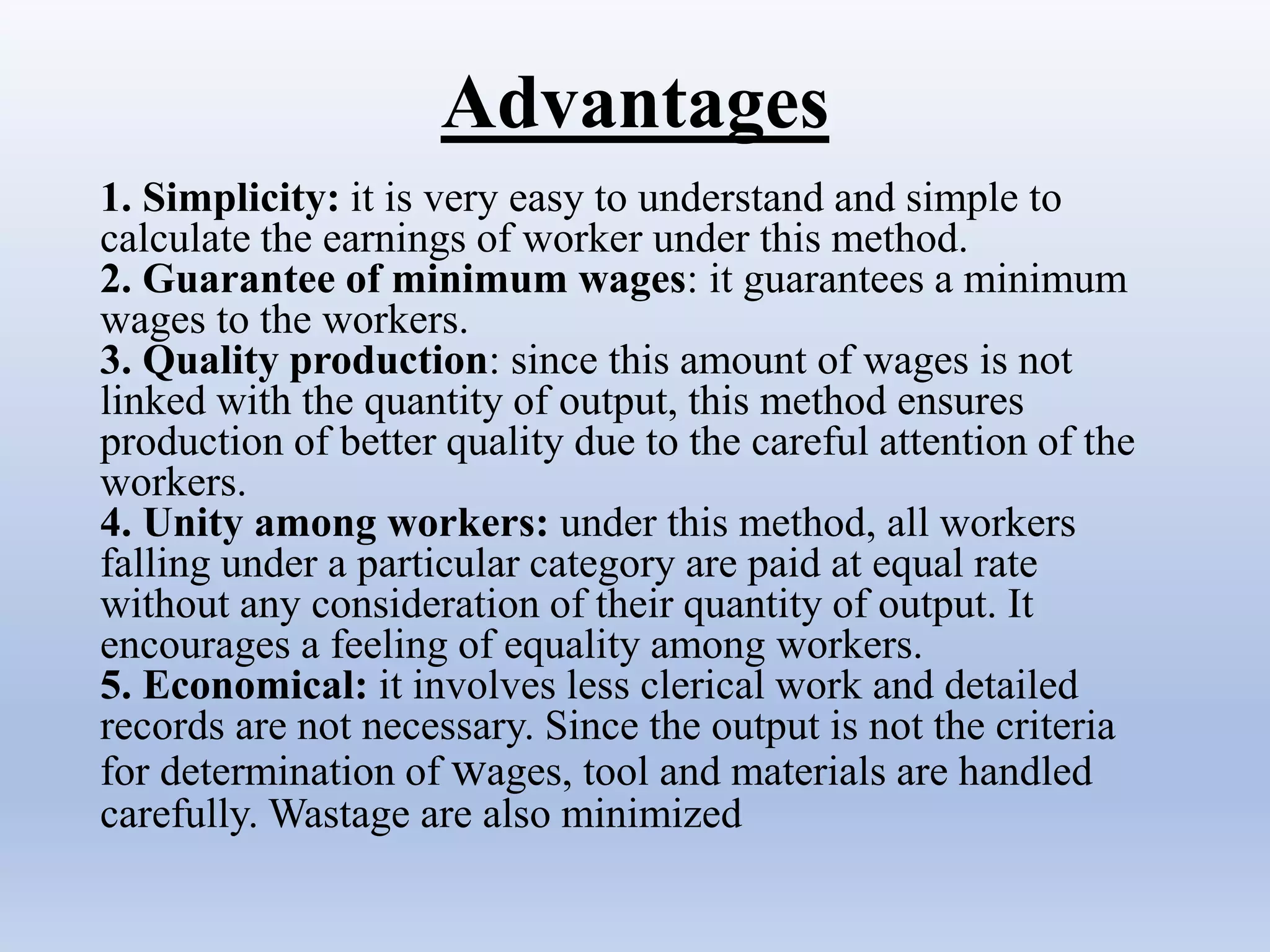

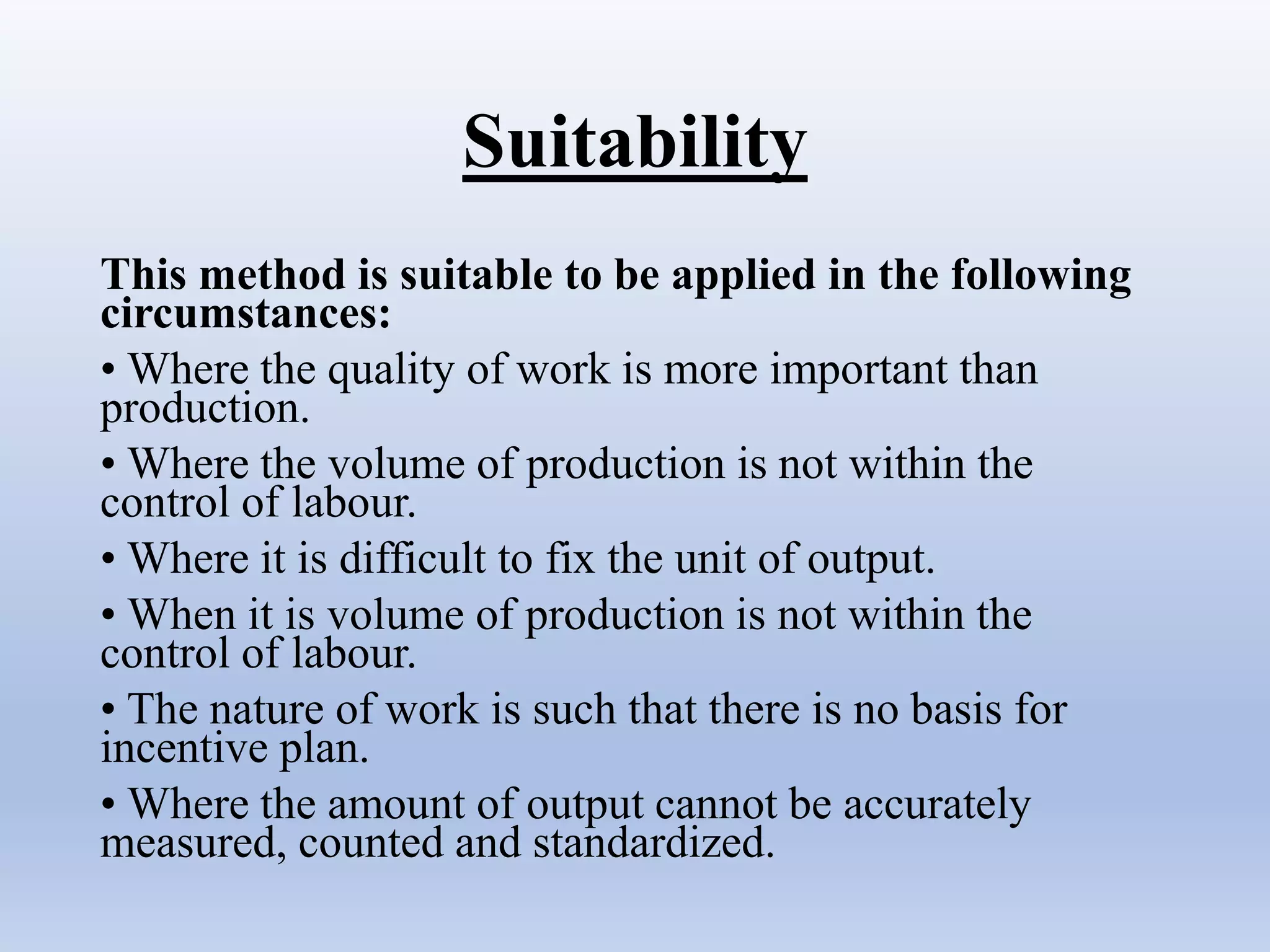

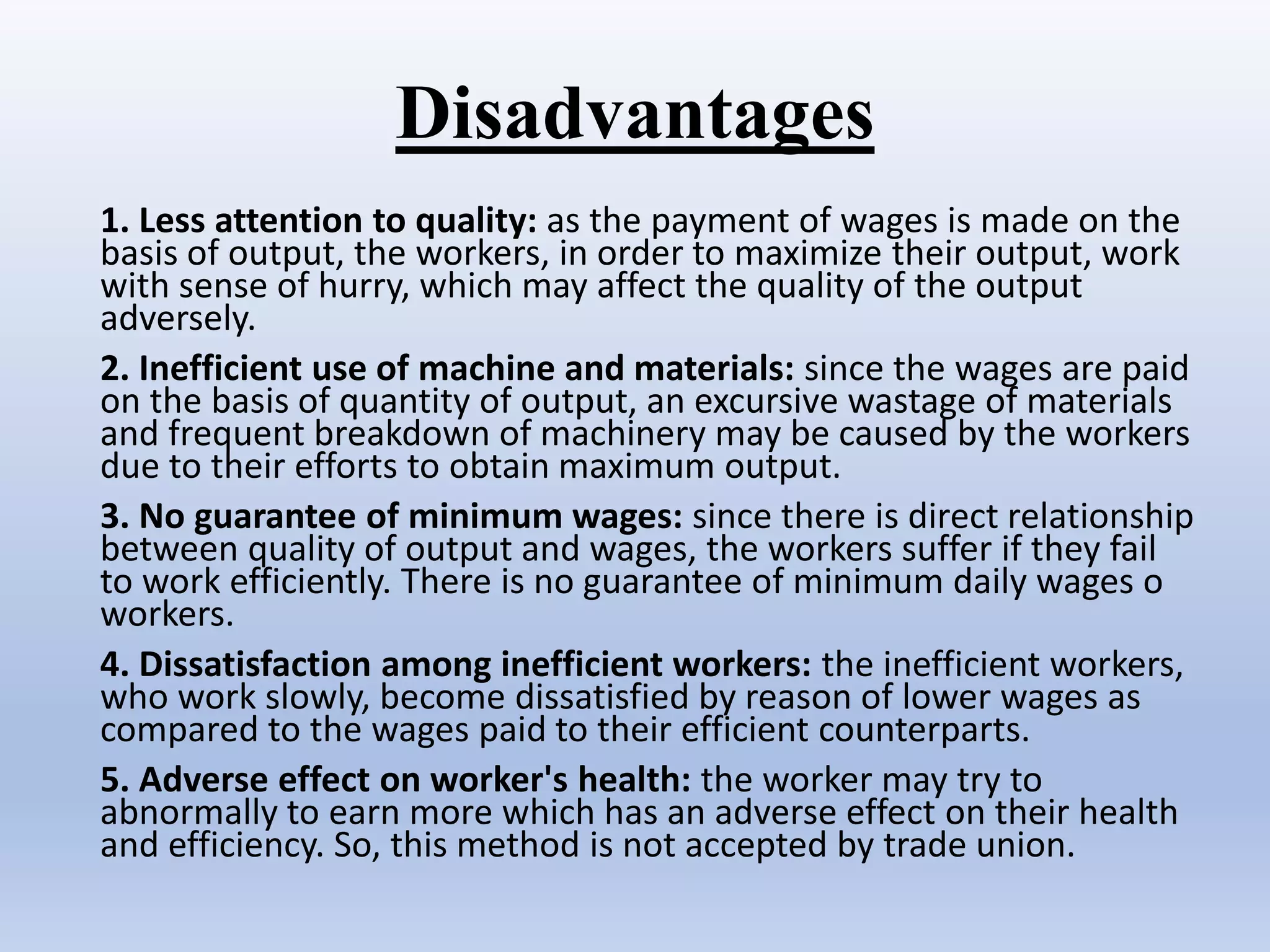

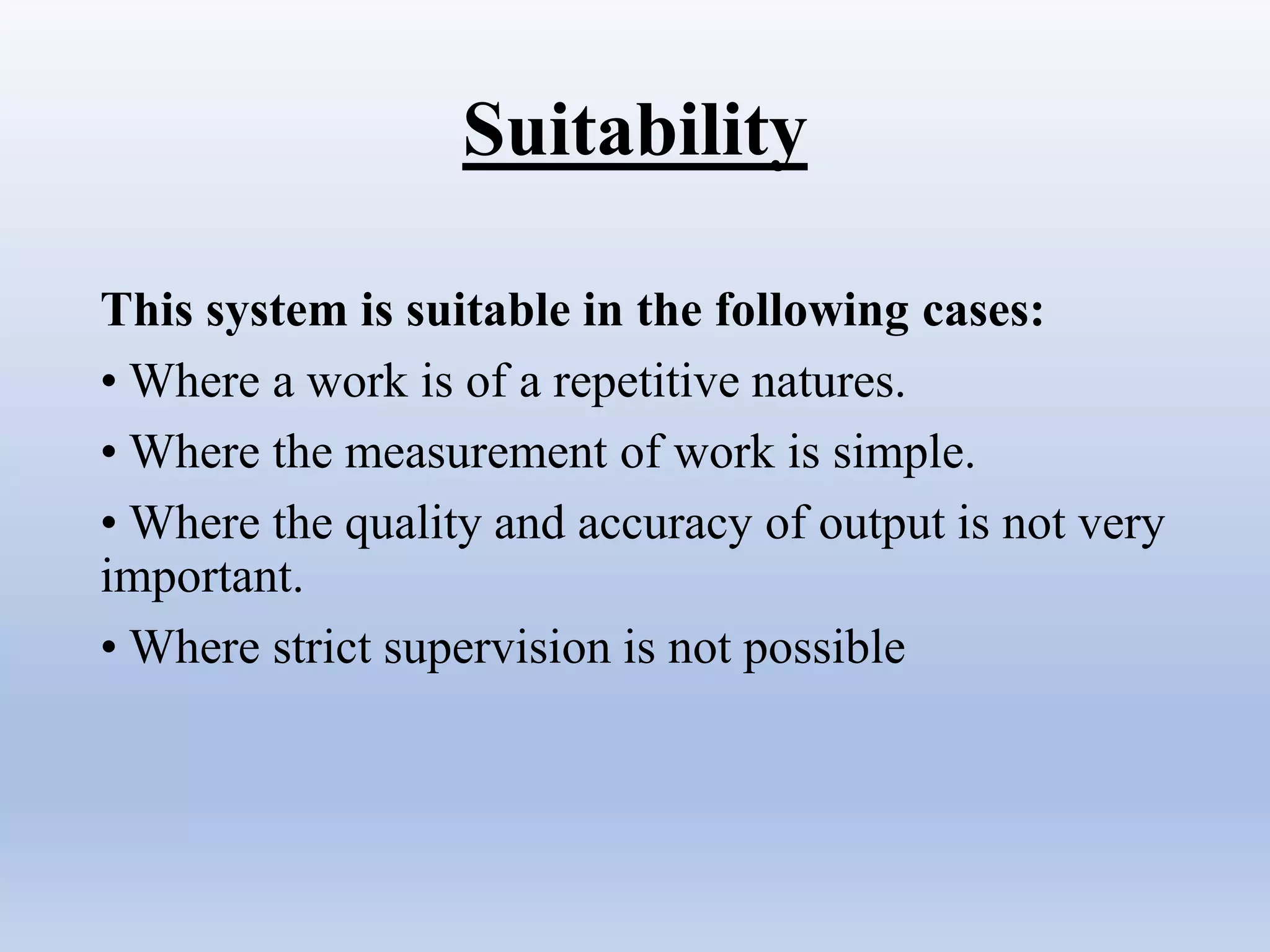

The document discusses compensation and reward management, focusing on different wage payment systems such as time rate, piece rate, and incentive wage systems. It outlines the advantages and disadvantages of each method, emphasizing the implications on worker satisfaction, productivity, and cost management. Additionally, it highlights the suitability of each system under various circumstances to optimize workforce performance and organizational efficiency.