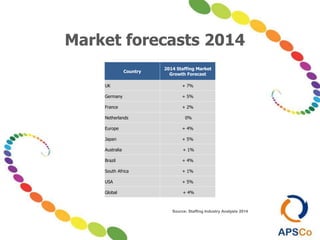

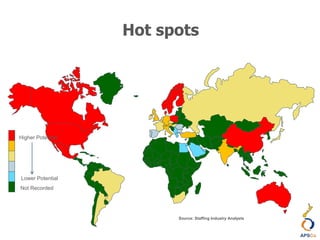

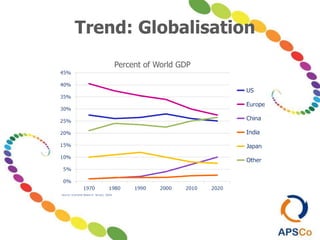

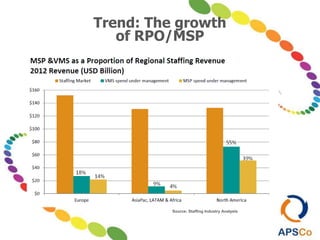

This document summarizes a presentation given by Ann Swain, CEO of APSCo, about capitalizing on global recruitment trends. Some of the key trends discussed include globalization, political/economic instability, growth of managed service providers, technology advances, and changing demographics. The presentation outlines each trend and recommends responses like expanding internationally, being adaptable, embracing new technologies, and tailoring services to changing workforce needs. Overall, the presentation advises that the recruitment industry is rapidly evolving and businesses must change internally at least as fast as external changes to remain successful.