The document provides an overview of VC industry trends in 2013 and performance for Cintrifuse Fund I and the Cintrifuse Fund of Funds. Some key points:

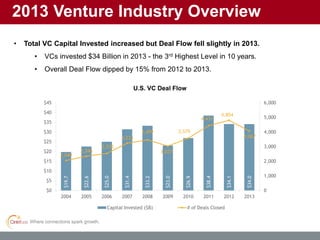

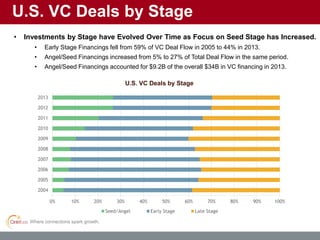

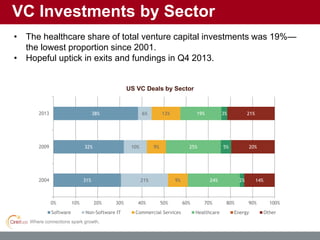

- Total VC investments in 2013 were $34 billion, the 3rd highest level in 10 years, though overall deal flow dipped slightly. Seed/angel investments increased significantly.

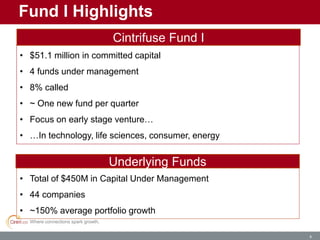

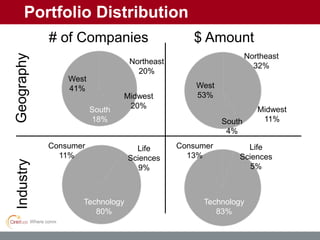

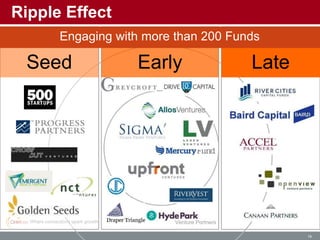

- Cintrifuse Fund I has $450 million under management across 44 companies with an average portfolio growth of 150%. The underlying funds focus on early stage companies in technology, life sciences, consumer and energy.

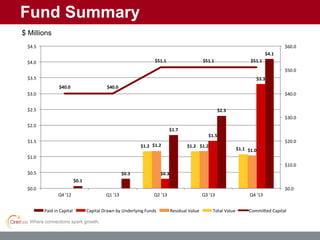

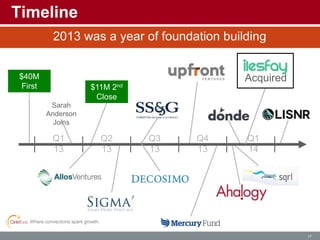

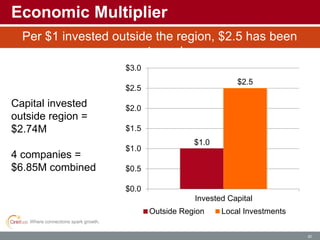

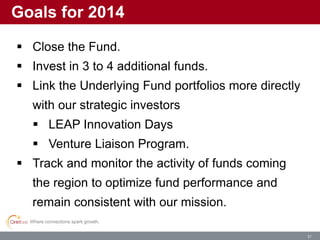

- The Cintrifuse Fund of Funds has $51.1 million committed across 4 underlying funds. Goals for 2014 include closing