Embed presentation

Download to read offline

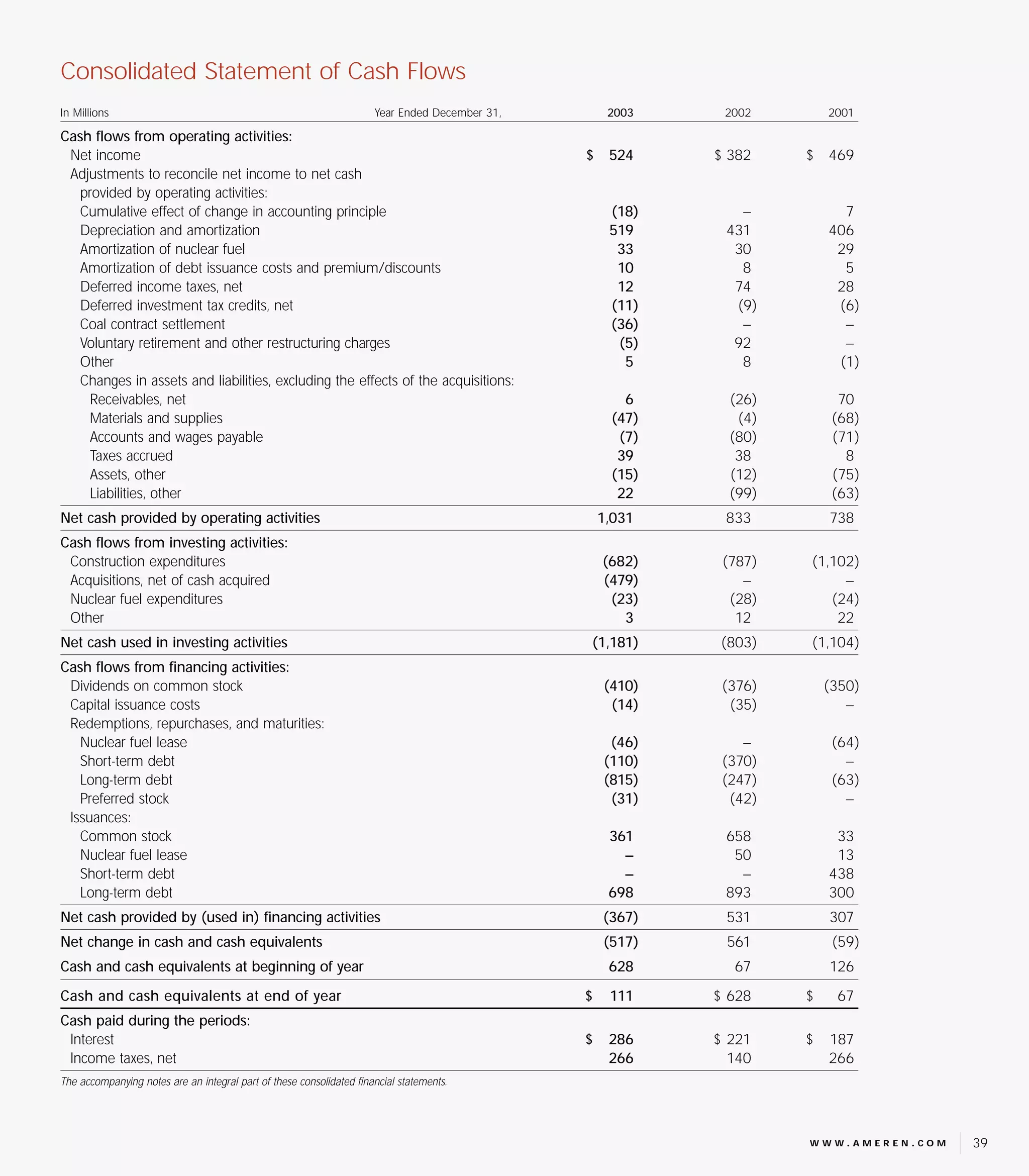

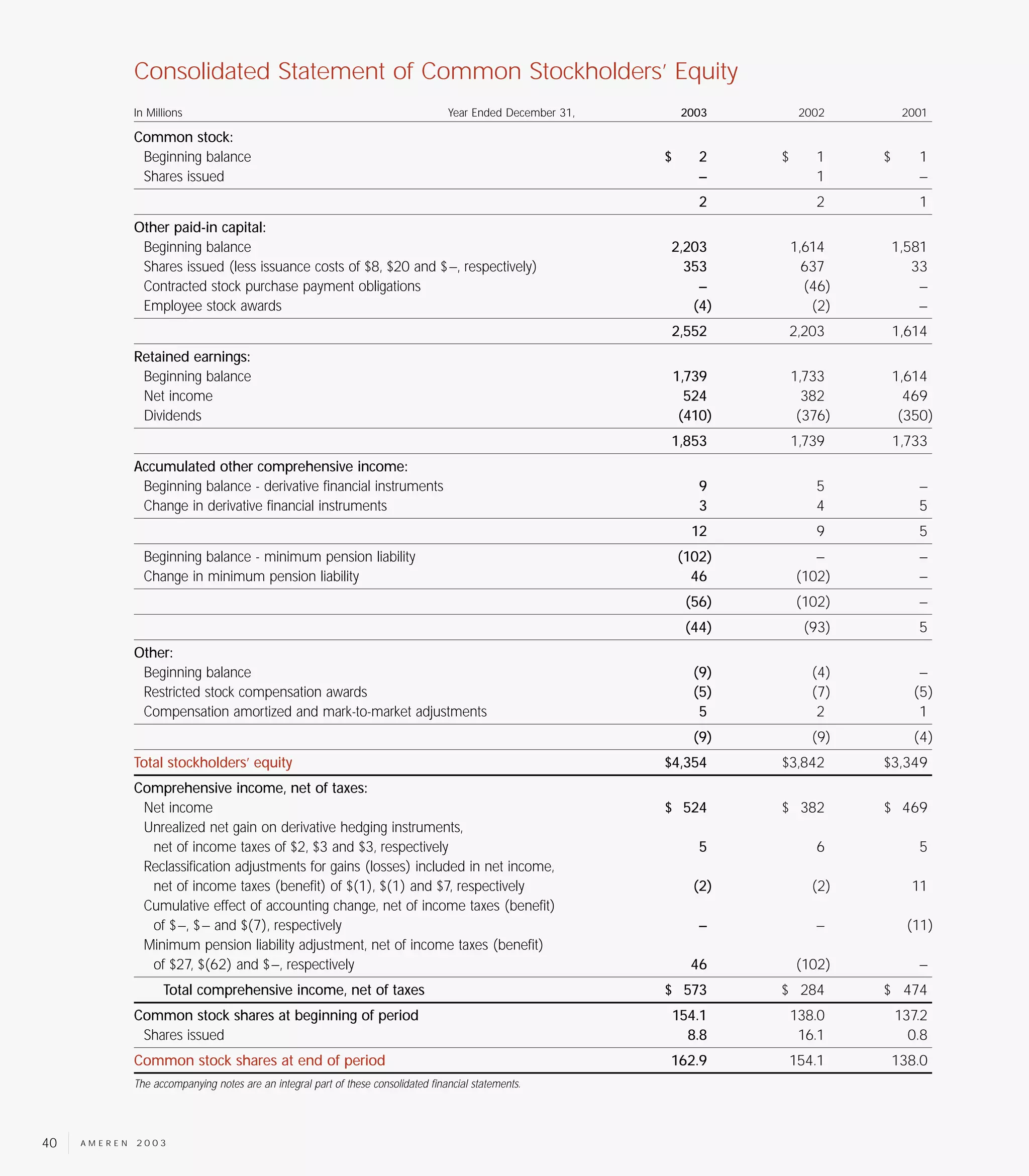

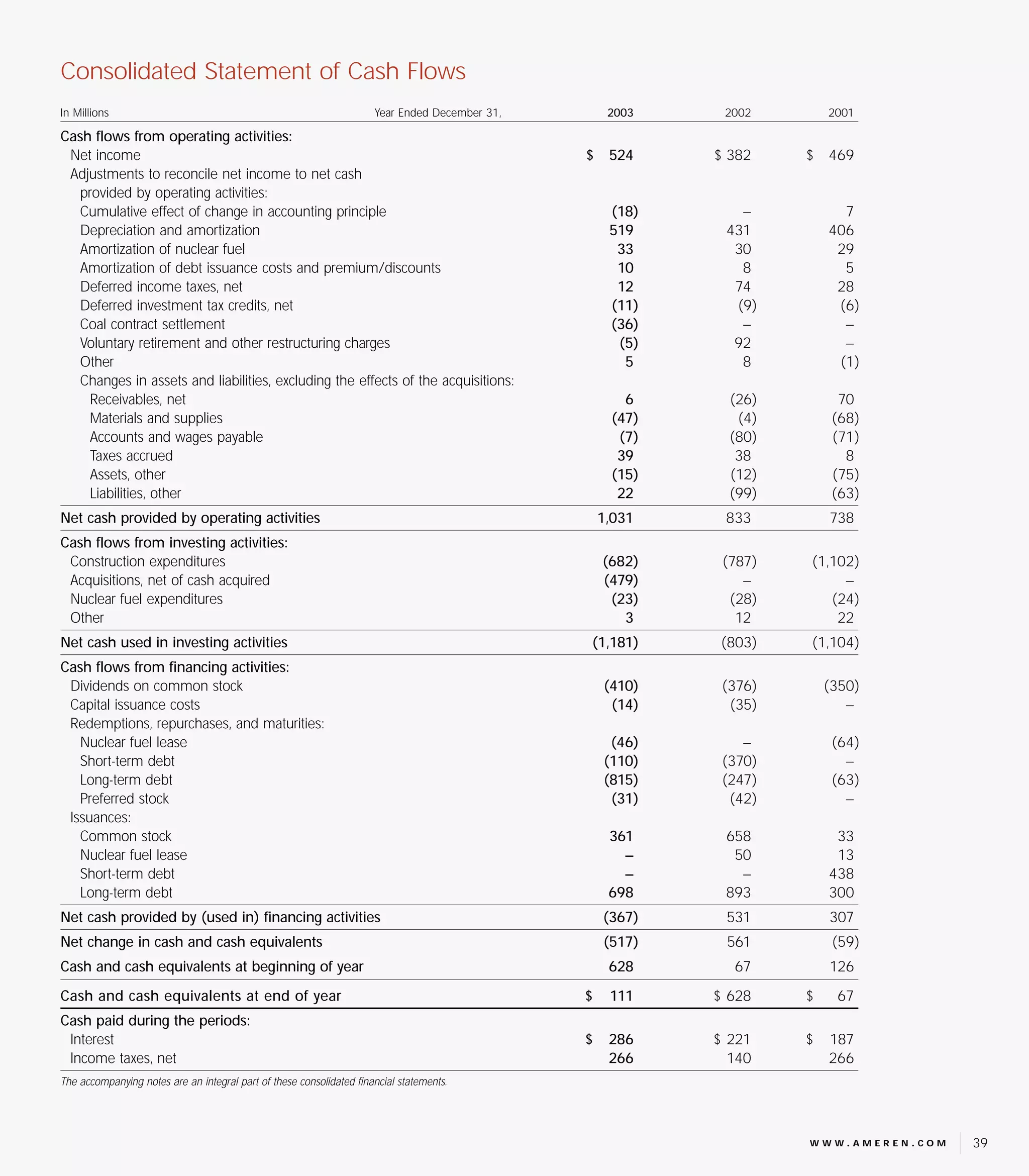

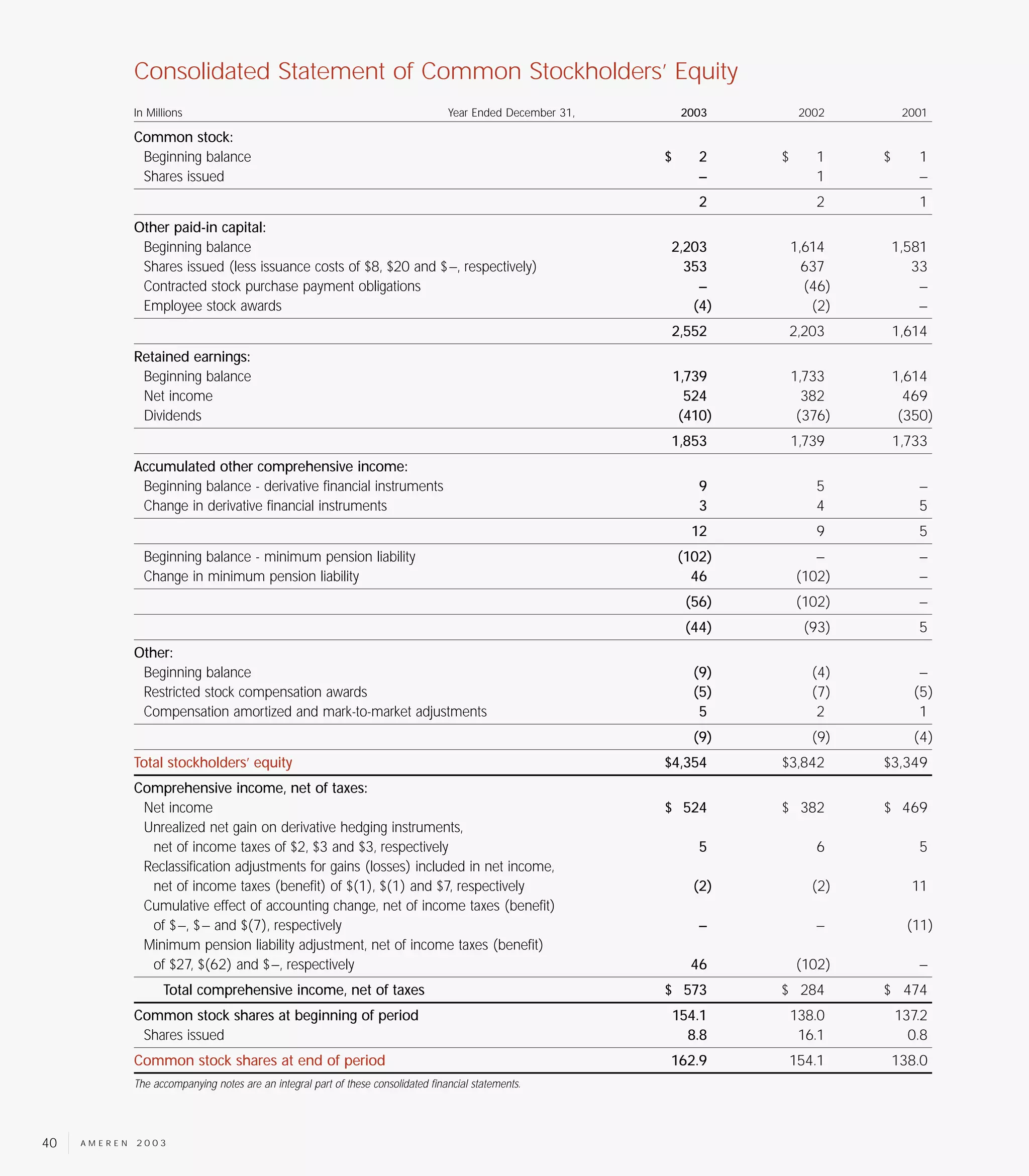

This document is Ameren's consolidated statement of income, balance sheet, and cash flows for the years ended December 31, 2003, 2002, and 2001. In 2003, Ameren reported total operating revenues of $4.6 billion and net income of $524 million. Total assets were $14.2 billion as of December 31, 2003, with long-term debt of $4.1 billion and total stockholders' equity of $4.4 billion. Cash provided by operating activities was $1 billion in 2003. Cash used in investing activities included $682 million for construction expenditures and $479 million for acquisitions. Financing activities included $410 million in dividends paid and $815 million in