The document provides information on configuration steps for asset accounting in SAP. It lists 24 steps for areas like defining depreciation areas, valuation methods, integration with general ledger, transactions, and more. Configuration involves defining charts of depreciation, asset classes, valuation methods, posting rules, and more. Transactions for acquisitions, retirements, transfers, and revaluations need to be set up.

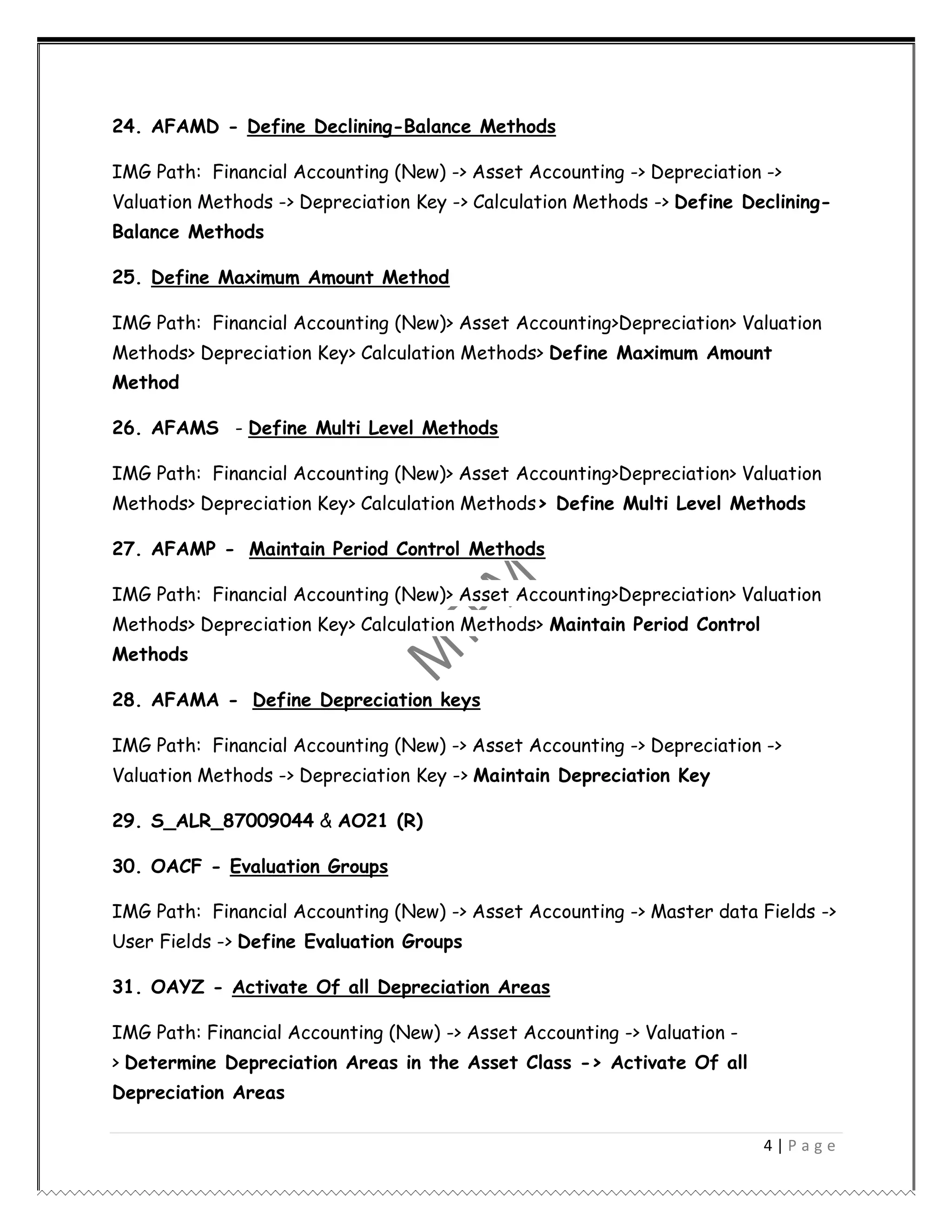

![6 | P a g e

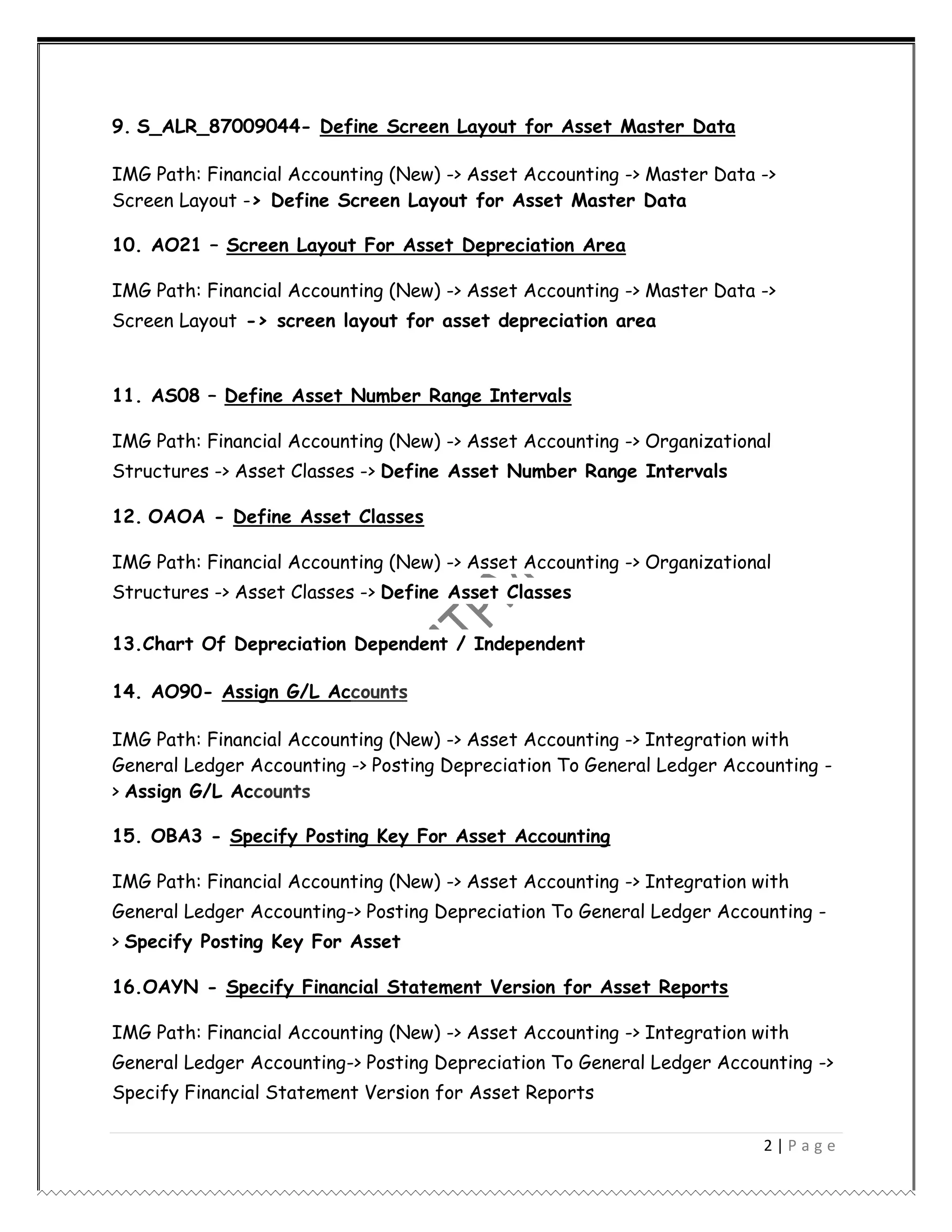

AS91 - Create Legacy Asset Assets(Individual) D- [AS93]

AS100 -Excel Template Upload(More Number)

OASV -Transfer Balance

OAMK -Deactivate Asset Recon A/C Type [F-02/FB01]

AS01 -Create Asset Master Record [AS02][AS03][AS05][AS06]

ABSO -Reduce/Adjust the Capitalization Value

ASKB -APC Values Postings [Value Updates To FI]

F-90 -Acquisition Of Asset

F-92 -Asset Retirement [Asset Sale with Customer]

AW01N -Asset Explorer

ABAON -Asset Sale W/o Customer

ABAVN -Scrapping of Asset

ABUMN -Transfer of Assets With In Company Code

ABTIN -Inter Company Asset Transfer

AFAB -Depreciation Run

AFAR -Recalculation of Planned Values

ABNAN -Post Capitalization of Assets

ABAA -Unplanned Depreciation

AFAMA -Create Depreciation Key

ANHAL -Cutoff Value Key [Need to assign in AFAMA]

OAYZ -Change Over Amount Method

AFBN -Automatic Opening Of New Dp

AB08 -Reversal Of Asset Accounting Document](https://image.slidesharecdn.com/assetaccountingtcodesandmenupaths-220722170925-231c139d/75/Asset-accounting-T-codes-and-Menupaths-pdf-6-2048.jpg)

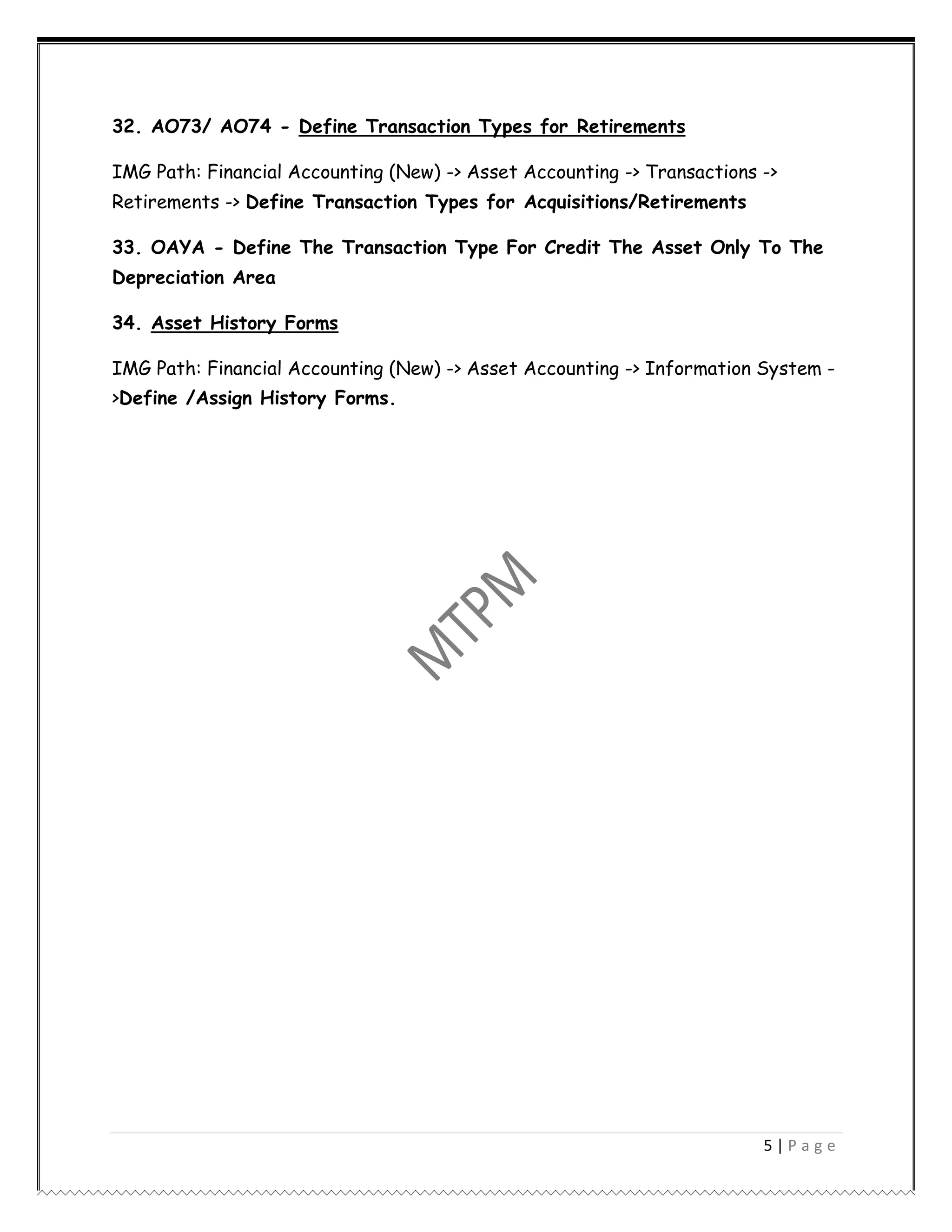

![7 | P a g e

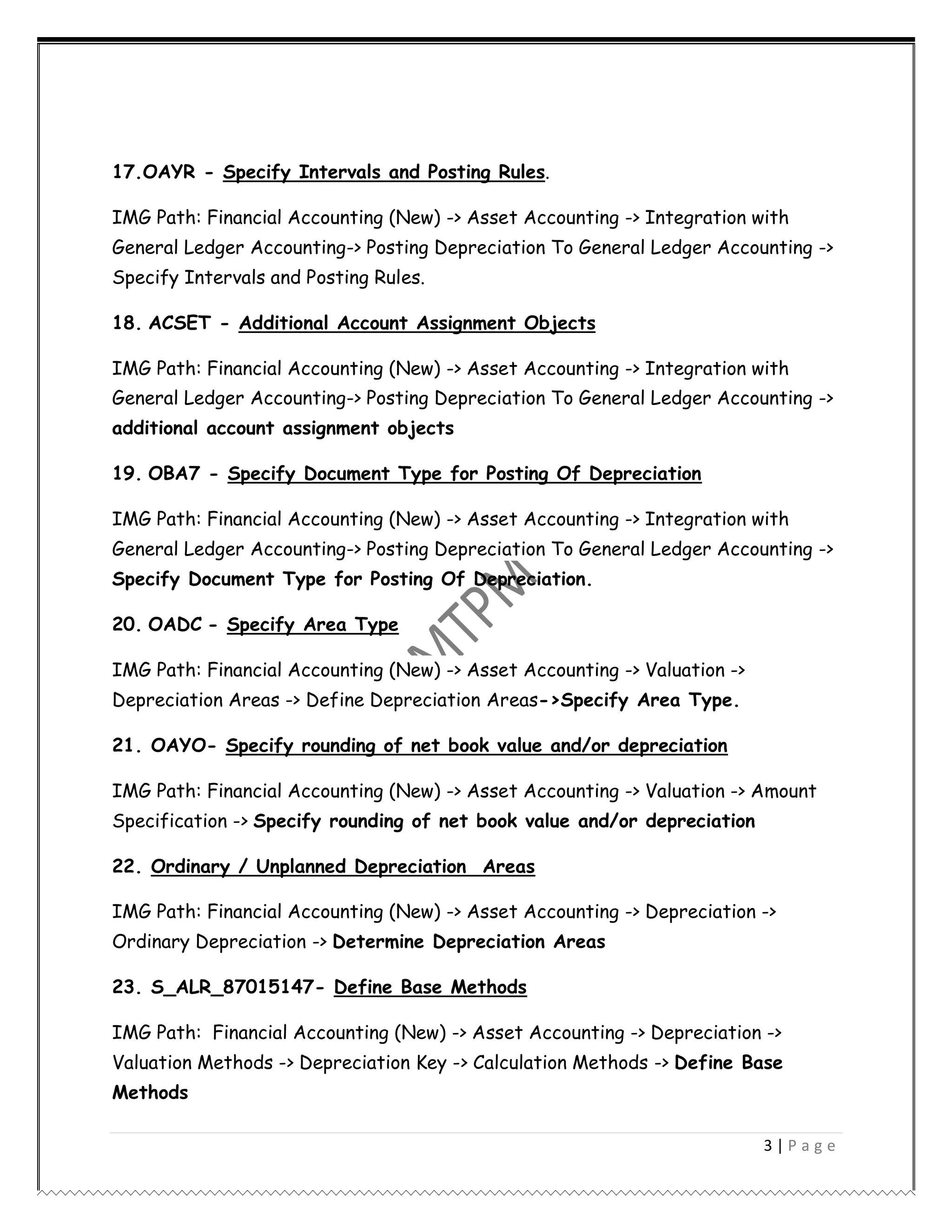

AIST -Reversal Of Settlement Of AUC

AFBP -Display Of Depreciation Log

AJRW -Fiscal Year Change

ABST2 -Asset Accounting Reconciliation With FI

AJAB -Close the Fiscal Year in Asset Accounting

OAAQ -Reopen the Fiscal Year in Asset Accounting

OAXG -Capitalization of AUC Transaction Types

OKO7 -Settlement Profile

OAAZ -Assign Settlement Profile to Company Code

SNUM -Maintain Number Ranges for Documents of Line item Settlement

AIAB -Distribution Rules For AUC Asset

AIBU -Execute the AUC Settlement

AS21 -Creation of Group Asset [AS22][AS23]

AUFW -Define Revaluation Measures

AO84 -Define the Transaction Types For Revaluation

OAXJ -Limit the Transaction Types to the Depreciation Areas

AR29 -

AR01 -Collective Retirement

AR31 -Edit Worklist](https://image.slidesharecdn.com/assetaccountingtcodesandmenupaths-220722170925-231c139d/75/Asset-accounting-T-codes-and-Menupaths-pdf-7-2048.jpg)