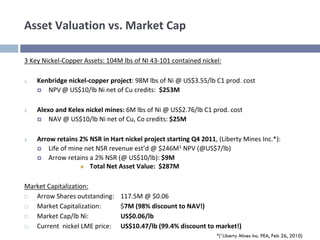

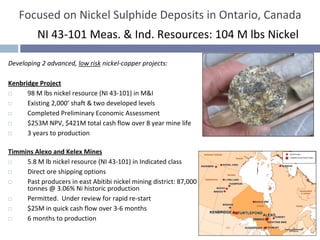

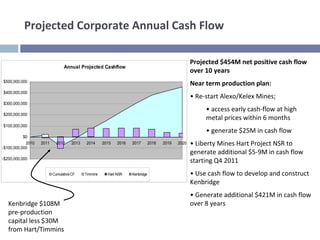

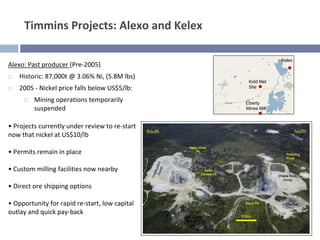

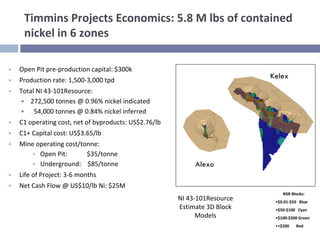

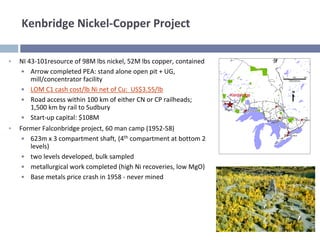

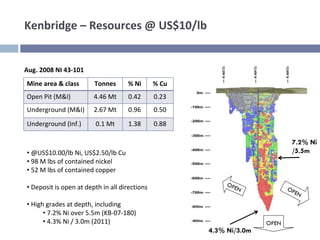

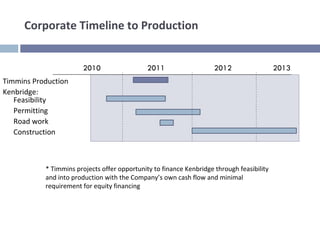

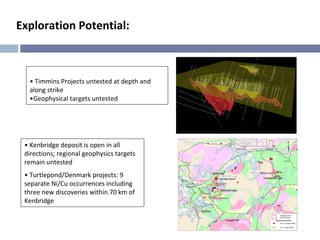

Canadian Arrow Mines Ltd. owns three key nickel-copper assets in Ontario, Canada containing over 104 million pounds of nickel. The assets include: 1) The Kenbridge nickel-copper project containing 98 million pounds of nickel. A PEA estimates its NPV at $253 million. 2) The Alexo and Kelex nickel mines containing 6 million pounds of nickel. Their NAV is estimated at $25 million. 3) A 2% NSR on the Hart nickel project which could generate $9 million in revenue. The total net asset value is estimated at $287 million, yet the company's market capitalization is only $7 million. Management plans to restart production at Alexo and Kelex within 6 months