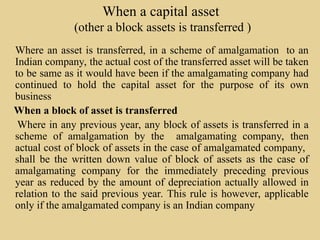

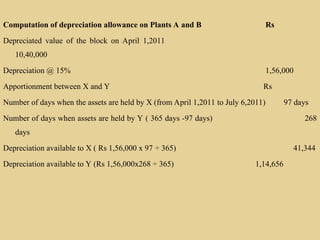

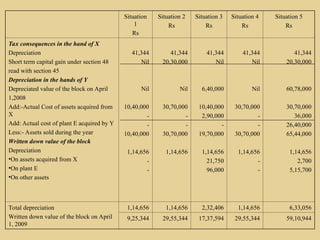

The document discusses corporate restructuring, focusing on the processes and tax implications of business restructuring, including mergers, amalgamations, and demergers. It outlines the definitions and necessary conditions for amalgamation under the Income Tax Act in India, as well as the tax benefits and consequences related to various restructuring scenarios. A series of case studies illustrate the practical application of these concepts, including conditions for carrying forward losses and depreciation after amalgamation.

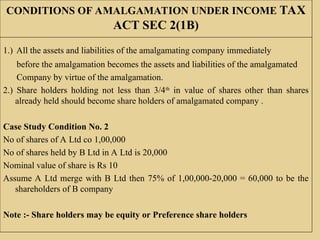

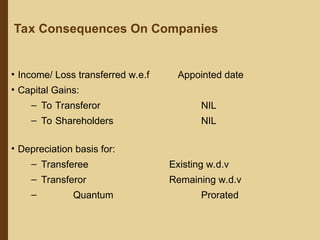

![Meaning of “Amalgamation”

under the income tax Act [ sec 2(1B)]

• Amalgamation in relation to companies, means-

• (a) Merger of one or more companies with another company.

• (b) Merger of two or more companies to form one company.

( in India merger is called amalgamation )

• Merger of A Ltd with X Ltd.(A Ltd, goes out of existence).

• Merger of A Ltd and B Ltd with X Ltd ( A Ltd and B Ltd go out of existence )

• Merger of A Ltd, B Ltd and C Ltd into a newly incorporated company X Ltd

(A Ltd, B Ltd and C Ltd go out of existence )

In these cases A Ltd, B Ltd and C Ltd are amalgamating companies while X Ltd

is an amalgamated company.

Merging companies are called – Amalgamating companies

New Company is called – Amalgamated Company](https://image.slidesharecdn.com/amalagamation-240921055533-16c6e313/85/amalagamation-Absorption-and-reconstructionppt-7-320.jpg)

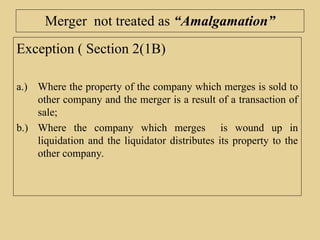

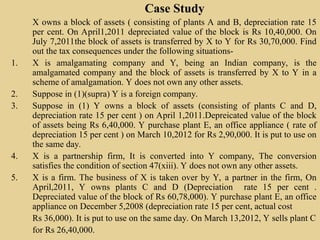

![Sec 47 (vii) and 49.2

( Allotment of shares in amalgamated Co to the shareholders of amalgamating)

Any transfer by a share holders in a scheme of amalgamation of shares held

by him in the amalgamating Co. shall not be regarded as transfer if :-

a) Transfer is made in consideration of allotment to him of shares in the

amalgamated Co; and

b) Amalgamated Co is an Indian Company.

According to Sec49(2) in the aforesaid the cost of shares of the

amalgamating Co shall be the cost of shares of the amalgamated company

Case study

X Ltd, an Indian company , take over the business of Y Ltd in a scheme of

amalgamation of the two companies. Z has purchased 100 shares in Y Ltd in

1994 for Rs 60 per share. As per the scheme of amalgamation, he gets 50

shares in X Ltd in lieu of 100 shares in Y Ltd Consequently the cost of

shares in X Ltd will be taken as Rs 120 per shares [ i.e. Rs 6000/- being cost

of 100 shares in Y Ltd ÷ 50 shares in X Ltd]](https://image.slidesharecdn.com/amalagamation-240921055533-16c6e313/85/amalagamation-Absorption-and-reconstructionppt-11-320.jpg)

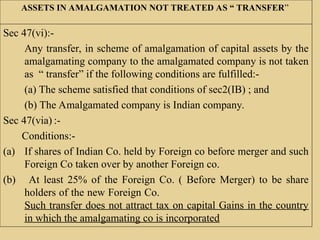

![Carry forward and set off of loss and depreciation [ Sec 72A]

If the following conditions are satisfied then the accumulated loss and the unabsorbed

depreciation of the amalgamating company shall be deemed to be loss / depreciation of

the amalgamated company for the P.Y in which the amalgamation is effected :-

Sec 72A to be fulfilled – conditions:-

1.) There is an amalgamation of a company owning industrial undertaking, ship or a hotel

with another Co, or a banking company with a SBI or any subsidiary of SBI, Public sector

airlines with another public sector airlines

Industrial undertaking – manufacture or processing of good, computer software,

generation or distribution of electricity, mining construction of ships, aircraft or rail

system, telecommunication services, broadband network and internet services ) Except

hospital.

2.) Accumulated losses remain unabsorbed for 3 or more years .

3.) 75% of Book value to be held at least for 2 years before amalgamation

4.) The amalgamated Co continues to hold ¾ the of book value at least for 5 years

5.) New Co Should continue for another 5 years.

6.) New Co. Should achieve at least 50% of installed capacity before end of 4 years and

should continue for 5 years

7.) The new amalgamated Co should furnish to assessing officer a certificate in form No 62

about particulars of production

This scheme is also applicable to banking institutions](https://image.slidesharecdn.com/amalagamation-240921055533-16c6e313/85/amalagamation-Absorption-and-reconstructionppt-12-320.jpg)

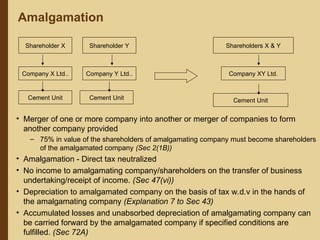

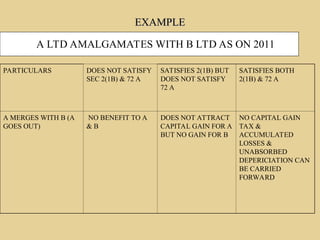

![The conditions of

Sec 2(1B) is satisfied

Sec 72 A is satisfied

Situation A Yes Yes

Situation B Yes No

Situation C No No

[Analysis ]

A Ltd proposes to be merged with B Ltd. consider which is the following benefits

are available to B Ltd under the following situations :-

The Benefits are :-

Situation A Situation B Situation C

Expected Bad debits

B/F business loss

Unabsorbed depreciation

B/F speculation loss

B/F Capital loss

Deduction U/S 801A or 80 I

B of unexpired period

Yes

Yes

Yes

No

No

yes

Yes

No

No

No

No

yes

No

No

No

No

No

No](https://image.slidesharecdn.com/amalagamation-240921055533-16c6e313/85/amalagamation-Absorption-and-reconstructionppt-13-320.jpg)

![Demerger ...

Demerger - Direct tax neutral for company/shareholder.

• No income to DC on transfer of undertaking (Section 47(vib))

• No income to shareholder on receipt of shares in RC (Section 47(vid))

• Proportionate depreciation in the year of demerger. Depreciation to RC

on the basis of tax W.D.V. in the hands of DC.[explanation to Section

43(1)]

• Accumulated business losses and unabsorbed depreciation (Section

72A):-

– directly relatable to the demerged undertaking - allowed to be carried

forward by RC

– not directly relatable to the demerged undertaking - to be apportioned in

the ratio of assets transferred to RC and assets retained by DC

• Demerged business undertaking eligible for most tax exemption -

benefits available even as part of RC (deduction u/s 80IA, 80IB

available for unexpired period to resulting Co.)](https://image.slidesharecdn.com/amalagamation-240921055533-16c6e313/85/amalagamation-Absorption-and-reconstructionppt-32-320.jpg)