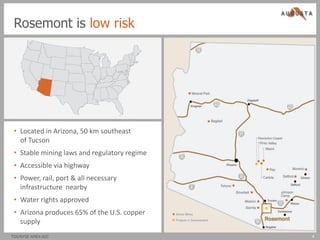

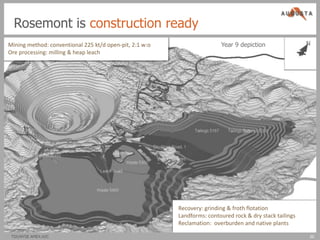

The document discusses the Rosemont copper mine project located in Arizona. Key points include:

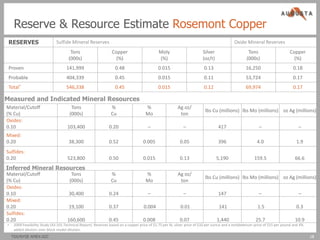

- Rosemont has proven and probable reserves of over 546 million tons containing 0.45% copper.

- Measured and indicated resources total over 665 million tons containing over 5.2 billion pounds of copper.

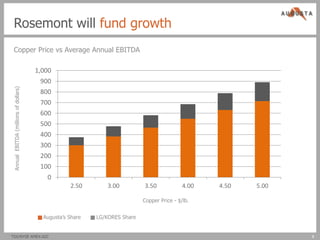

- The mine is expected to produce over 220 million pounds of copper annually over a mine life of over 21 years.

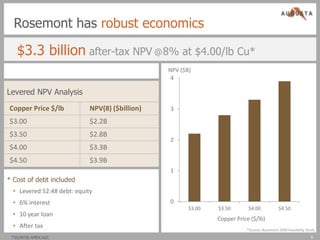

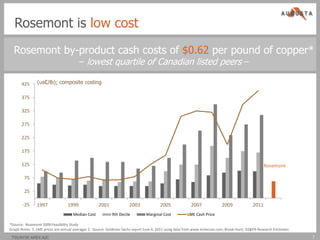

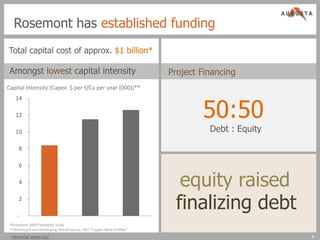

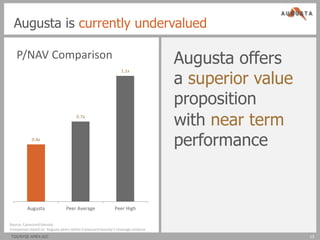

- With an after-tax NPV of $3.3 billion and low costs of $0.62 per pound of copper, Rosemont is expected to be a very profitable project for Augusta Resource Corporation.