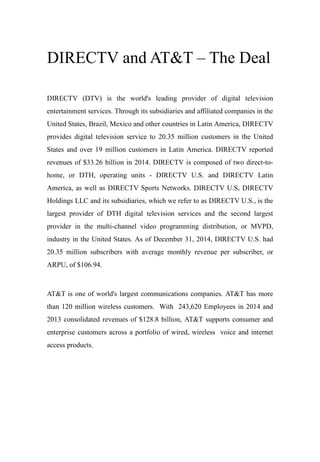

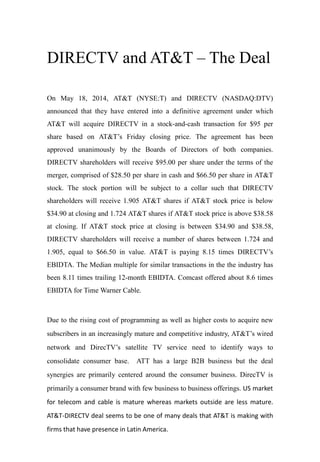

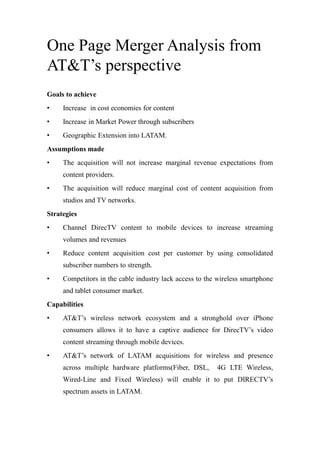

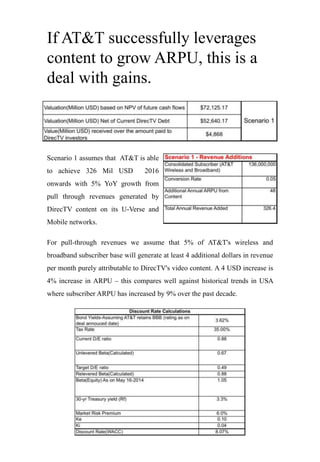

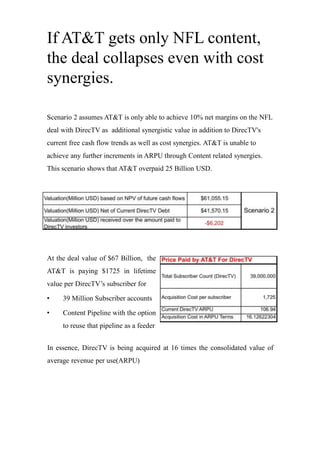

This document analyzes and summarizes the proposed merger between AT&T and DIRECTV. It provides background on both companies and their operations. The key details of the merger are that AT&T will acquire DIRECTV in a stock-and-cash deal valued at $95 per DIRECTV share. The merger is aimed at combining AT&T's telecommunications networks with DIRECTV's satellite television business. The document analyzes the strategic rationale for the merger from both companies' perspectives, potential synergies, and risks. It considers whether the merger price reflects the value that can be created through synergies between the companies.