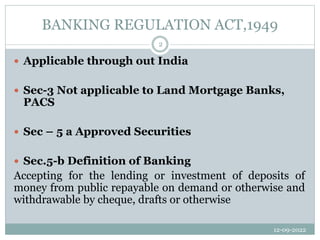

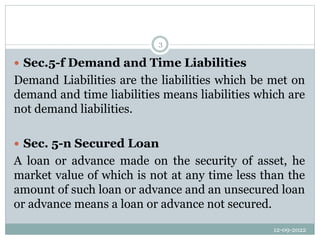

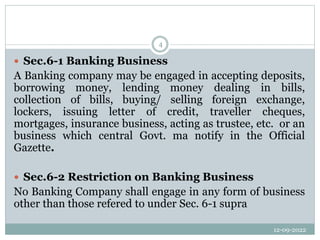

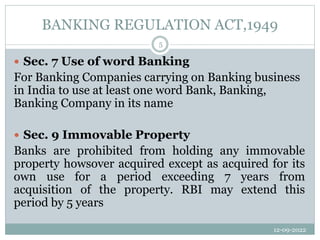

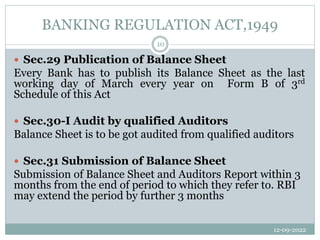

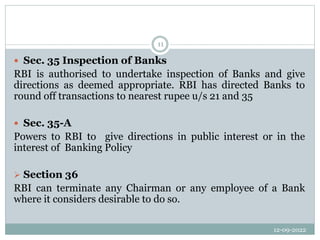

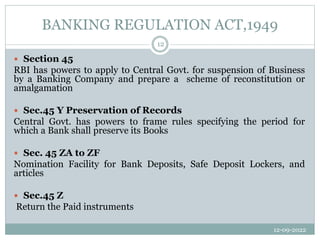

This document provides an overview of key sections of the Banking Regulation Act of 1949 in India. It outlines sections related to the definition of banking, activities permitted for banks, reserve requirements, auditing of balance sheets, inspection powers of the Reserve Bank of India, suspension of troubled banks, and penalties for non-compliance. The act establishes the regulatory framework for banking in India and grants oversight powers to RBI to supervise banks and issue directives to ensure the health of the banking sector.