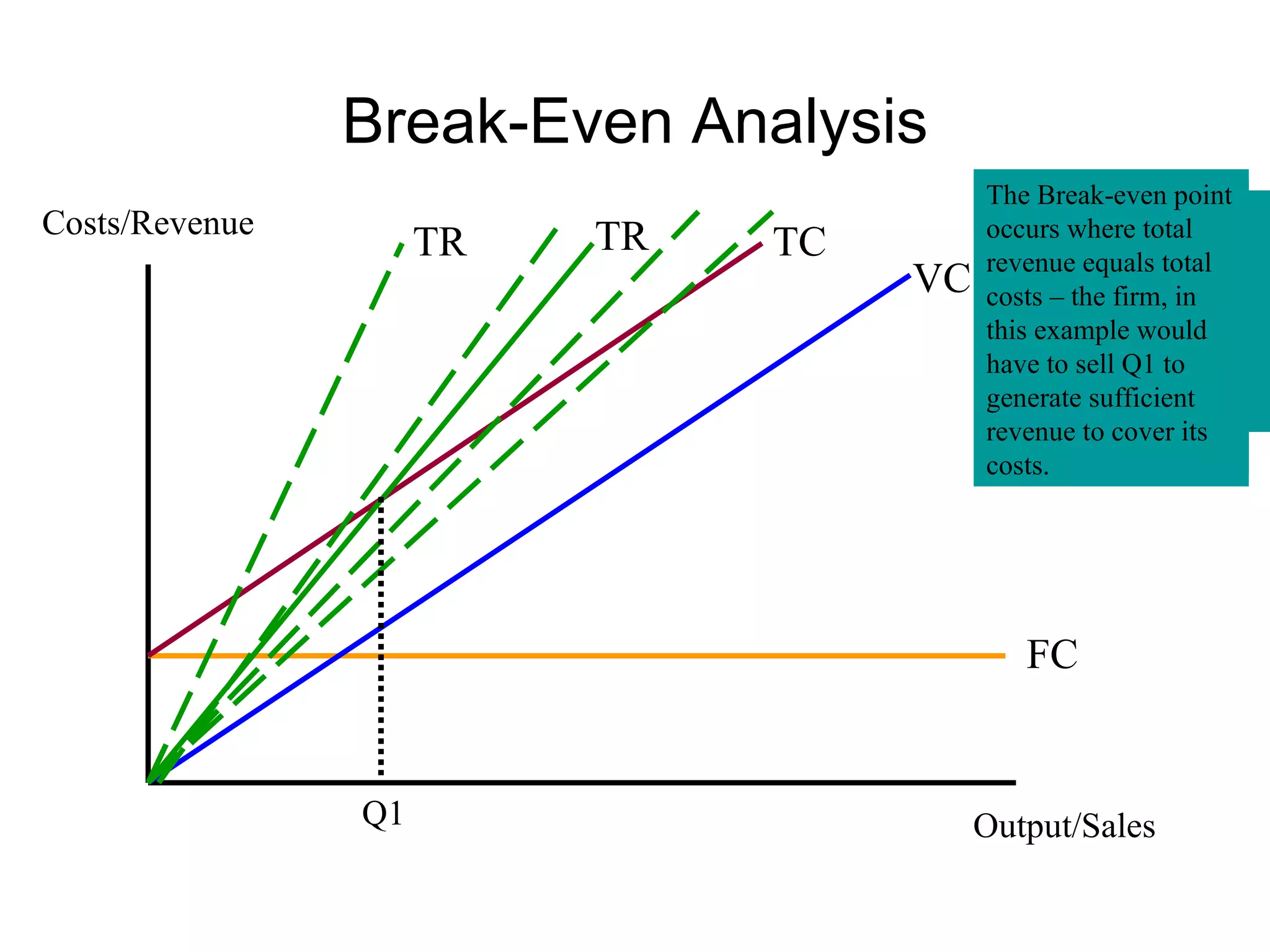

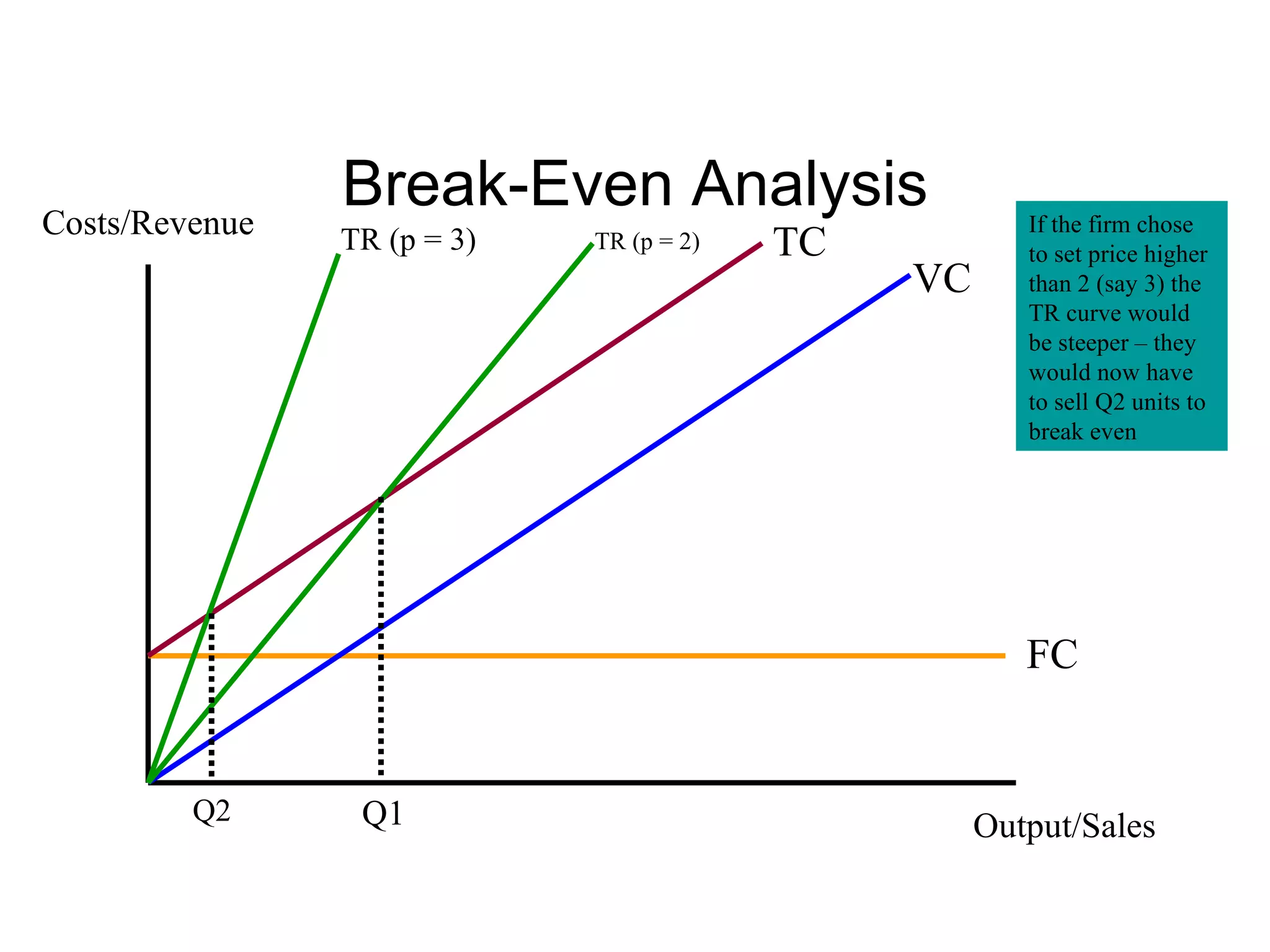

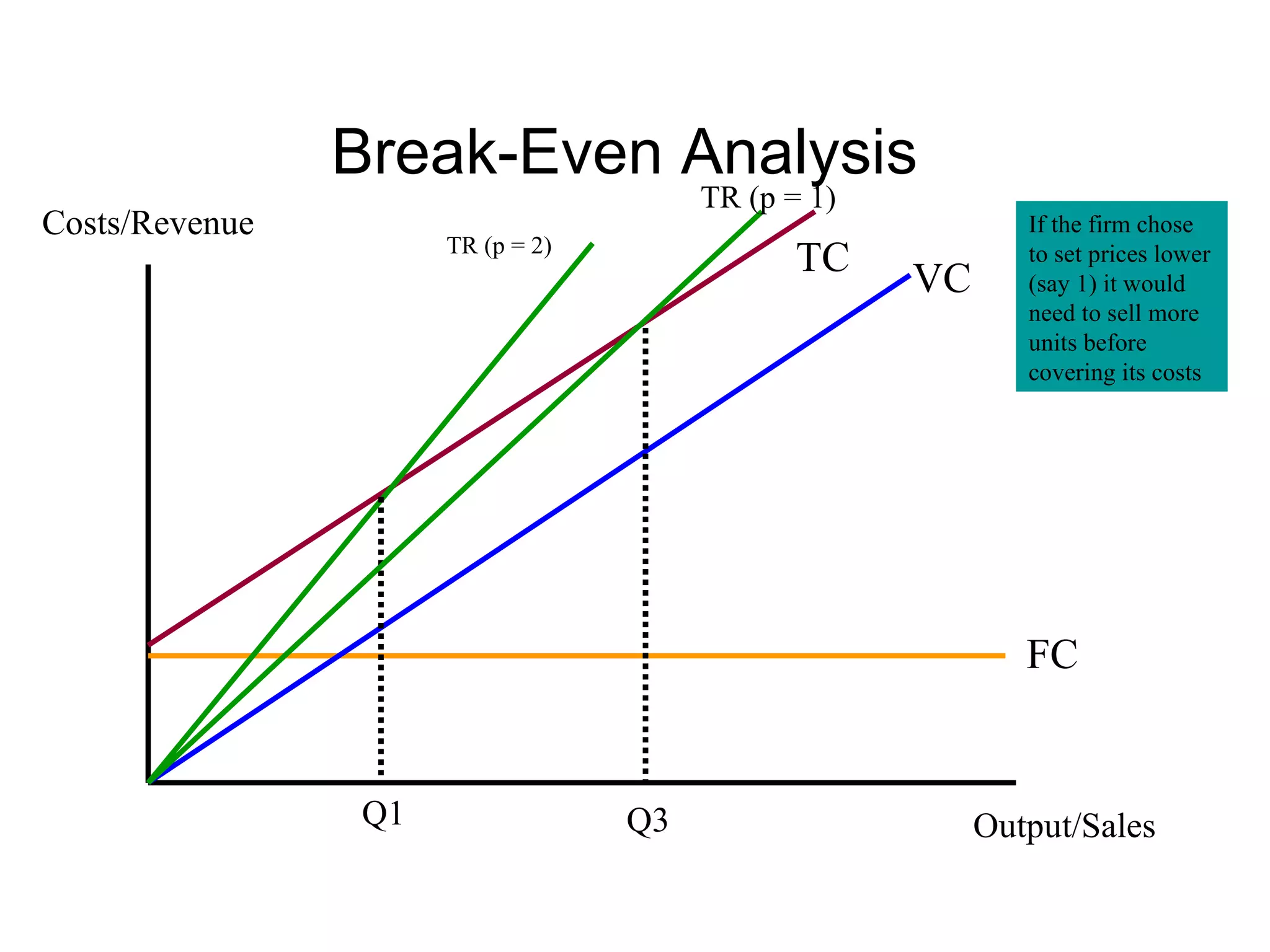

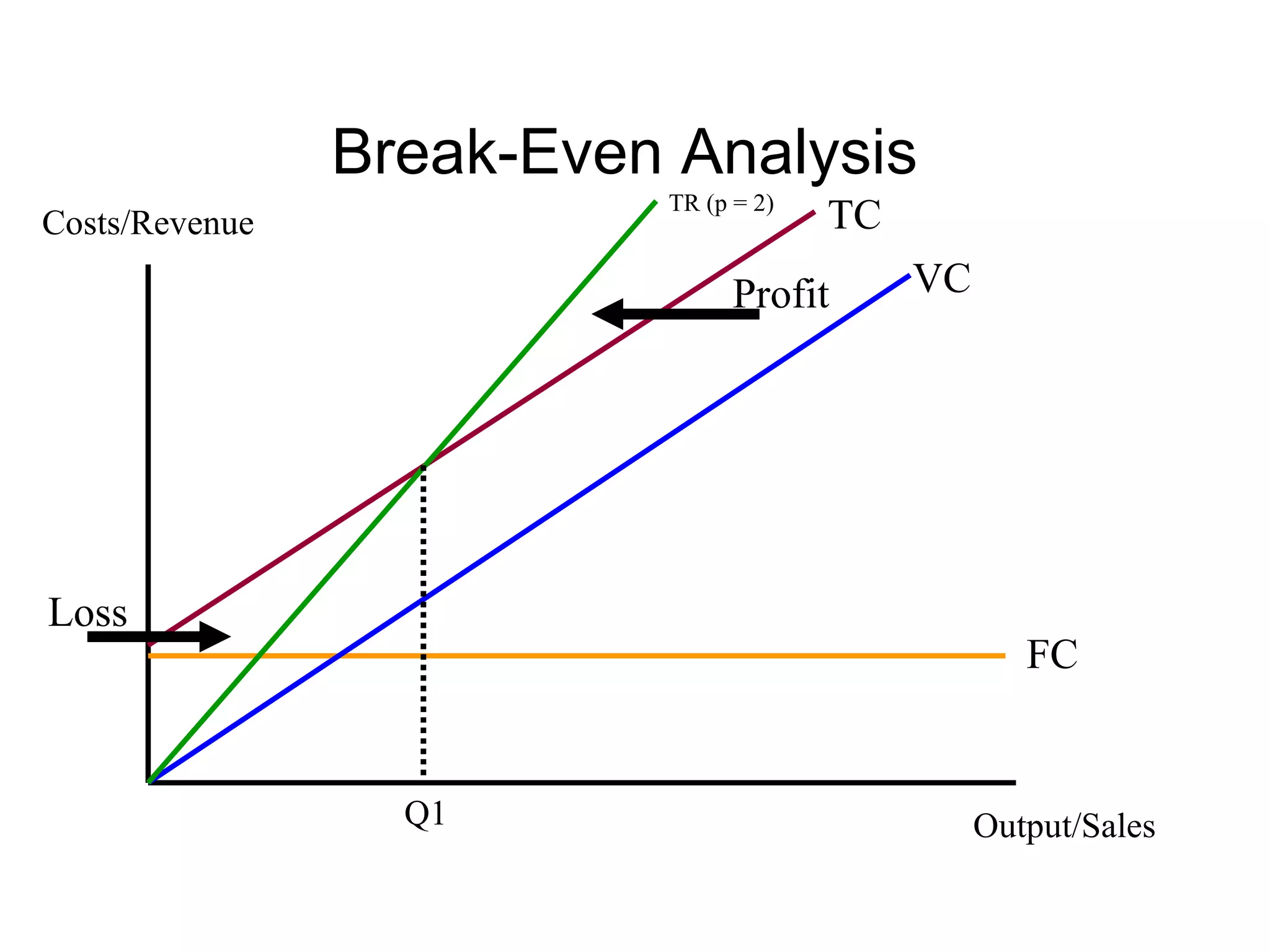

Break-even analysis determines the level of sales or production needed for a business to neither profit nor lose money. It categorizes costs as either fixed costs that do not change with production or variable costs that change with production levels. The break-even point is where total revenue from sales equals total costs. The price charged affects total revenue and the sales volume needed to break even. Higher prices may decrease sales volume required but take longer to reach, while lower prices may increase sales but require a higher volume.