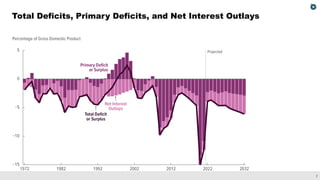

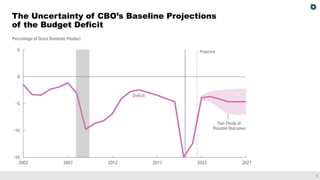

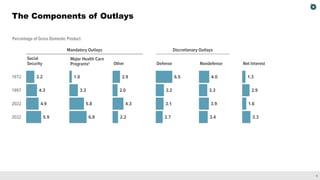

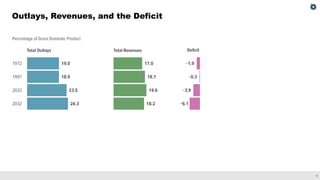

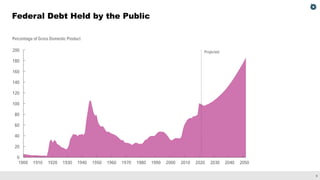

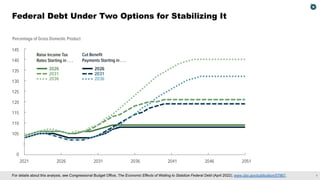

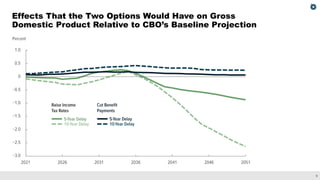

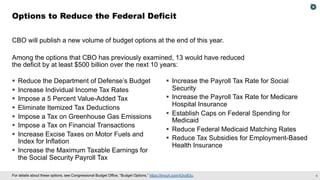

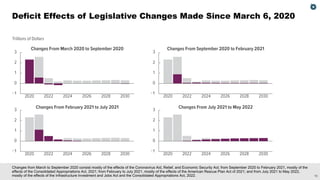

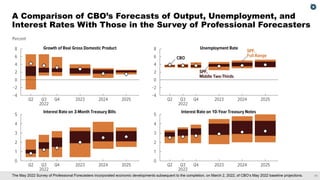

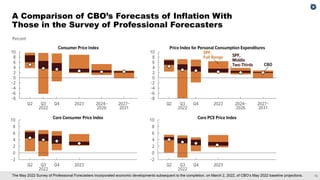

The presentation discusses the budget and economic outlook for the U.S. over the next decade, highlighting total deficits, debts, and projections from the Congressional Budget Office (CBO). It outlines potential options for reducing the federal deficit, including adjustments to defense spending, tax rates, and healthcare subsidies. Additionally, the impact of recent legislation on the deficit and economic forecasts is examined.