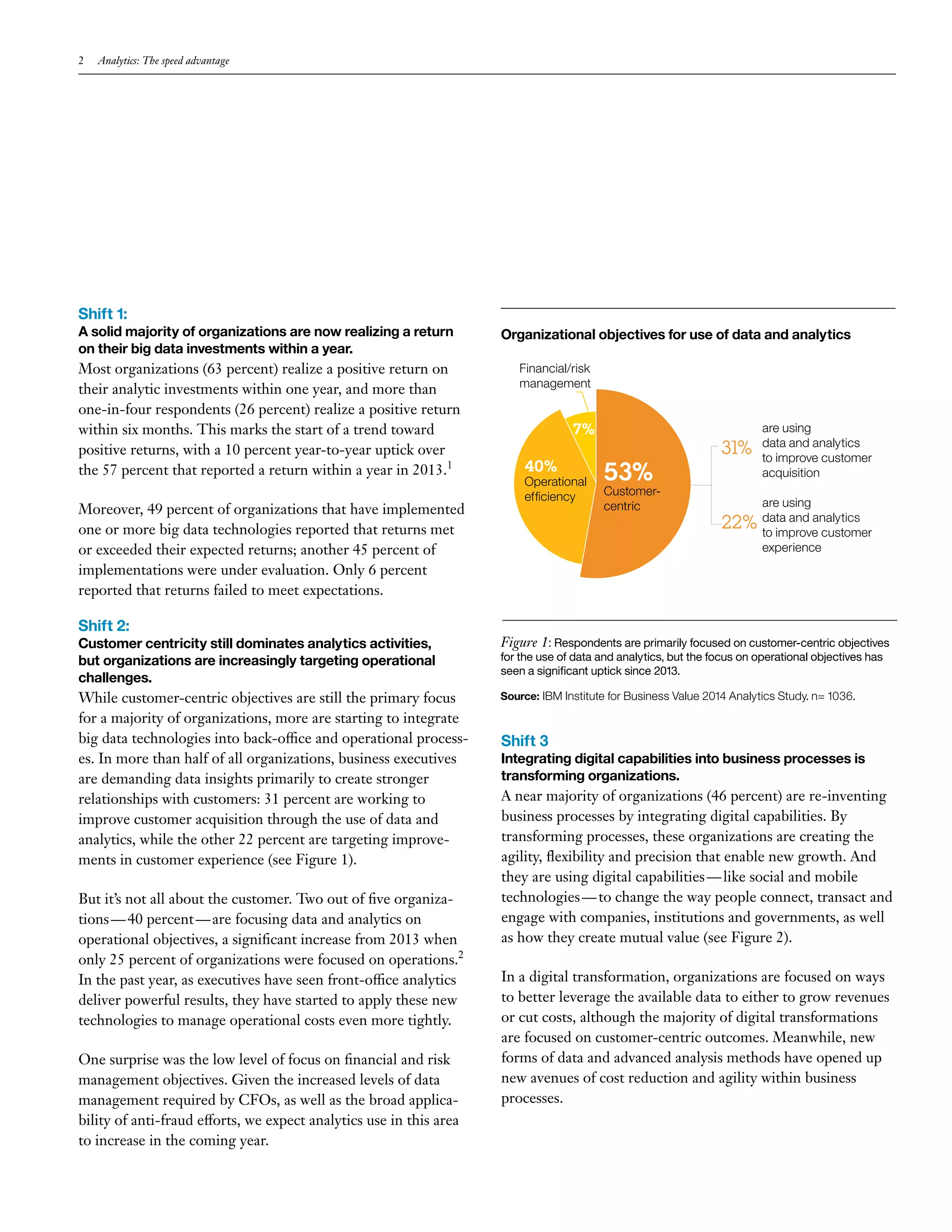

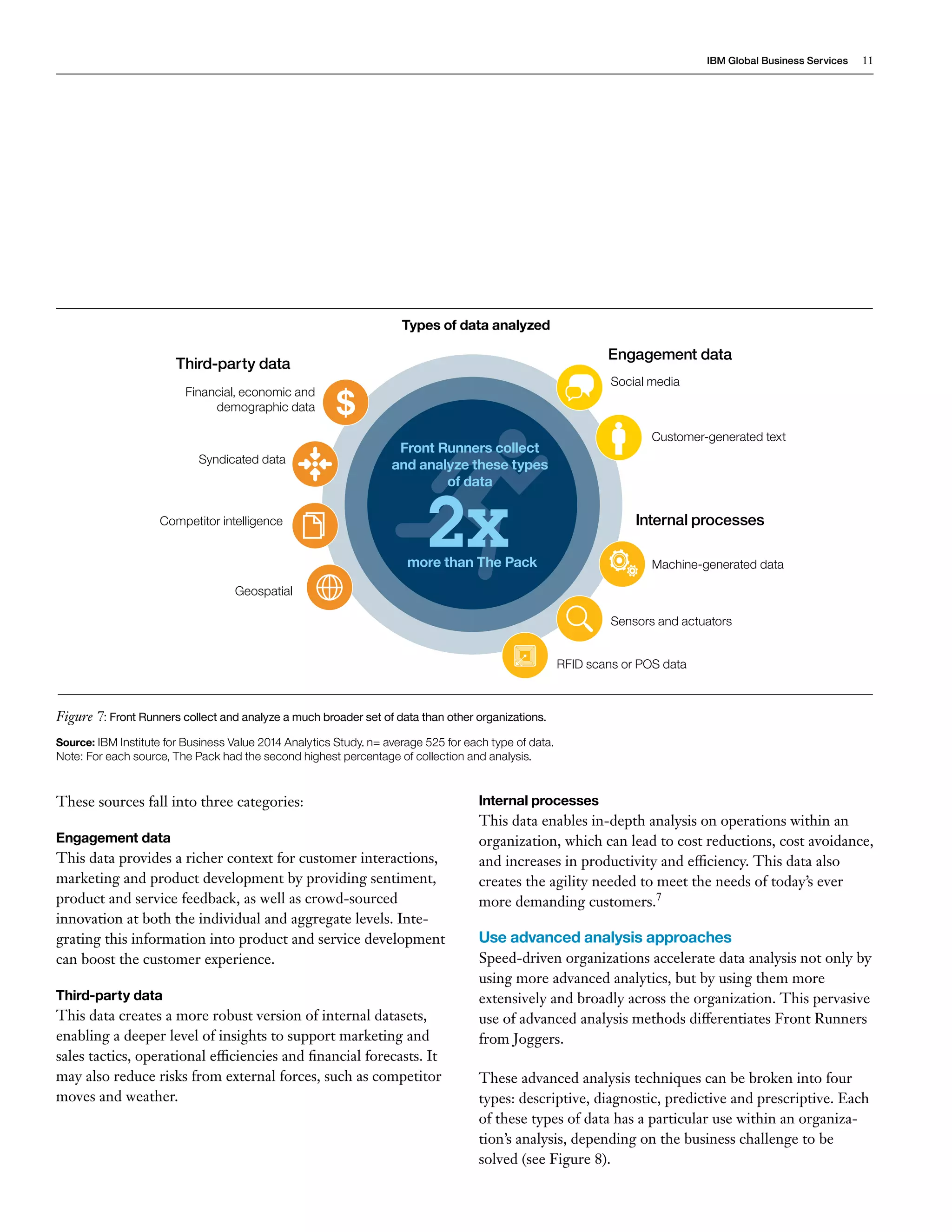

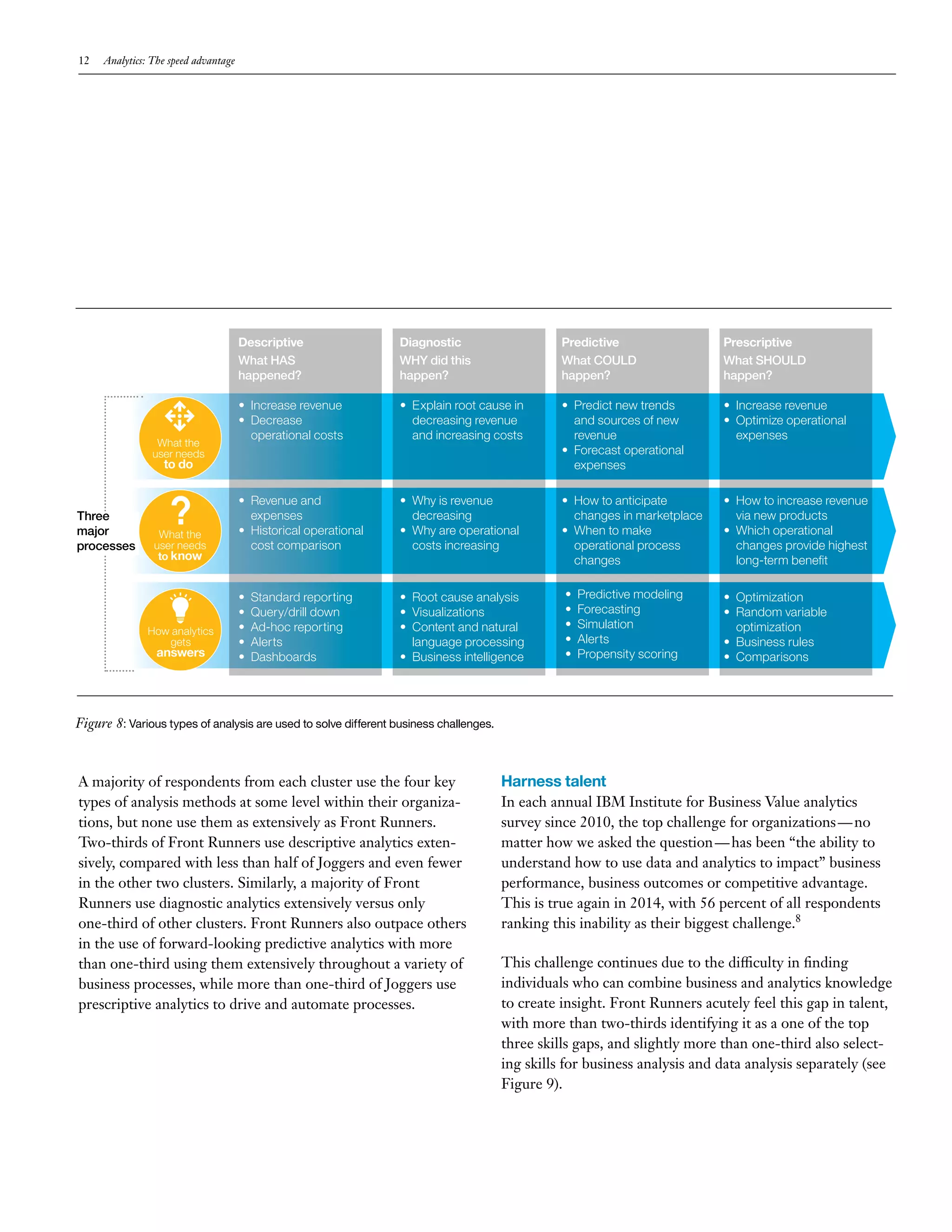

1. The document discusses shifts in analytics and big data, including that the majority of organizations now realize returns on analytics investments within a year, and that while customer focus remains important, organizations are increasingly using data and analytics to improve operations.

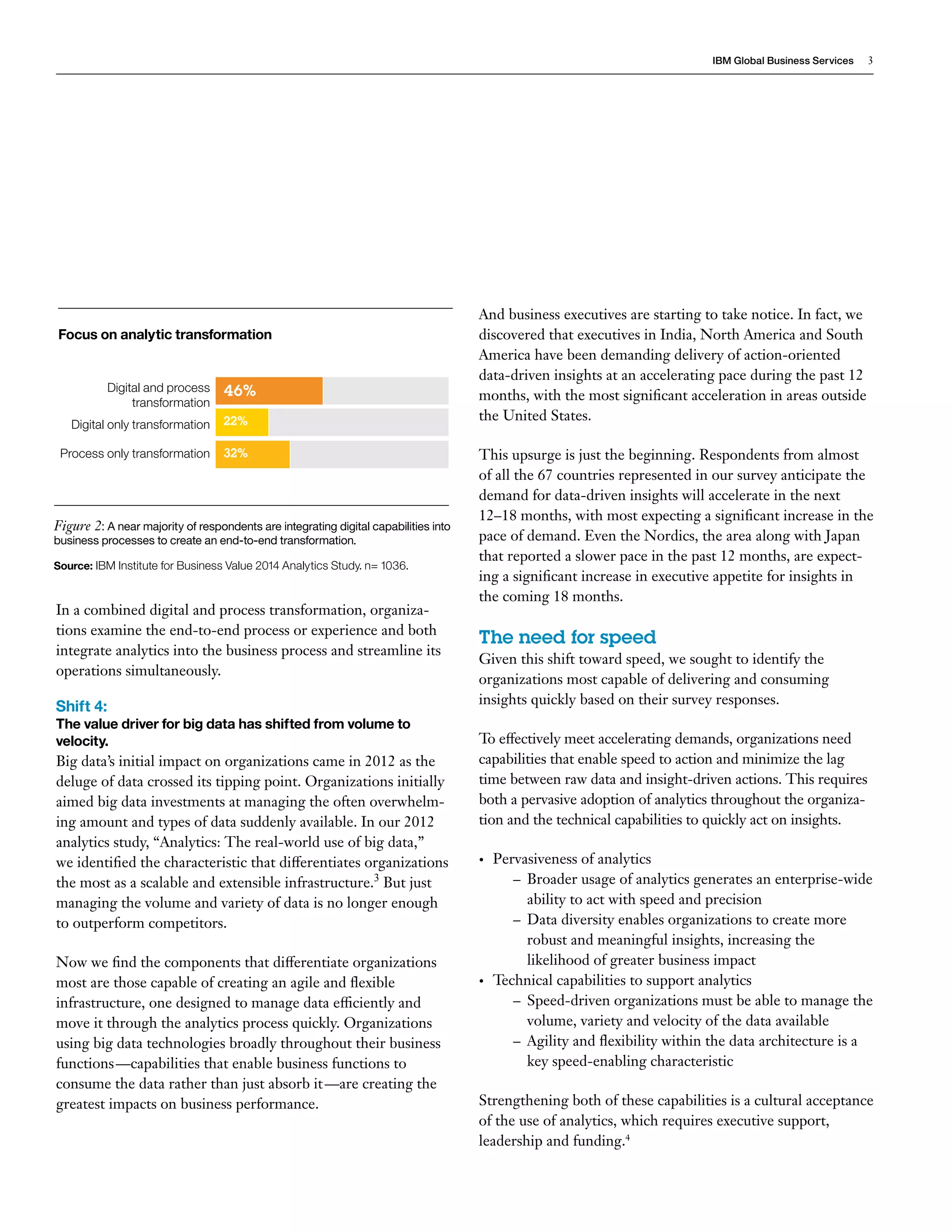

2. It also notes that many organizations are transforming processes by integrating digital capabilities, and that the value driver for big data has shifted from volume to velocity - the ability to quickly move from data to action.

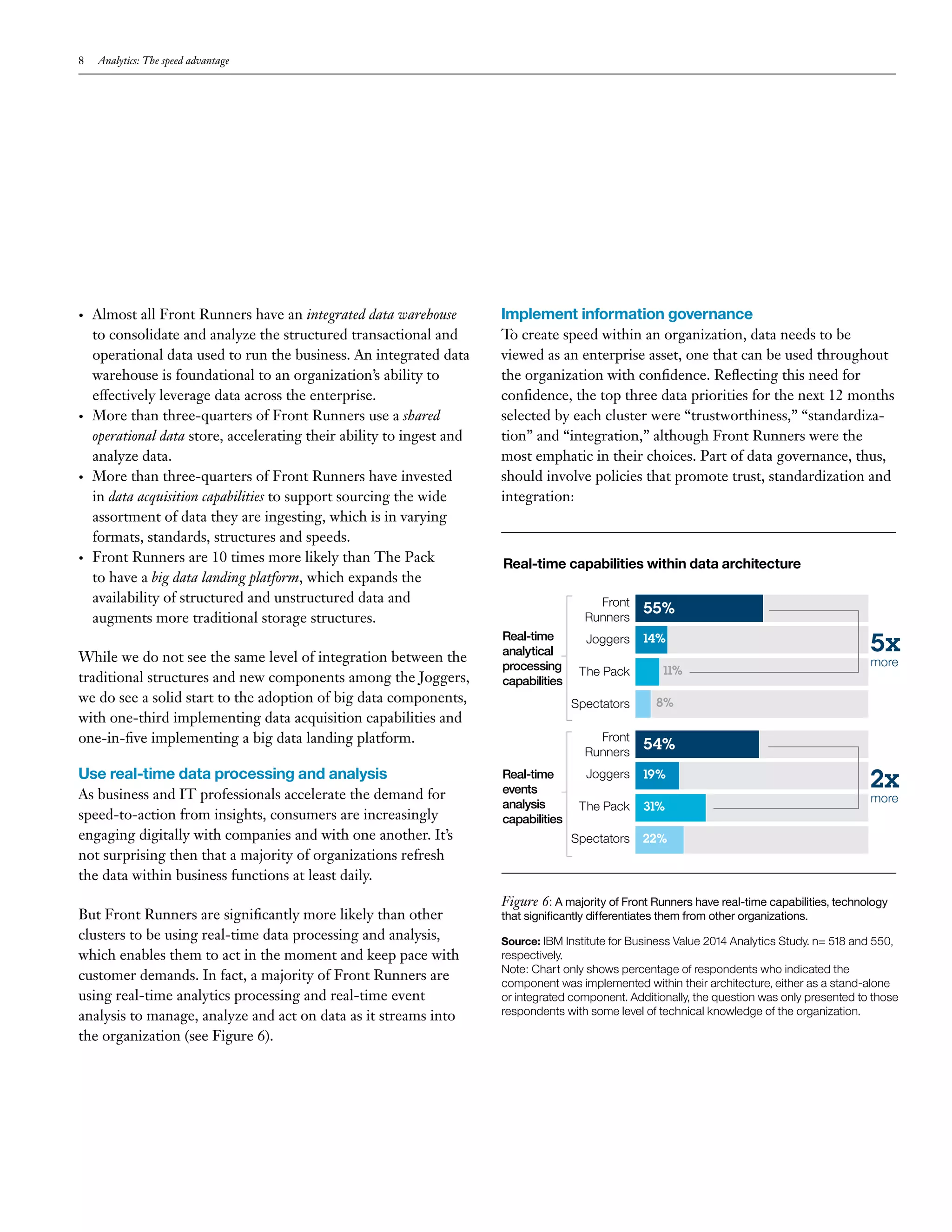

3. Speed is now the key differentiator, as data-driven organizations with capabilities for broad, fast analytics usage and agile technical infrastructure are creating significant business impacts.