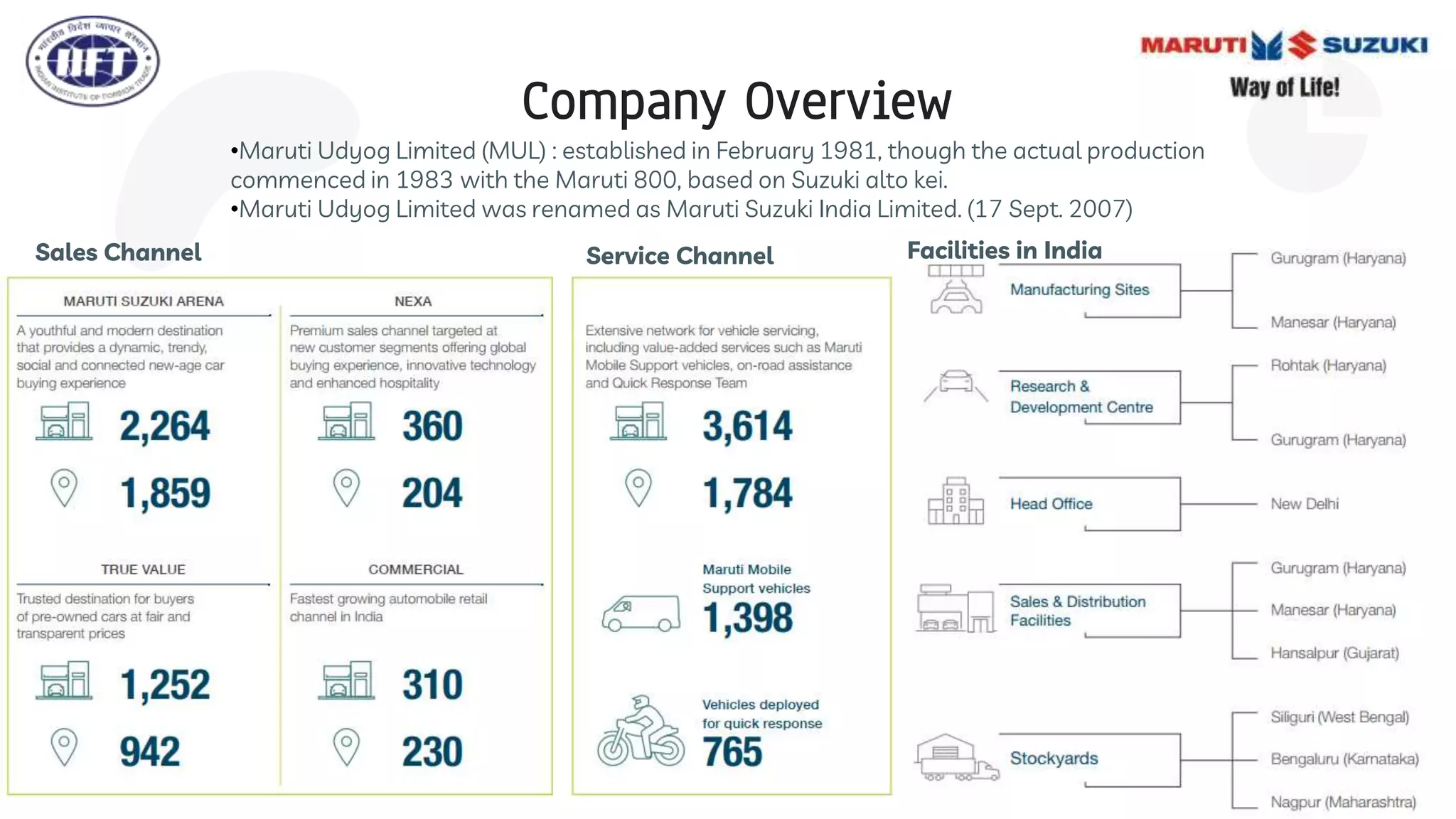

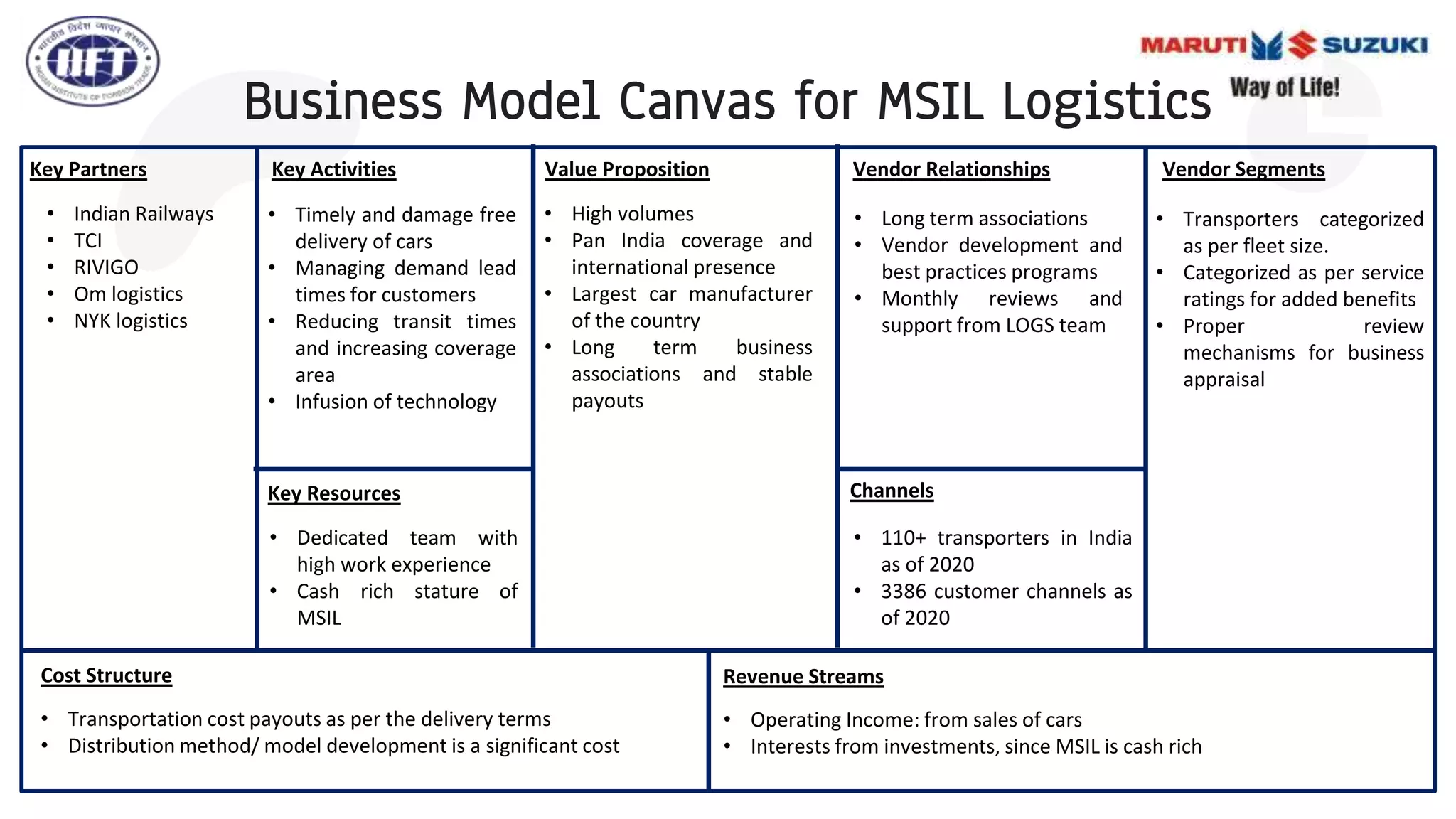

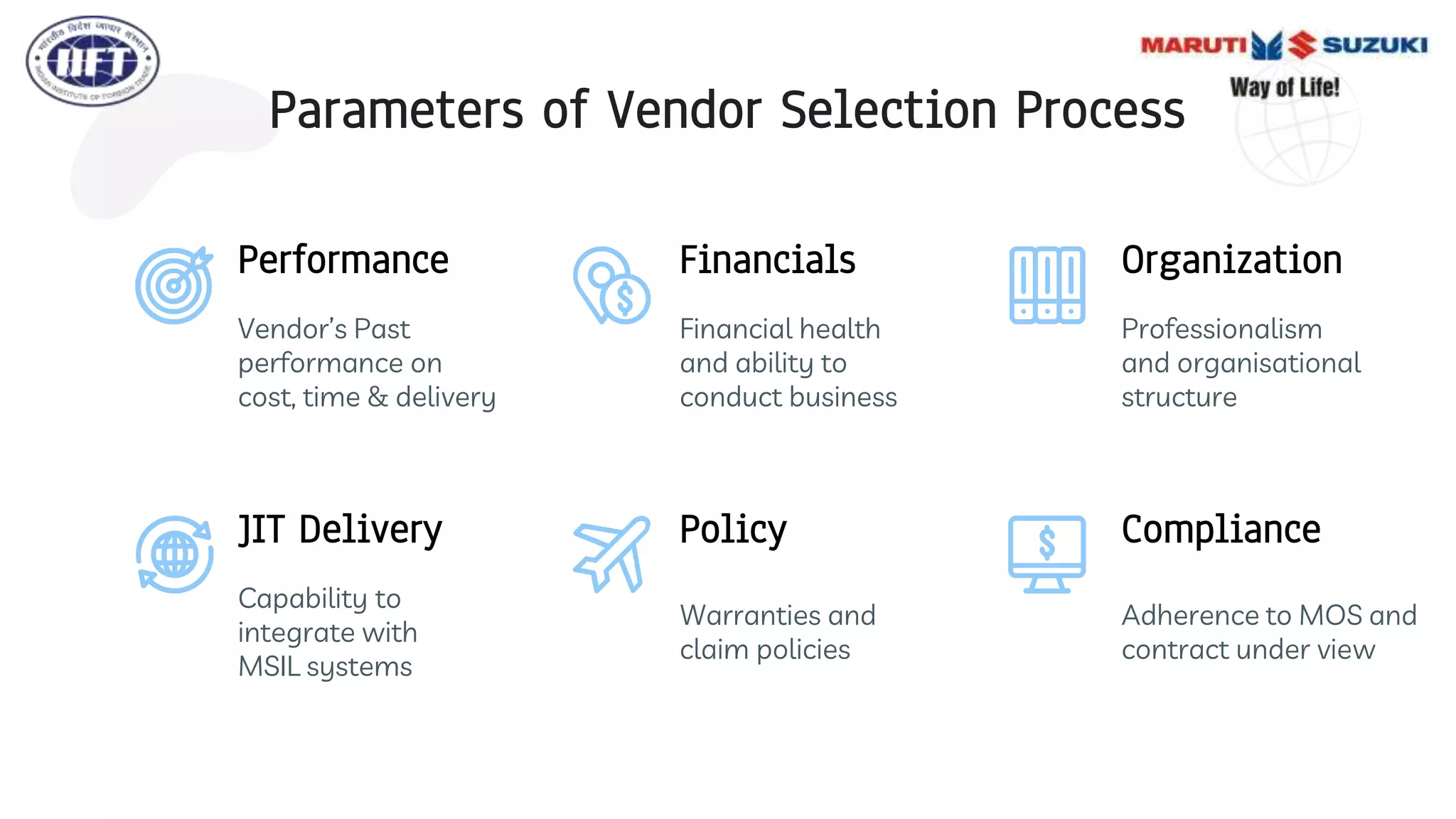

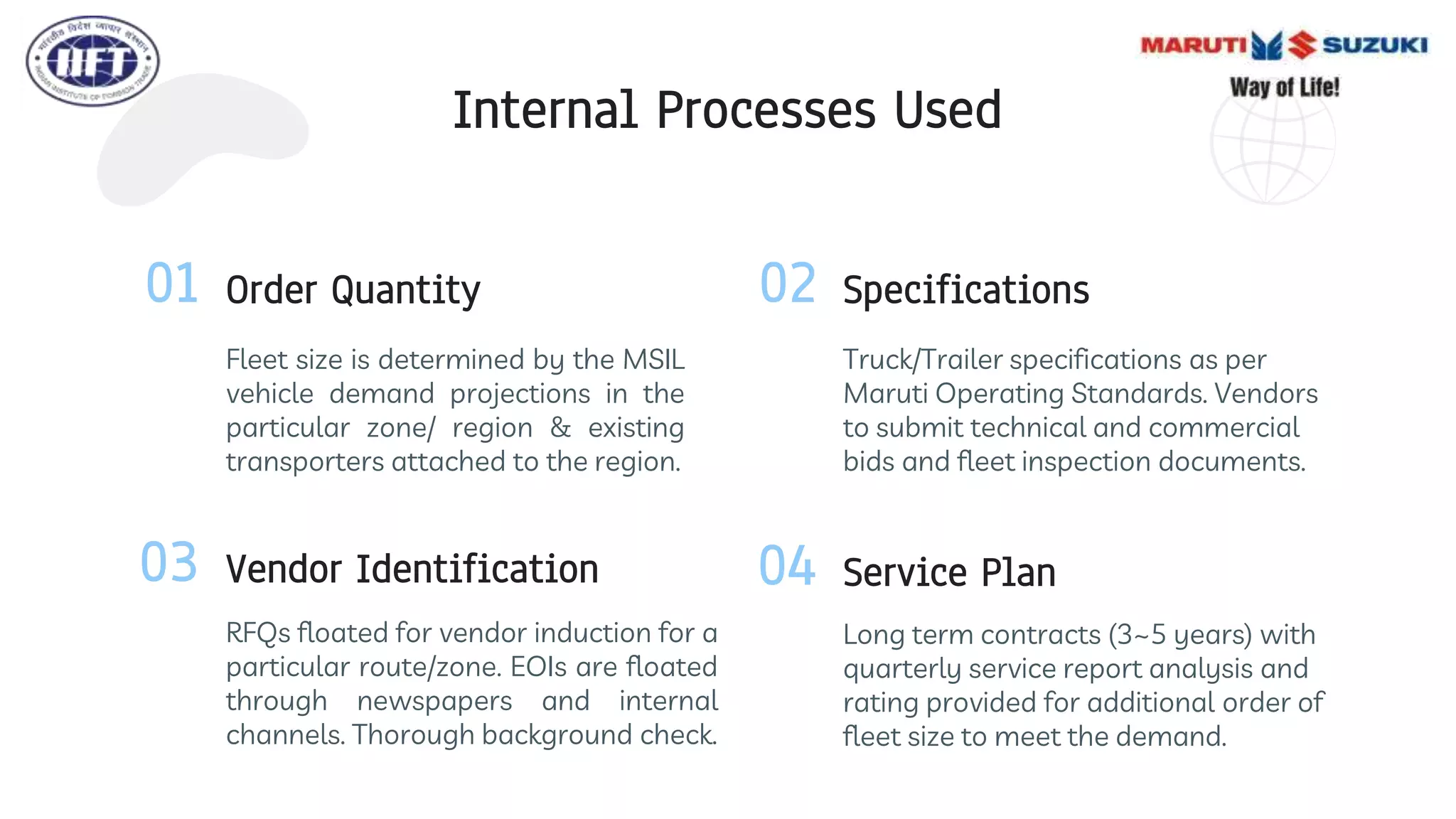

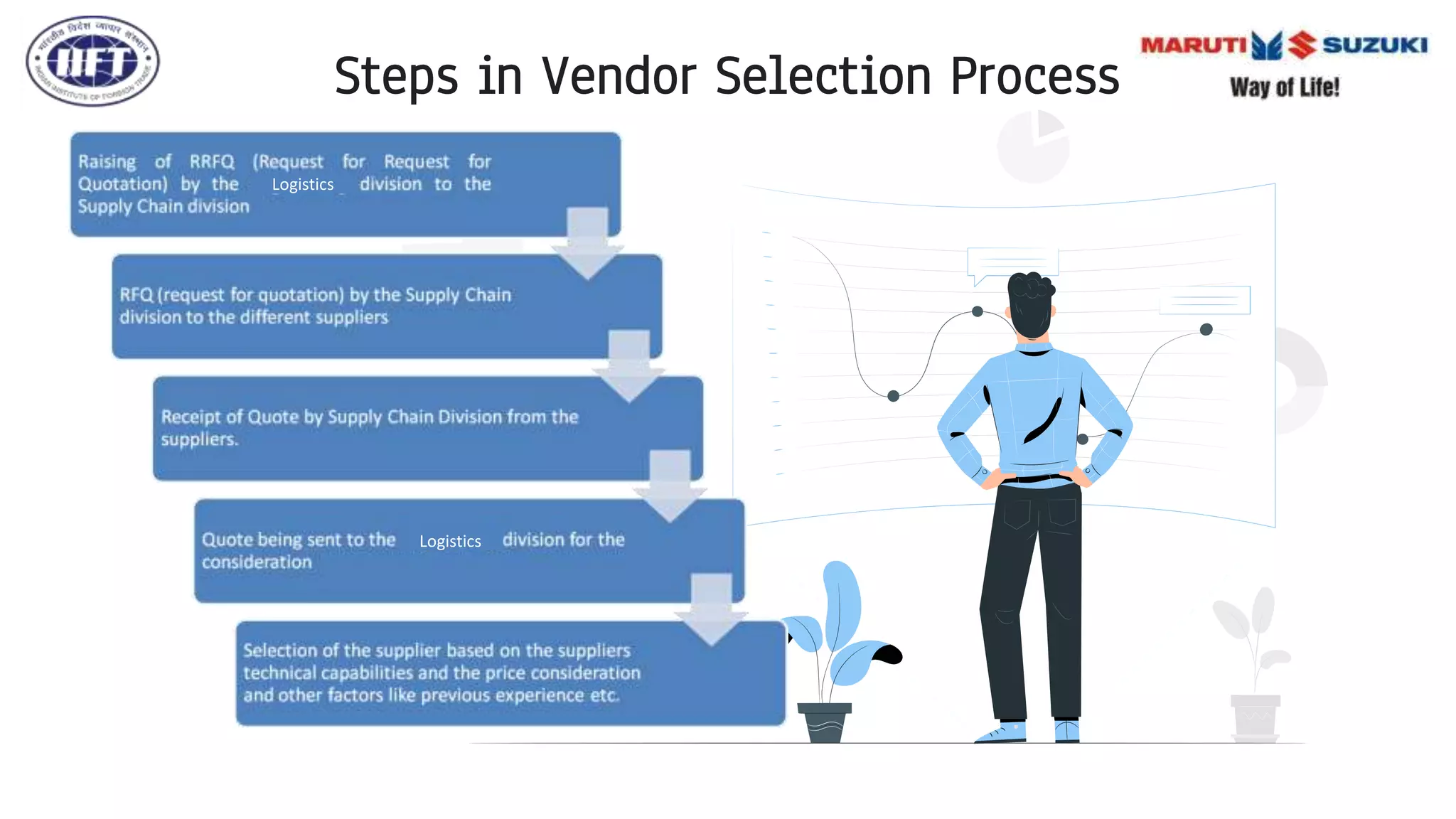

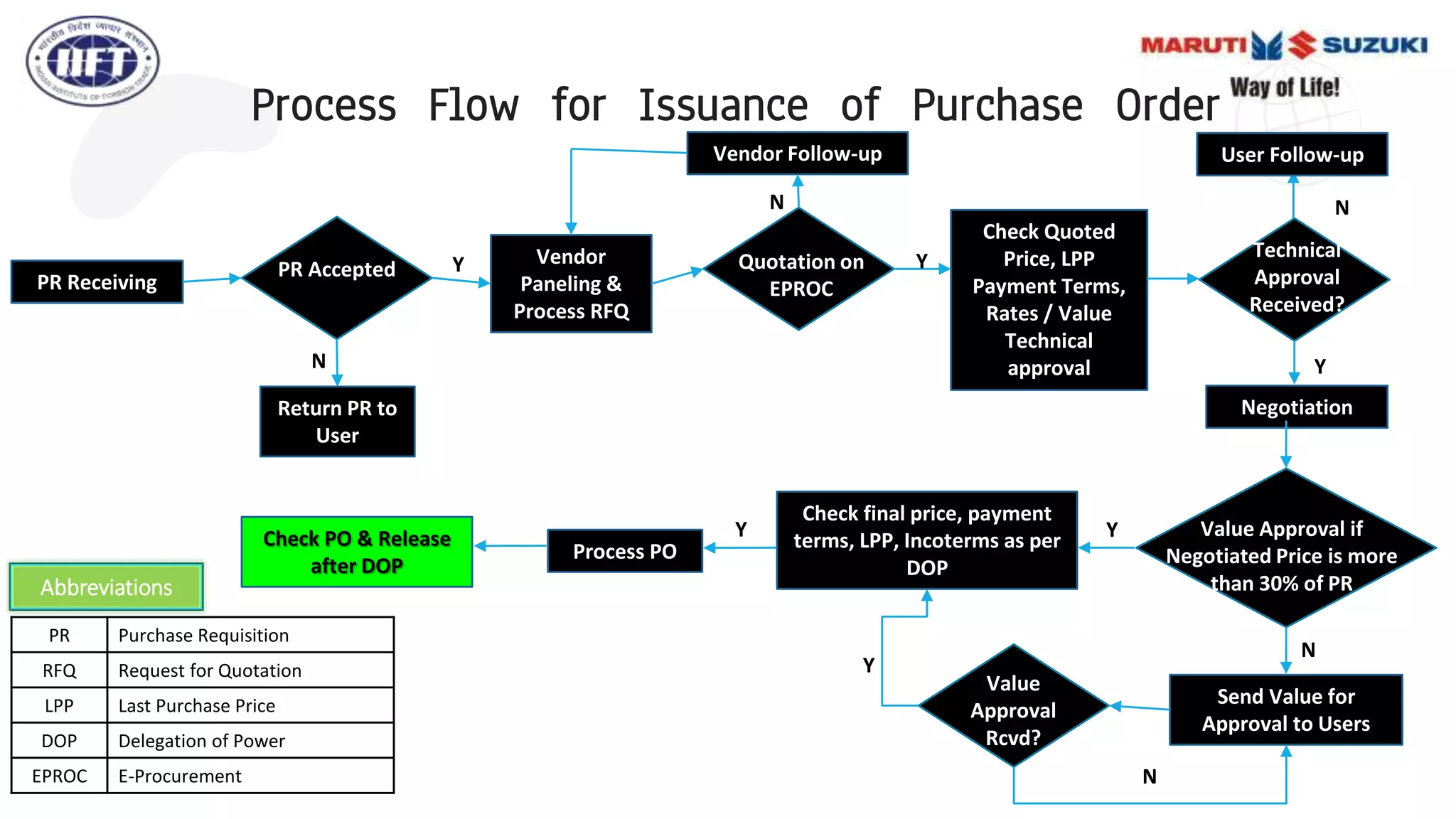

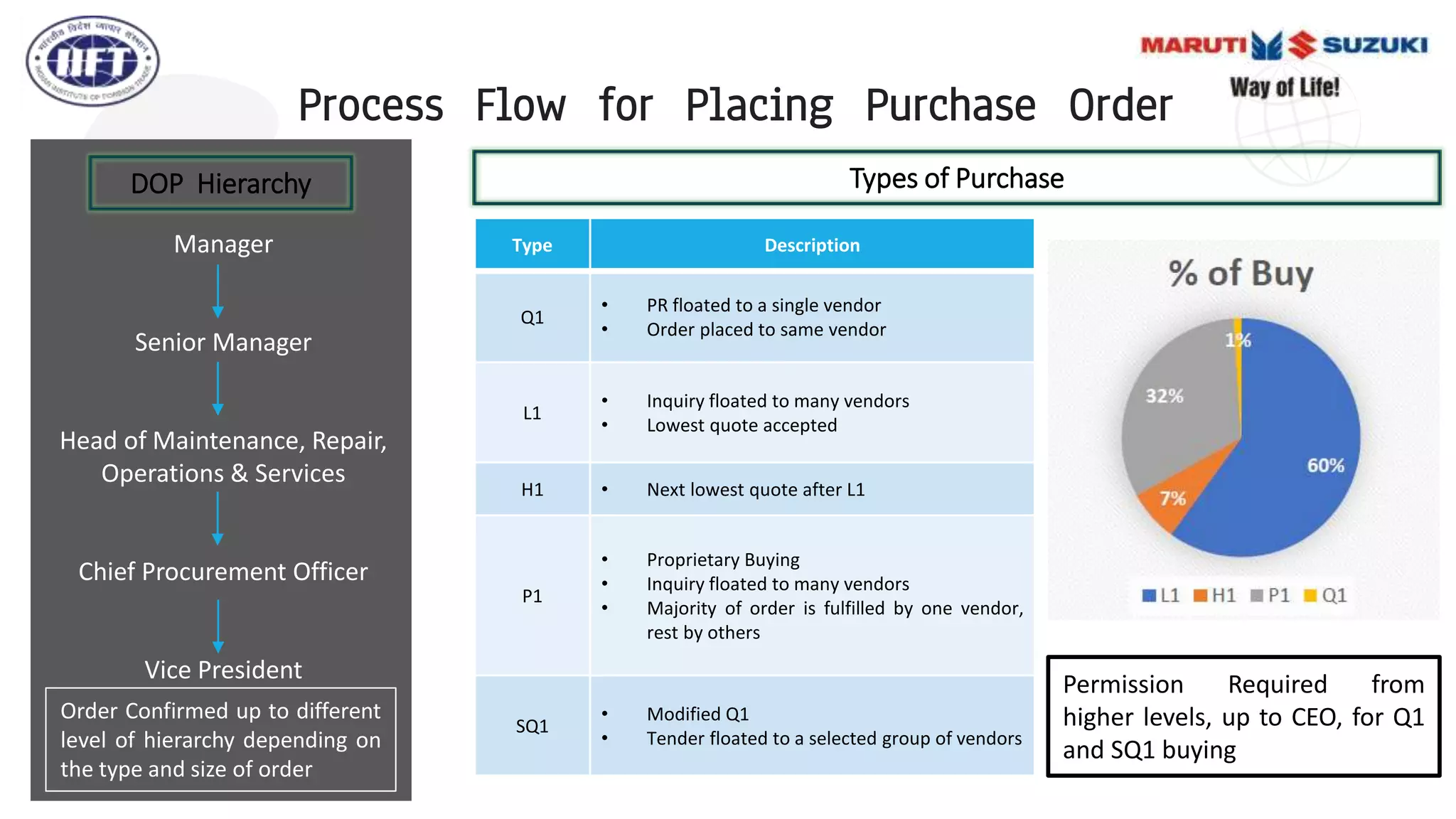

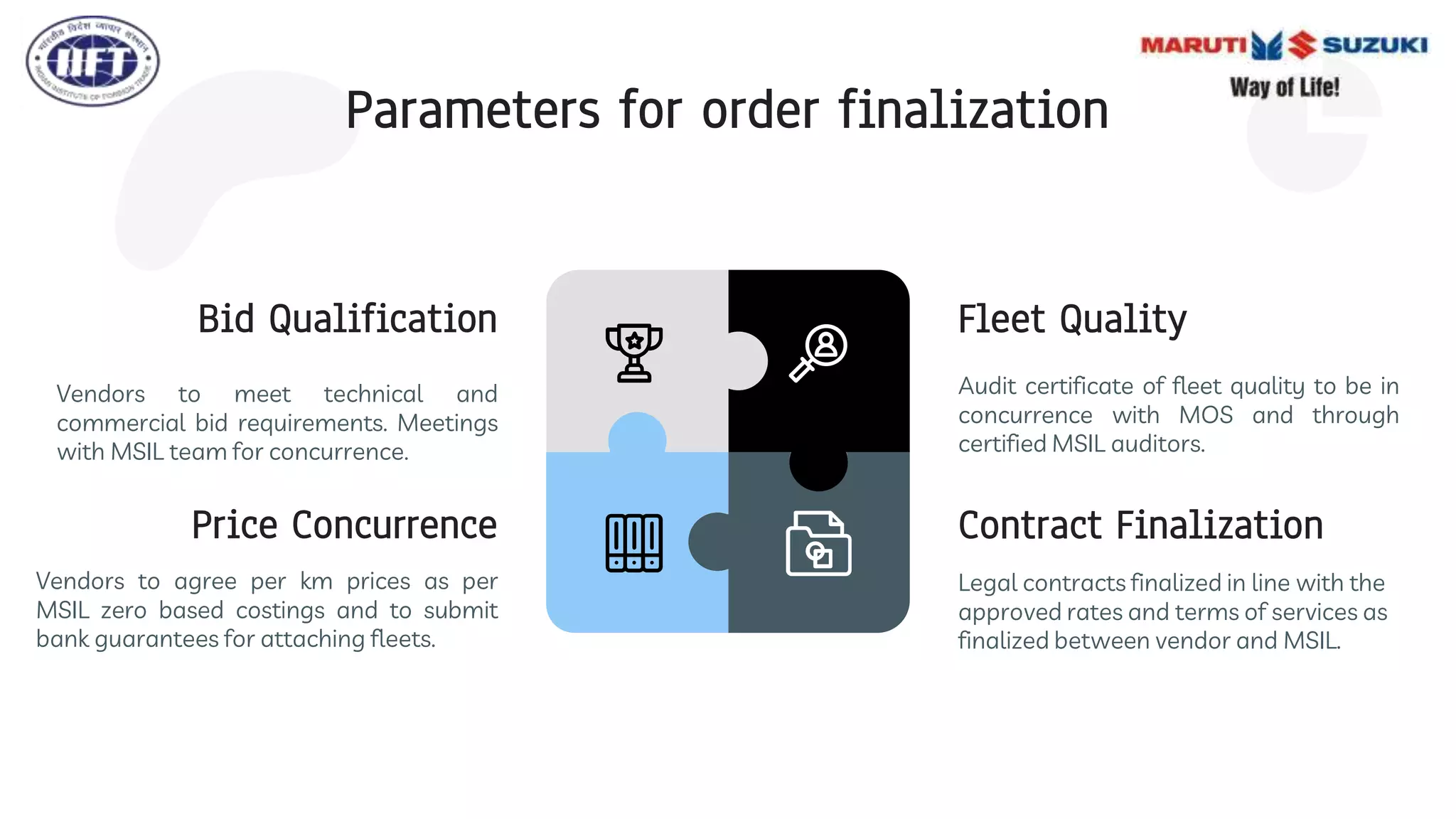

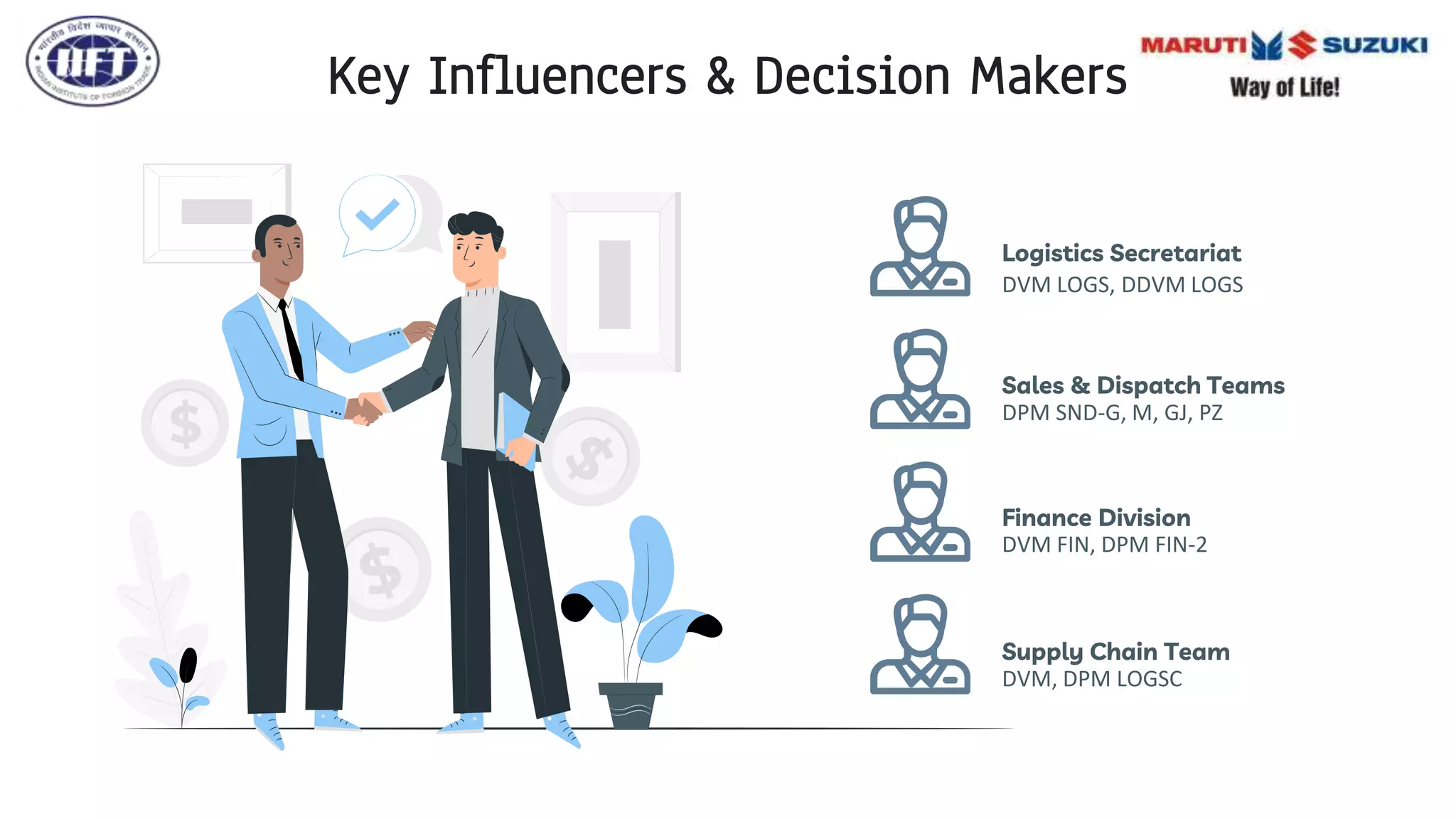

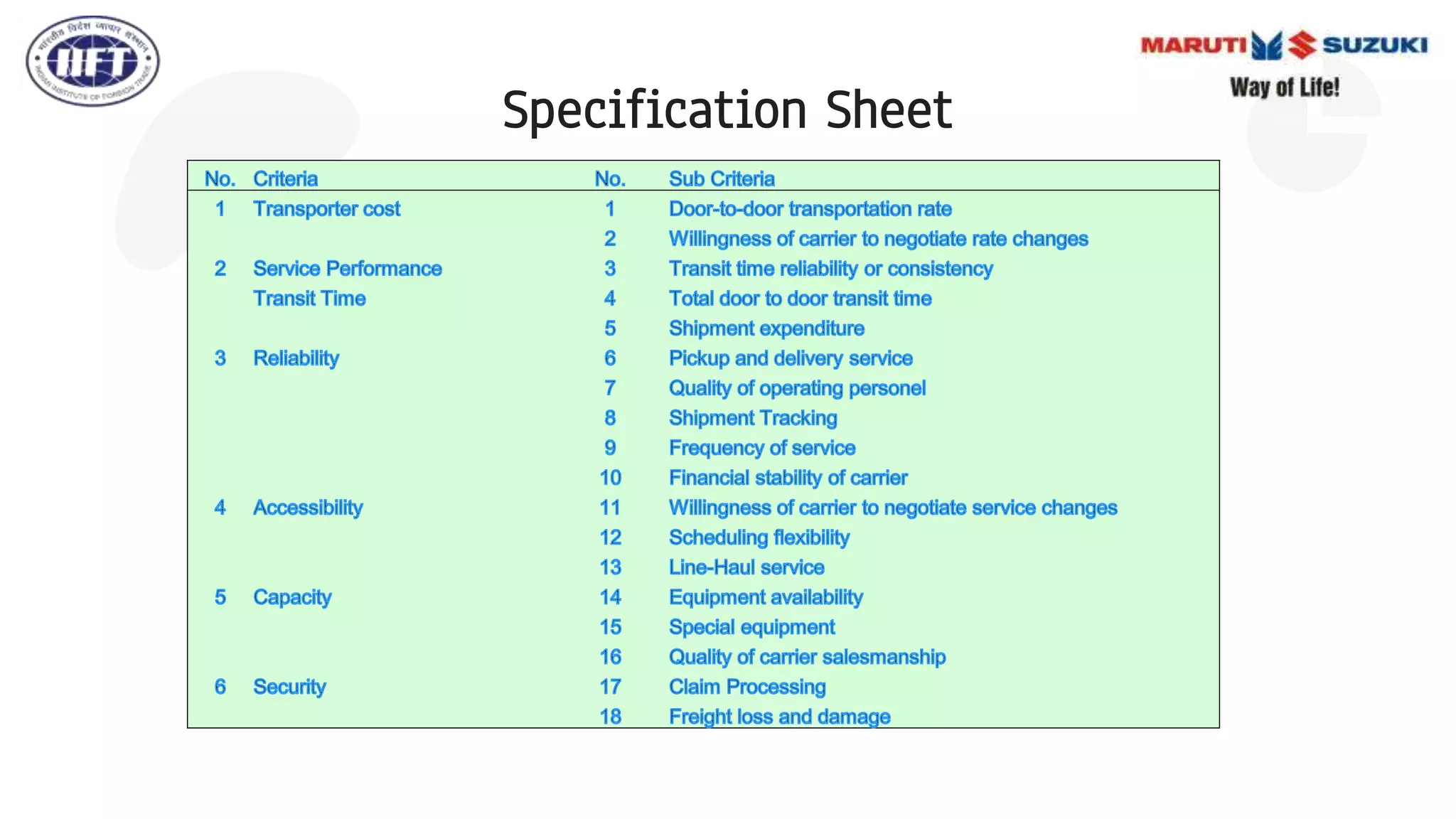

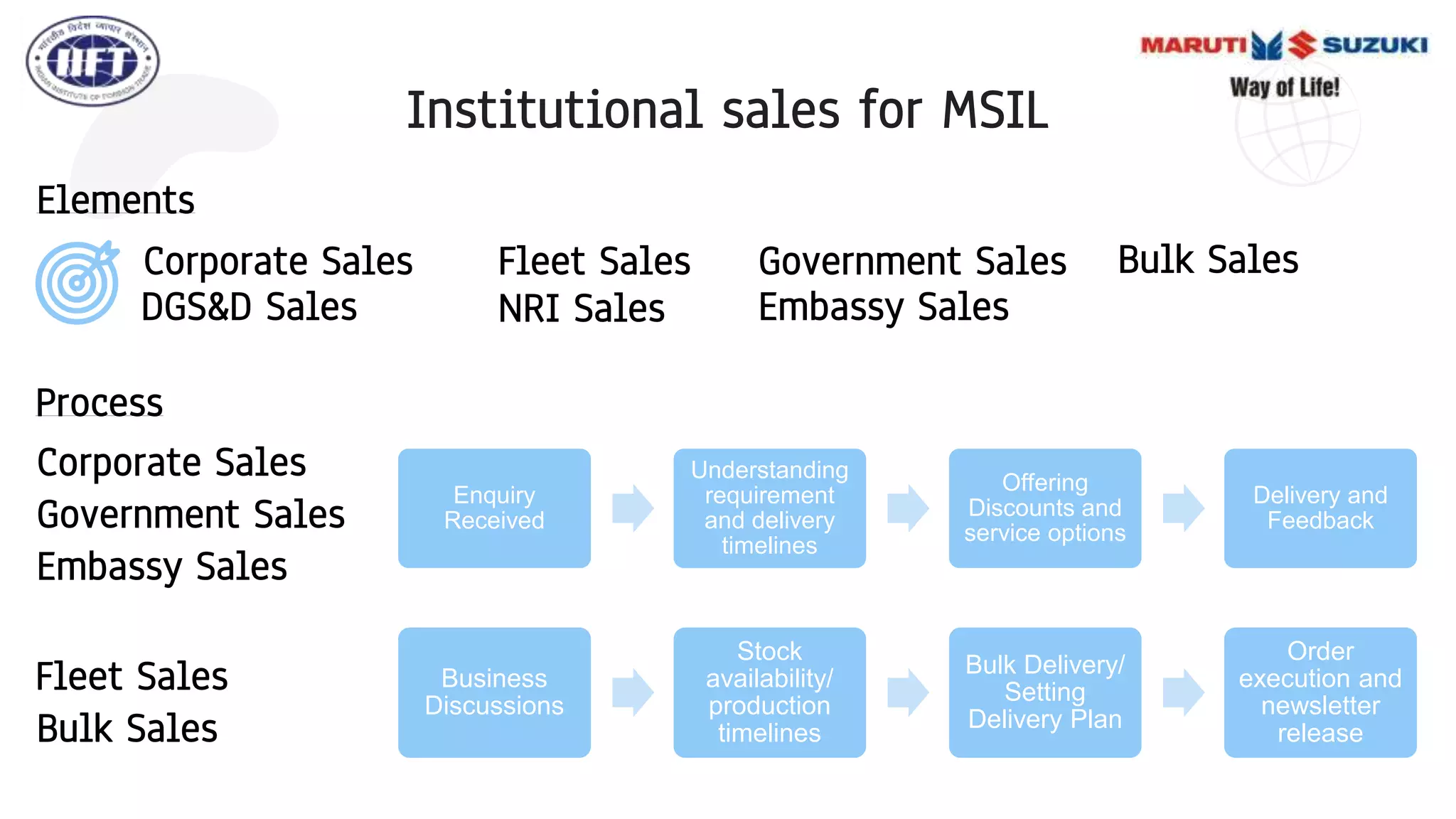

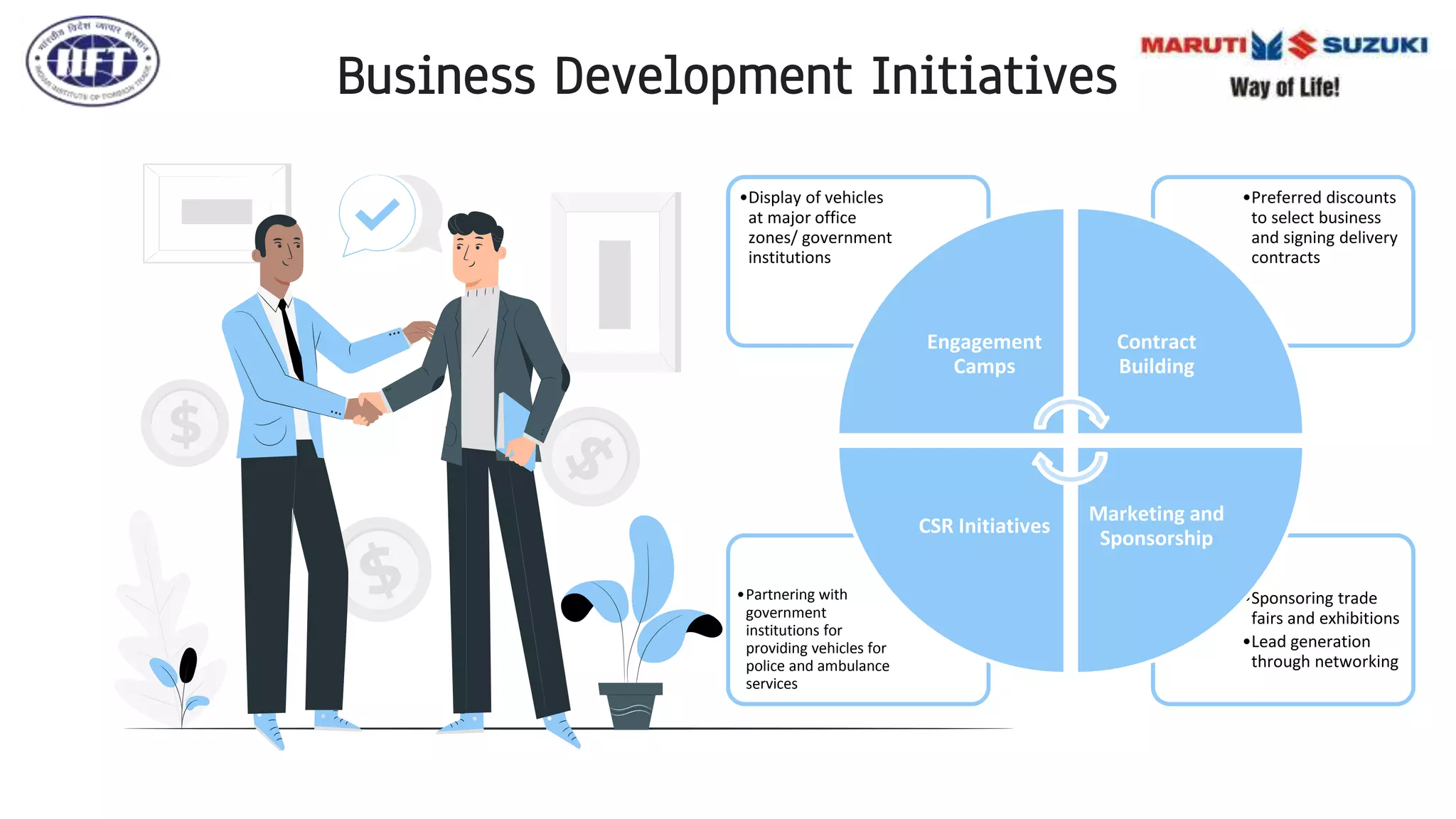

The document discusses the dynamics of B2B sales and transporter selection processes for Maruti Suzuki India Limited (MSIL), detailing the company's history, logistics operations, and vendor selection criteria. It outlines the business model, key partners, activities, and resources, alongside procedures for purchase orders and vendor contracts. The document also highlights the importance of compliance, performance assessment, and strategic relationships in ensuring timely and efficient delivery of vehicles.