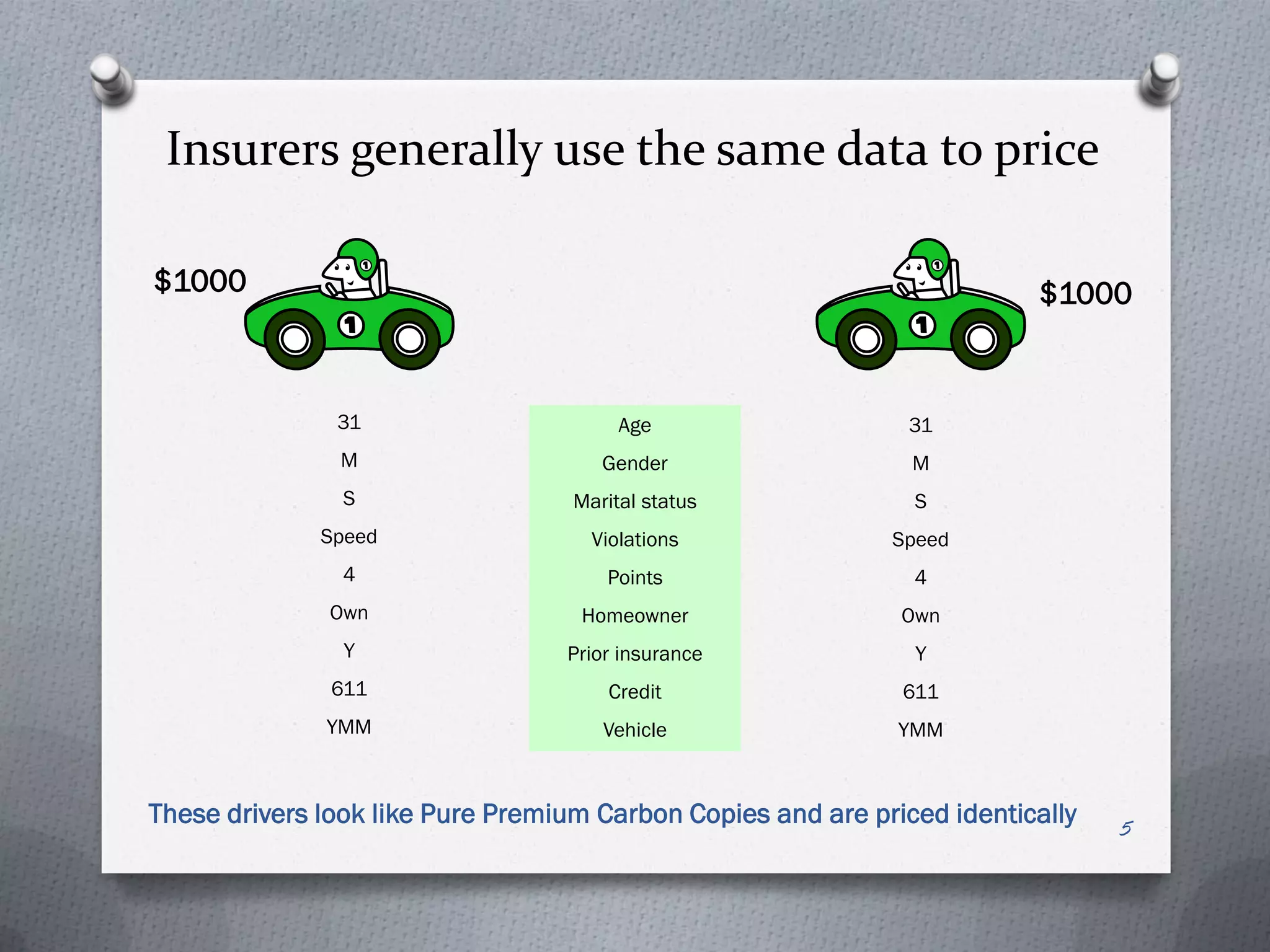

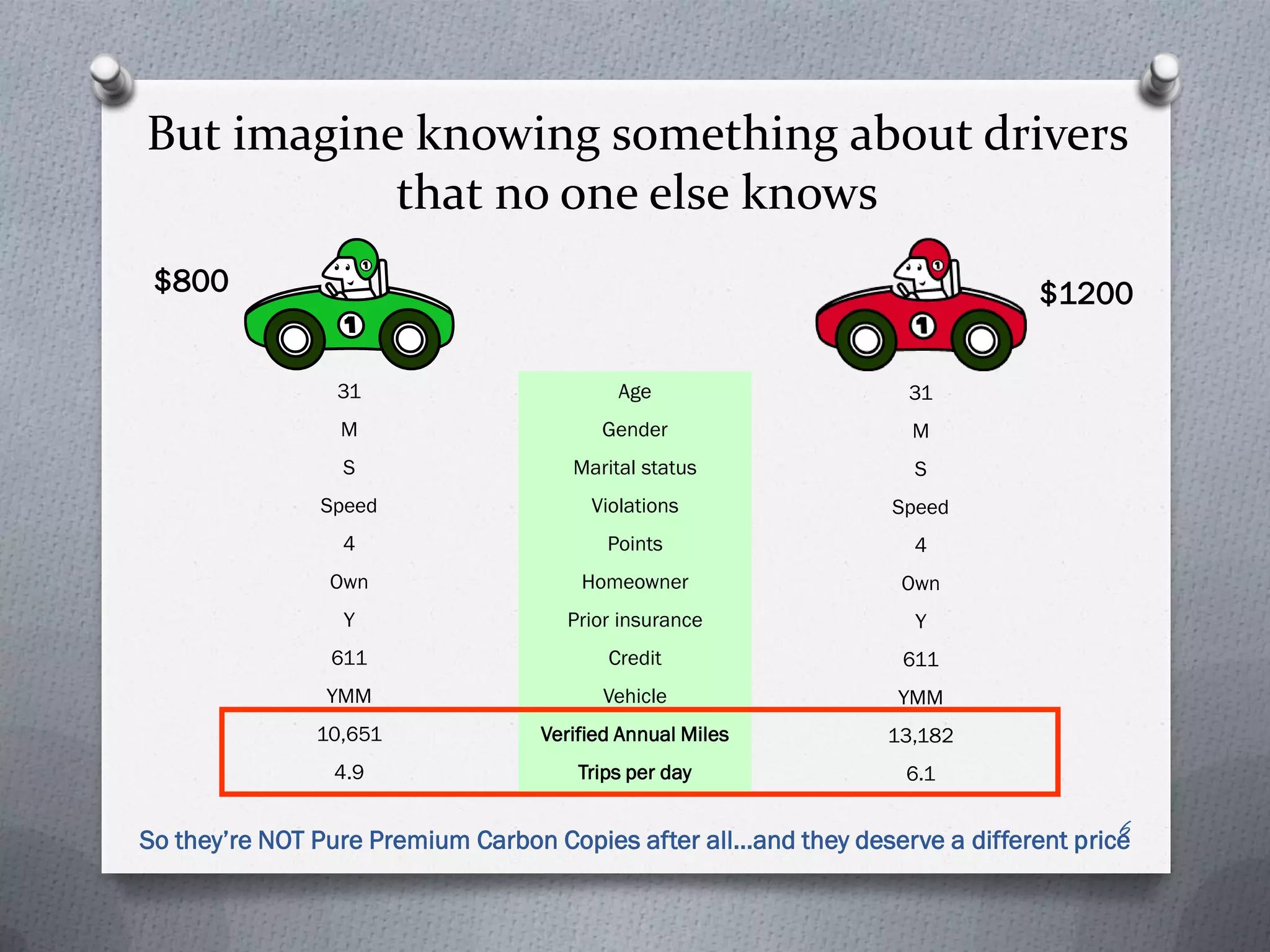

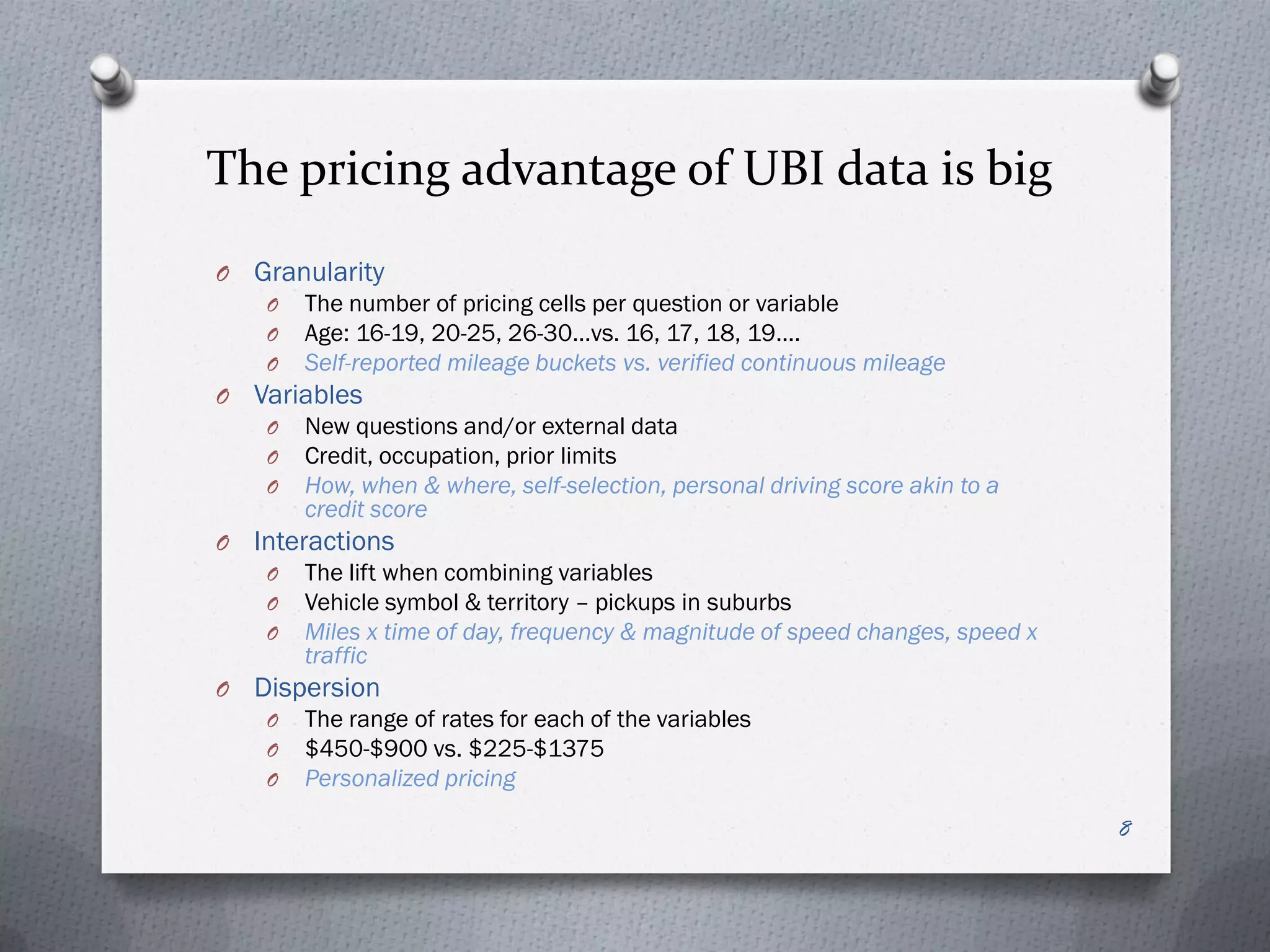

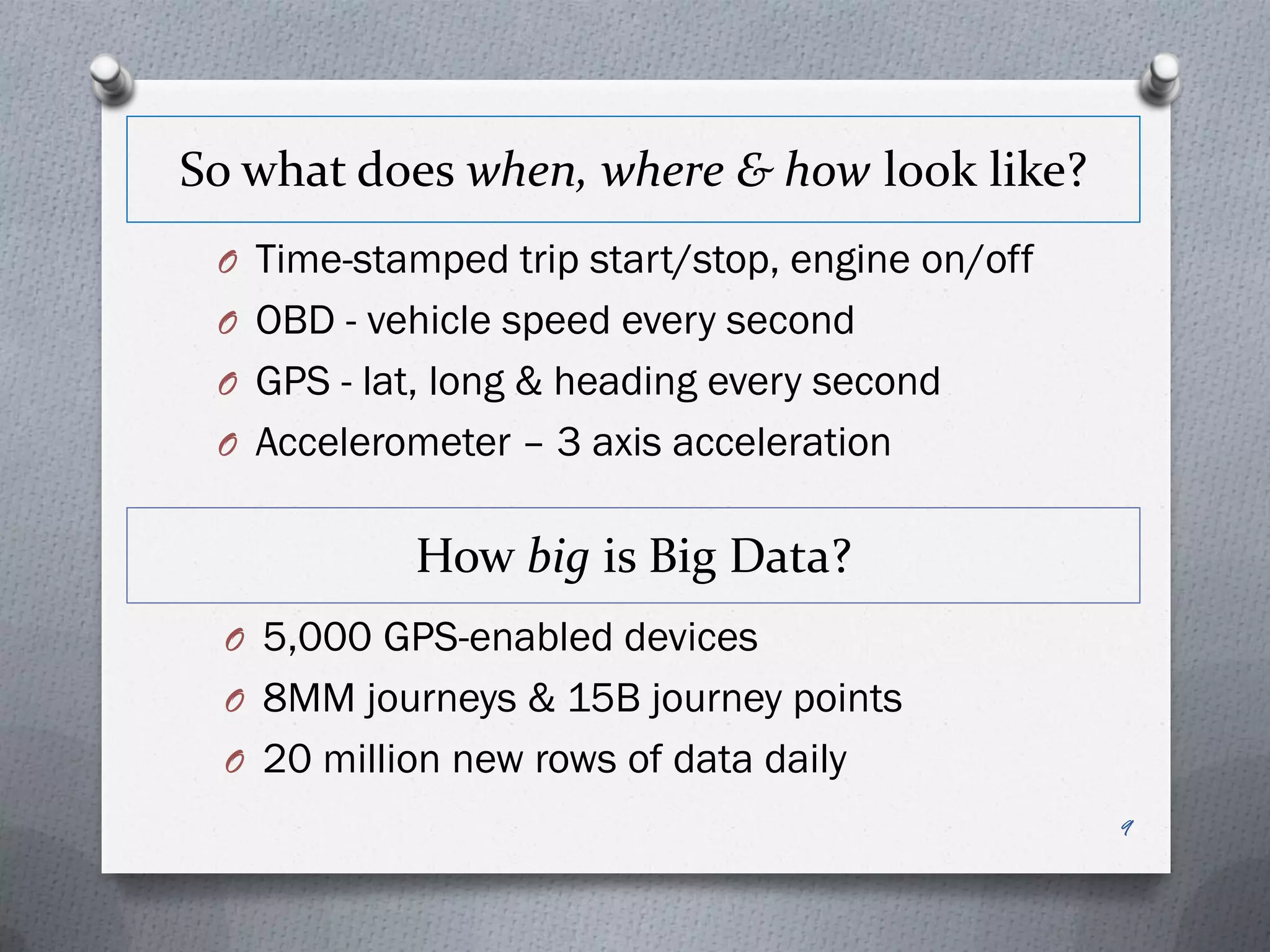

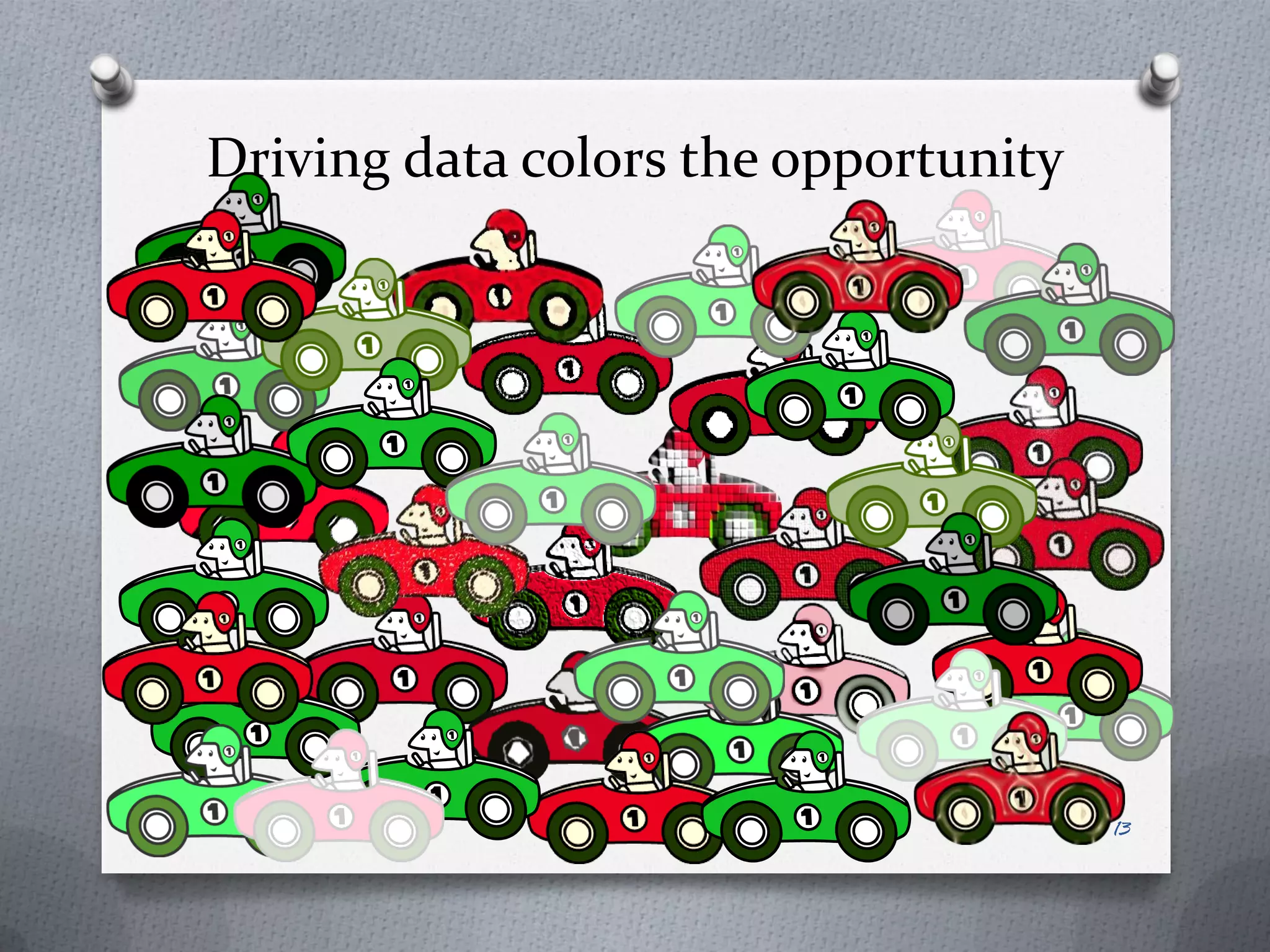

Insurance telematics uses big data from vehicle tracking to provide more accurate driver profiles and pricing, allowing insurers to better segment risks. However, analyzing and utilizing large amounts of driving data presents new challenges for insurers and requires capabilities beyond their traditional core competencies. While telematics offers potential for growth and competitive advantage, insurers must overcome headaches around collecting, storing, and deriving insights from massive driving data sets.