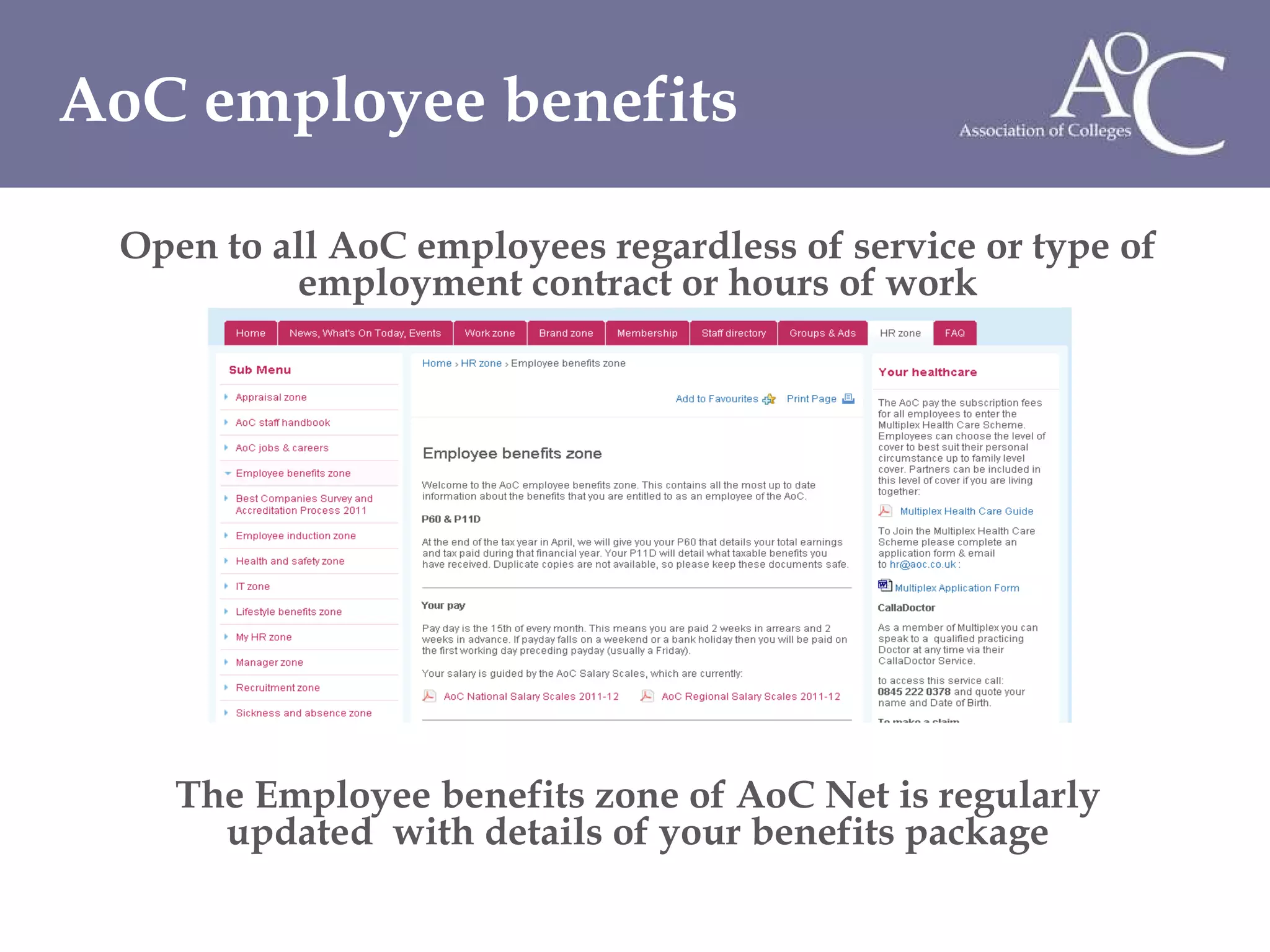

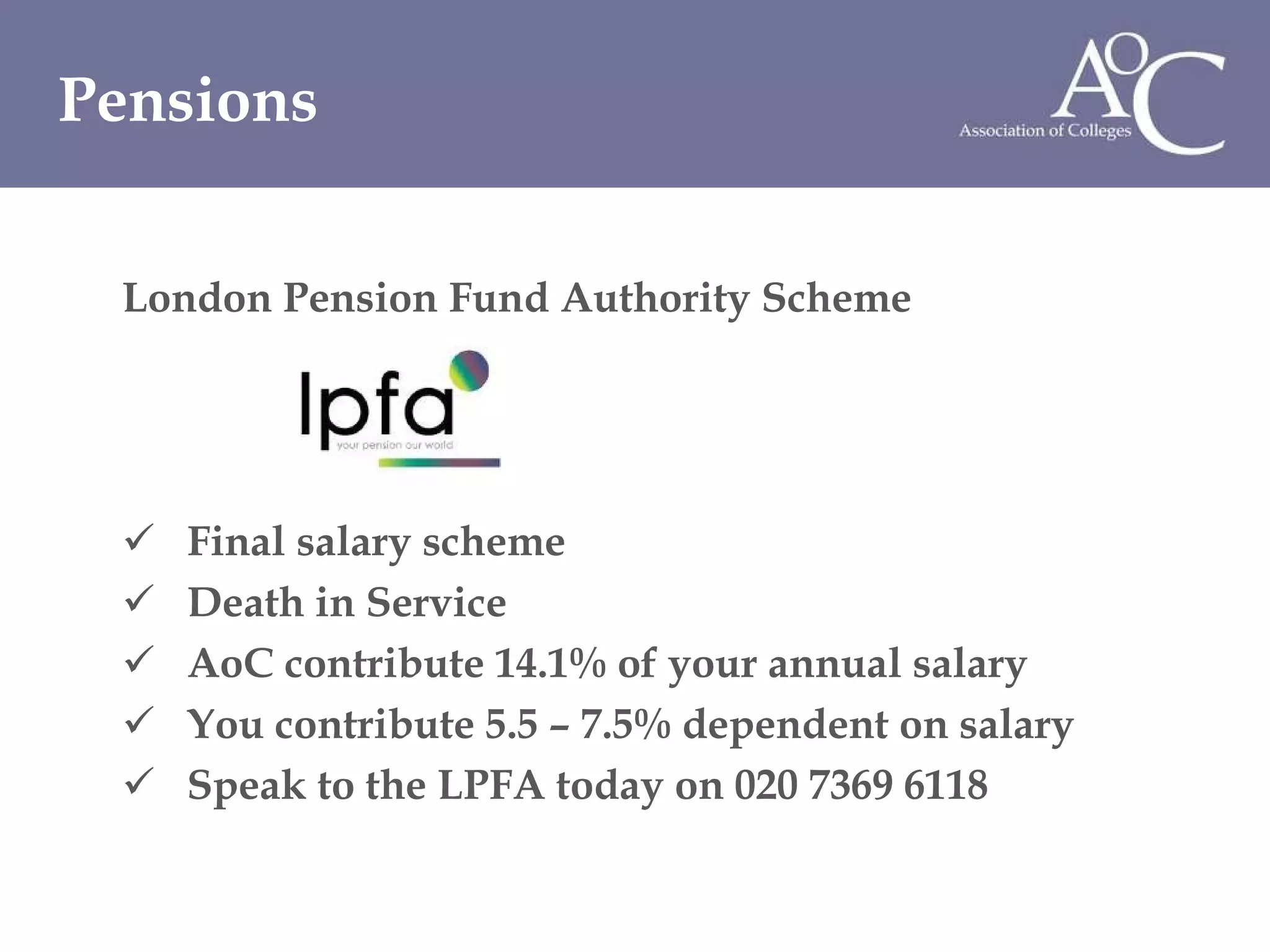

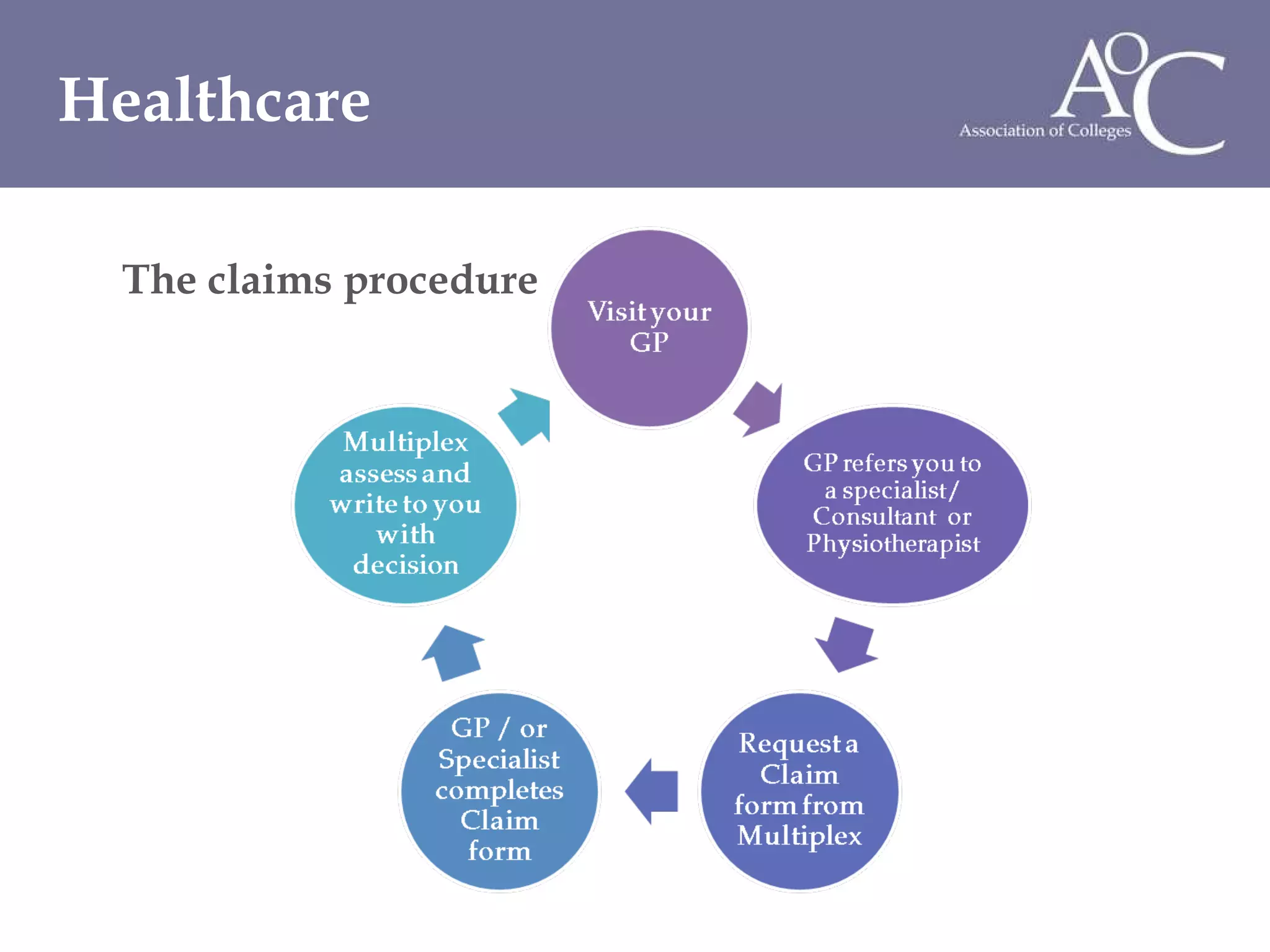

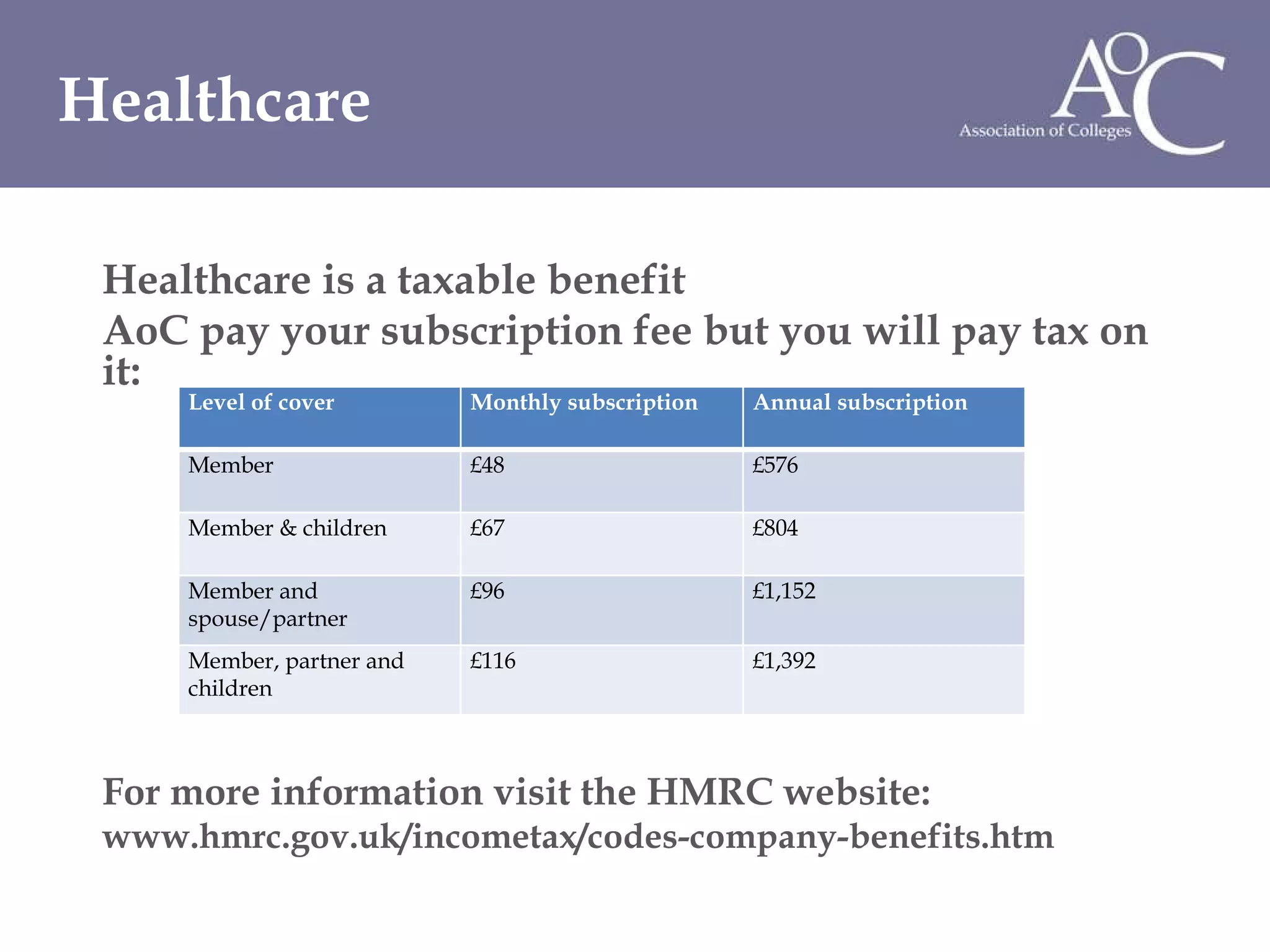

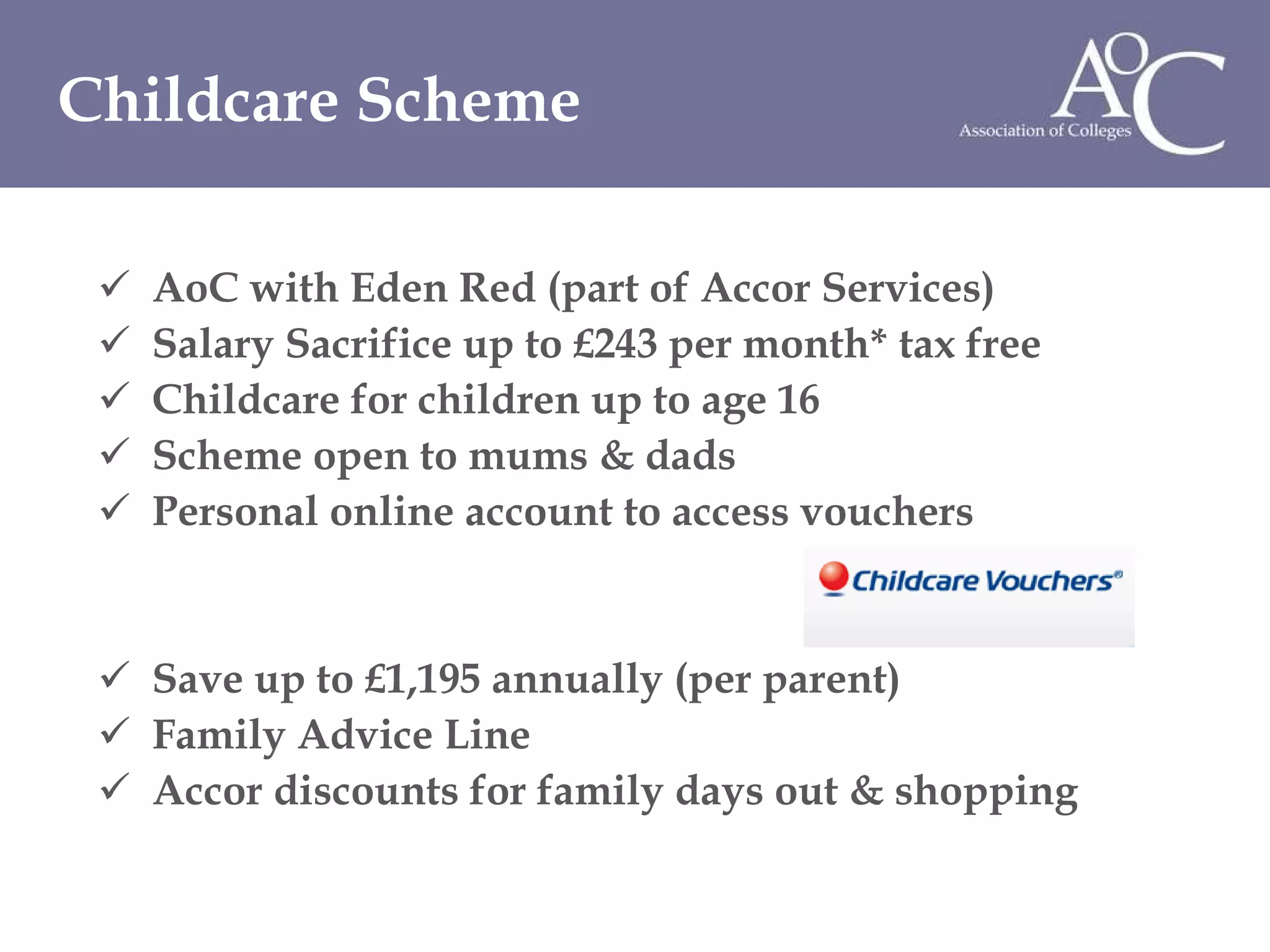

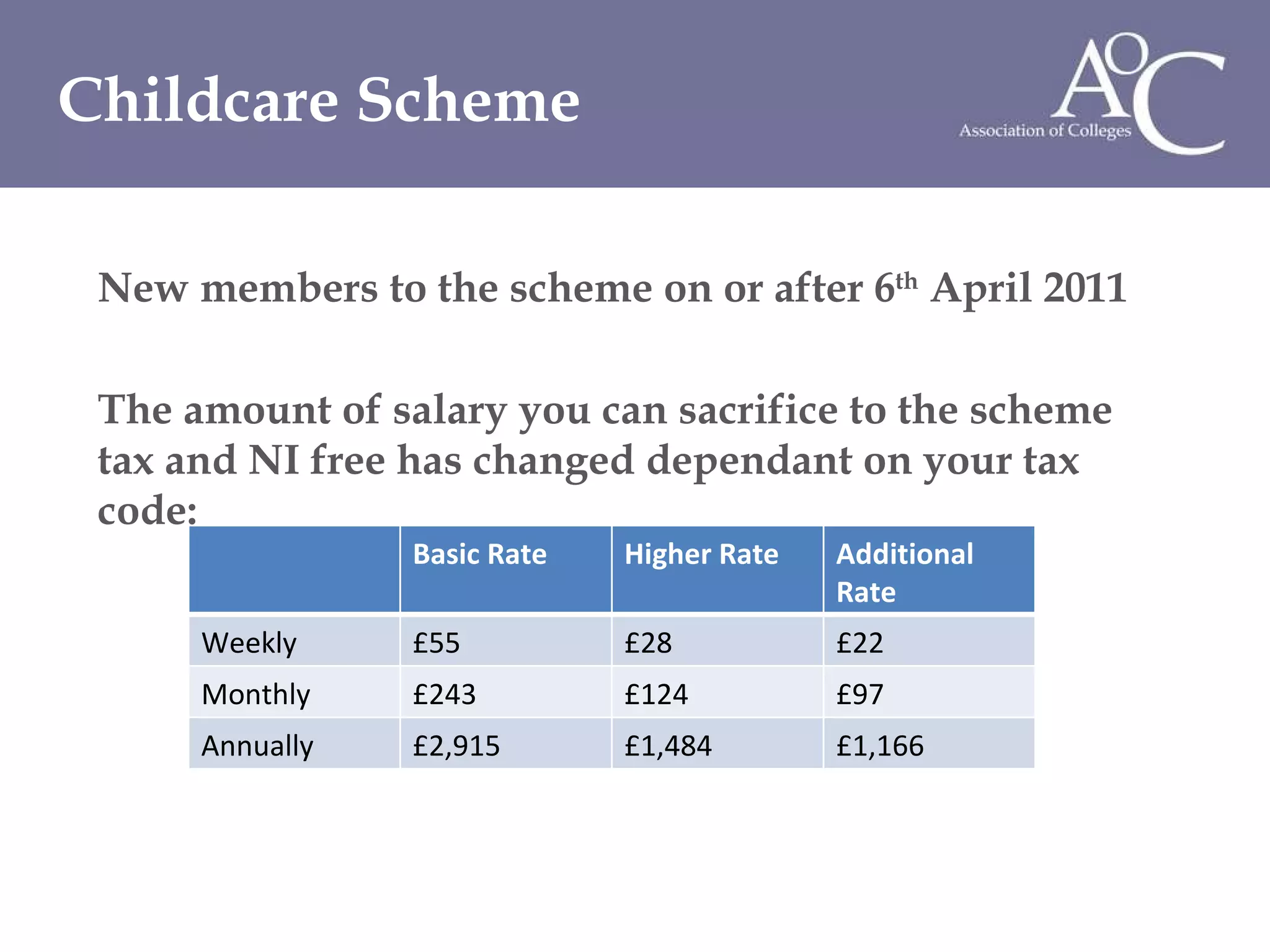

The document discusses various employee benefits available to AoC employees including pension schemes, healthcare coverage, childcare vouchers, study support for professional qualifications, cycle to work and lifestyle benefits. It provides details on the London Pension Fund Authority pension scheme and option for personal pensions. Healthcare coverage through Multiplex is outlined including monthly subscription costs and eligibility. The childcare voucher scheme through EdenRed is described as saving up to £1,195 annually in tax-free childcare vouchers. Study support benefits from AoC include up to 80% course cost coverage and time off for exams.