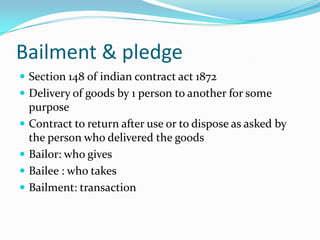

This document discusses bailment and pledge under Indian contract law. It defines bailment as the delivery of goods by one person to another for a specific purpose, with an obligation to return the goods. A bailor delivers the goods, while a bailee receives them. Bailments can be for the exclusive benefit of the bailor or bailee, or for mutual benefit. They can also be gratuitous or for reward. The document outlines the duties of bailors and bailees, as well as their rights. It also discusses how bailments can be terminated. Finally, it defines a pledge as a bailment where goods are delivered as security for a debt, with the pawner delivering and the p

![Kinds of bailment

Kinds of bailment Based on benefit:

Bailment for the exclusive benefit of :

1] bailor: leaving goods in safe custody without paying

2] bailee :a loan of some article like a pen

3] mutual benefit: contracts for hiring, repair ,etc](https://image.slidesharecdn.com/bailment-120406142216-phpapp01/85/Bailment-4-320.jpg)

![Kinds of bailment:

Based on reward:

1] Gratuitous bailment: neither bailor nor bailee is

entitled for remuneration, example: lending a book to a

friend

2] Non-gratuitous bailment: bailment of reward: either

bailee or bailor is entitled to a remuneration , example:

hire, tailor, etc](https://image.slidesharecdn.com/bailment-120406142216-phpapp01/85/Bailment-5-320.jpg)

![Duties of bailee:

Take reasonable care of goods[S.151]

Not to make unauthorized use of goods[S.154]

Not to mix goods with his own goods[S.155-157]

Duty to return goods[S.160&161]

Not doing any act inconistent with terms of

bailment[S.153]

Returning any profit [S.163]](https://image.slidesharecdn.com/bailment-120406142216-phpapp01/85/Bailment-7-320.jpg)

![Rights of bailee

Right to compensation for loss on account of fault in

goods bailed[S.150]

Right to receive necessary expenses[S.158]

Right against premature termination of

bailment[S.159]

Right to compensation in case of defective title[S.164]

Delivery of goods to one of the joint owners[S.165]

Right against third parties](https://image.slidesharecdn.com/bailment-120406142216-phpapp01/85/Bailment-8-320.jpg)

![Duties of bailor

To Disclose faults in goods bailed [S.150]

To repay the necessary expenses [S.158]

To indemnify the bailee [S.164]

Liability on premature breach of bailment[S.159]](https://image.slidesharecdn.com/bailment-120406142216-phpapp01/85/Bailment-9-320.jpg)

![Rights of bailor

Right of indemnity for losses due to negligence by

bailee[S.152]

Termination of bailment on inconsistent use by the

bailee[S.153]

Compensation for unauthorised use by the

bailee[S.154]

Compensation when the bailee mixes the goods bailed

with own goods [S.155]

Right of return of goods back[S.160]

Right to profit from goods bailed[S.163]](https://image.slidesharecdn.com/bailment-120406142216-phpapp01/85/Bailment-10-320.jpg)

![Termination of bailment

Doing an act inconsistent with terms of

bailment[S.153]

At desire of the bailor in case of gratuitous

bailment[S.159]

On expiry of period[S.160]

On accomplishment of object[S.160]

Death of the bailor or bailee [S.162]](https://image.slidesharecdn.com/bailment-120406142216-phpapp01/85/Bailment-11-320.jpg)