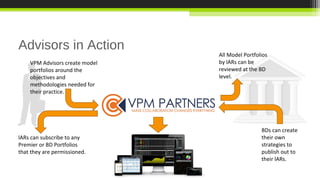

VPM Partners provides investment strategies and portfolio management services to advisors. They offer multiple portfolio solutions including VPM Classic portfolios and vDAS portfolios that can be customized and deployed across advisors' businesses. Their platforms allow advisors to construct model portfolios, monitor positions, and access research tools. VPM integrates with broker-dealers to provide white-labeled solutions and reduce pricing for advisors. Their presentation covered their investment approaches, portfolio examples, available platforms, broker-dealer integration options, and questions.