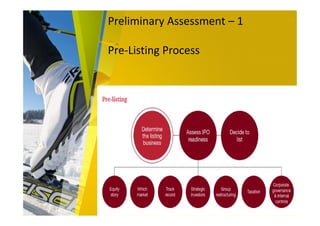

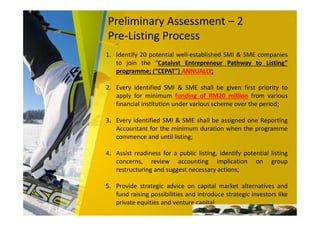

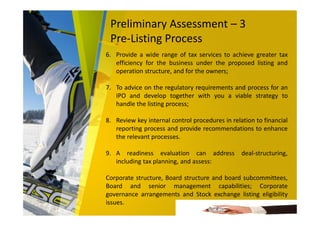

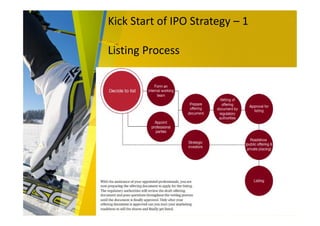

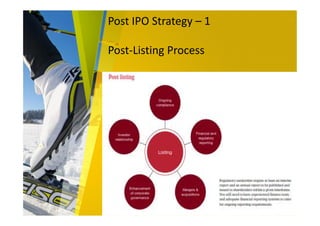

Global Bridge Management Sdn Bhd provides concierge services to guide small and medium enterprises through the process of going public. They assist companies with pre-listing assessments and diagnostics, fundraising of RM20 million, assigning a reporting accountant, and strategic advice. During the listing process, they help with audit/reporting, M&A opportunities, regulatory compliance, internal controls, capital markets transactions, management team development, and governance best practices. Their goal is to prepare companies for a successful initial public offering and life as a publicly traded entity.