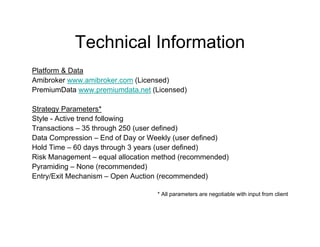

This document summarizes the benefits of direct systematic investing for advisors, businesses, and clients. For advisors, it provides justification for fees, allows a focus on strategy over transactions, and offers a point of differentiation. For businesses, it enables scalable boutique advice, the ability to capture higher net worth clients, and a value-add service. For clients, it provides clear fees and services, transparency of investment outcomes, and a differentiated approach. The strategy attributes include no forecasting, adaptive momentum triggers, cash protection in downturns, and the ability to operate on any market.