The document provides an overview of a Teaching Guide for a Business Finance course in the senior high school Academic Track, outlining the course description, content standards and competencies, and sample modules on topics like financial management, financial statement analysis, and financial planning tools. The guide is intended to help teachers facilitate lessons aligned with DepEd's SHS curriculum and CHED's college readiness standards.

![D

E

P

E

D

C

O

P

Y

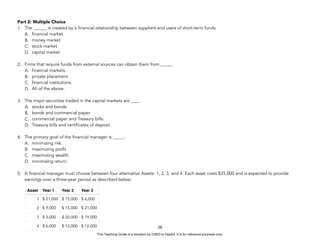

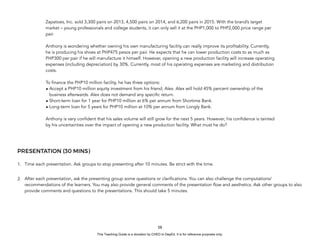

INTRODUCTION/MOTIVATION (30 MINS)

1. Savings and Shortages

• Recall from the previous discussions that one of the functions of a financial manager is financing and

investing of funds.

• Pick a random learner (A) and present a scenario that during his/her management of money, some

cash will remain. Ask him/her what he/she should do with that cash.

- Expected answer: Save or Invest

• Ask your students if they are going to save their money, where would they keep it.

- Expected answers: Banks, Piggy bank, Investments – stocks, mutual funds, insurance

• Pick another learner (B) and ask B what business he/she would like to try. Now, suppose that he/she

had the business running and is profitable for some time. B then decides to expand his/her business

but does not have enough cash to pay for the expansion. Ask the students where can B get the

additional funding?

- Expected answers: Ask from parents, ask from friends, banks, lending institutions.

• Suppose B knew that A had excess money and approached A to lend him/her the capital he/she

needs to expand his/her business for a 20% interest. Since A observed that B’s business has been

profitable, A is willing to lend B the money since he/she is confident that B can repay his loan. A is

now expecting to be 20% richer from his lending to B and B can now expand his operations to gain

more profit from his business.

• Emphasize that this scenario where the lender and the borrower are present at the right time and at

the right place may not happen all the time. In fact, it seldom happens. What happens if they did

not meet? A will not be able to find someone to invest his money to and B cannot get funds to start

his expansion. Here is where the Financial System comes in.

2. Role playing to introduce the concept of saving and investing

• Draw two boxes and label with names of learners A and B. Below [A], write “Saver”, and below [B],

write “users of funds”.

20

Terms Defined:

Financial Markets – organized forums in

which the suppliers and users of various

types of funds can make transactions

directly

This Teaching Guide is a donation by CHED to DepEd. It is for reference purposes only.](https://image.slidesharecdn.com/businessfinancetg-230212063343-d1d3850b/85/Business-Finance-TG-pdf-33-320.jpg)

![D

E

P

E

D

C

O

P

Y

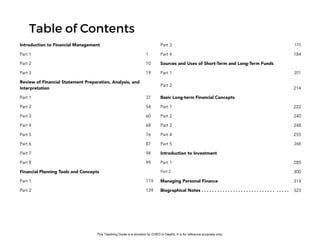

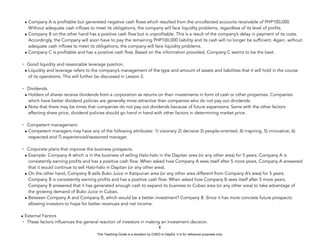

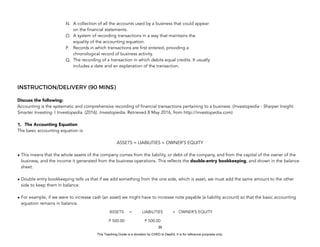

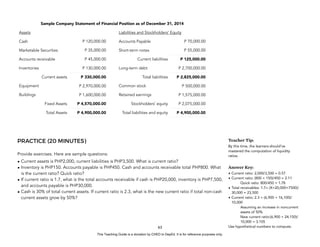

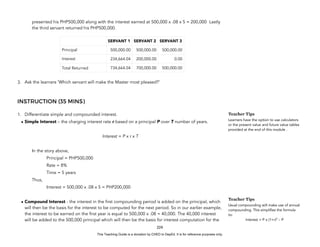

Financial System

Figure 1: The Financial System

• Post the question of how transactions between suppliers and users of funds take place. How would they prove that there was a transaction

so that the demander will be able to repay the supplier on time and at the right amount?

- Answers:

- Verbal agreement

- Written agreement

• Discuss that due to the increased need for security for the performance of obligations arising from these transactions and due to the

growing size of the financial system, the transfers of funds from one party to another are made through Financial Instruments.

• Note that on the diagram presented, the solid lines represent the flow of cash/funds, while the broken lines represent the flow of financial

instruments which represent obligations to transfer cash or other assets in the future.

22

Financial

Institutions

[Learner A]

Savers/Suppliers

of Funds

[Learner B]

Users/Demanders

of Funds

Private Placement

Financial Markets

Flow of funds Flow of securities/notes/bonds/debt instruments

This Teaching Guide is a donation by CHED to DepEd. It is for reference purposes only.](https://image.slidesharecdn.com/businessfinancetg-230212063343-d1d3850b/85/Business-Finance-TG-pdf-35-320.jpg)

![D

E

P

E

D

C

O

P

Y

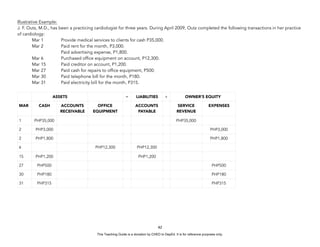

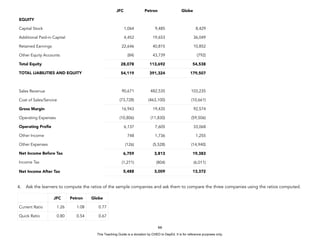

INSTRUCTION/DELIVERY (30 MINS)

1. Define financial leverage.

• Financial leverage refers to the company’s use of debt. It defines the company’s capital structure

which indicates how much of the total assets are financed by debt and equity.

2. Illustrate how financial leverage works. The teacher may provide a scenario/case where an

entrepreneur is deciding how to finance a business venture, specifically what capital structure

should be chosen. With this, you can demonstrate that with increased debt comes greater risk as

well as higher potential return. An example is provided before:

• Pam has a small restaurant business with current equity of PHP60,000. With the increasing demand,

she is planning to expand her restaurant space. After much analysis she determined that an initial

investment of PHP50,000 in fixed assets is necessary. These funds can be obtained in either of two

ways. The first is the no-debt plan, under which she would ask a relative to become an investor

(owner) by investing the full PHP50,000. The other alternative, the debt plan, involves borrowing

PHP50,000 from the nearby rural bank at 10% annual interest.

• Pam expects PHP 30,000 in annual sales, PHP18,000 in operating expenses, and a 30% tax rate. The

no-debt plan results in after-tax profits of PHP8,400, which is an 8.4% return on equity (new equity of

PHP100,000)

• The debt plan results in PHP4,400 of after-tax profits or 8.8% return on equity (equity still at

PHP50,000). The debt plan provides Pam with a higher rate of return, but the risk of this plan is also

greater, because the annual PHP5,000 of interest must be paid whether Pam’s business is profitable

or not.”

• Provide sensitivity analysis, focus on Earnings before Income Tax [EBIT]

• You may summarize the results of the two alternatives in the board.

3. Define the types of leverage ratios and write the formulas on the board.

• Debt ratio – This ratio measures the proportion of total assets finance by total liabilities or money

provided by creditors (not by the business owners).

• Debt-to-equity ratio – A variation of debt ratio, shows the proportion of debt to equity.

• The teacher may review the accounting equation (Assets = Liabilities + Equities) in showing how the

first two ratios relate.

• Interest coverage ratio – This ratio shows the company’s ability to pay its fixed interest charges in

89

Teacher Tip:

Before reaching this point, make sure the

class understands what debt and preferred

stocks are.

This Teaching Guide is a donation by CHED to DepEd. It is for reference purposes only.](https://image.slidesharecdn.com/businessfinancetg-230212063343-d1d3850b/85/Business-Finance-TG-pdf-102-320.jpg)

![D

E

P

E

D

C

O

P

Y

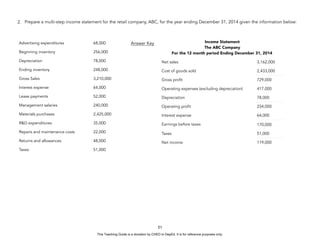

of bread. However, you also have to take account your competition. What if there are 4 other sellers of bread? You will need to have to

divide the sales between the 5 of you. Does this mean your new forecast should be 100 units of bread? Not necessary. You should also

know the preference of your consumers. If more of them would prefer to buy more bread from you, then you should increase your sales

forecast.

- Production Capacity and man power (internal)

Suppose that you have already evaluated the macroeconomic factors and identified that there is a very strong market for your product

and consumers are very likely to buy from you. You forecasted that you will be able to sell 1,000 units of your product. However, you

only have 20 employees who are able to produce 20 units each. Your capacity cannot cover your expected demand hence, you are

limited by it. To be able to increase capacity, you should be able to expand your operations.

• Discuss the implications if sales budget is not correct. If understated, there can be lost opportunities in the form of forgone sales. If it is too

optimistic, the management may decide to unnecessarily increase capacity or hire more employees and end up with more inventories.

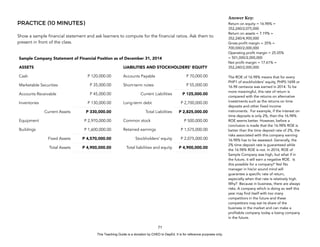

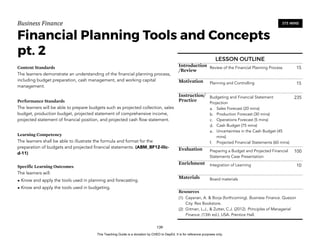

2. Production Budget

• Discuss what a production budget is and how it is formulated.

- A production budget provides information regarding the number of units that should be produced over a given accounting period based

on expected sales and targeted level of ending inventories.

- It is computed as follows

Required production in units = Expected Sales + Target Ending Inventories - Beginning Inventories

Note: Ending inventory of current period is beginning inventory of next period.

• Provide the following example (EASY):

- [A] Company forecasts sales in units for January to May as follows:

143

Jan Feb Mar Apr May

Units 2,000 2,200 2,500 2,800 3,000

This Teaching Guide is a donation by CHED to DepEd. It is for reference purposes only.](https://image.slidesharecdn.com/businessfinancetg-230212063343-d1d3850b/85/Business-Finance-TG-pdf-156-320.jpg)

![D

E

P

E

D

C

O

P

Y

- Moreover, [A] Company would like to maintain 100 units in its ending inventory at the end of each month.

- Beginning inventory at the start of January amounts to 50 units.

- How many units should [A] Company produce in order to fulfill the expected sales of the company?

- Answer Key:

3. Budgeting Cash

• Discuss what an Operation Budget is and how it is formulated.

- Operations budget refers to the variable and fixed costs needed to run the operations of the company but are not directly attributable to

the generation of sales.

- Examples of this are the following:

• Rent payments

• Wages and Salaries of selling and administrative personnel

• Administrative Costs

• Travel and representation expenses

• Professional fees

• Interest Payments

• Tax Payments

144

MONTH

Jan Feb Mar Apr May Total

Projected Sales 2,000 2,200 2,500 2,800 3,000 12,500

Target level of ending inventories 100 100 100 100 100 100

Total 2,100 2,300 2,600 2,900 3,100 12,600

Less: beginning inventories 50 100 100 100 100 50

Required production 2,050 2,200 2,500 2,800 3,000 12,500

This Teaching Guide is a donation by CHED to DepEd. It is for reference purposes only.](https://image.slidesharecdn.com/businessfinancetg-230212063343-d1d3850b/85/Business-Finance-TG-pdf-157-320.jpg)

![D

E

P

E

D

C

O

P

Y

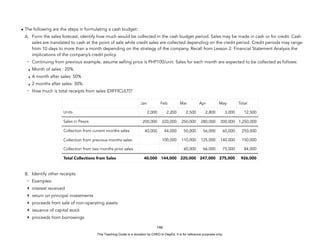

H. If the net cash flow is above the minimum cash balance, the company is in excess cash and may consider putting it in short term

investments. If it is below, the company should make a short term borrowing during that period.

- Moreover, [A] Company has a beginning cash balance of PHP80,000 and would like to maintain an ending cash balance of PHP100,000

per month. Prepare [A] Company’s Cash Budget for January to May. Prepare a cash budget (DIFFICULT).

- Evaluating the Cash Budget:

‣ If the ending cash balance after payment of all required disbursements is less than the required ending balance, the company needs to

borrow additional cash from short term borrowings to meet its required ending balance. Should the ending cash balance exceed the

company’s minimum cash requirement the next period, the company may be able to repay the loan plus accrued interest.

‣ Should the Company have excess cash above its required maintaining cash balance, the company may invest this cash on short term

investments so that it will have an opportunity to earn additional profits. If the company’s cash balance would then fall below its

minimum cash requirement, the company may withdraw the investment to be able to meet the required cash balance.

5. Projected Financial Statements (60 mins)

• Discuss the purpose of projected financial statements.

149

Jan Feb Mar Apr May Total

Cash Receipts 40,000 144,000 220,000 247,000 275,000 926,000

Less: Cash Disbursements (53,000) (157,500) (148,000) (321,000) (193,000) (872,500)

Net Cash Flow (13,000) (13,500) 72,000 (74,000) 82,000 53,500

Add: Beginning Cash 80,000 67,000 53,500 125,500 51,500 80,000

Ending Cash Balance 67,000 53,500 125,500 51,500 133,500 133,500

Less: Minimum Cash Balance (100,000) (100,000) (100,000) (100,000) (100,000) (100,000)

Cumulative excess cash balance

(Cumulative required financing)

(33,000) (46,500) 25,500 (48,500) 33,500 33,500

This Teaching Guide is a donation by CHED to DepEd. It is for reference purposes only.](https://image.slidesharecdn.com/businessfinancetg-230212063343-d1d3850b/85/Business-Finance-TG-pdf-162-320.jpg)

![D

E

P

E

D

C

O

P

Y

- Projected financial statements is a tool of the company to set an overall goal of what the company’s performance and position will be for

and as of the end of the year. It sets targets to control and monitor the activities of the company. The following reports may be

forecasted:

‣ Projected Income Statement

‣ Projected Statement of Financial Position

‣ Projected Statement of Cash Flows

• Provide the learners a historical financial statement that they would use to make their forecast. You may use your own set of financial

statements or the one found below.

150

[A] Company

Income Statements

For the years ended December 31

2014 2013 2012 2011 2010

Net Sales 5,250,000 4,770,000 4,310,000 3,910,000 3,547,000

Cost of sales 4,305,000 3,959,100 3,663,500 3,128,000 2,979,480

Gross Profit 945,000 810,900 646,500 782,000 567,520

Operating expenses 314,750 297,890 246,231 221,500 217,538

Operating income 630,250 513,010 400,259 560,500 349,982

Interest Expense 250,000 250,000 250,000 450,000 300,000

Income before taxes 380,250 263,010 150,259 110,500 49,982

Taxes 114,075 78,903 45,078 33,150 14,995

Net Income 266,175 184,107 105,181 77,350 34,987

This Teaching Guide is a donation by CHED to DepEd. It is for reference purposes only.](https://image.slidesharecdn.com/businessfinancetg-230212063343-d1d3850b/85/Business-Finance-TG-pdf-163-320.jpg)

![D

E

P

E

D

C

O

P

Y

151

[A] Company

Statement of Financial Positions

As of December 31

2014 2013 2012 2011 2010

Assets

Current Assets

Cash 1,060,000.00 990,000.00 770,000.00 760,000.00 880,000.00

Receivables 2,300,500.00 1,921,000.00 1,722,000.00 1,454,000.00 1,396,000.00

Inventories 4,850,000.00 4,500,000.00 3,797,000.00 3,290,000.00 3,350,000.00

Other current assets 1,050,000.00 980,000.00 984,000.00 735,000.00 998,000.00

Total Current Assets 9,260,500.00 8,391,000.00 7,273,000.00 6,239,000.00 6,624,000.00

Non-current Assets

Property, plant, and equipment, net 2,440,000.00 2,260,000.00 1,810,000.00 1,870,000.00 1,900,000.00

Other noncurrent assets 835,689.00 925,681.00 896,842.00 876,235.00 827,490.00

Total non-current assets 3,275,689.00 3,185,681.00 2,706,842.00 2,746,235.00 2,727,490.00

Total assets 266,175.00 184,107.00 105,181.00 77,350.00 34,987.00

Liabilities and Equity

Current Liabilities

Notes payable (external funds needed)

Trade payables 5,050,000.00 4,756,000.00 4,130,000.00 3,300,000.00 2,870,000.00

Income taxes payable 28,520.00 19,725.00 11,270.00 8,290.00 3,750.00

Current portion of long-term debt 2,250,000.00 2,500,000.00 1,000,000.00 2,000,000.00 2,000,000.00

Other current liabilities 85,600.00 28,700.00 40,990.00 30,688.00 37,890.00

7,414,120.00 7,304,425.00 5,182,260.00 5,338,978.00 4,911,640.00

This Teaching Guide is a donation by CHED to DepEd. It is for reference purposes only.](https://image.slidesharecdn.com/businessfinancetg-230212063343-d1d3850b/85/Business-Finance-TG-pdf-164-320.jpg)

![D

E

P

E

D

C

O

P

Y

- Start the exercise in financial statement projection with the Projected Income Statement. Provide the information below.

- Ask the learners to prepare pro-forma financial statements without numbers. The blank spaces will be filled as the steps on financial

statement projections are discussed.

- Flash an excel file of the blank FS on the screen if there are available facilities. Otherwise a set of blank pro-forma FS can be written on

the board.

153

Sales are expected to increase by 10% in 2015 from the 2014 sales level. This

growth assumption is based on the assessment of the external and internal

factors related to the Company and the historical growth of the company. The

company’s sales grew by 10.3% annually from 2010 to 2014.

[A] Company

Projected Income Statement

For the year ending December 31

Net Sales xxx

Cost of sales xxx

Gross Profit xxx

Operating expenses xxx

Operating income xxx

Interest Expense xxx

Income before taxes xxx

Taxes xxx

Net Income xxx

This Teaching Guide is a donation by CHED to DepEd. It is for reference purposes only.](https://image.slidesharecdn.com/businessfinancetg-230212063343-d1d3850b/85/Business-Finance-TG-pdf-166-320.jpg)

![D

E

P

E

D

C

O

P

Y

154

[A] Company

Projected Statement of Financial Position

December 31, 2015

Assets

Current Assets

Cash xxx

Receivables xxx

Inventories xxx

Other Current Assets xxx

Total Current Assets xxx

Non-current assets

Property, plant, and equipment, net xxx

Other non-current assets xxx

Total non-current assets xxx

Total Assets xxx

Liabilities and Equity

Current liabilities xxx

Notes payable (external funds

needed)

xxx

Trade payables xxx

Income taxes payable xxx

Current portion of long term debt xxx

Other current liabilities xxx

xxx

[A] Company

Projected Statement of Financial Position

December 31, 2015

Non-current liabilities

Long-term debt, net of current

portion

xxx

Total liabilities xxx

Stockholders’ equity

Capital stock xxx

Retained earnings xxx

Total stockholders’ equity xxx

Total liabilities and stockholders’

equity

xxx

This Teaching Guide is a donation by CHED to DepEd. It is for reference purposes only.](https://image.slidesharecdn.com/businessfinancetg-230212063343-d1d3850b/85/Business-Finance-TG-pdf-167-320.jpg)

![D

E

P

E

D

C

O

P

Y

- Complete projected income statement as follows:

- Compute for Income Tax Payable.

Projected Income Tax Payable in 2015: 51,225 x (1 – 75%) = 12,806

- Compute for current and non-current portion of long term assets:

159

[A] Company

Projected Statement of Profit or Loss

For the year ending December 31

Net Sales 5,775,000

Cost of sales 4,735,500

Gross Profit 1,039,500

Operating expenses 598,750

Operating income 440,750

Interest Expense 270,000

Income before taxes 170,750

Taxes 51,225

Net Income 119,525

Loan Current Portion Long-term Portion Total

Loan incurred on December 31, 2014 of PHP3 million 1,000,000 1,000,000 2,000,000

Loan of PHP3.5 million to be incurred on December

31, 2015

1,000,000 2,500,000 3,500,000

Total 2,000,000 3,500,000 5,500,000

This Teaching Guide is a donation by CHED to DepEd. It is for reference purposes only.](https://image.slidesharecdn.com/businessfinancetg-230212063343-d1d3850b/85/Business-Finance-TG-pdf-172-320.jpg)

![D

E

P

E

D

C

O

P

Y

- Ask the learners what the implication of a positive or negative EFN is.

- Suggested discussion:

‣ A positive value for EFN, means that the company needs more funds equivalent to the positive value of EFN. As to how this will be

raised depends on the management and the company’s ability to access funds. This EFN can be raised in the form of short term

borrowing, long term borrowing or equity, or a combination of all sources. The projected balance sheet which generated this EFN is

just the first iteration in preparing a pro-forma balance sheet.

‣ A negative value for EFN, means that the company has excess cash. As to how this excess cash will be distributed will be the subject

of the next iteration for the pro-forma balance sheet. This can be disposed by adding it to the projected cash balance or it can be

used to retire some of the debt if pre-termination is allowed.

- Complete FS as follows:

161

[A] Company

Projected Statement of Financial Position

December 31, 2015

Assets

Current Assets

Cash 1,165,973

Receivables 2,530,605

Inventories 5,334,945

Other Current Assets 1,155,000

Total Current Assets 10,186,523

Non-current assets

Property, plant, &equipment, net 3,130,000

Other non-current assets 835,689

Total non-current assets 3,965,689

Total Assets 13,152,212

[A] Company

Projected Statement of Financial Position

December 31, 2015

Non-current liabilities

Long-term debt, net of current

portion

3,500,000

Total liabilities 11,210,618

Stockholders’ equity

Capital stock 1,000,000

Retained earnings 1,941,594

Total stockholders’ equity 2,941,594

Total liabilities and stockholders’

equity

13,152,212

[A] Company

Projected Statement of Financial Position

December 31, 2015

Liabilities and Equity

Current liabilities

Notes payable (external funds

needed)

57,239

Trade payables 5,554,973

Income taxes payable 12,806

Current portion of long term

debt

2,000,000

Other current liabilities 85,600

7,710,618

This Teaching Guide is a donation by CHED to DepEd. It is for reference purposes only.](https://image.slidesharecdn.com/businessfinancetg-230212063343-d1d3850b/85/Business-Finance-TG-pdf-174-320.jpg)

![D

E

P

E

D

C

O

P

Y

- Prepare the projected statement of cash flows. Follow the discussion.

162

[A] Company

Projected Statement of Cash Flows

For the Year Ending December 31, 2015

Cash flows from operating activities

Income before taxes 170,750

Adjustments:

Depreciation 310,000

Changes in the following accounts

Decrease (Increase) in accounts receivable (230,105)

Decrease (Increase) in inventories (484,945)

Decrease (increase) in other current assets (105,000)

Increase (decrease) in accounts payable 504,973

Increase (decrease) in other current liabilities -

Income taxes paid (66,939)

Cash flows from operating activities 98,734

Cash flows from investing activities

Acquisitions of PPE

(1,000,000)

Acquisition of other non-current assets -

Cash flows from investing activities (1,000,000)

[A] Company

Projected Statement of Cash Flows

For the Year Ending December 31, 2015

Cash flows from financing activities

Payment of cash dividents (300,000)

Short-term notes payable (EFN) 57,239

Loans, net of payments 1,250,000

Cash flows from financing activities 1,007,239

Net change in cash 105,973

Cash, beginning 1,060,000

Cash, ending 1,165,973

This Teaching Guide is a donation by CHED to DepEd. It is for reference purposes only.](https://image.slidesharecdn.com/businessfinancetg-230212063343-d1d3850b/85/Business-Finance-TG-pdf-175-320.jpg)

![D

E

P

E

D

C

O

P

Y

Cash flow x {[(1+r)t

- 1)]/r} Cash flow x

or

Cash flow multiplied by the FV factor seen on the table.

To use the table provided, look for the rate of interest at the uppermost row and the number of periods on the left most column. The

intersection will be the factor to be multiplied to the cash flow.

Illustration: Mr. Mendoza wishes to determine how much the value of his savings in 5 years will be if he will put PHP1,000 per year in a bank

which provides 7% interest per annum.

FV = 1,000 x (FVA factor: 5.7507 period=5, rate=7%) = PHP5,750.70

• (Present of an Ordinary Annuity) The formula for computing the present value of an ordinary annuity is as follows:

Cash flow x

or

Cash flow multiplied by the PV factor seen on the table

Illustration: Mr. Yusoph wants to buy a pair of shoes worth PHP10,500. He has the option of paying it today for PHP10,500 or buying them in

instalment where he has to pay a down payment of PHP4,000 today, and the balance will be paid in two equal payments of PHP4,000 each

for the next two years. Given an interest rate of 10%, which is the better option?

PV = 4,000 + 4000 x (PVA factor: 1.7355 period=2, rate=10%) = PHP10,932.00 for buying on instalment vs. PV PHP10,500 for buying today.

The 4,000 down payment is not multiplied by the annuity factor because it is paid today.

Since buying on instalment would be more expensive, Mr. Yusoph should buy the pair of shoes today.

232

[(1+r)t

- 1]

r

1 -

r

1

(1+r)t

This Teaching Guide is a donation by CHED to DepEd. It is for reference purposes only.](https://image.slidesharecdn.com/businessfinancetg-230212063343-d1d3850b/85/Business-Finance-TG-pdf-245-320.jpg)

![D

E

P

E

D

C

O

P

Y

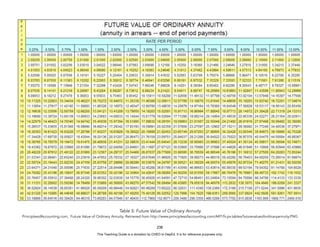

Discuss how to compute for present value and future value of annuity payments. Illustrate how the

present and future values are used.

An annuity is a stream of equal periodic cash flows over a specified period. First, you have to

distinguish between ordinary annuity and annuity due. Ordinary annuity payments are made at the end

of each period (usually annually), while for annuity due, the cash flow occurs at the beginning of each

period. We shall first illustrate ordinary annuities.

(Future Value of an Ordinary Annuity) The formula for computing the future value of an ordinary

annuity is as follows:

Cash flow x {[(1+r)t - 1)]/r}

or

Cash flow multiplied by the FV factor seen on the table

To use the table provided, look for the rate of interest at the uppermost row and the number of periods

on the on the first column (leftmost). The intersection will be the factor to be multiplied to the cash

flow.

Illustration:

Mr. Mendoza wishes to determine how much will be the value of his savings in 5 years if he will put

PHP1,000 per year in a bank which provides 7% interest per annum.

FV = 1,000 x (FVA factor: 5.7507 period=5, rate=7%) = PHP5,750.70

(Present Value of an Ordinary Annuity). The formula for computing the present value of an ordinary

annuity is as follows:

'''''''''''''''''''''''''''''''''''Cash'flow'mul$plied'by'the'PV'factor'seen'on'the'table'

246

Teacher Tip

Walkthrough the process of getting each

EAR using the formula provided.

This Teaching Guide is a donation by CHED to DepEd. It is for reference purposes only.](https://image.slidesharecdn.com/businessfinancetg-230212063343-d1d3850b/85/Business-Finance-TG-pdf-259-320.jpg)