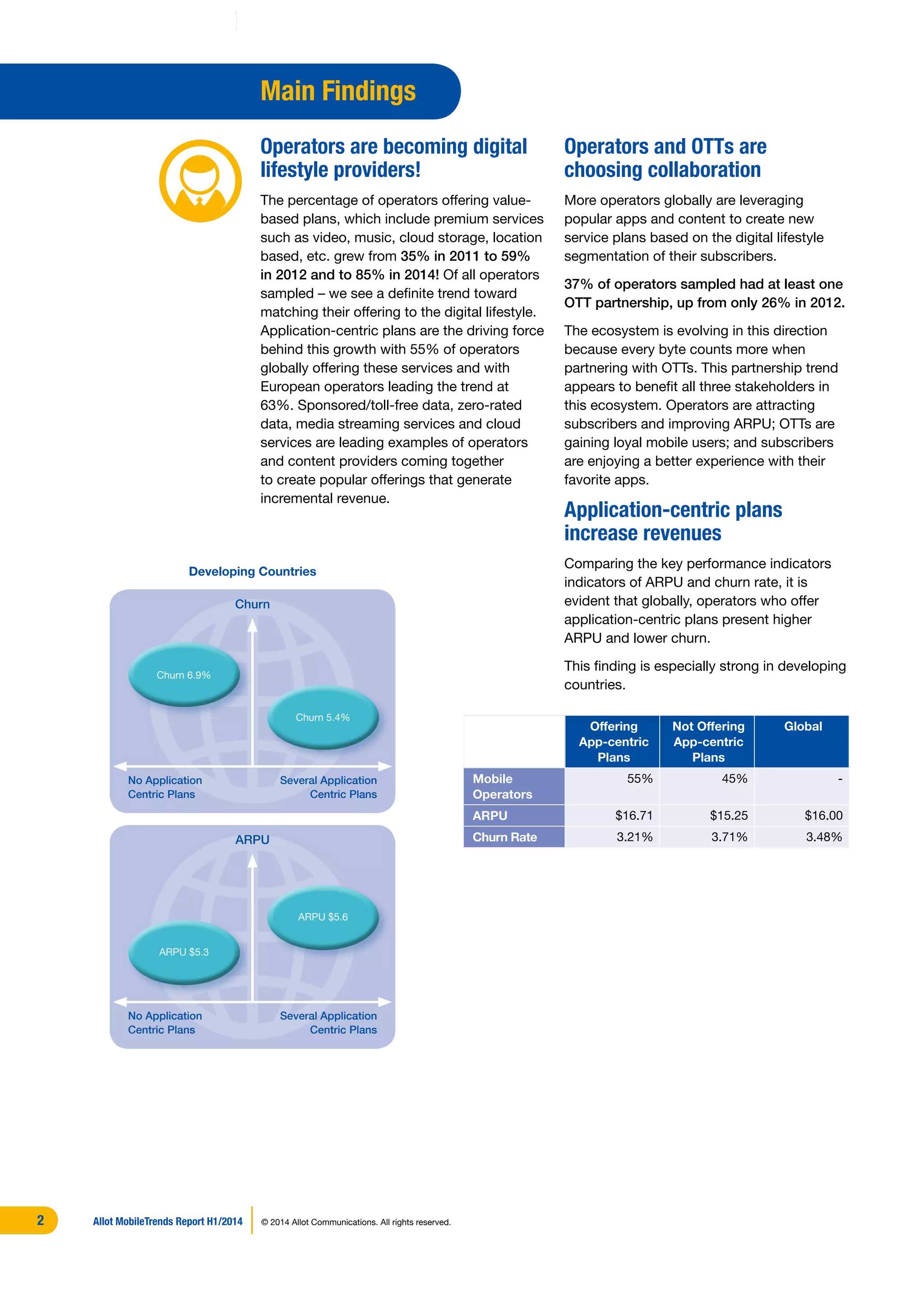

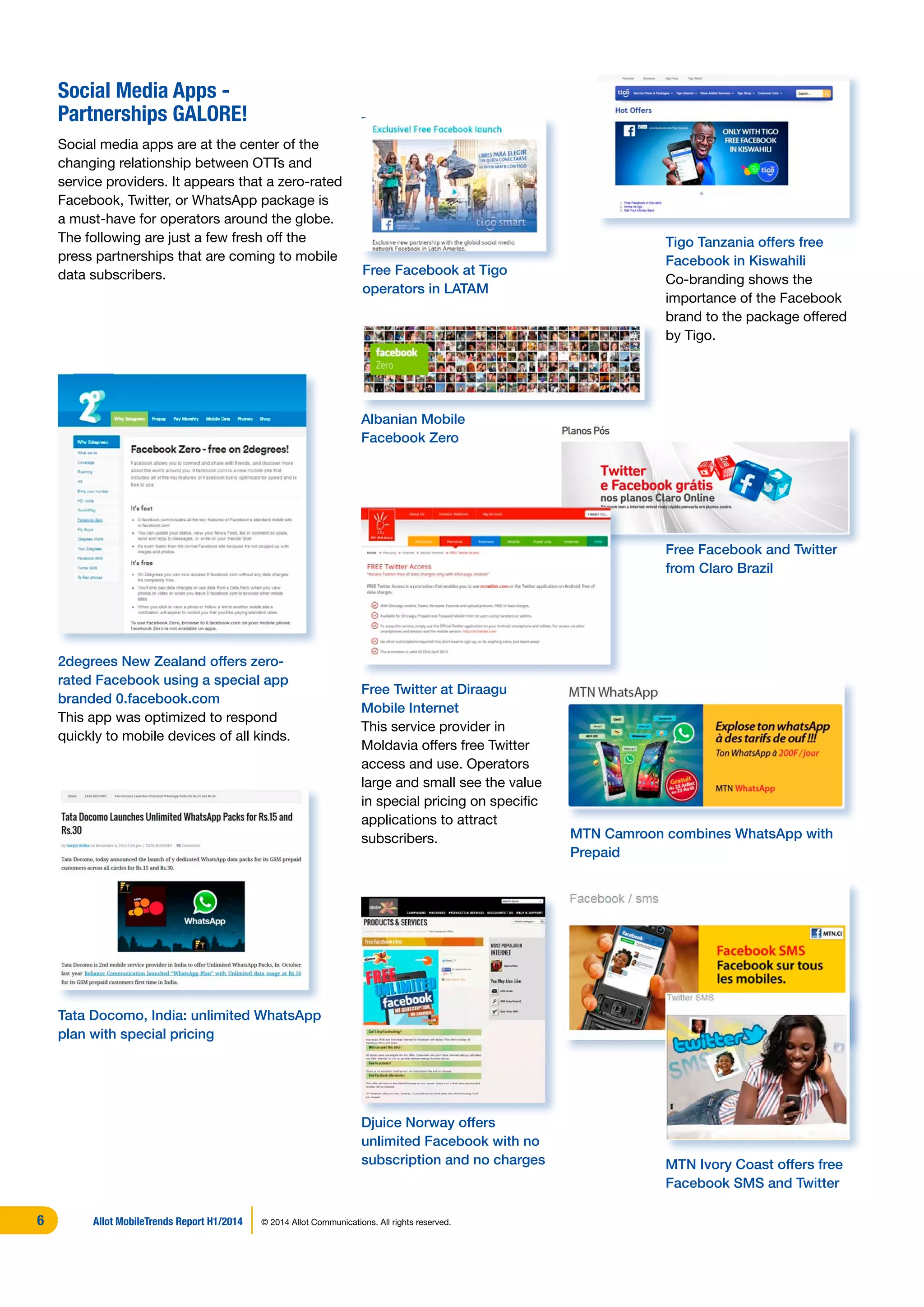

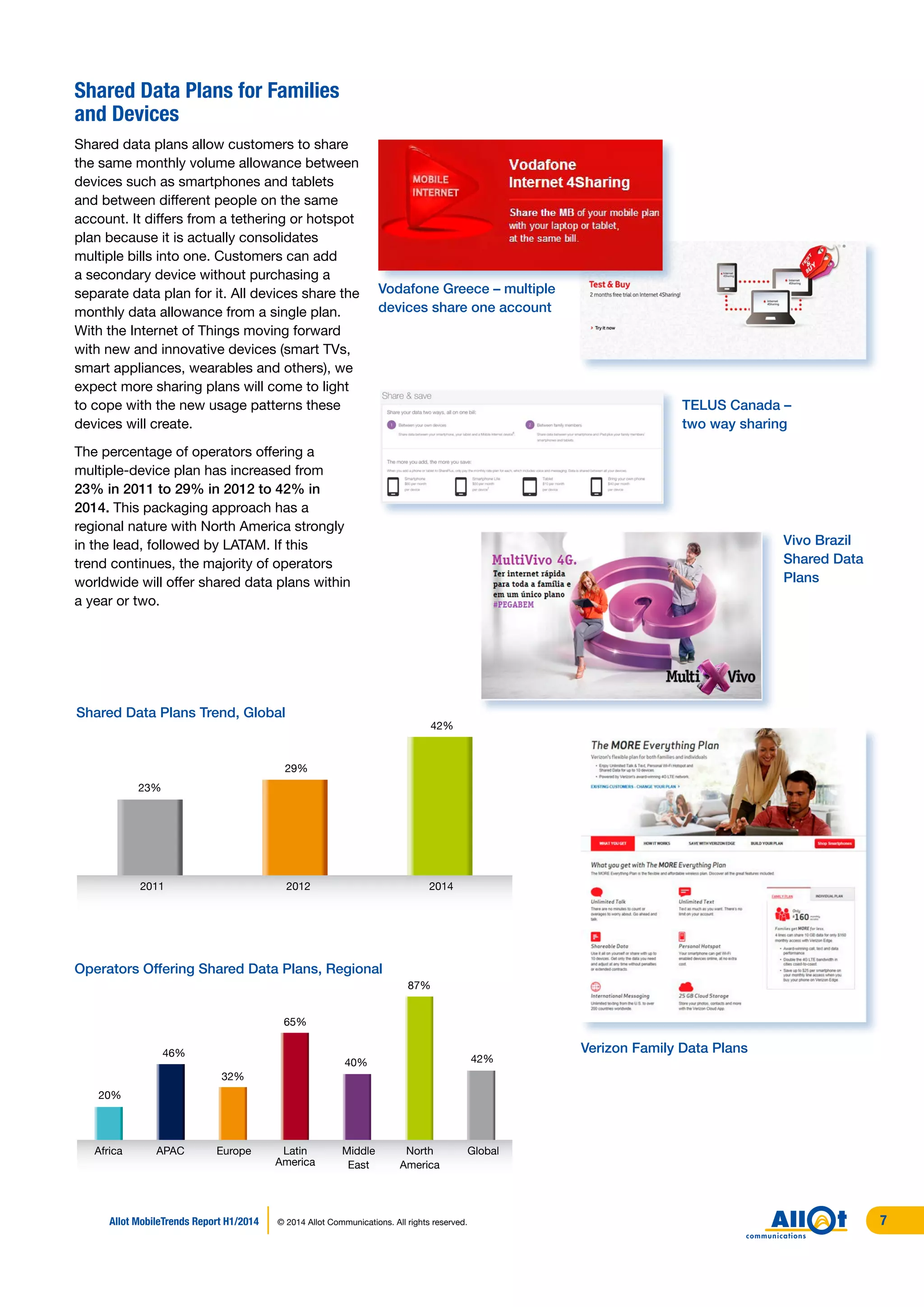

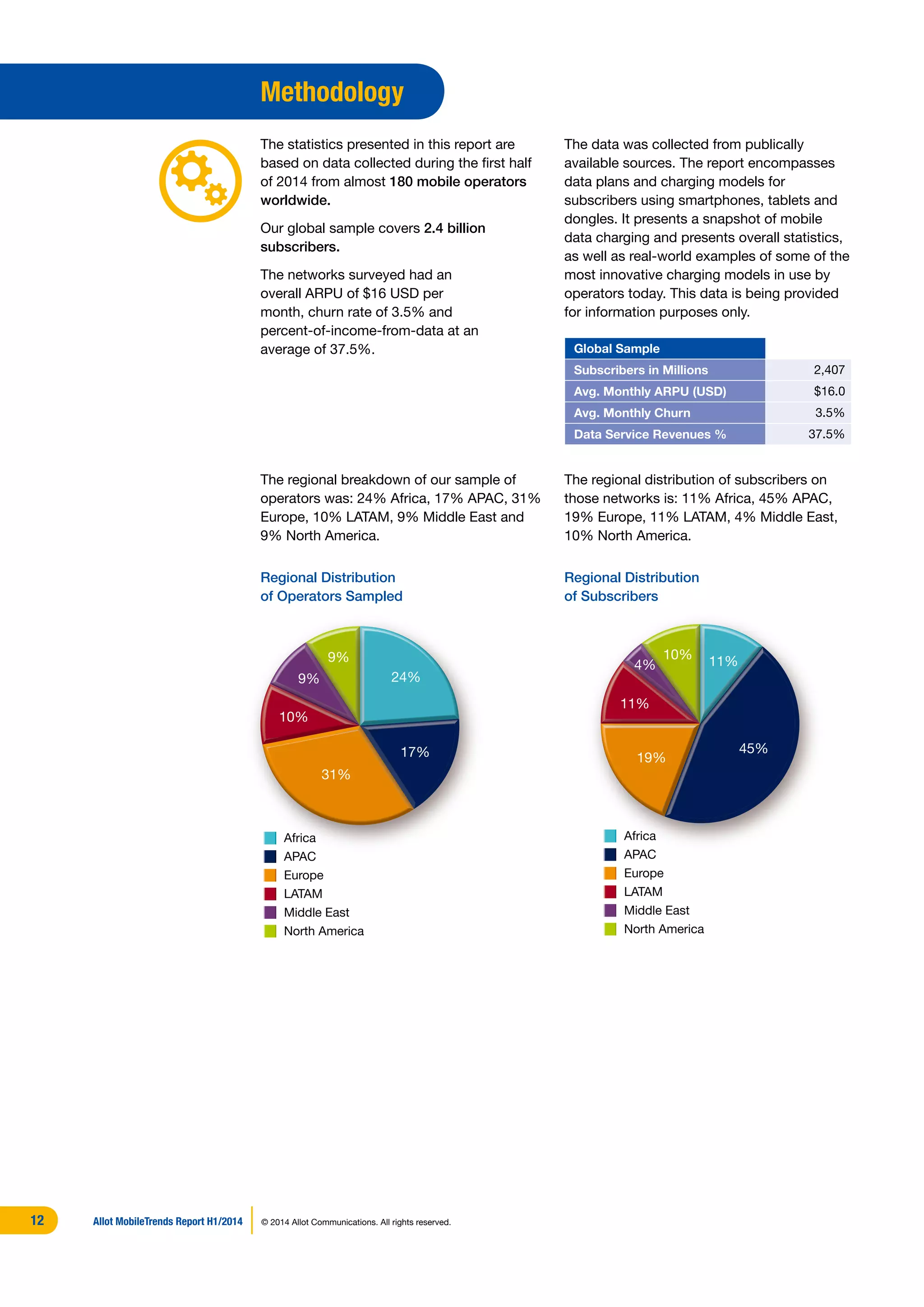

The Allot MobileTrends Charging Report for H1 2014 highlights a significant shift in the mobile operator landscape, with operators moving from traditional bandwidth providers to digital lifestyle service providers through partnerships with over-the-top (OTT) content providers. The report reveals that application-centric plans are becoming prevalent, leading to higher average revenue per user (ARPU) and lower churn rates, particularly in developing countries. Notably, the trend towards shared data plans and value-based offerings is increasing, while unlimited data plans are declining in popularity.