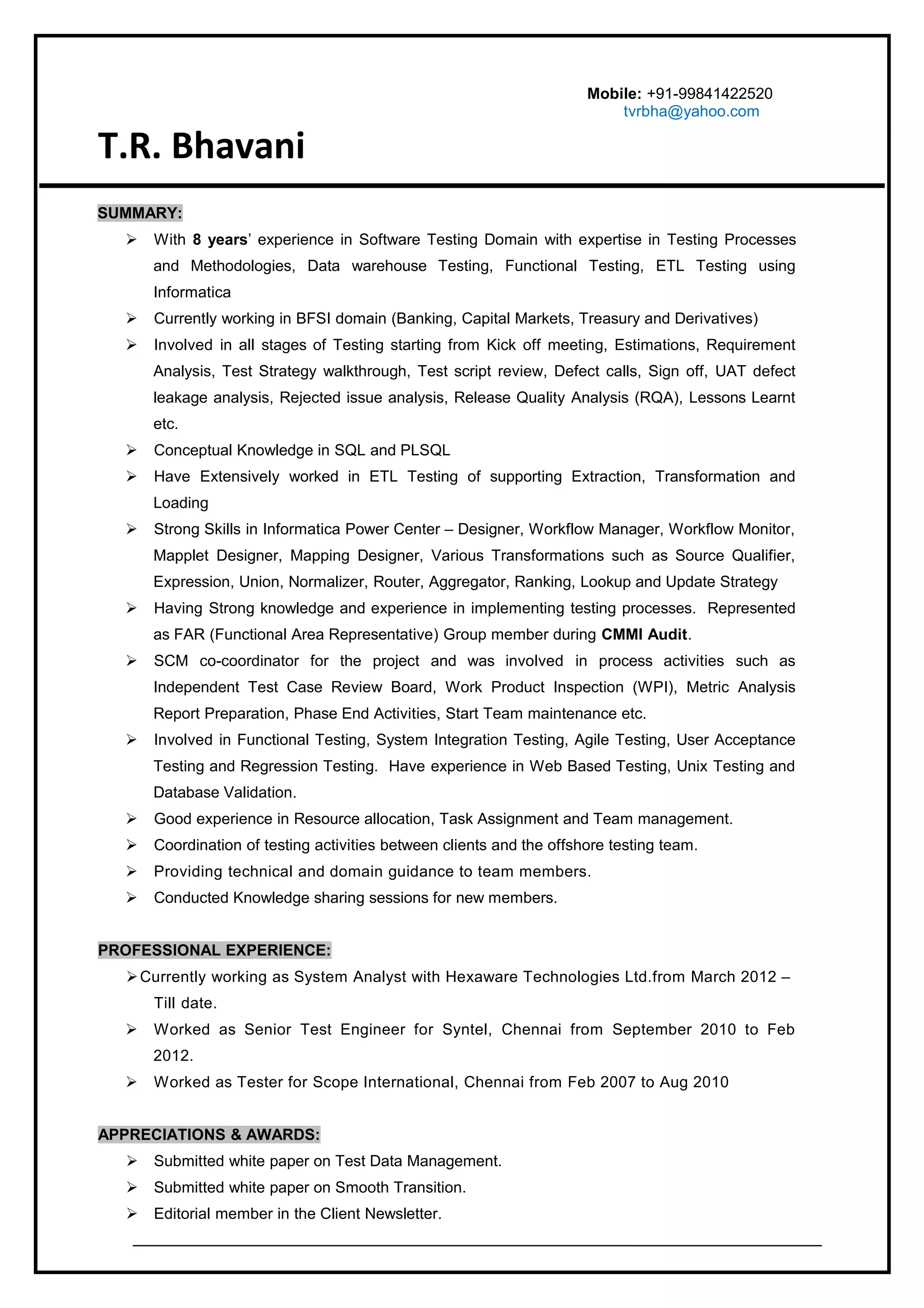

- Over 8 years of experience in software testing with expertise in testing processes, methodologies, data warehouse testing, functional testing, and ETL testing using Informatica

- Currently working in the BFSI domain, testing applications for banking, capital markets, treasury, and derivatives

- Involved in all stages of the testing process from requirements analysis to sign-off

- Strong skills in testing tools like HP ALM, Informatica, SQL, and programming languages like Java