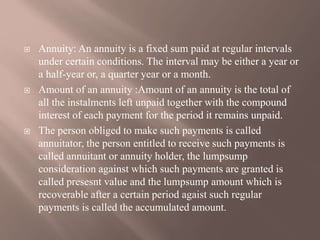

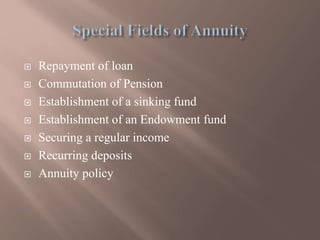

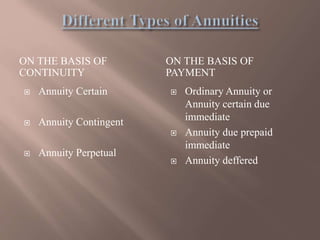

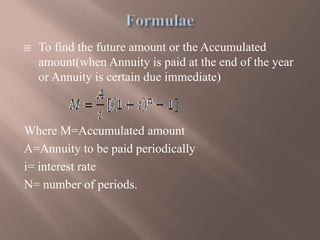

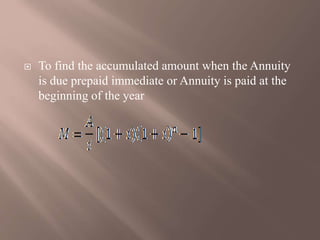

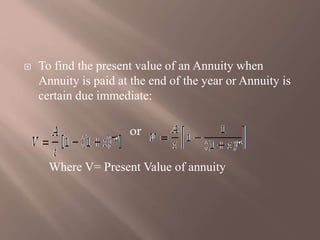

This document defines and explains various types of annuities. It begins by defining an annuity as a fixed sum paid at regular intervals under certain conditions. It then discusses the amount of an annuity and defines relevant terms like annuitator and annuitant. The document goes on to explain different types of annuities based on continuity and payment timing, including annuity certain, annuity contingent, annuity perpetual, and others. It also provides formulas for calculating future amounts, accumulated amounts, and present values for different annuity types.