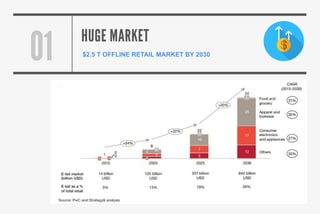

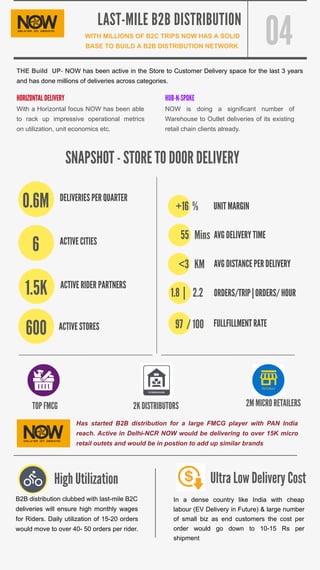

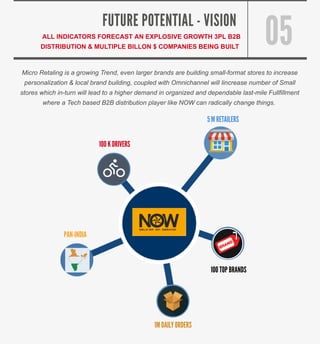

The document discusses the evolving landscape of B2B distribution in India, highlighting the need for faster delivery and real-time data as businesses shift from a push to pull sales model. With the potential for a $2.5 trillion offline retail market by 2030 and a robust network of delivery agents, the document emphasizes the opportunity for third-party logistics (3PL) to enhance efficiency and reduce costs in B2B distribution. Additionally, it mentions that technology-driven solutions could transform last-mile fulfillment, catering to the growth of micro-retailing and omnichannel commerce.