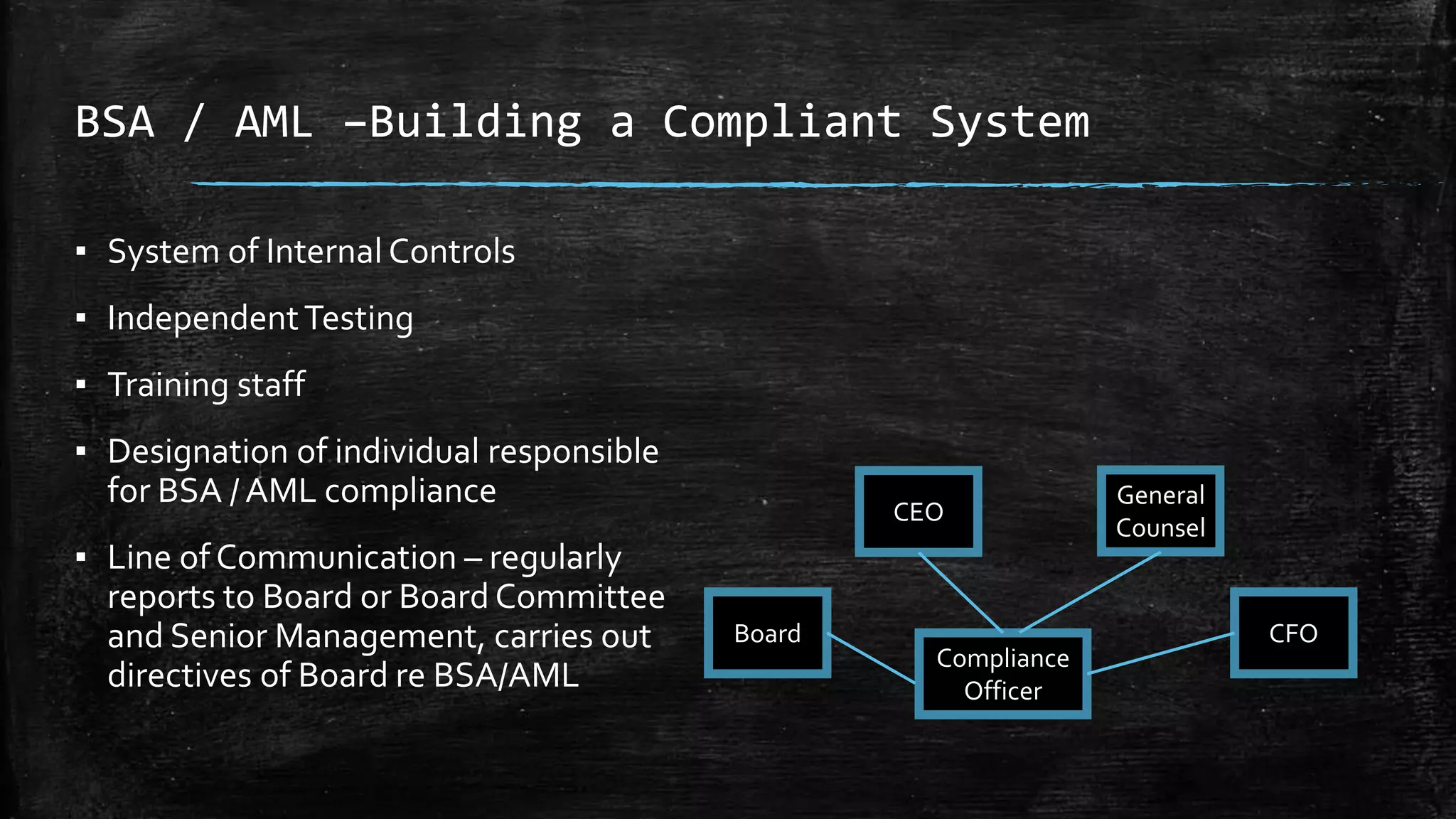

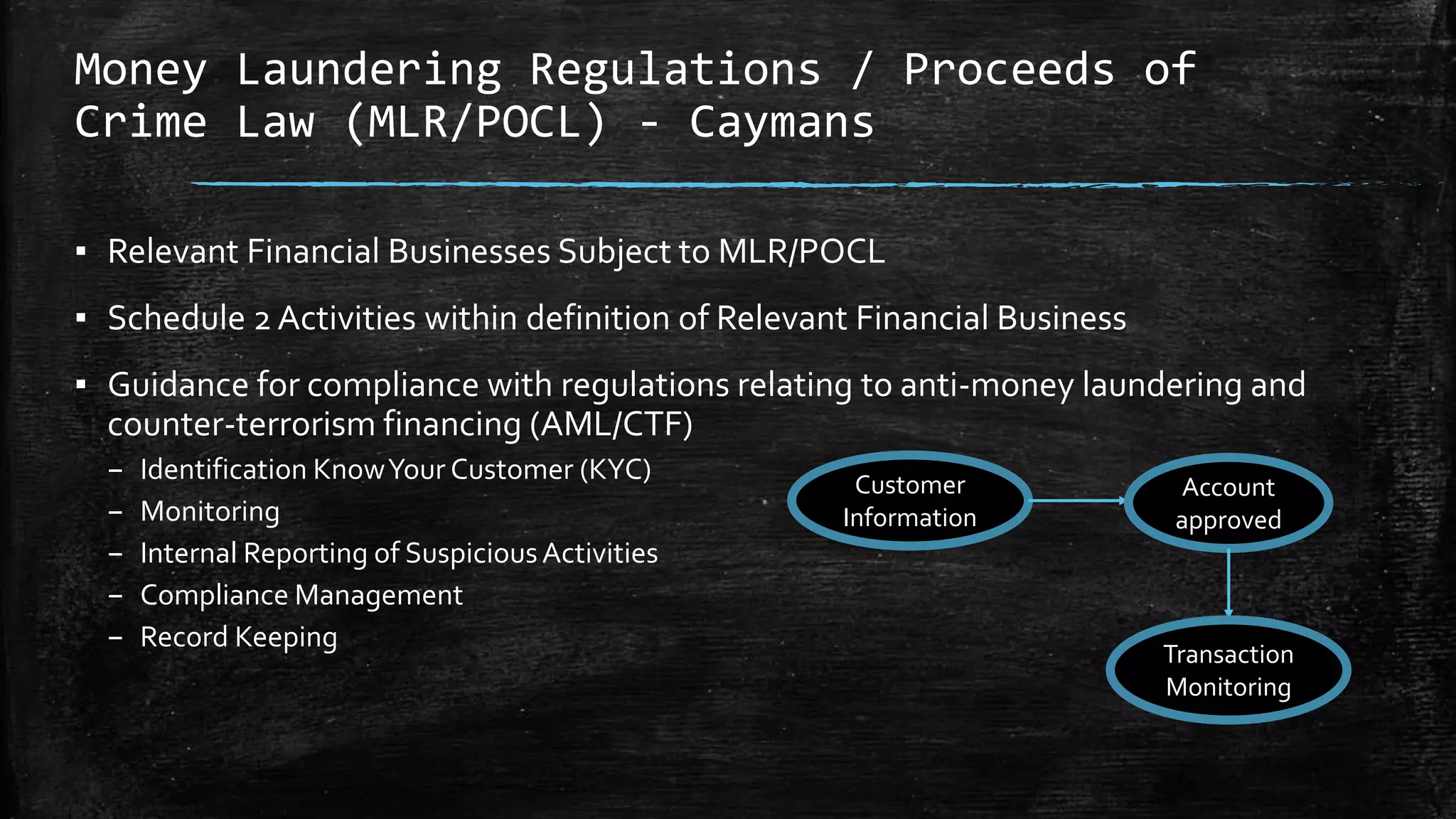

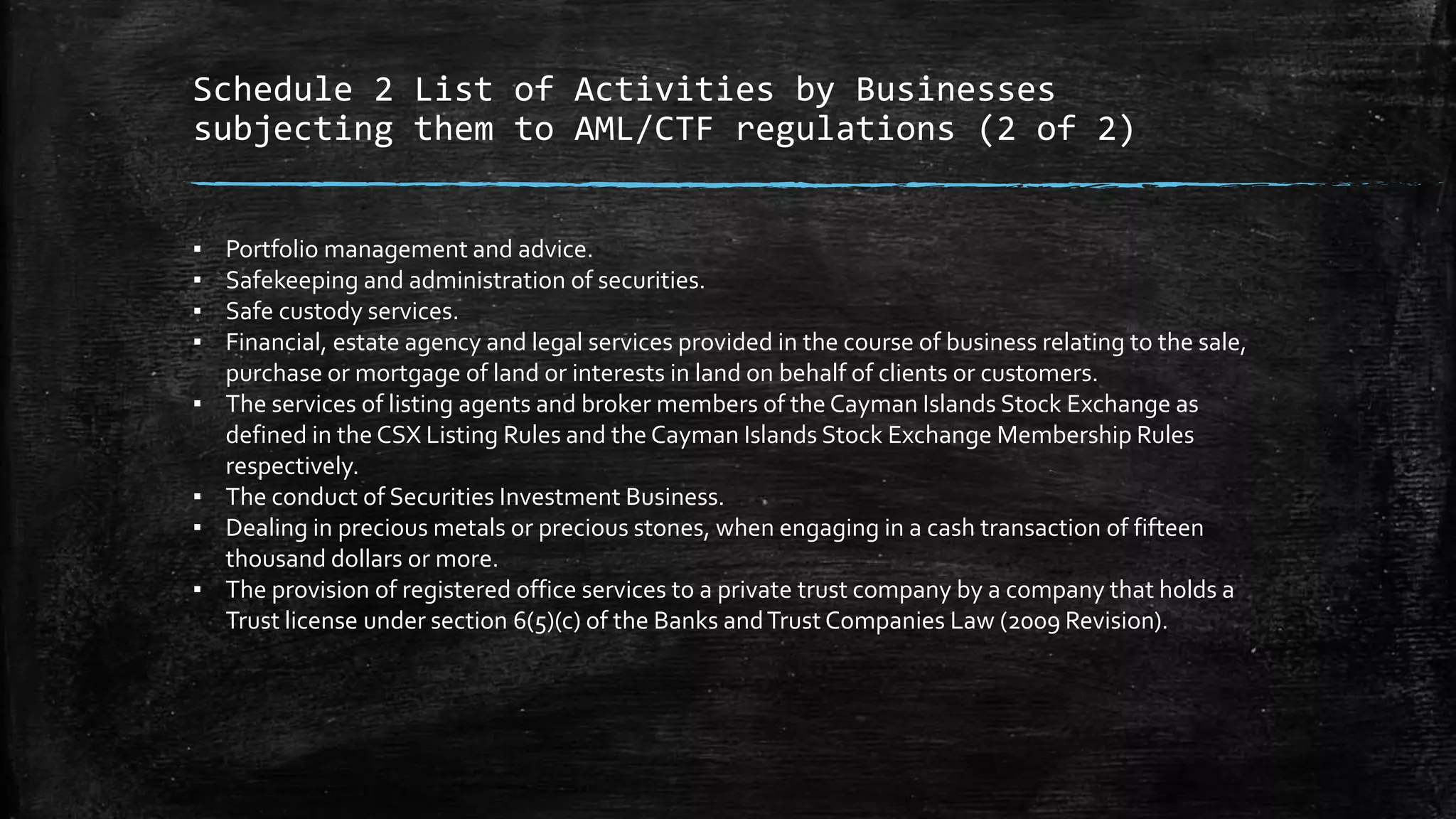

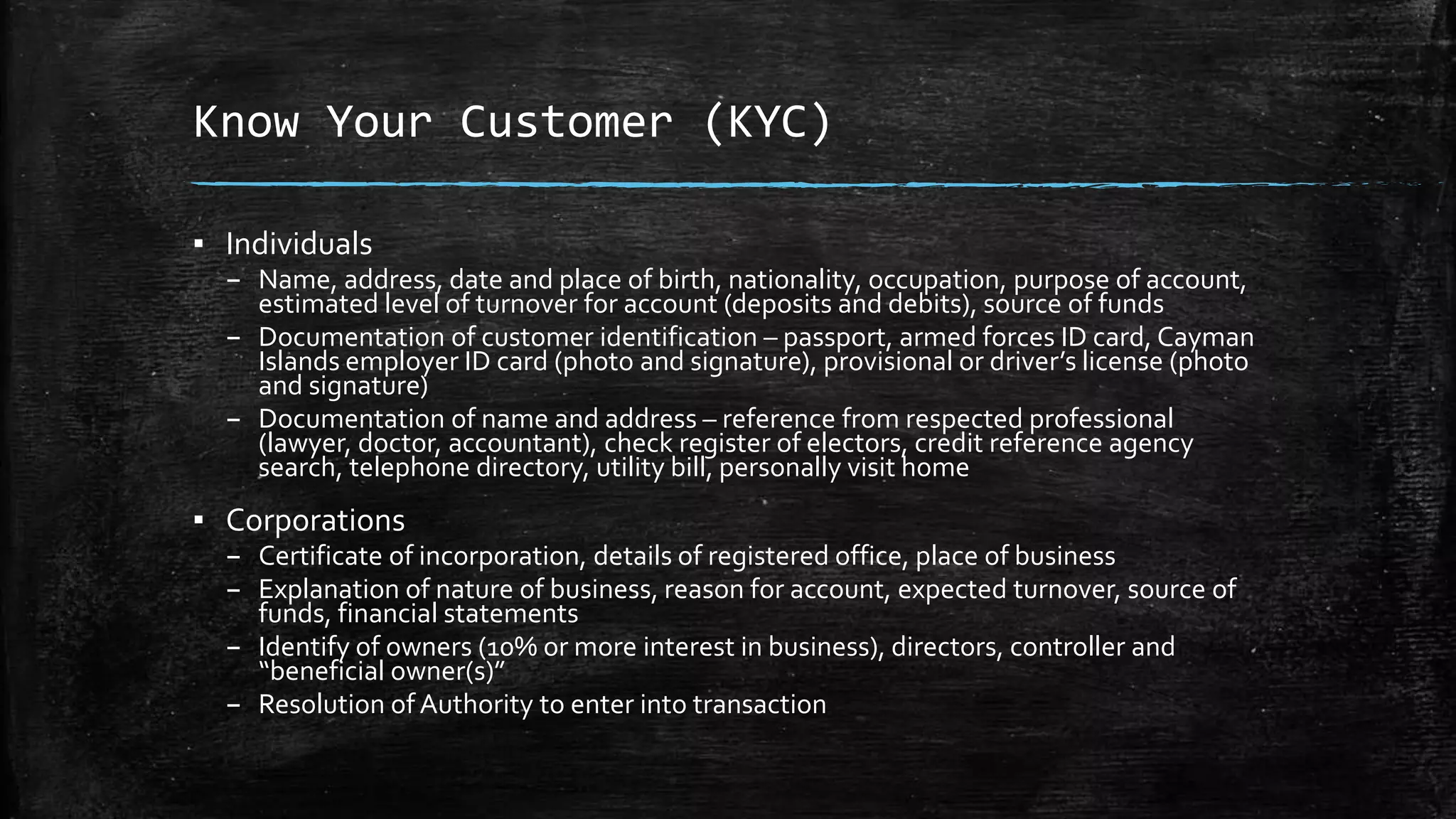

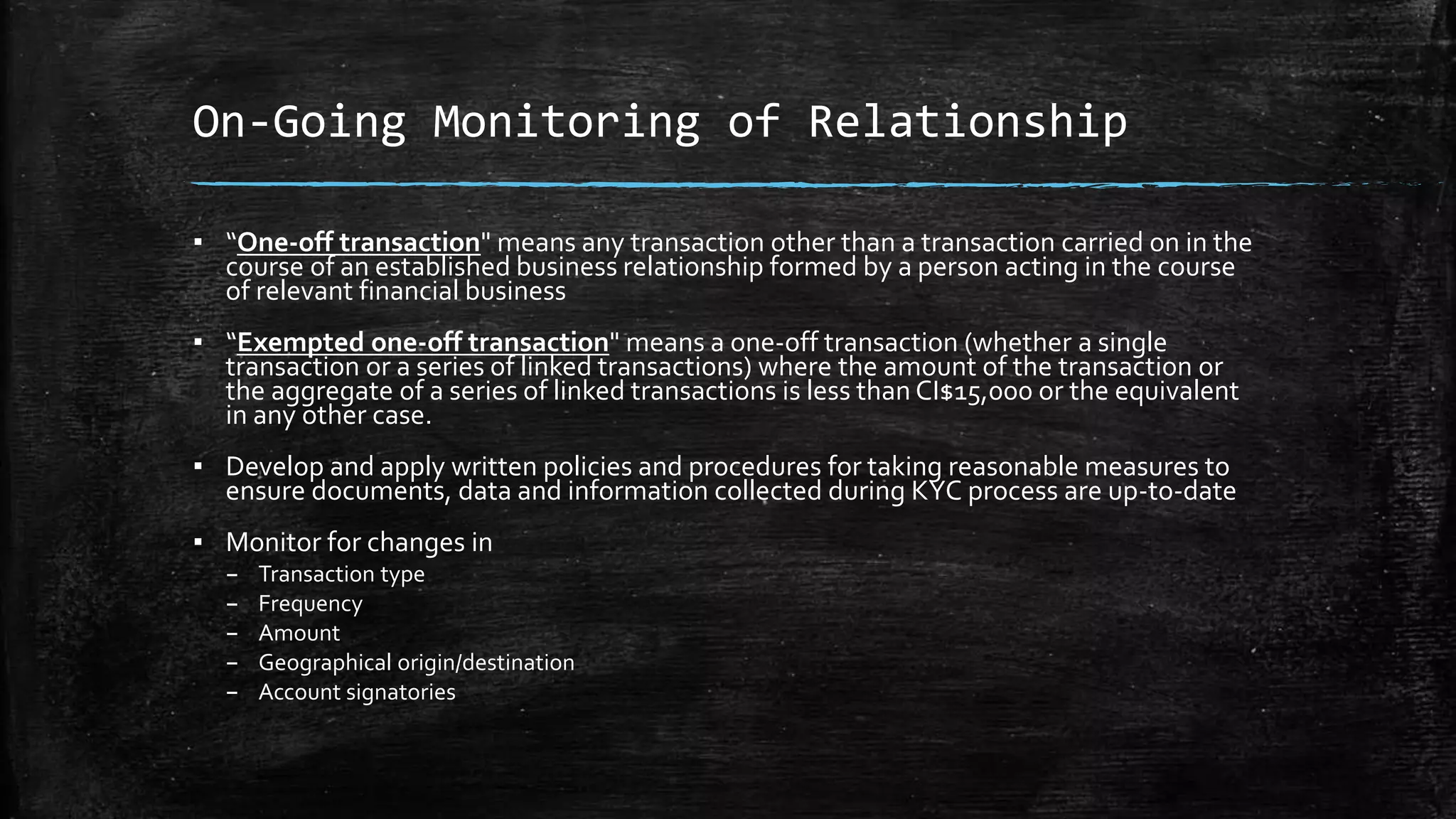

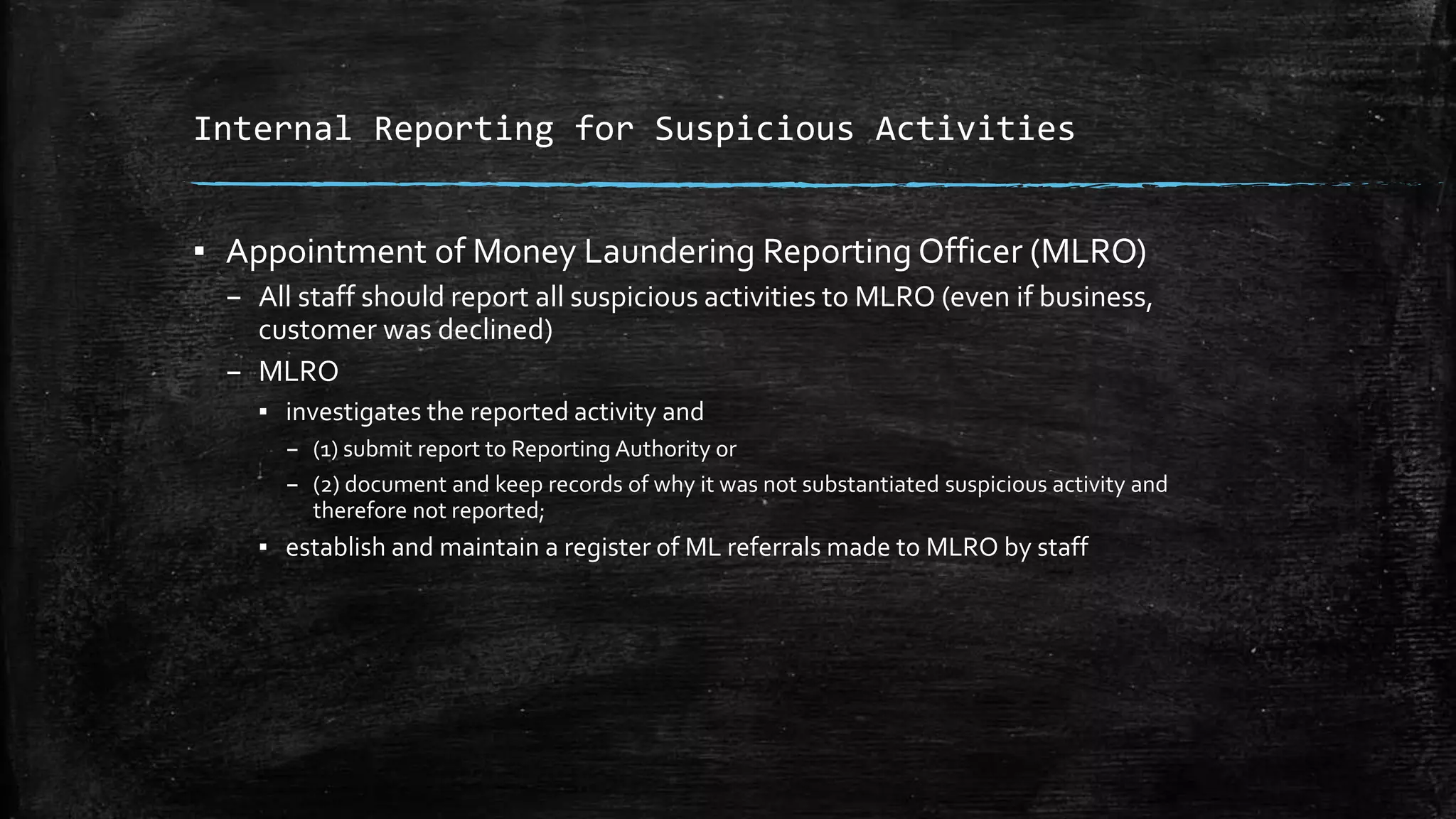

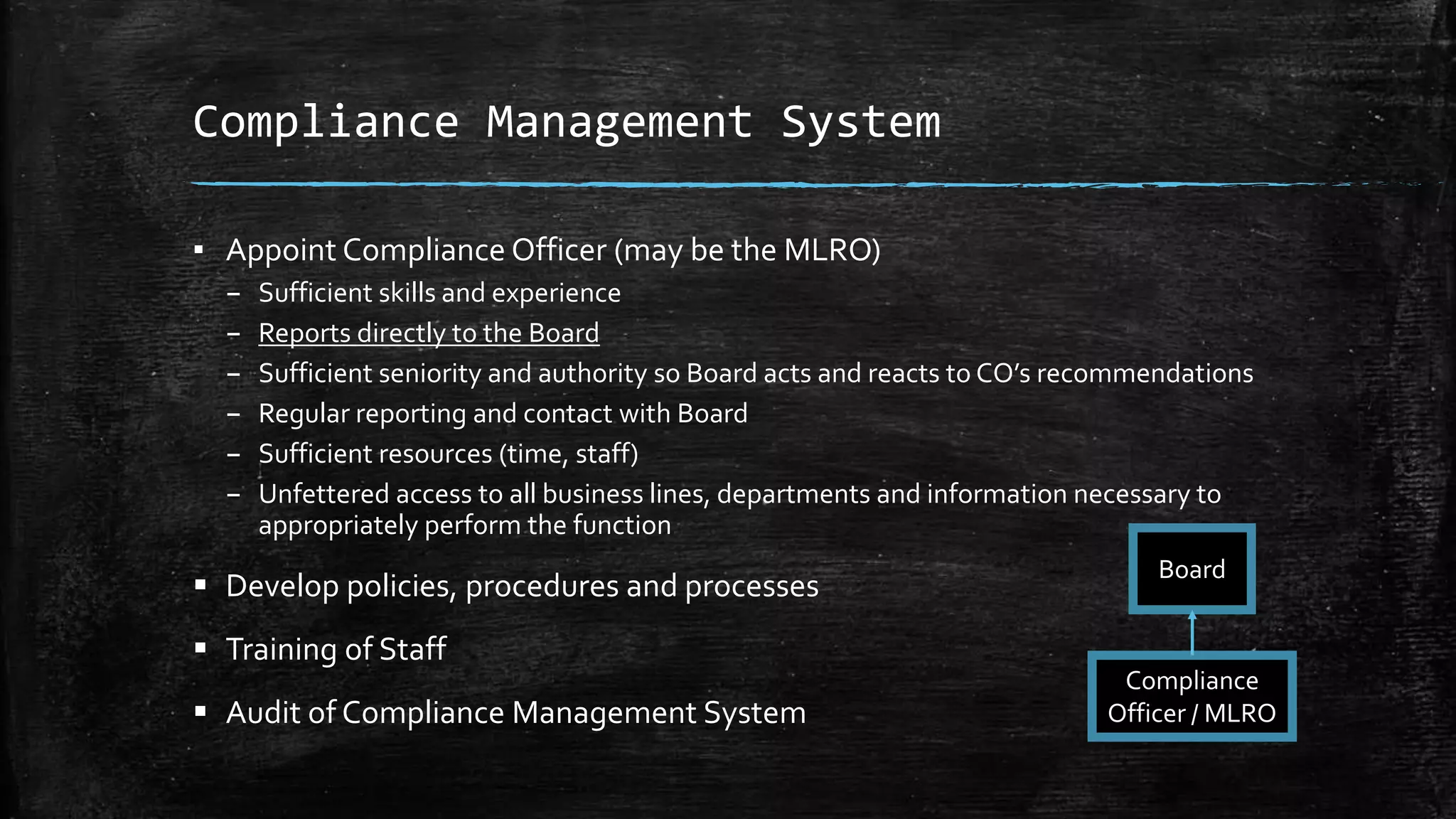

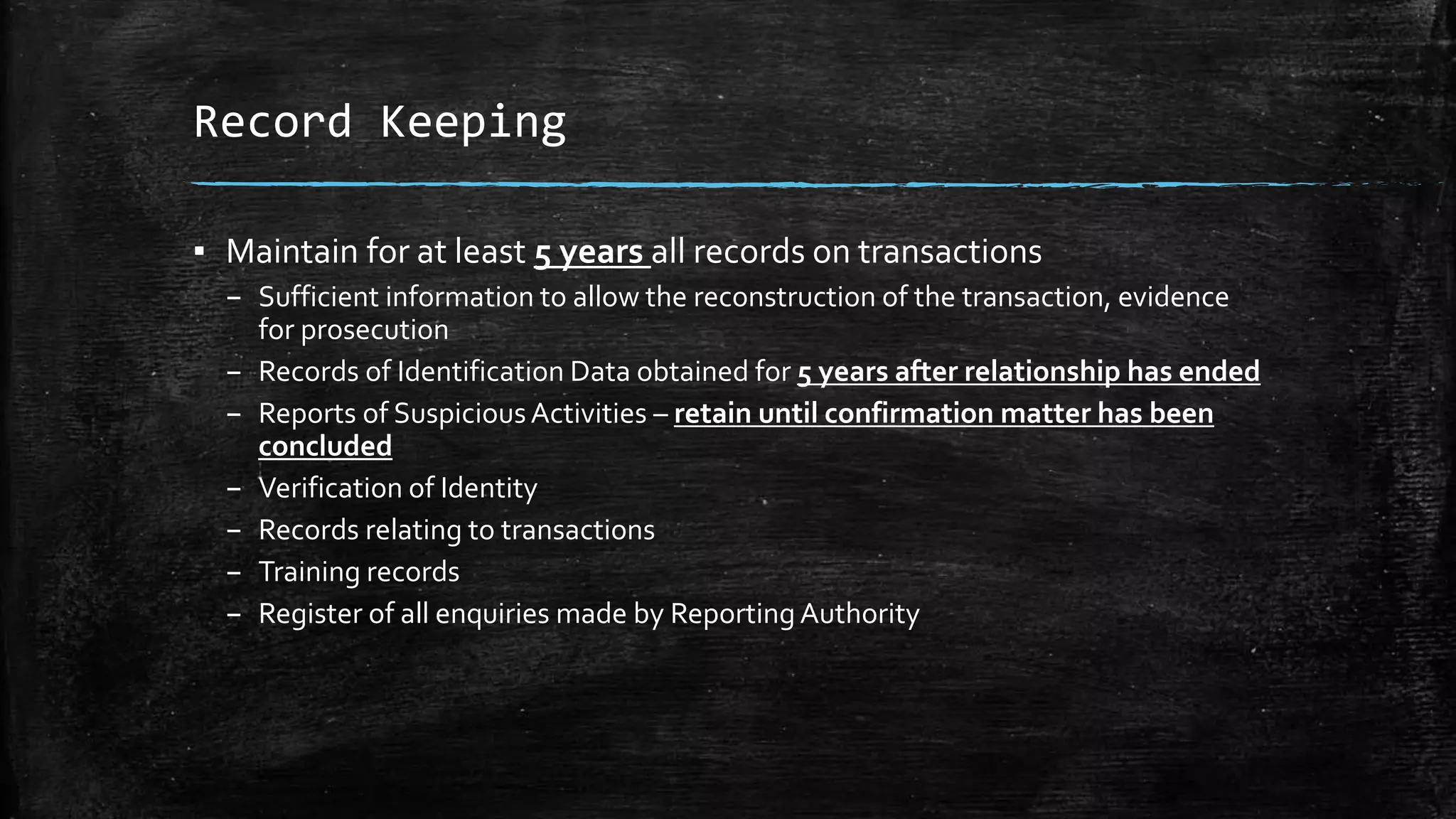

The document outlines key components for establishing a compliant bank secrecy act (BSA) and anti-money laundering (AML) system, emphasizing internal controls, risk assessment, and employee training. It details the responsibilities of the compliance officer and the processes for customer due diligence (CDD), reporting suspicious activities, and ongoing compliance management. Additionally, it provides guidelines for the Cayman Islands’ AML/CFT regulations and highlights necessary procedures for customer identification and transaction monitoring.