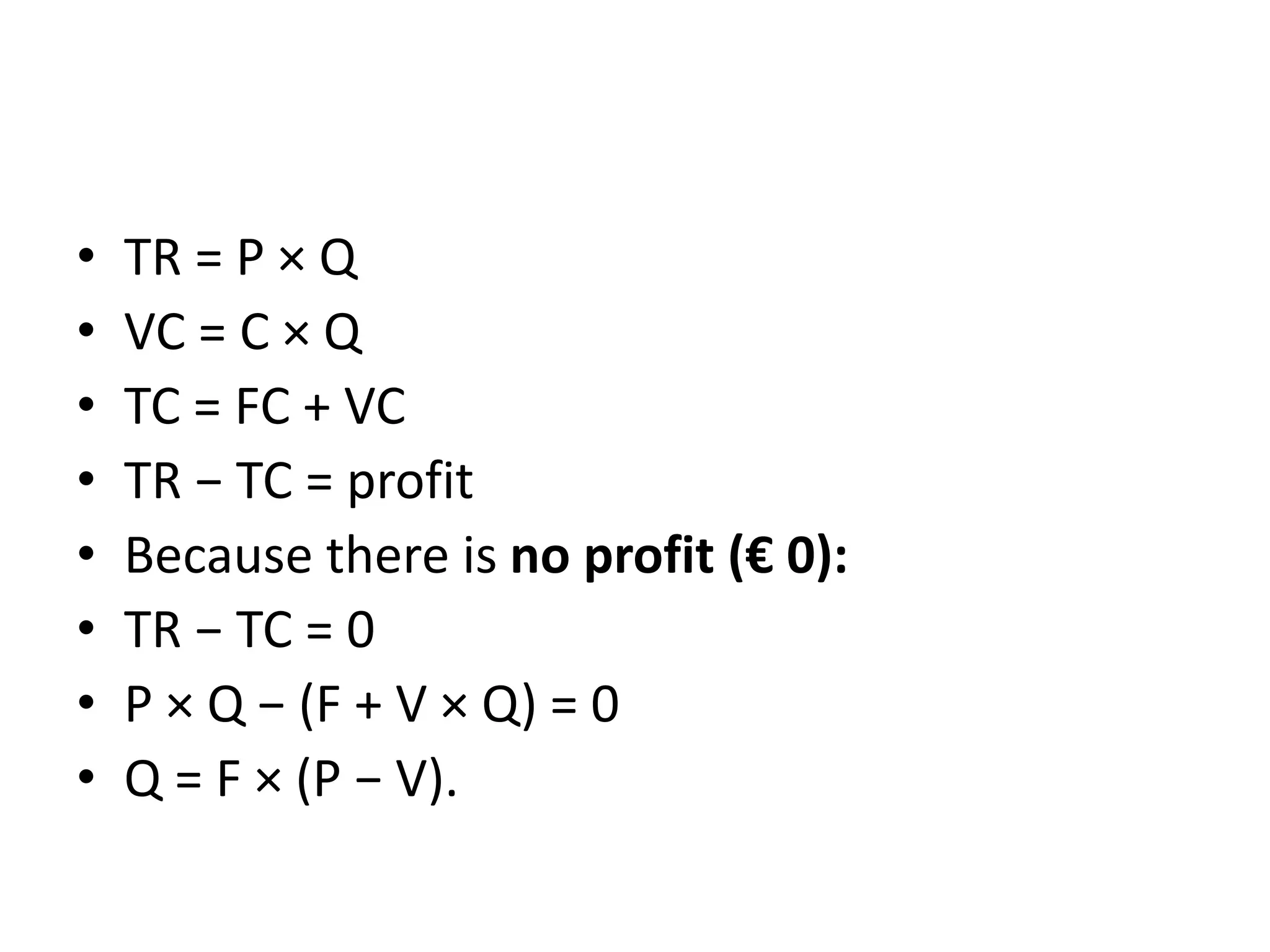

Break-even analysis is an accounting tool that calculates the sales volume needed to cover total costs. It determines the point where total revenue equals total costs, resulting in zero profit. Costs are categorized as either variable costs that change with production volume or fixed costs that remain constant. The break-even point formula divides total fixed costs by the price per unit minus the variable cost per unit to calculate the sales volume required to break even. Understanding the break-even point helps companies ensure they have sufficient market demand to be profitable.