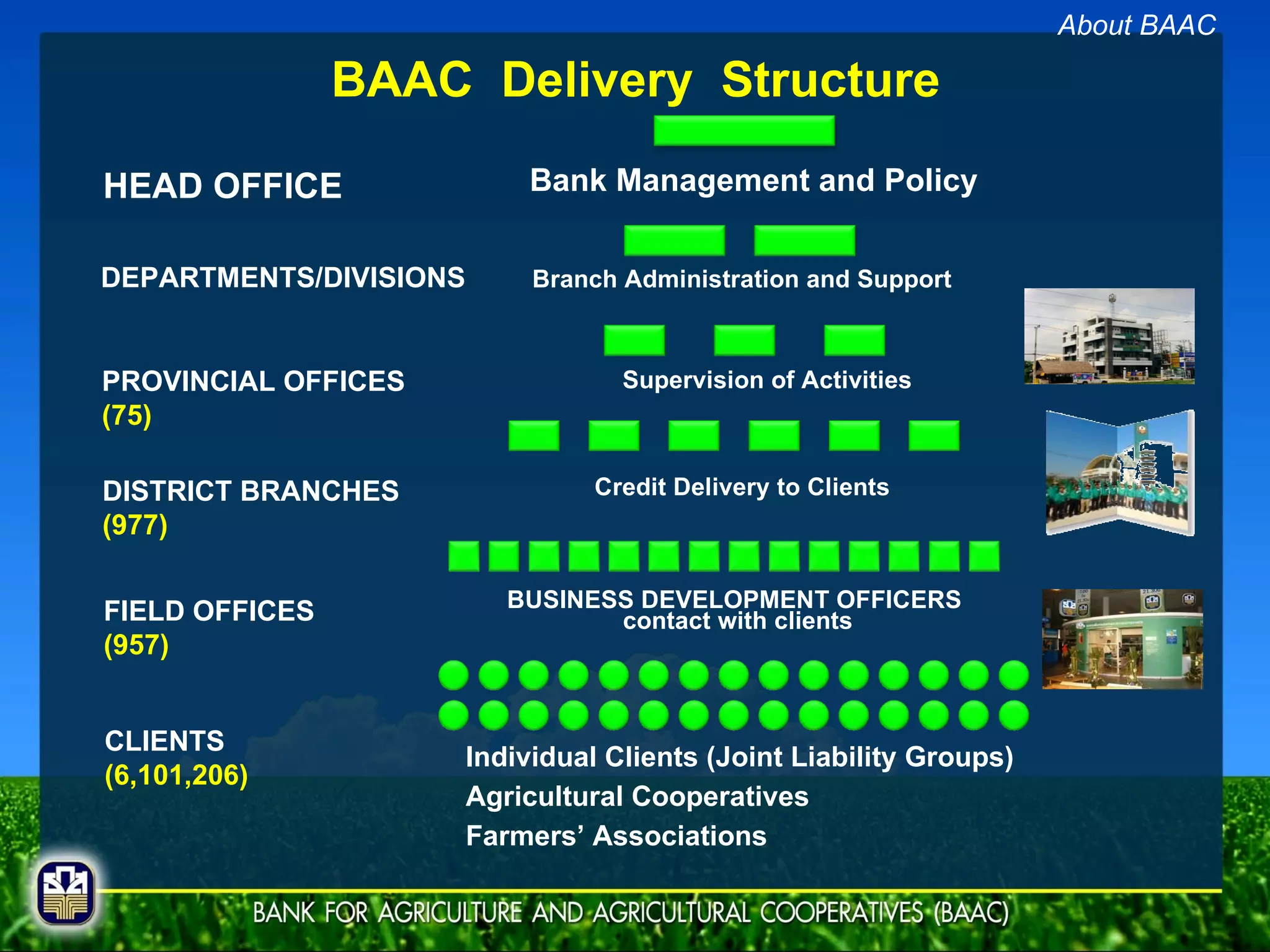

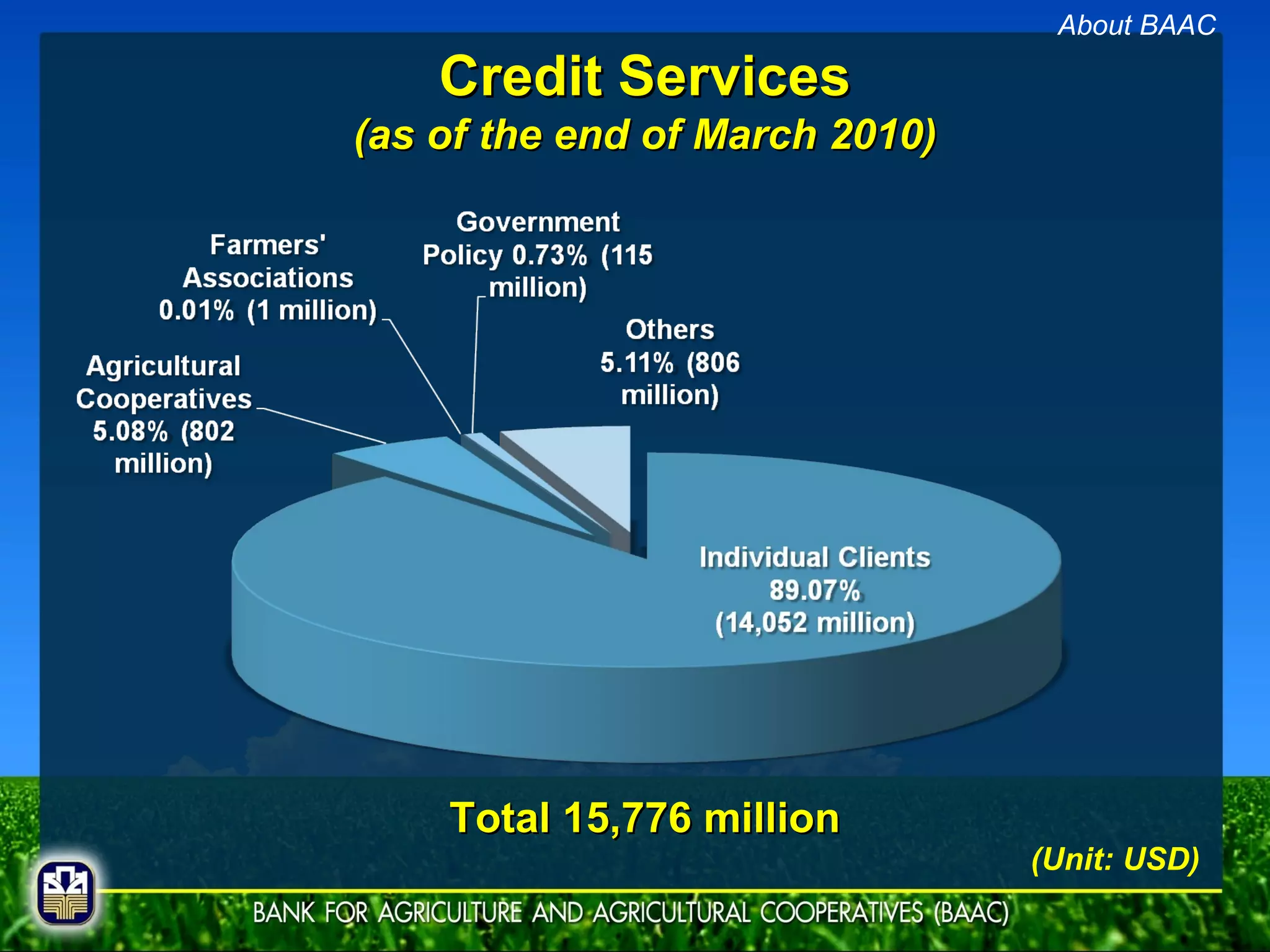

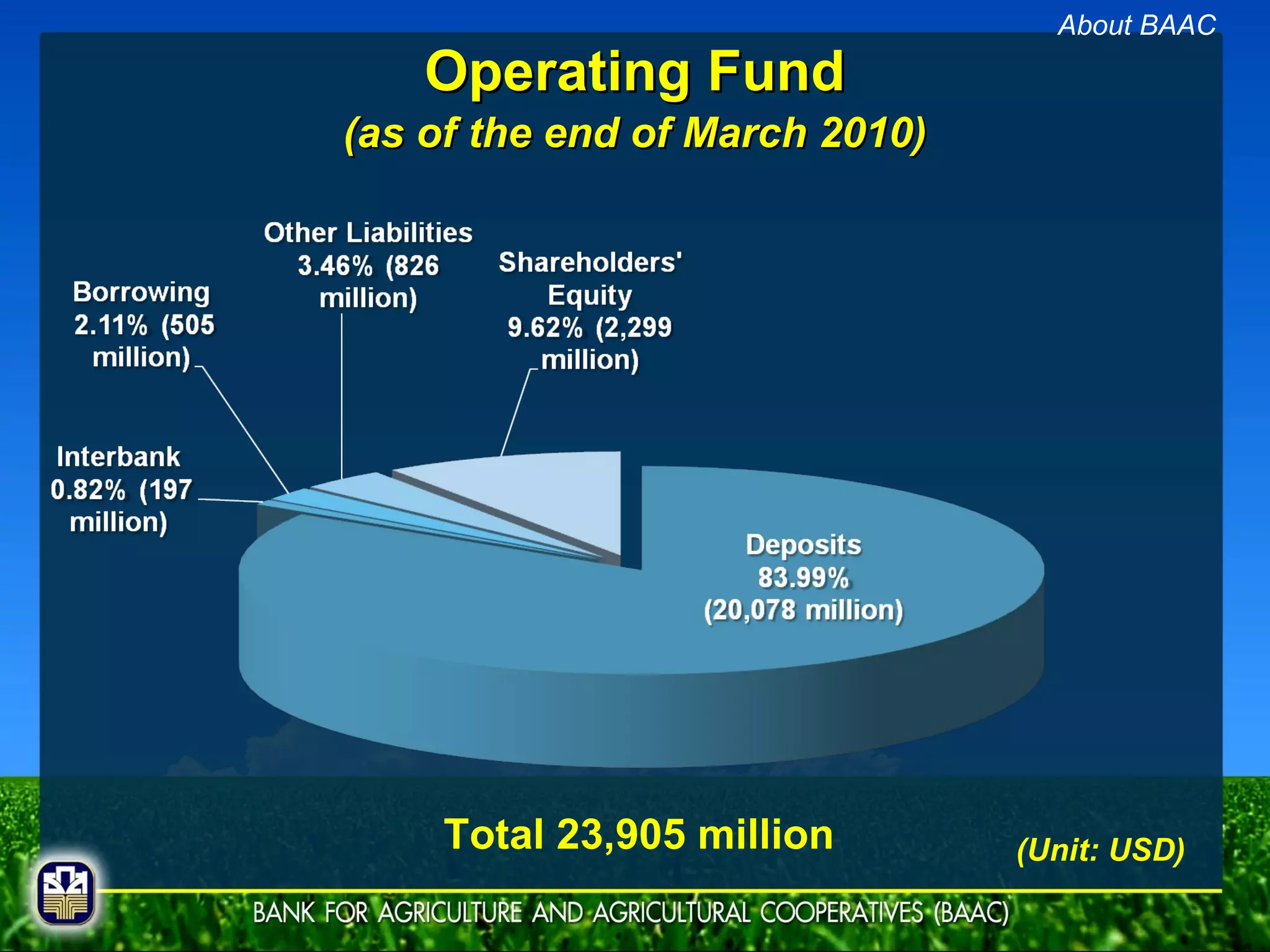

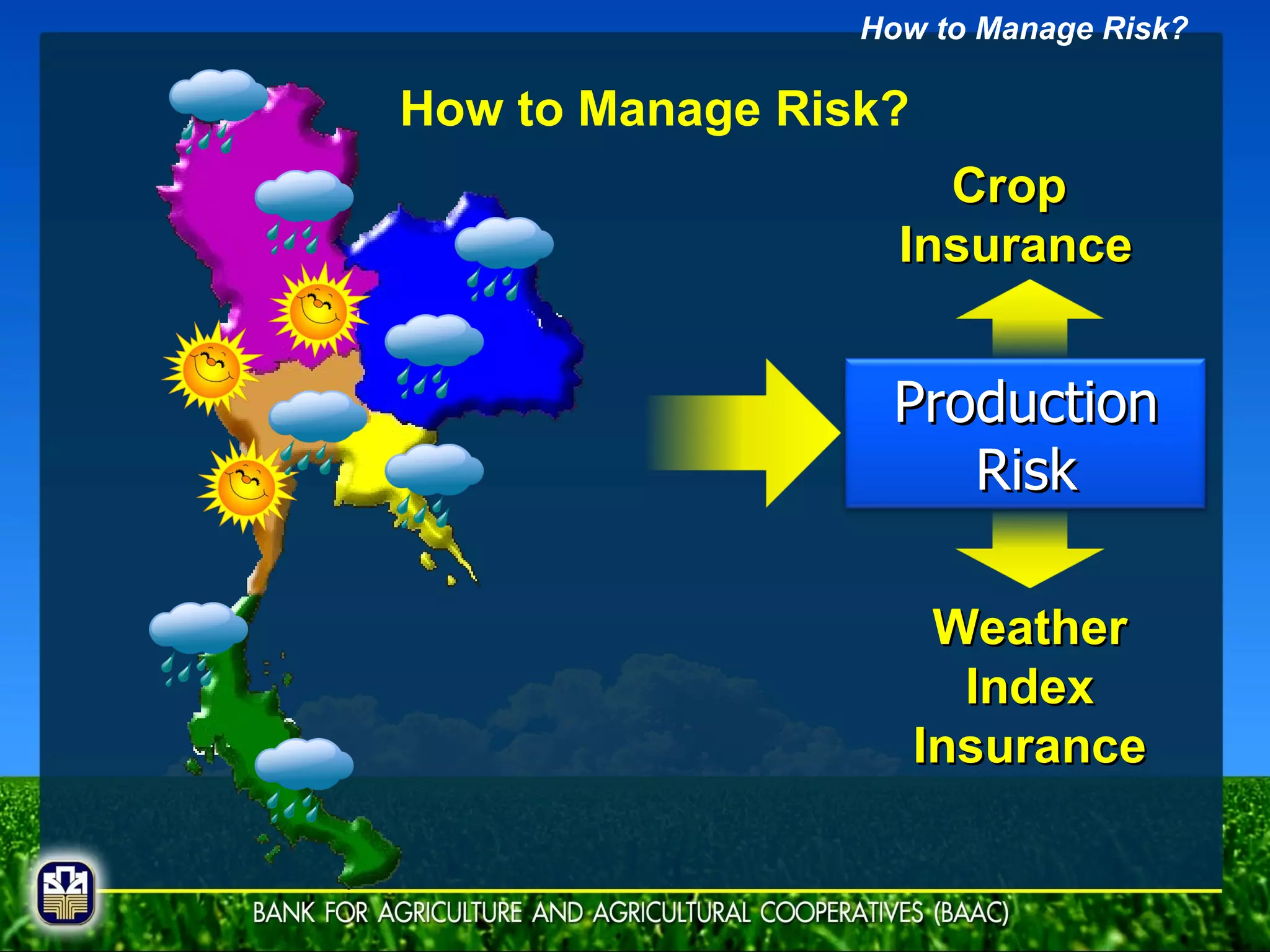

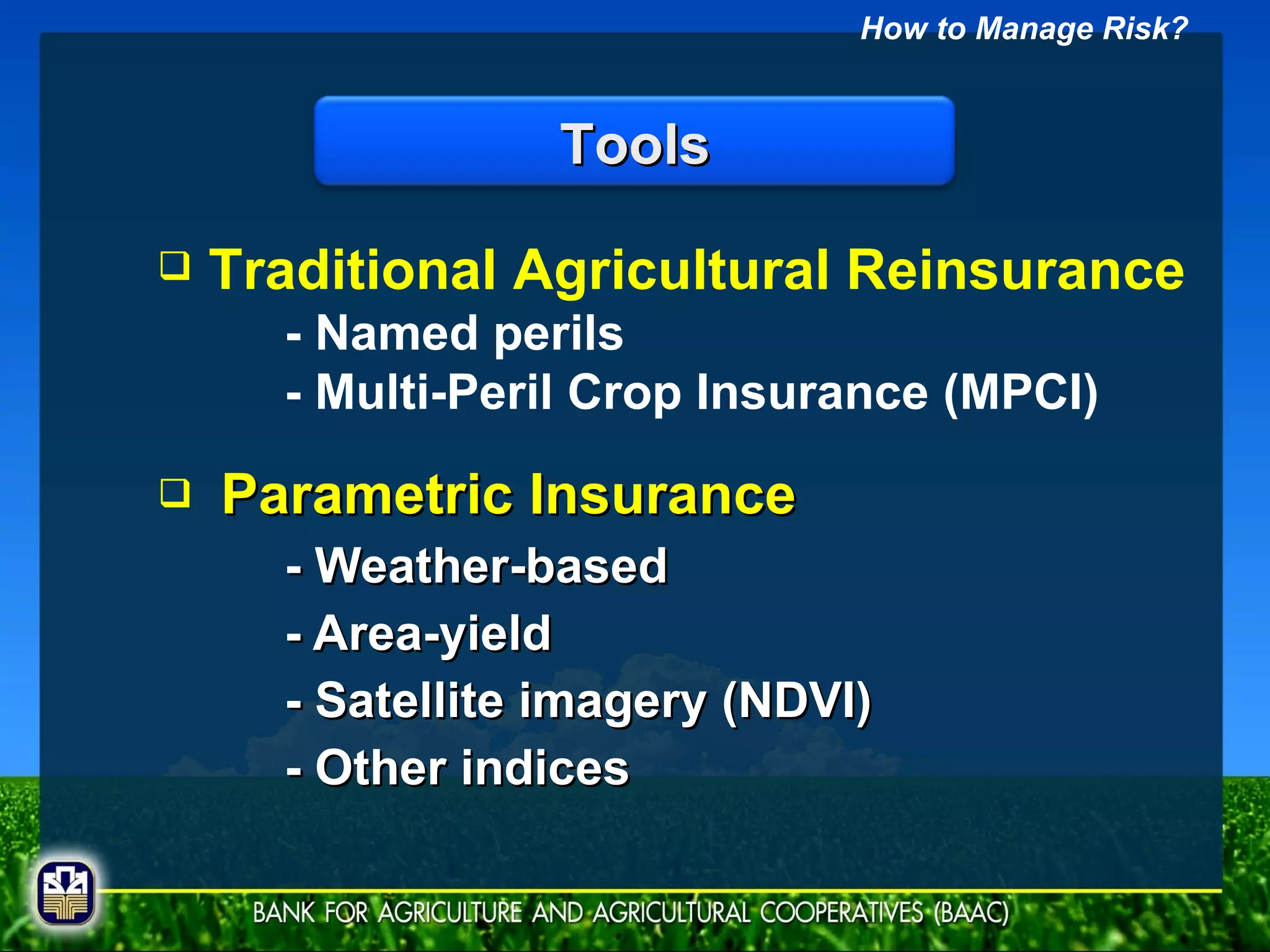

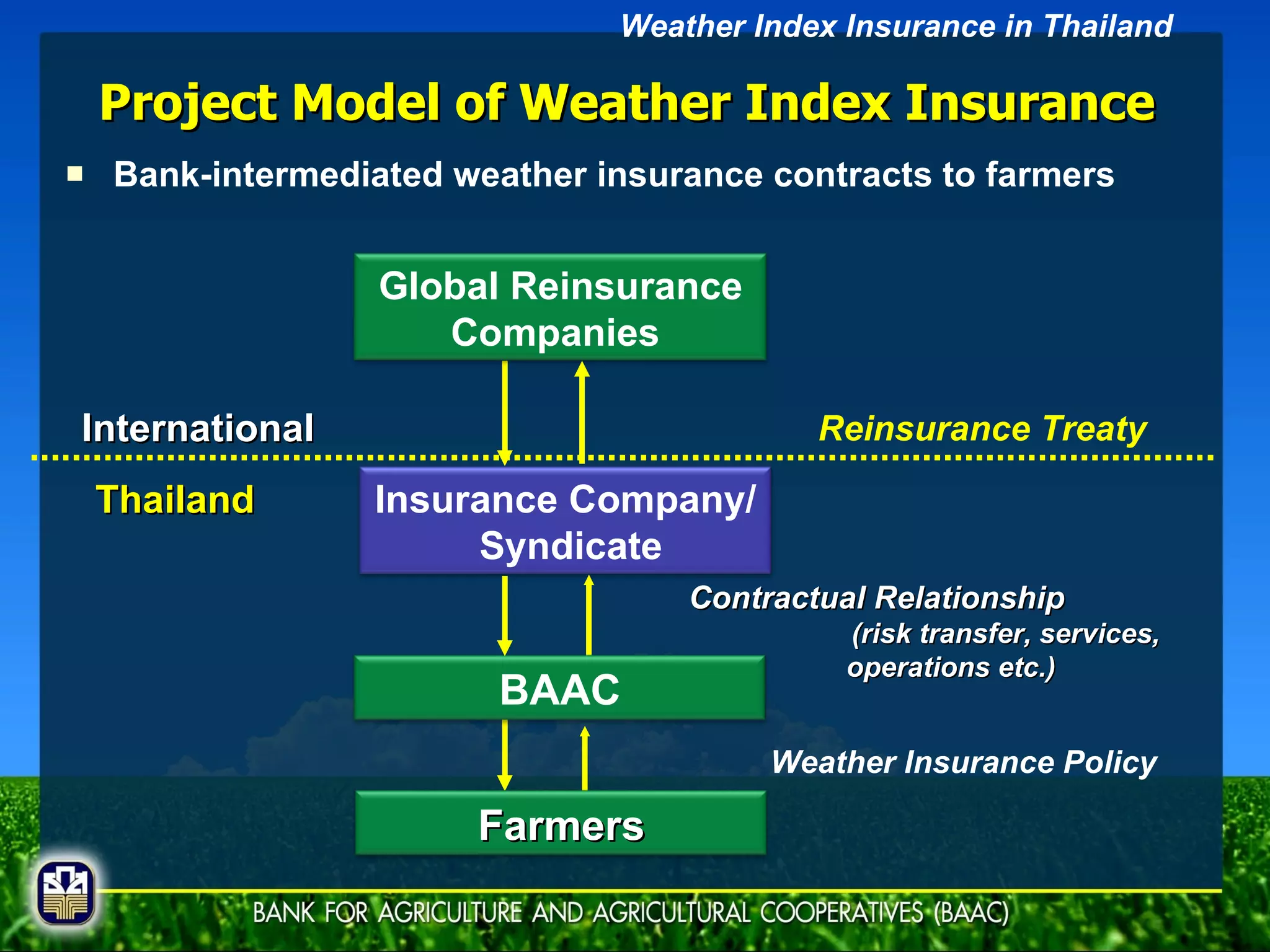

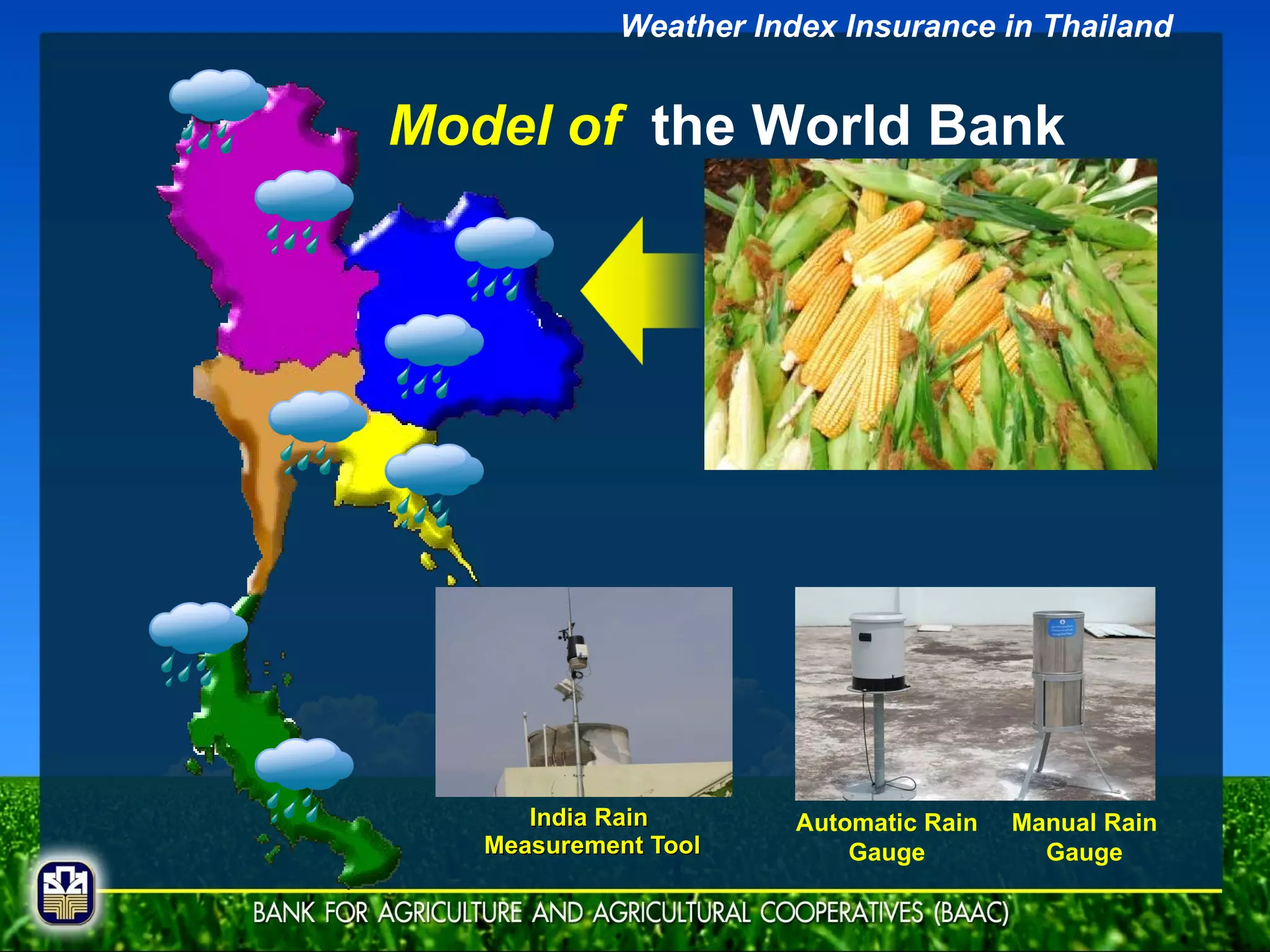

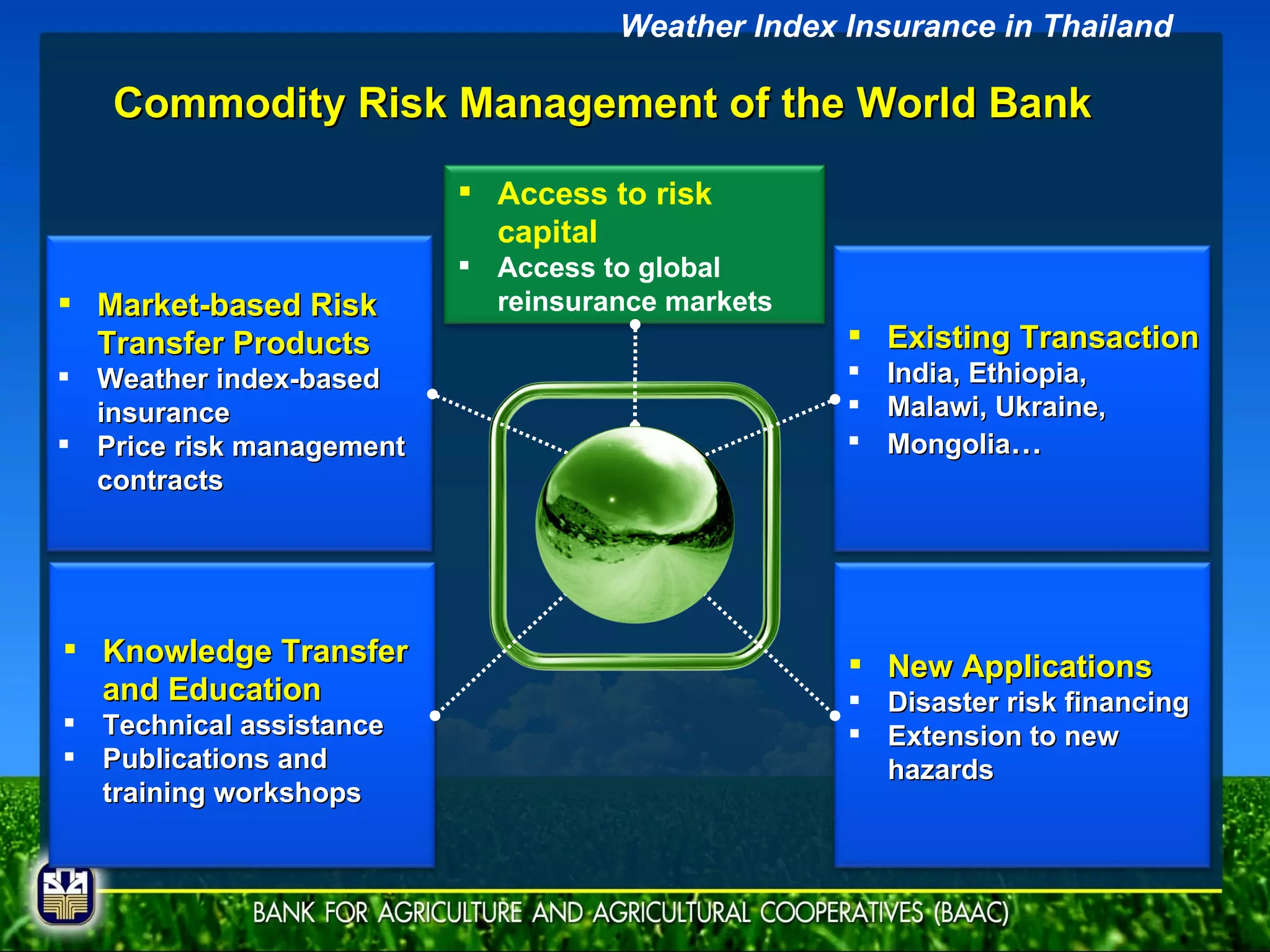

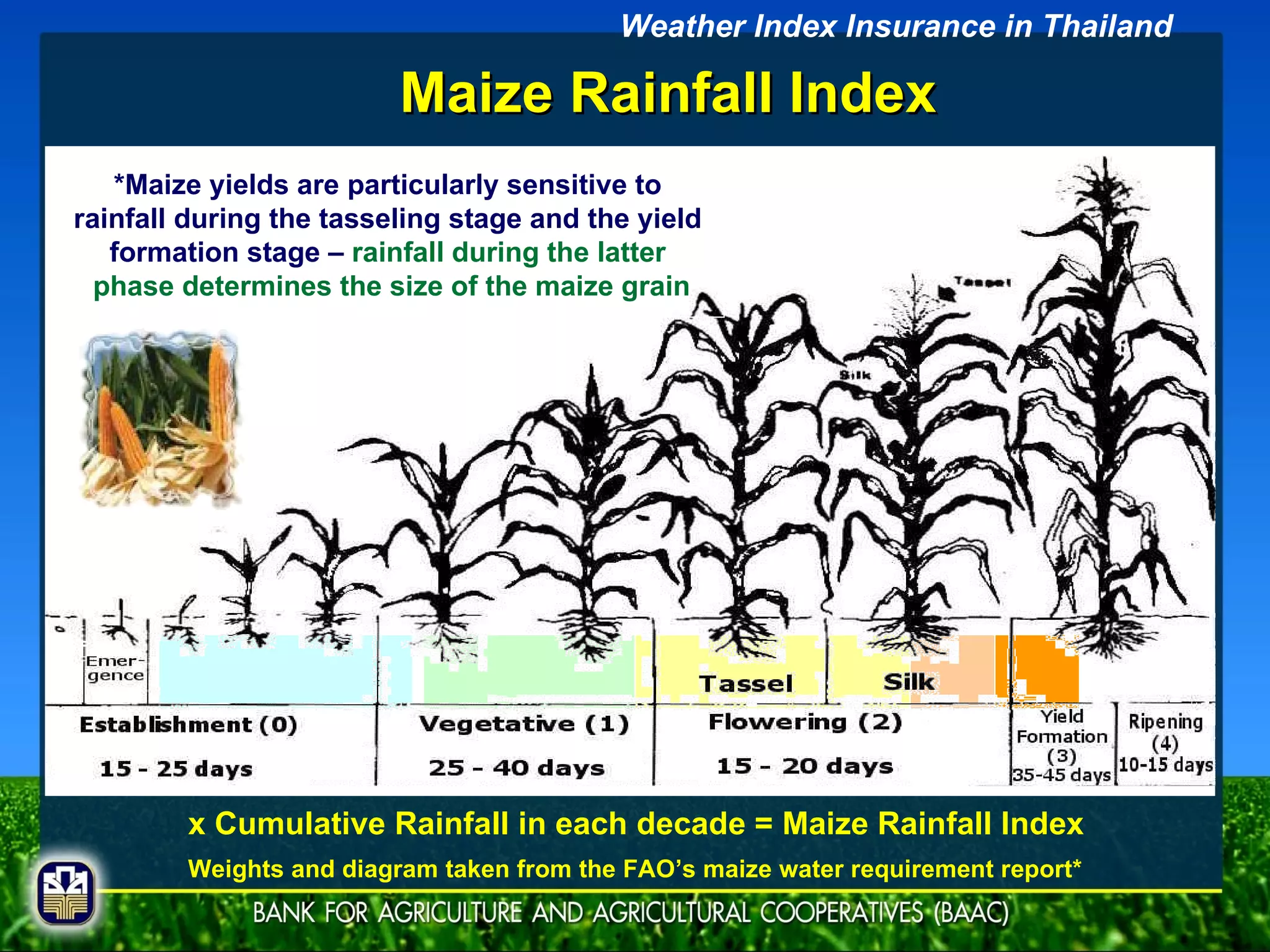

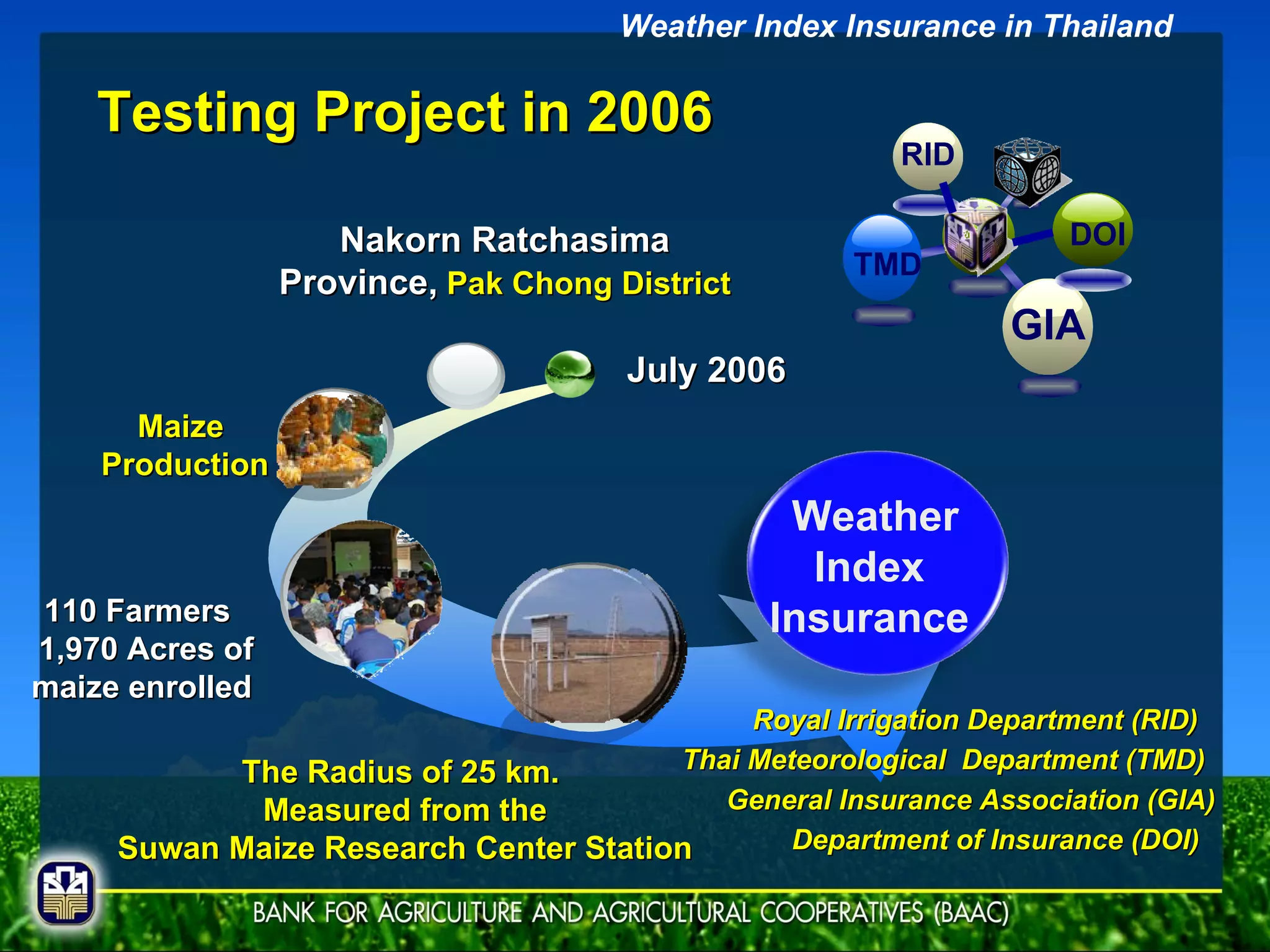

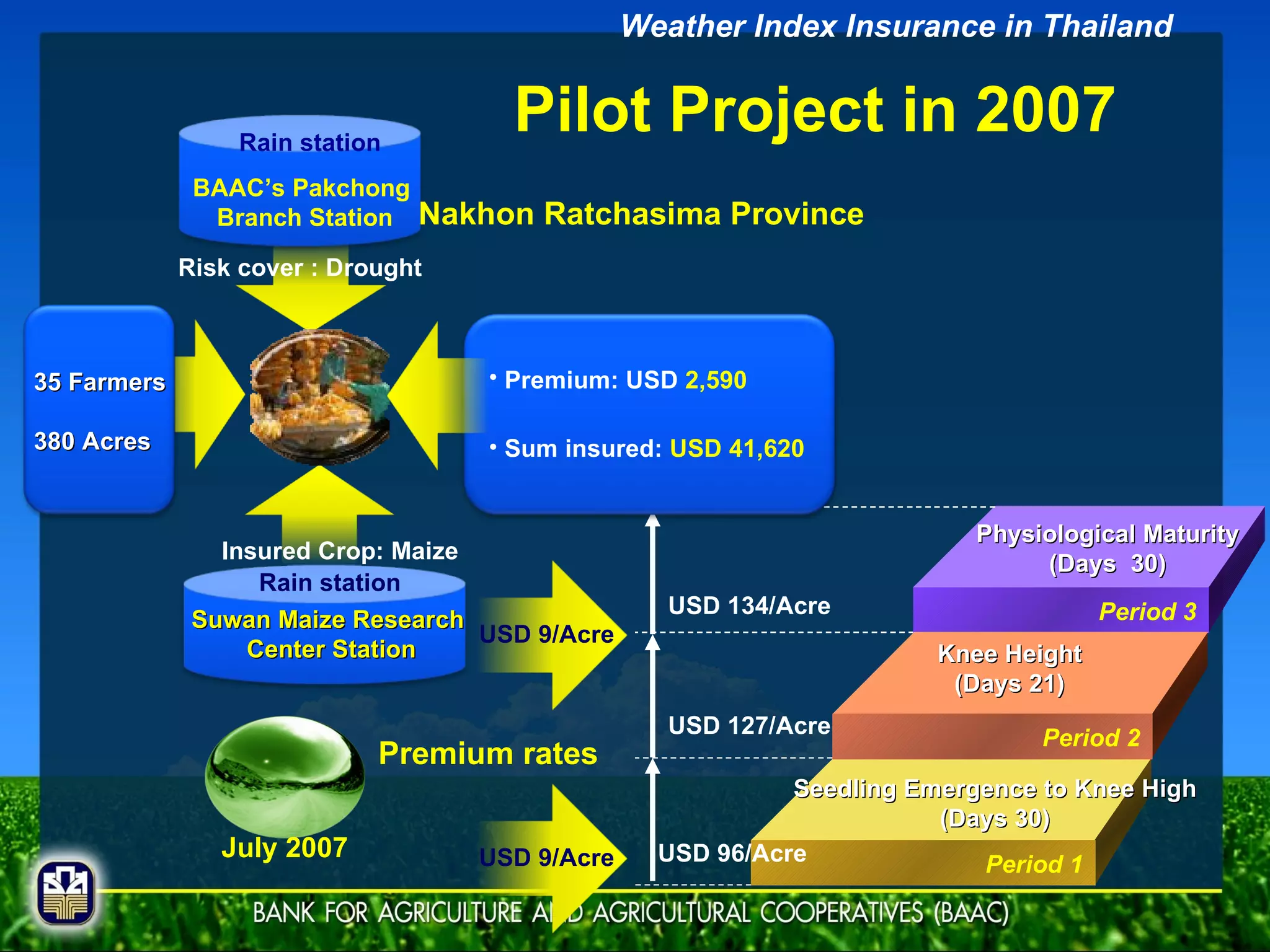

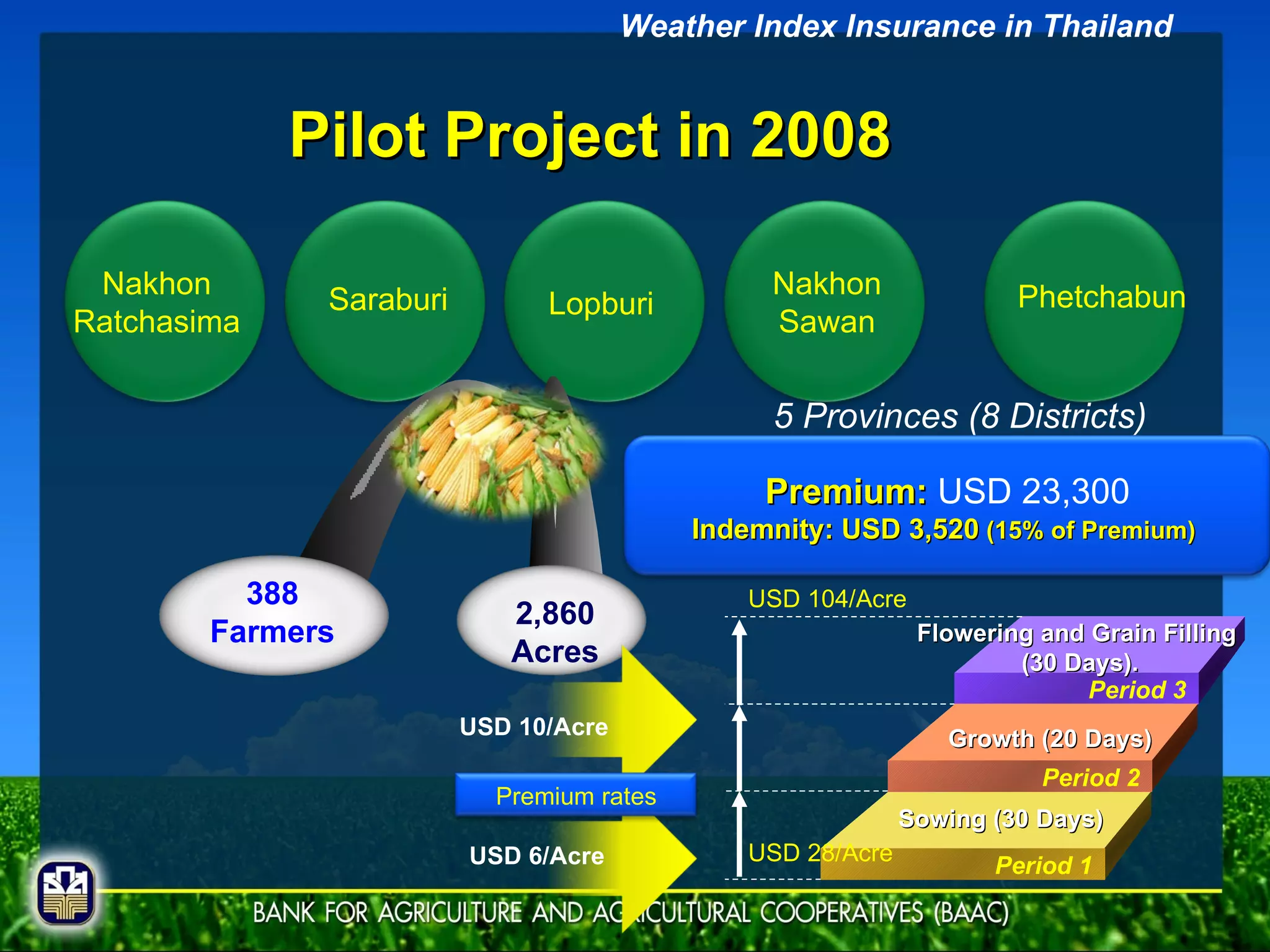

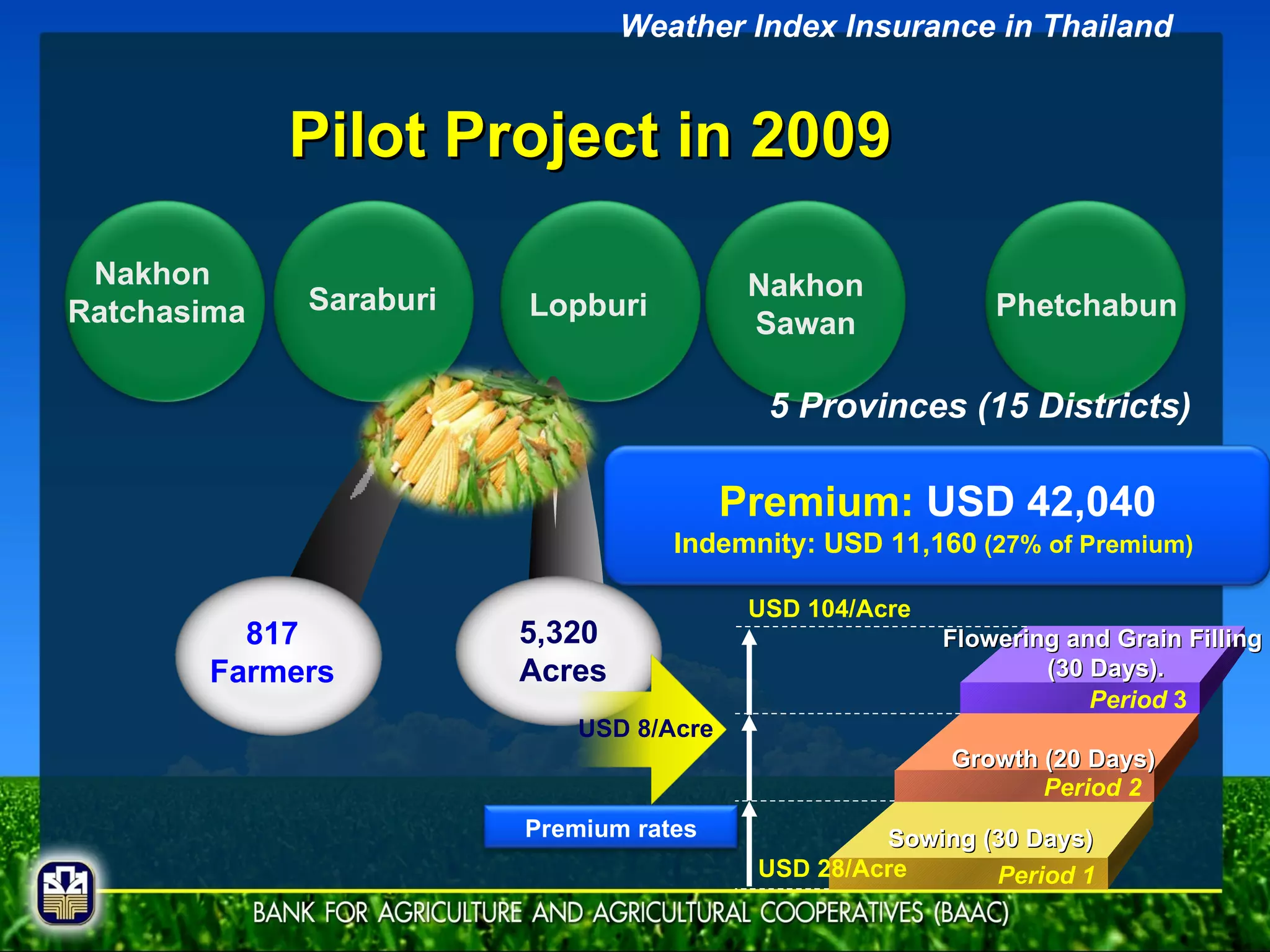

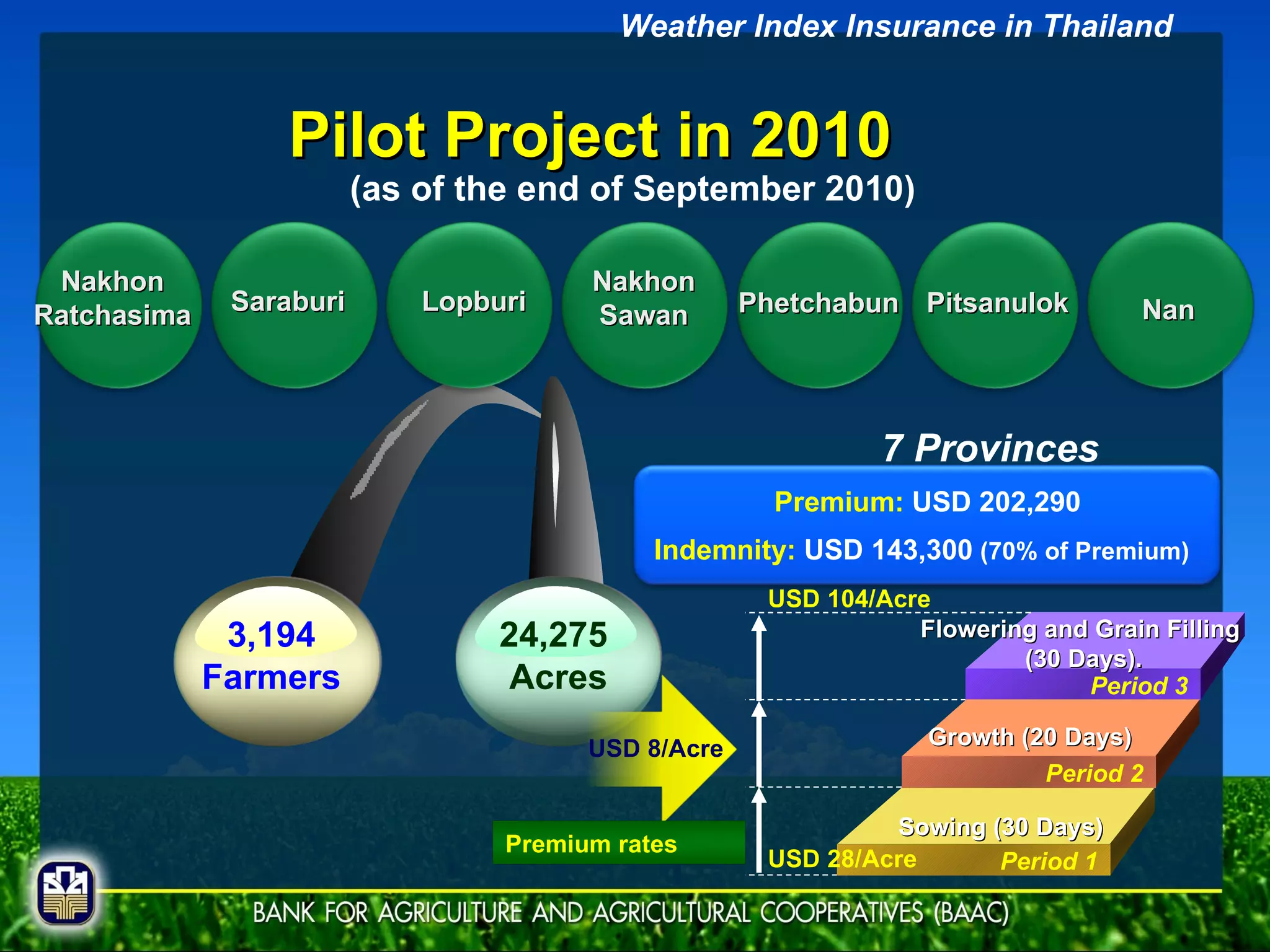

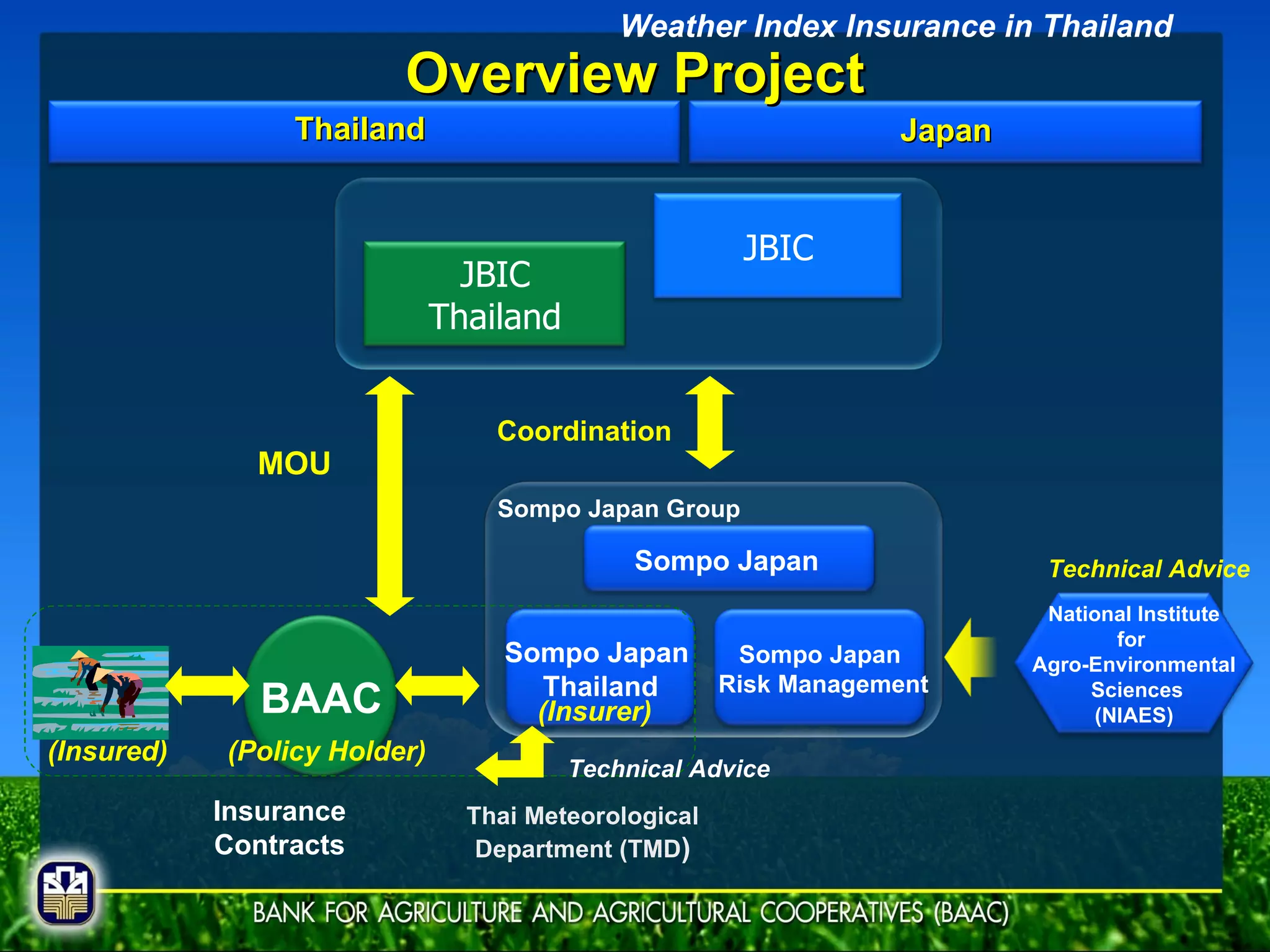

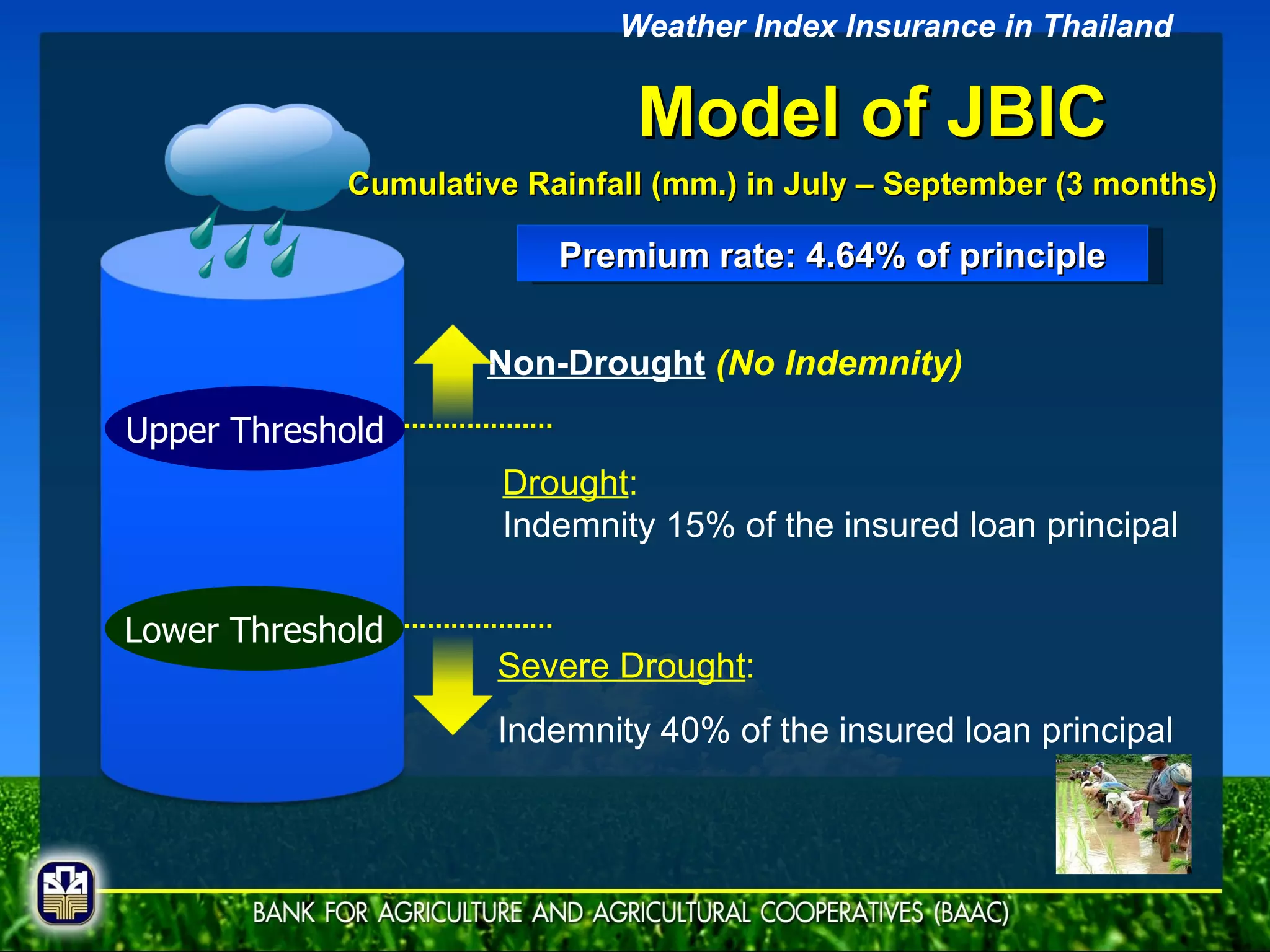

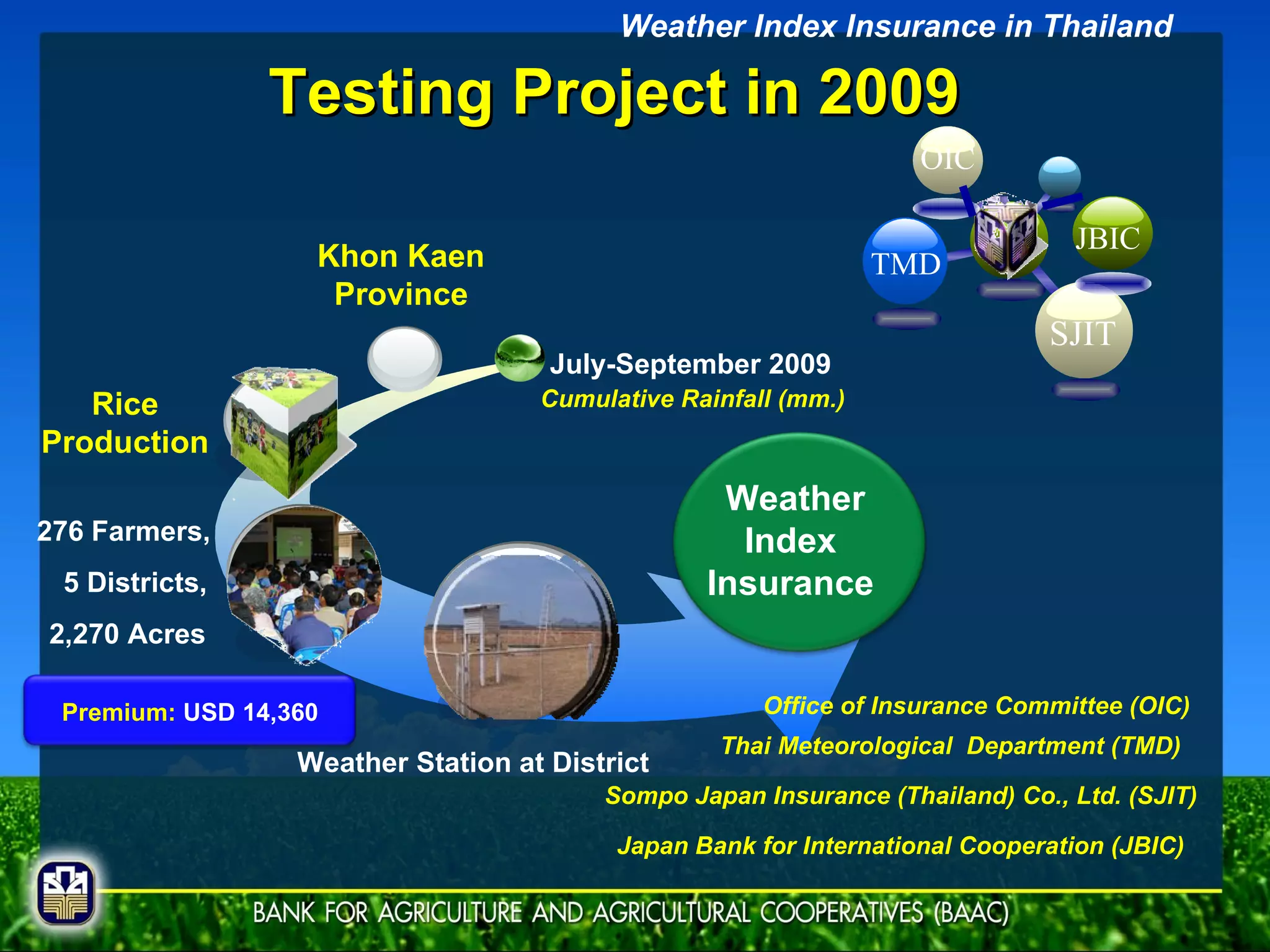

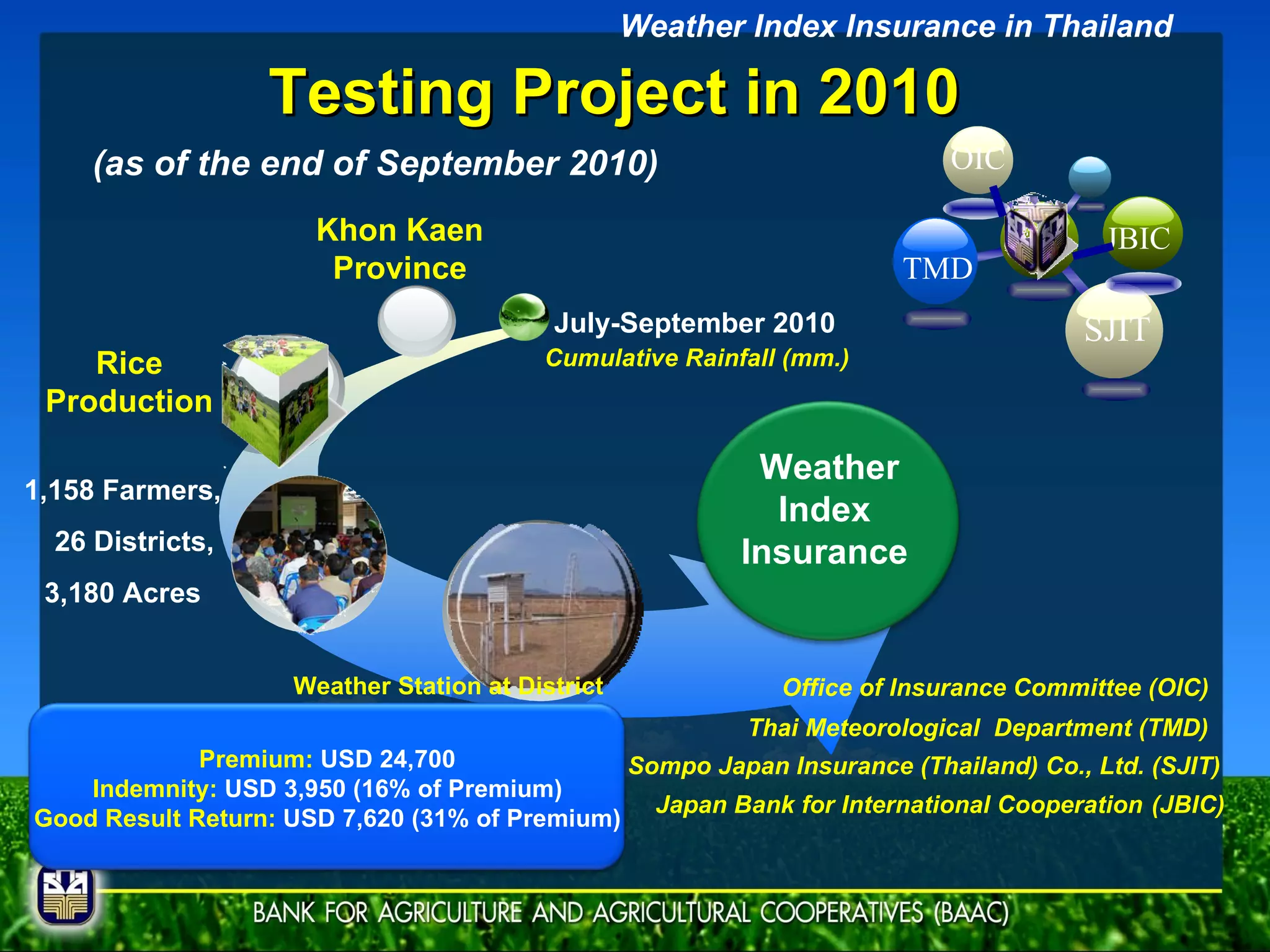

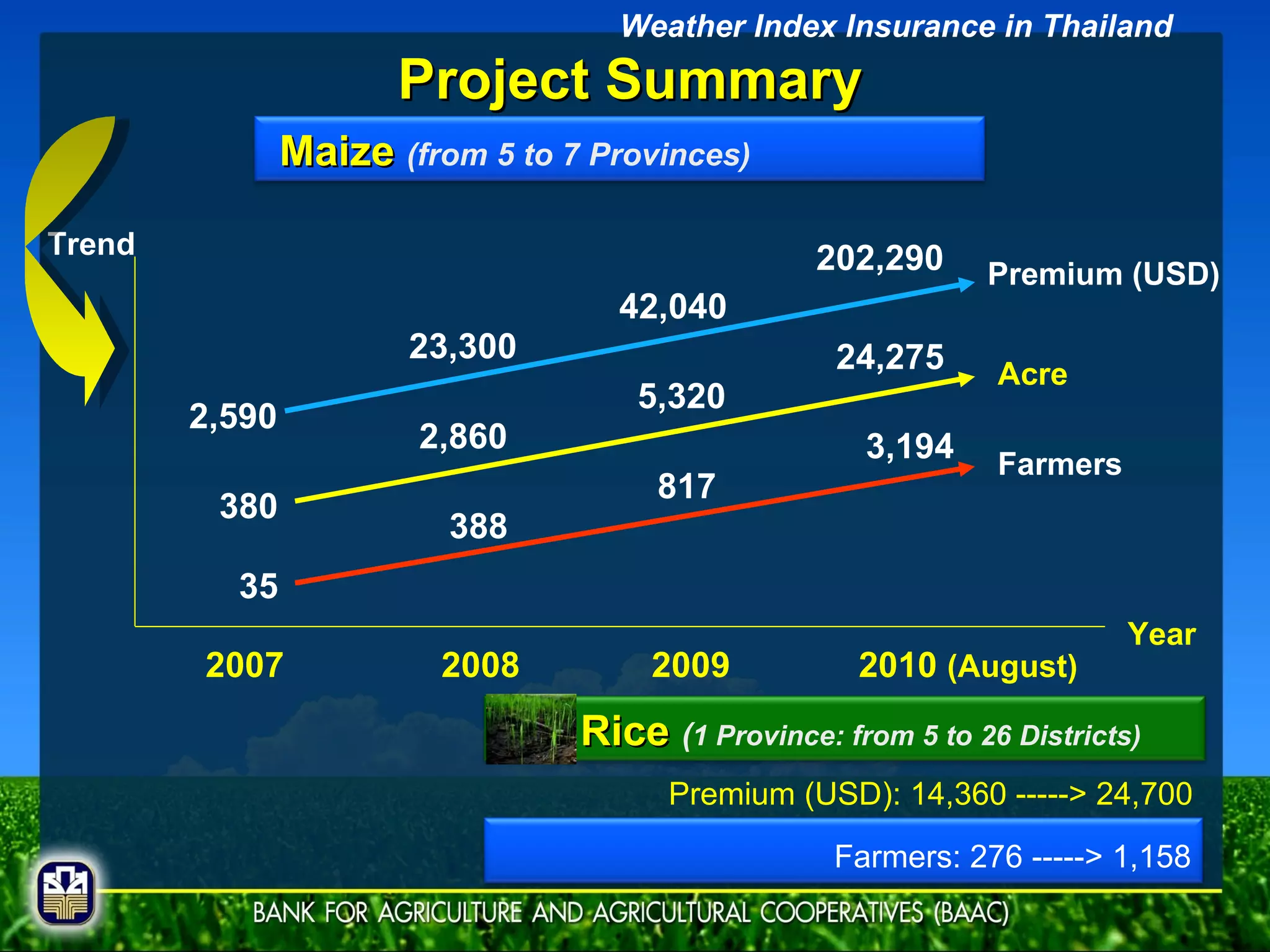

The document discusses agricultural weather index insurance in Thailand provided by the Bank for Agriculture and Agricultural Cooperatives (BAAC). It provides an overview of BAAC and its operations. It then discusses why risk management is important for farmers, how weather index insurance works as a risk management tool, and the pilot projects conducted from 2006-2010 to test weather index insurance. The pilots showed growing interest from more farmers and covered more provinces and districts over the years. Lessons learned included having a non-complicated model and collaboration between relevant organizations.