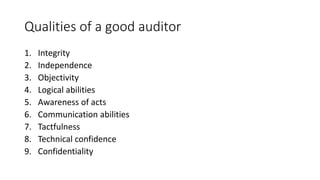

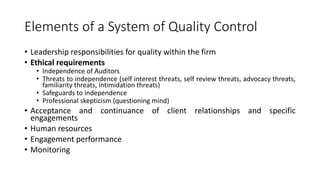

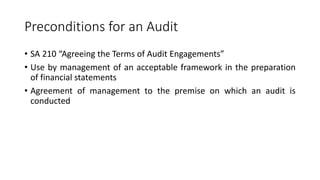

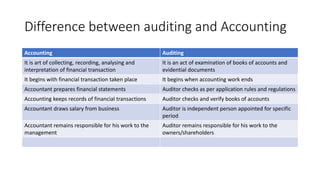

This document provides an overview of auditing and secretarial practice. It discusses key aspects of an audit including examining internal controls, verifying transactions and assets, and confirming statutory compliance. It also describes types of audits, advantages of auditing, inherent limitations, relationships to other disciplines, the standard setting process, audit principles, an auditor's qualities, and preconditions for an audit.