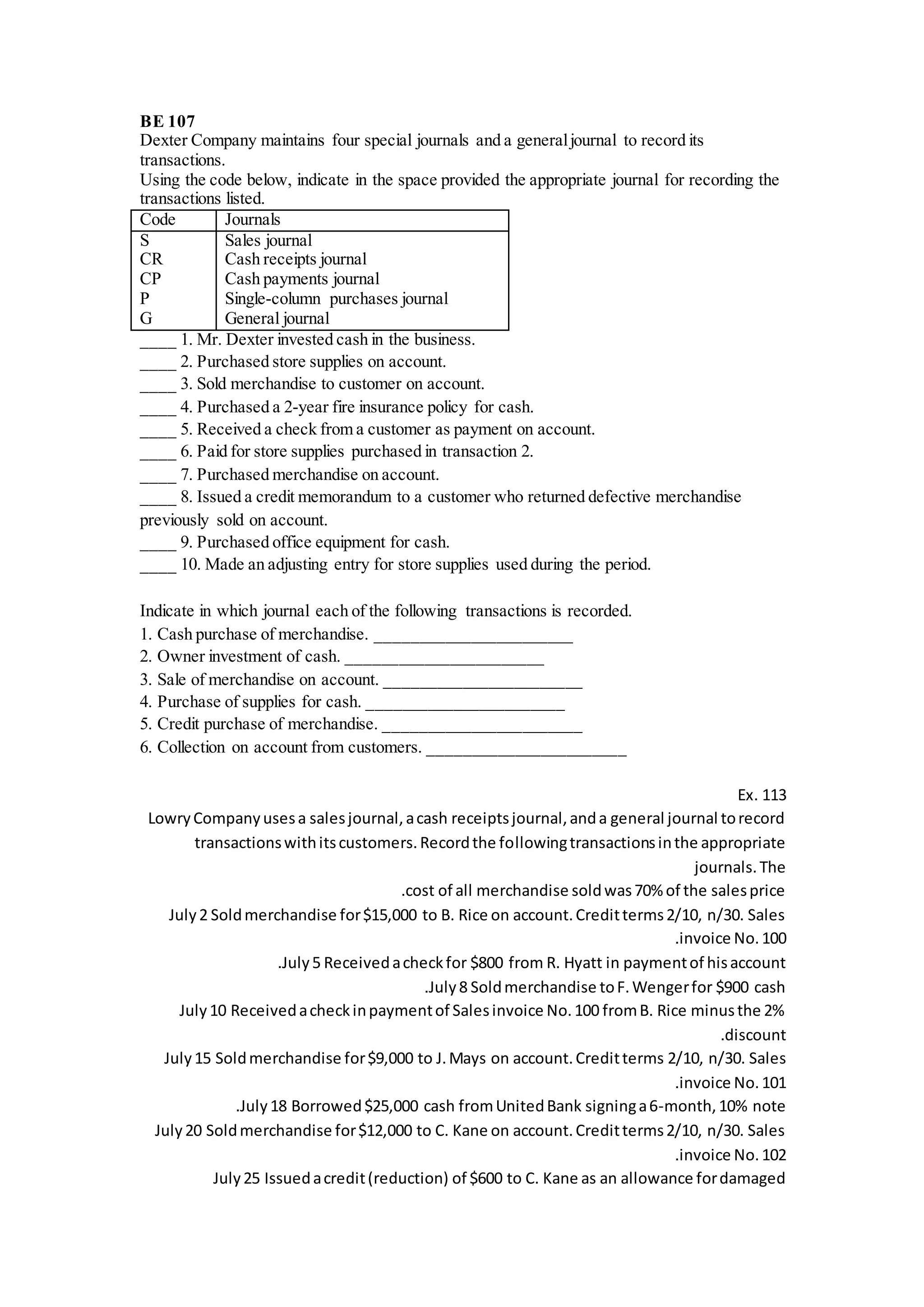

Dexter Company uses four special journals and a general journal to record transactions. The document provides a code to indicate the appropriate journal for each of ten transactions. It also asks which journal six additional transactions would be recorded in. The second document provides transactions for Lowry Company and asks to record them in the appropriate sales, cash receipts, or general journal. The third document similarly provides transactions for Goren Company and asks to record them in the appropriate purchases, cash payments, or general journal.