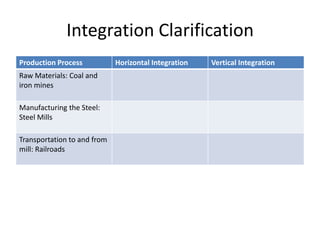

Andrew Carnegie created the Carnegie Steel Company in 1873, which manufactured more steel than all of Britain through practices like vertical and horizontal integration. Vertical integration involved buying out suppliers to control raw materials and transportation, while horizontal integration meant acquiring companies making similar products to limit competition. The success or failure of businesses, according to the philosophy of social Darwinism, was governed by natural laws and intervention in the market was unacceptable. Figures like John D. Rockefeller and his Standard Oil Company merged with competitors through trusts that centralized control like a single large corporation. By 1880, Rockefeller controlled 90% of oil refining by undercutting competitors and buying them out, earning the title of "robber baron," though he also established philanthropic organizations.