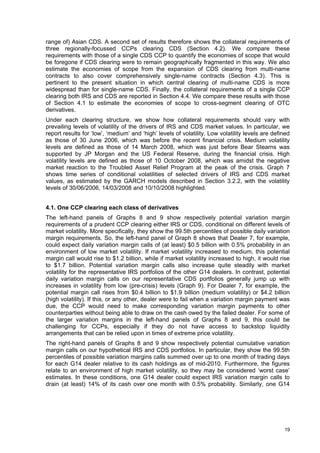

This document analyzes the collateral requirements for central clearing of over-the-counter derivatives by major derivatives dealers. It estimates the amount of collateral central counterparties would need to safely clear representative interest rate swap and credit default swap portfolios of major dealers. The results suggest dealers have sufficient assets to meet initial margin requirements, but some may need more cash to meet variation margin calls. Default funds worth a small fraction of dealers' equity appear sufficient to protect central counterparties against losses from a dealer default. Concentrating clearing in a single central counterparty could reduce collateral needs without compromising robustness.