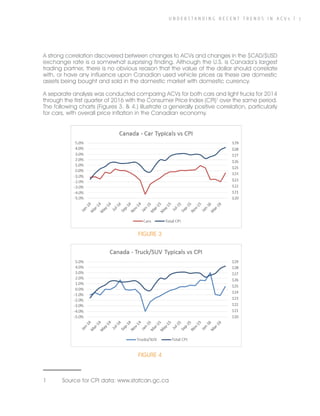

The document analyzes recent trends in actual cash values (ACVs) as estimated by Autosource. Through statistical analysis of ACV data and a literature review, it aims to identify key drivers of ACV trends and ensure valuations accurately reflect market prices. The research found ACVs closely mirrored used vehicle market prices and macroeconomic factors. Specifically, ACVs correlated with consumer price inflation and fluctuations in the Canadian dollar. The analysis revealed some vehicle clusters, consisting mainly of older domestic or import brands, performed differently than the ACV model predicted. Overall the study confirmed Autosource ACV trends are reliable proxies for underlying used vehicle market conditions.