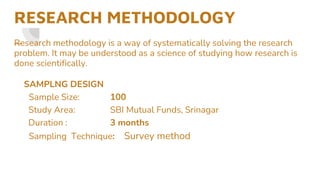

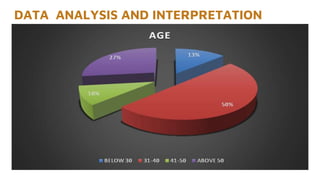

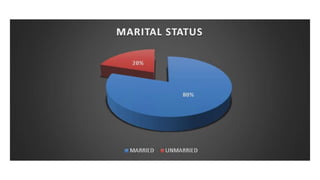

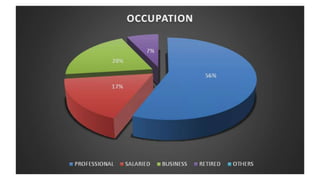

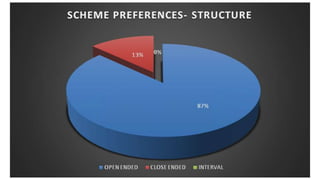

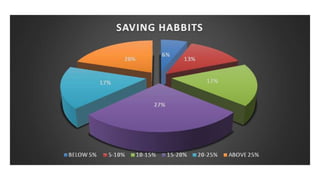

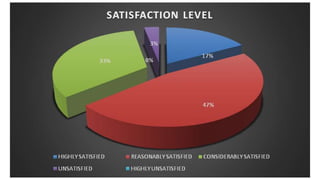

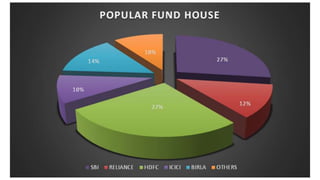

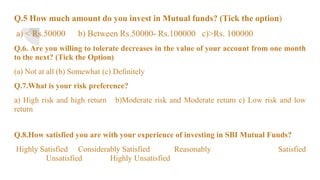

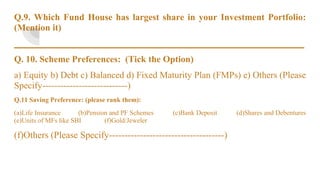

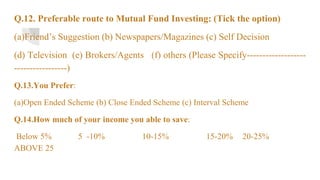

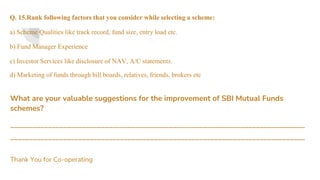

This document provides an overview of a research study on SBI Mutual Funds. It includes an introduction, objectives, research methodology, data collection and analysis, findings, limitations, conclusions and recommendations. The methodology section describes a survey of 100 investors in Srinagar over 3 months to understand their preferences and awareness of mutual funds. Key findings indicate that most people prefer savings deposits over investment options and are unaware of mutual fund schemes. The conclusions recommend that SBI mutual funds improve awareness of their schemes, especially for the service sector as a core market, and highlight the tax benefits of mutual fund investments.