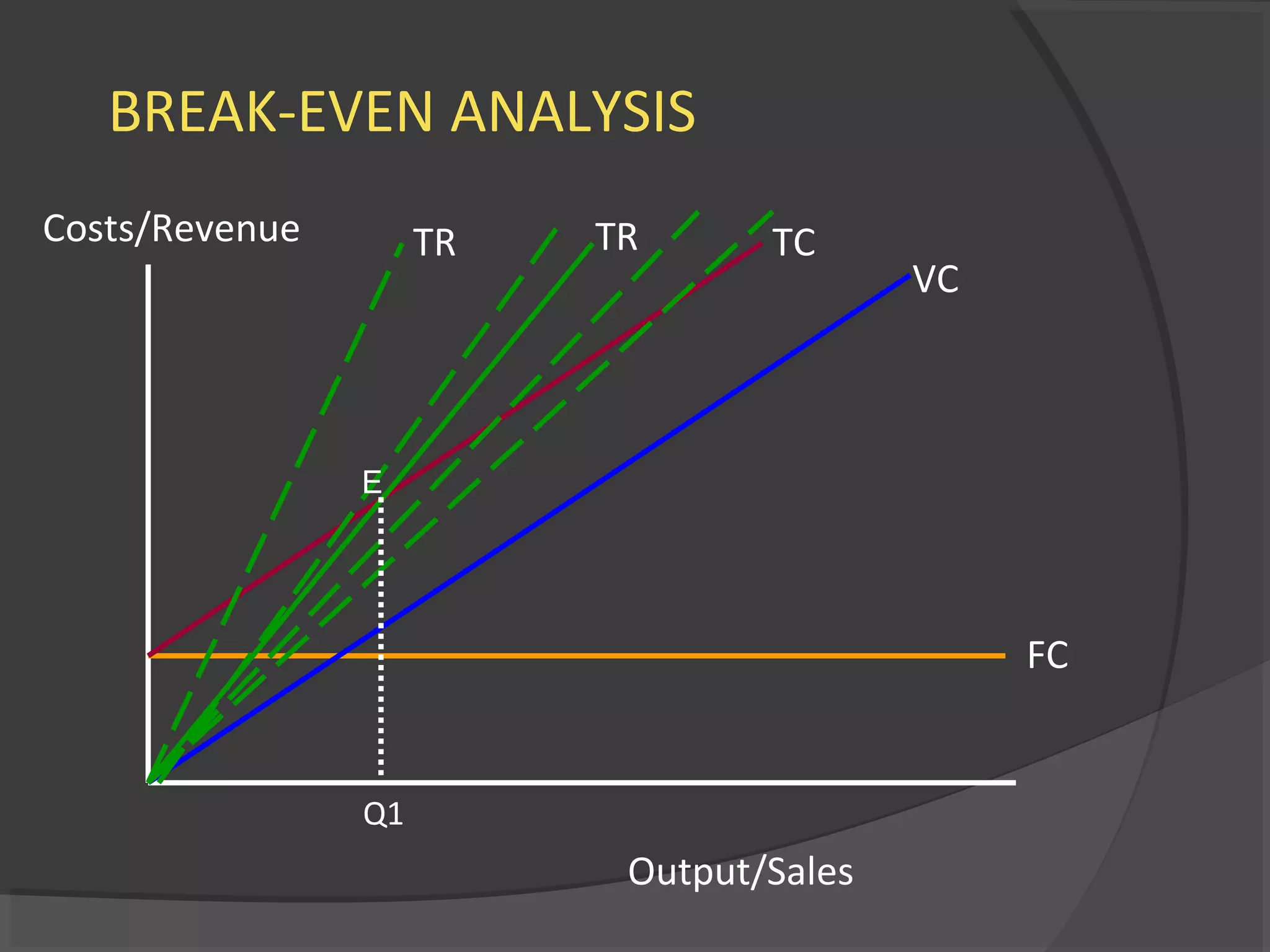

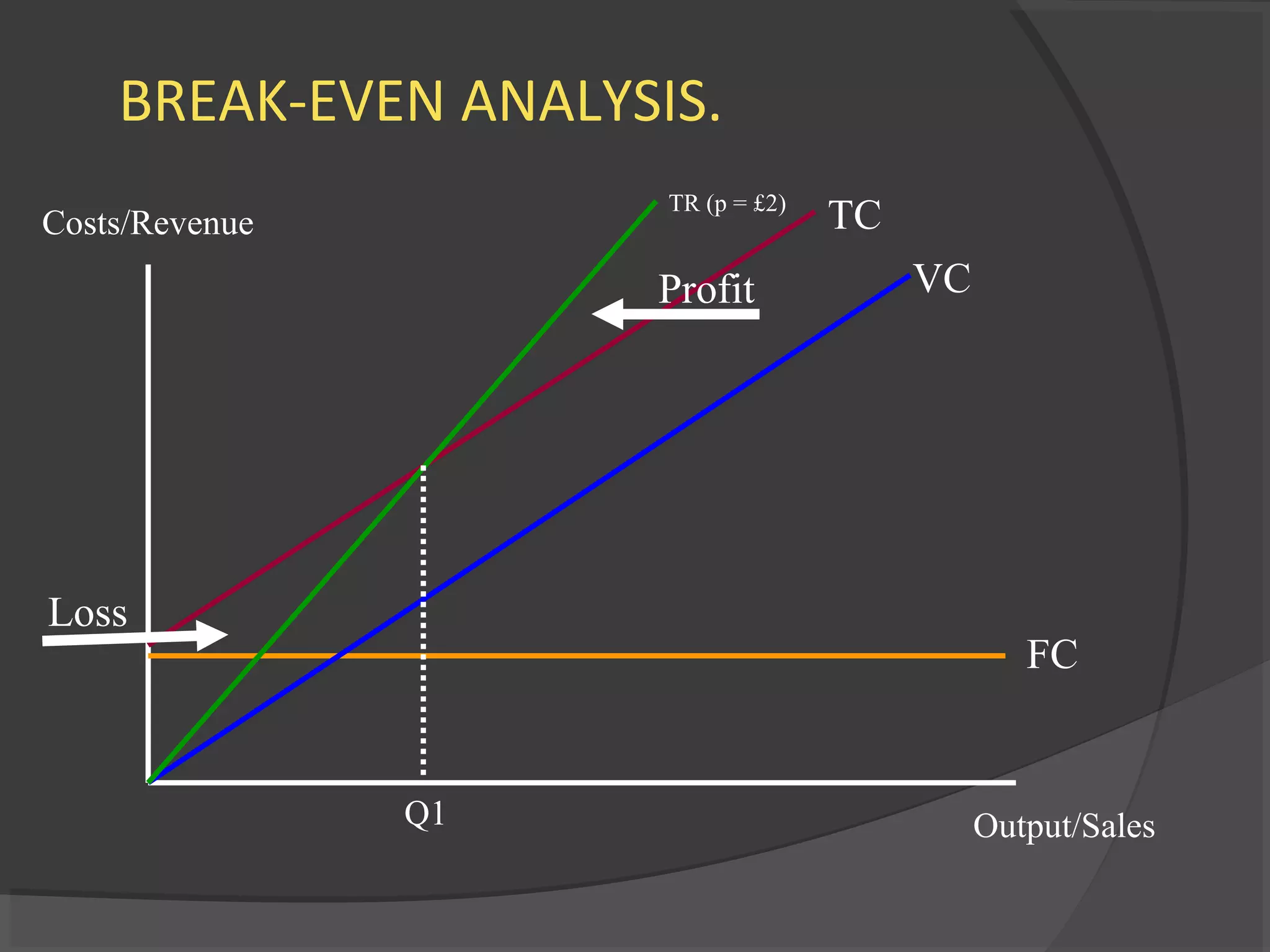

The document provides an overview of break-even analysis. It defines break-even point as the level of sales or production where total revenue equals total costs, resulting in no profit or loss. It explains fixed and variable costs and how to calculate break-even point algebraically as fixed costs divided by the difference between selling price and variable cost per unit. An example calculates that a company needs to sell 10,000 Christmas trees at $8 each to cover its $30,000 in fixed costs and $5 variable cost per tree.