- The Banbury Group is a manufacturer and exporter of textiles founded in 1997 with customers in over 40 countries.

- In 2010, Banbury's sales were close to INR 25.6 crores with most exports going to the Middle East, South America, and Europe. However, sales growth had slowed to 2.5% annually in recent years.

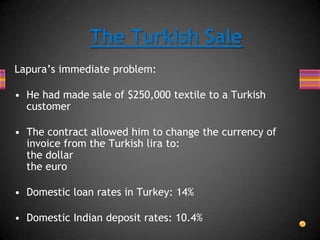

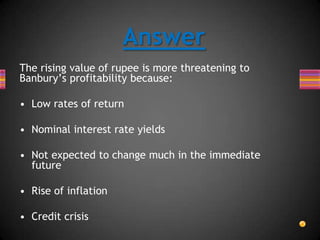

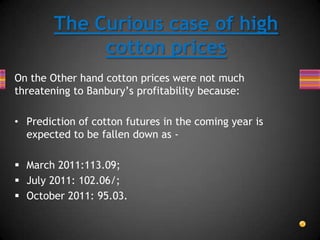

- Banbury faced two issues in 2010 - negotiating a short-term textile sale to a Turkish company and increasing long-term profitability in light of rising cotton prices and an appreciating Indian rupee.