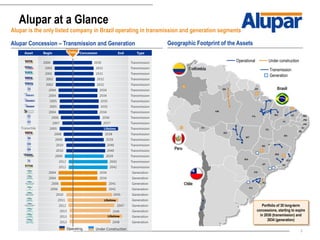

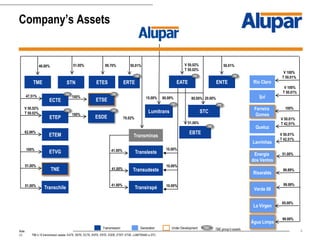

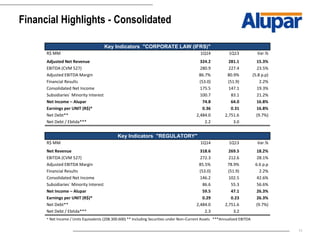

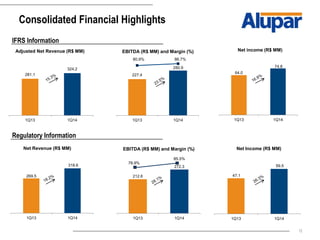

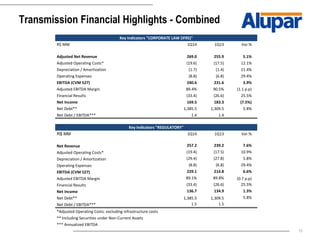

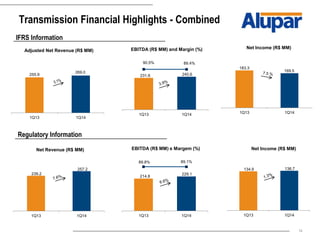

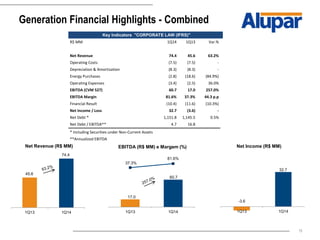

Alupar reported its financial results for the first quarter of 2014, with consolidated net income growing 19.3% compared to the same period in 2013. Key highlights included adjusted net revenue increasing 15.3% to R$324.2 million and EBITDA growing 23.5% to R$280.9 million. For the transmission business, EBITDA rose 3.9% to R$240.6 million while generation EBITDA increased significantly to R$60.7 million. The company also announced it had declared interim dividends of R$156 million and recommended final dividends of R$193.7 million for fiscal 2013.