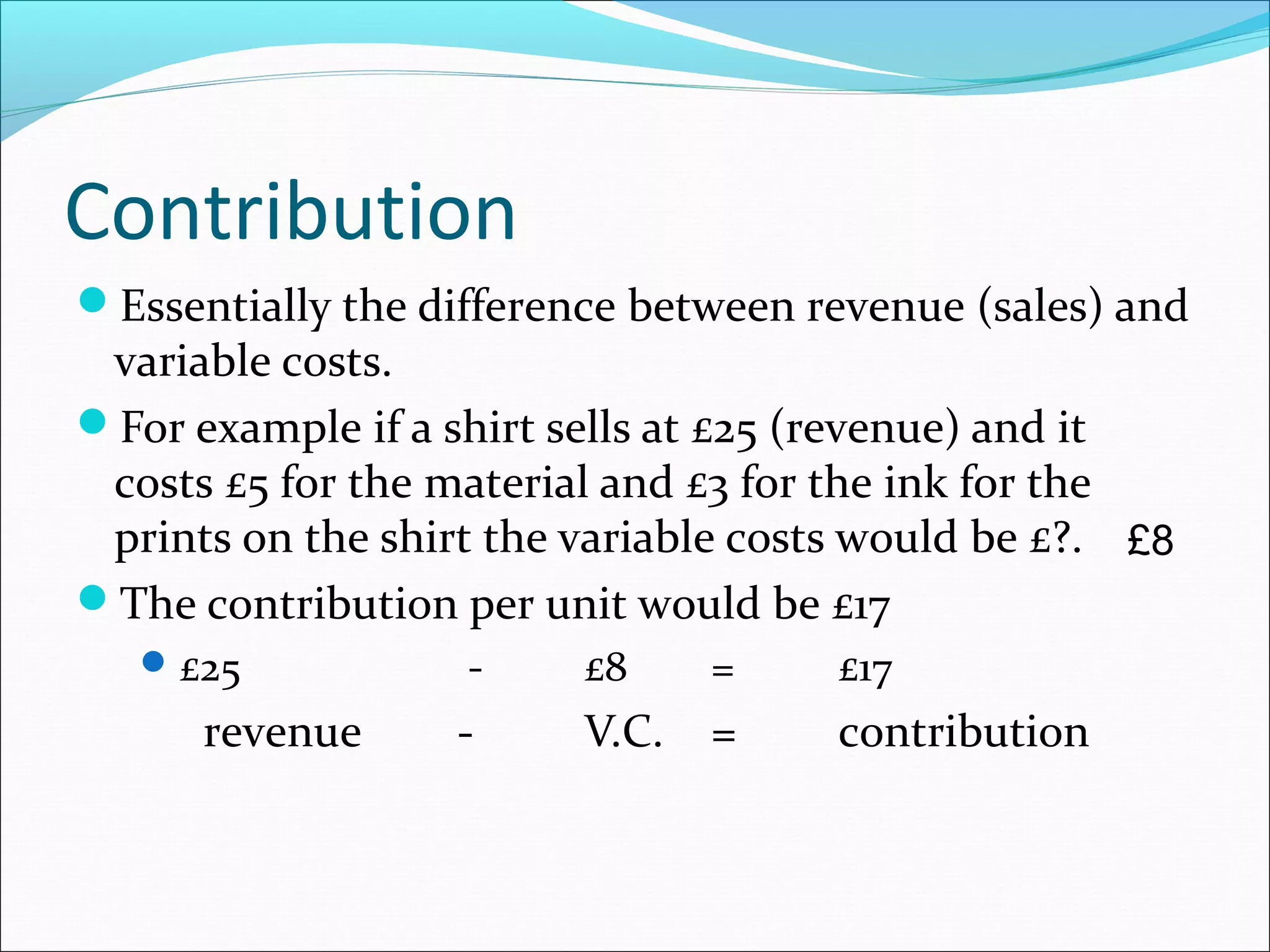

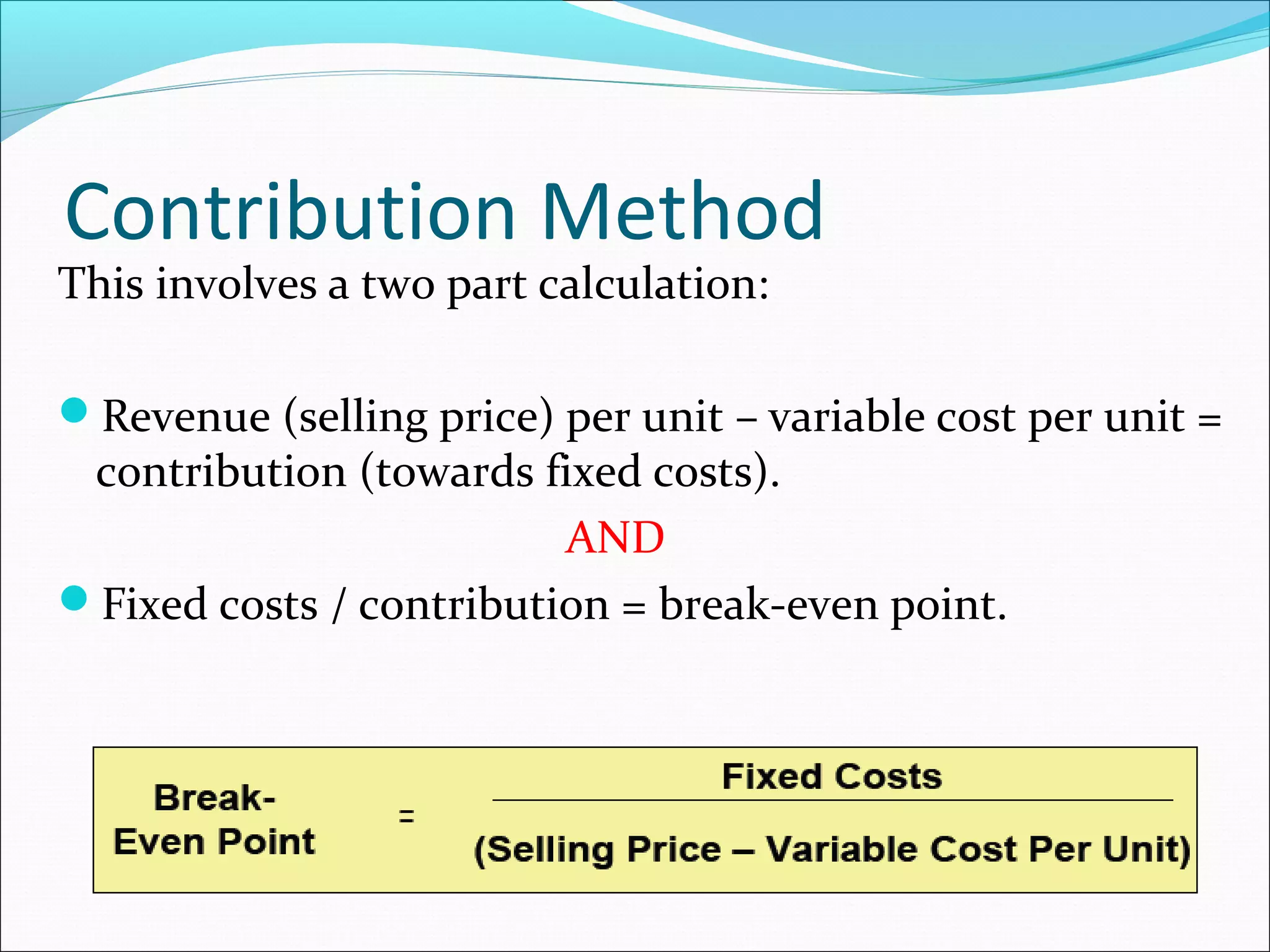

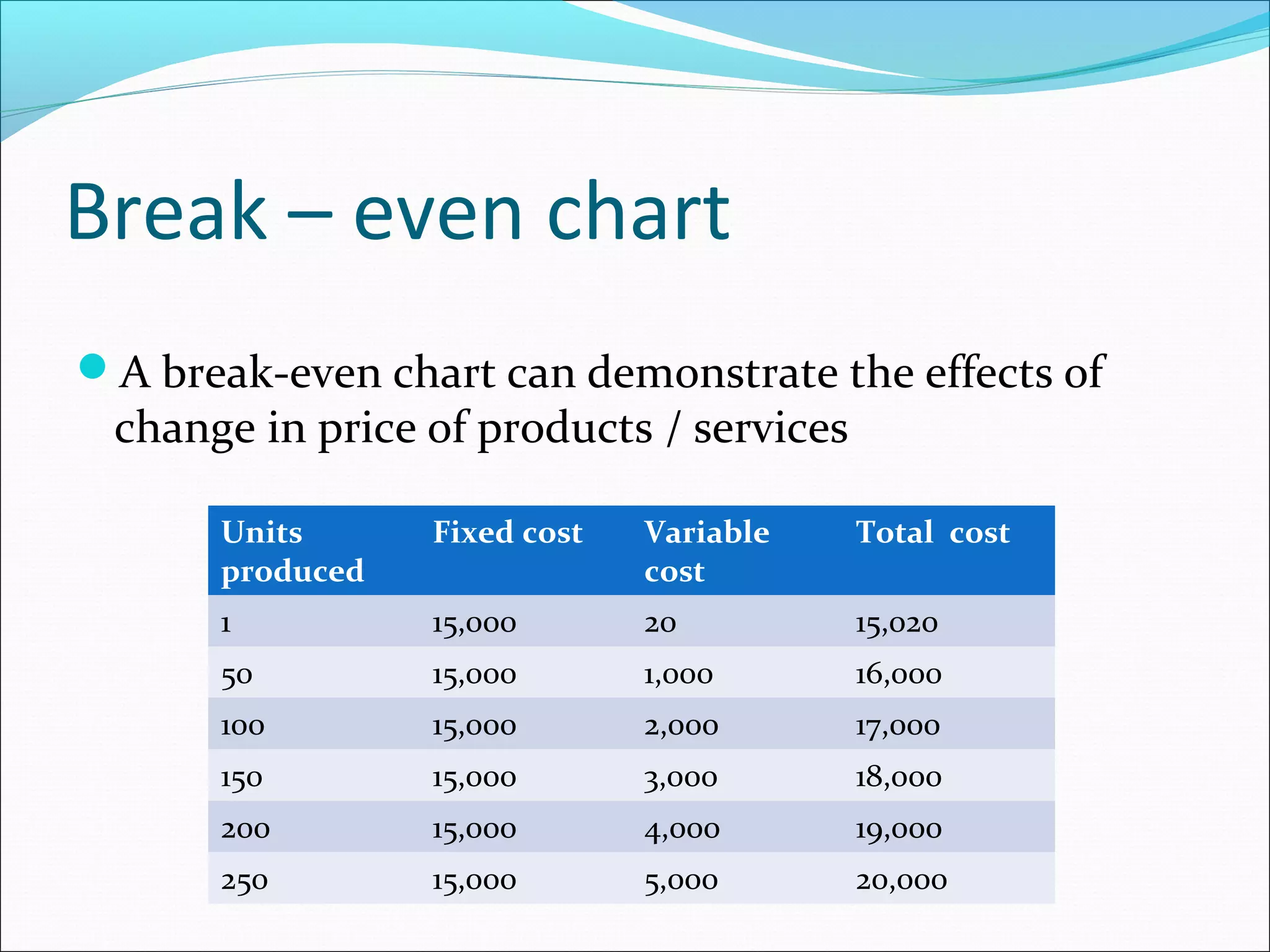

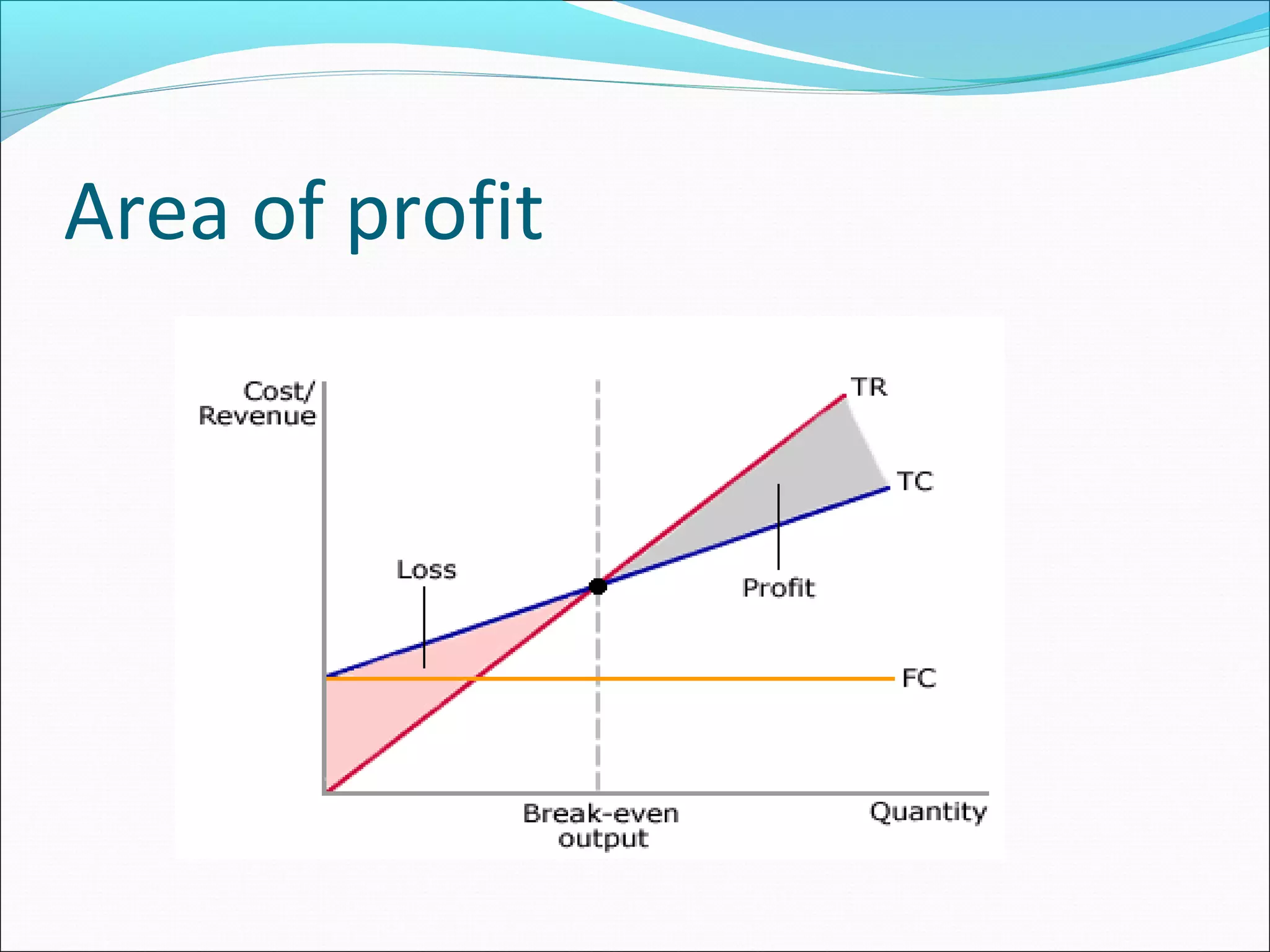

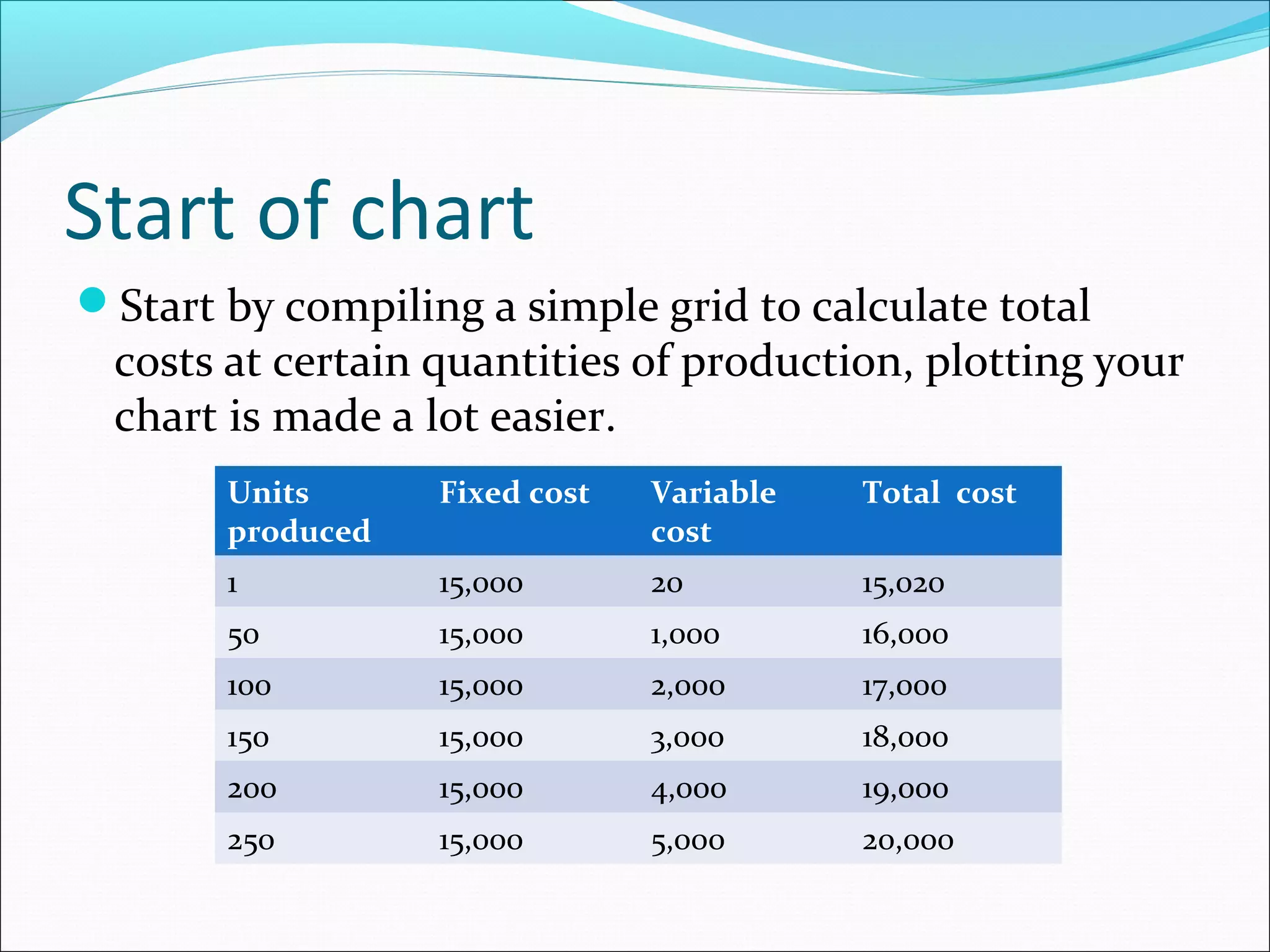

This document provides an introduction to break-even analysis, including definitions of key terms and methods for calculating break-even points. It explains that break-even analysis is used to determine the level of output or sales needed to cover total costs. The document outlines the contribution method and break-even charts as two approaches. It provides examples of calculating break-even points using contribution per unit and defines margin of safety as the difference between current output and the break-even point.