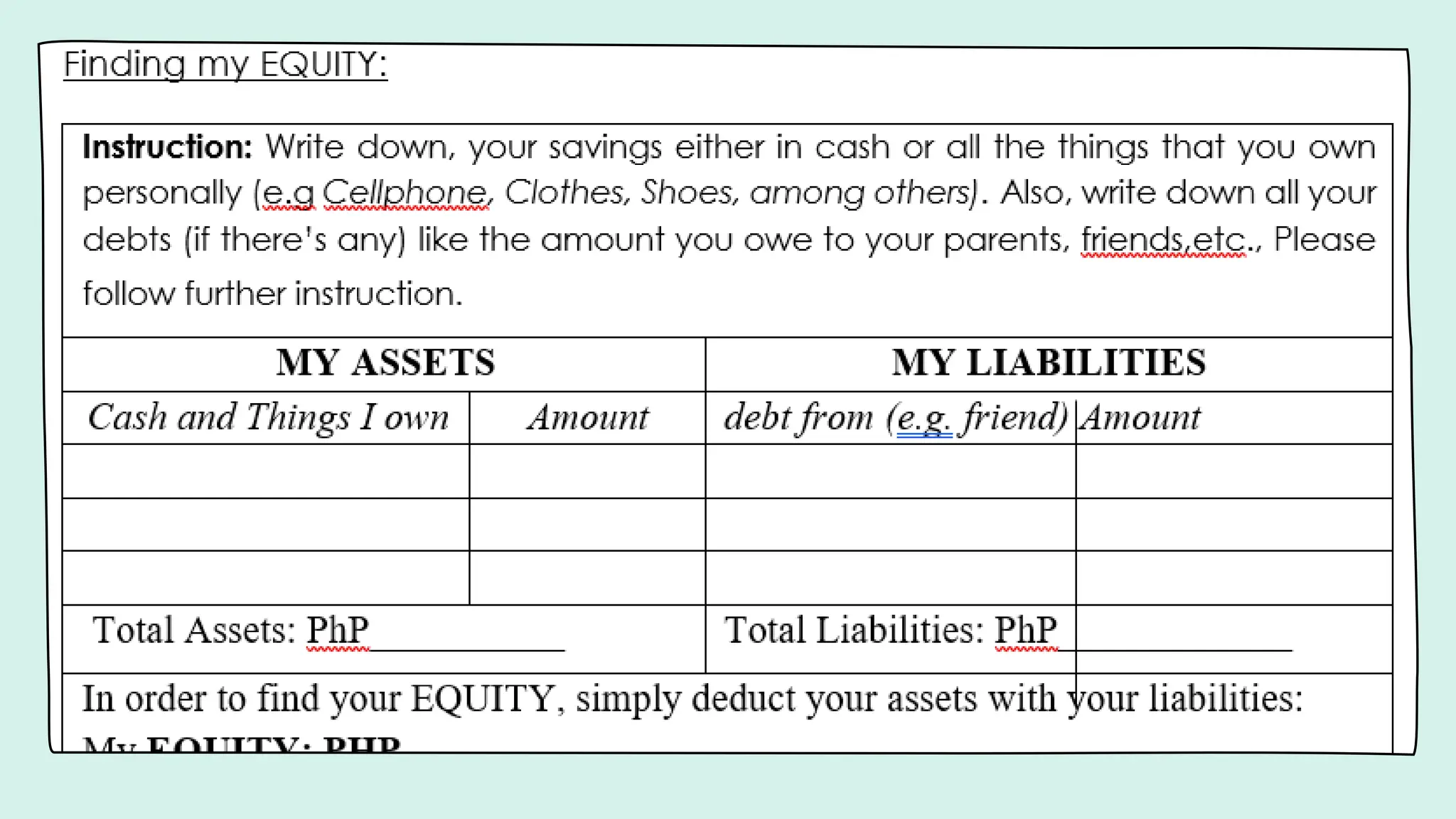

A Statement of Financial Position reports a company's assets, liabilities, and shareholders' equity at a point in time. It provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Assets and liabilities can be classified as current or non-current. Current assets can be converted to cash within a year, while non-current assets cannot. Current liabilities are due within a year, while non-current liabilities are not. Examples of each are provided. Capital or equity represents the residual interest in a company's assets after deducting all liabilities, and is known as owners', partners', or shareholders' equity depending on the business type.