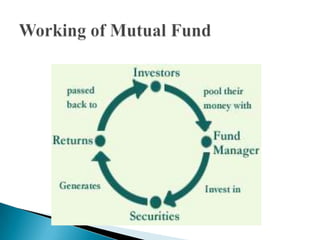

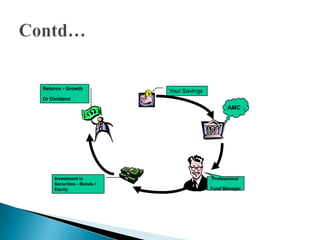

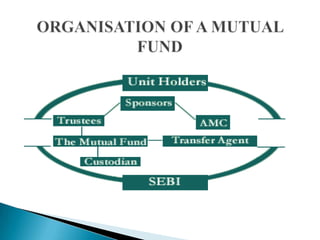

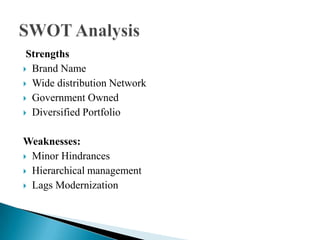

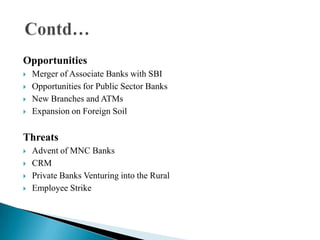

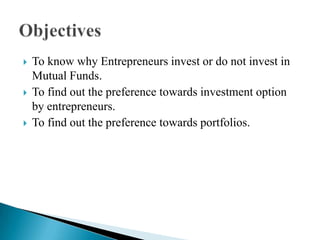

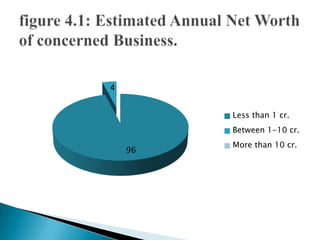

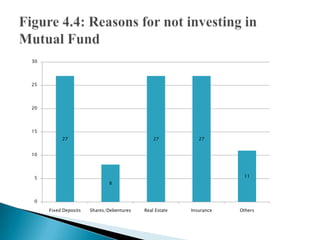

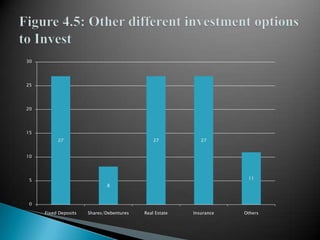

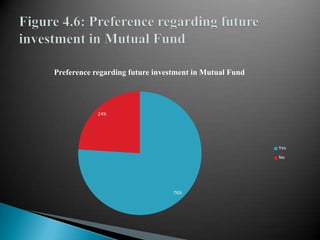

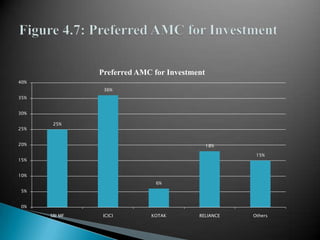

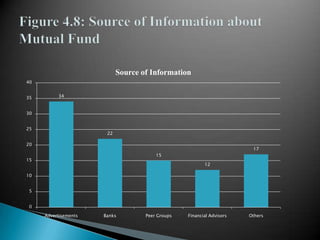

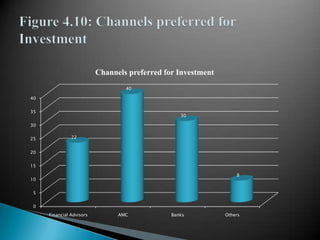

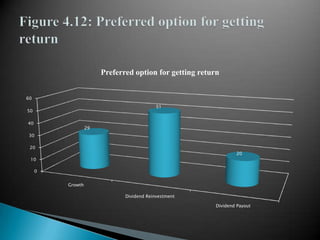

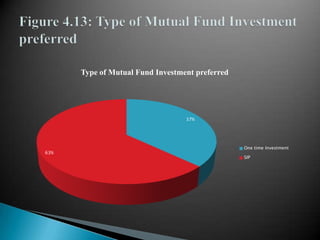

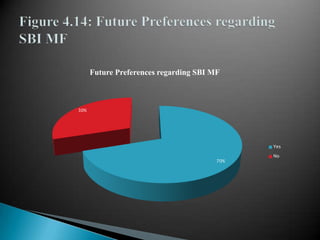

This document summarizes information about mutual funds in India, including how they work, the types of mutual fund schemes, the history of the Indian mutual fund industry, and SBI Mutual Fund products. It also describes a research study on awareness and preferences of mutual funds among entrepreneurs in Chandigarh, including key findings such as most entrepreneurs being aware of but not invested in mutual funds, with fixed deposits and real estate being more common investments. The document provides figures and analyses results of the study.