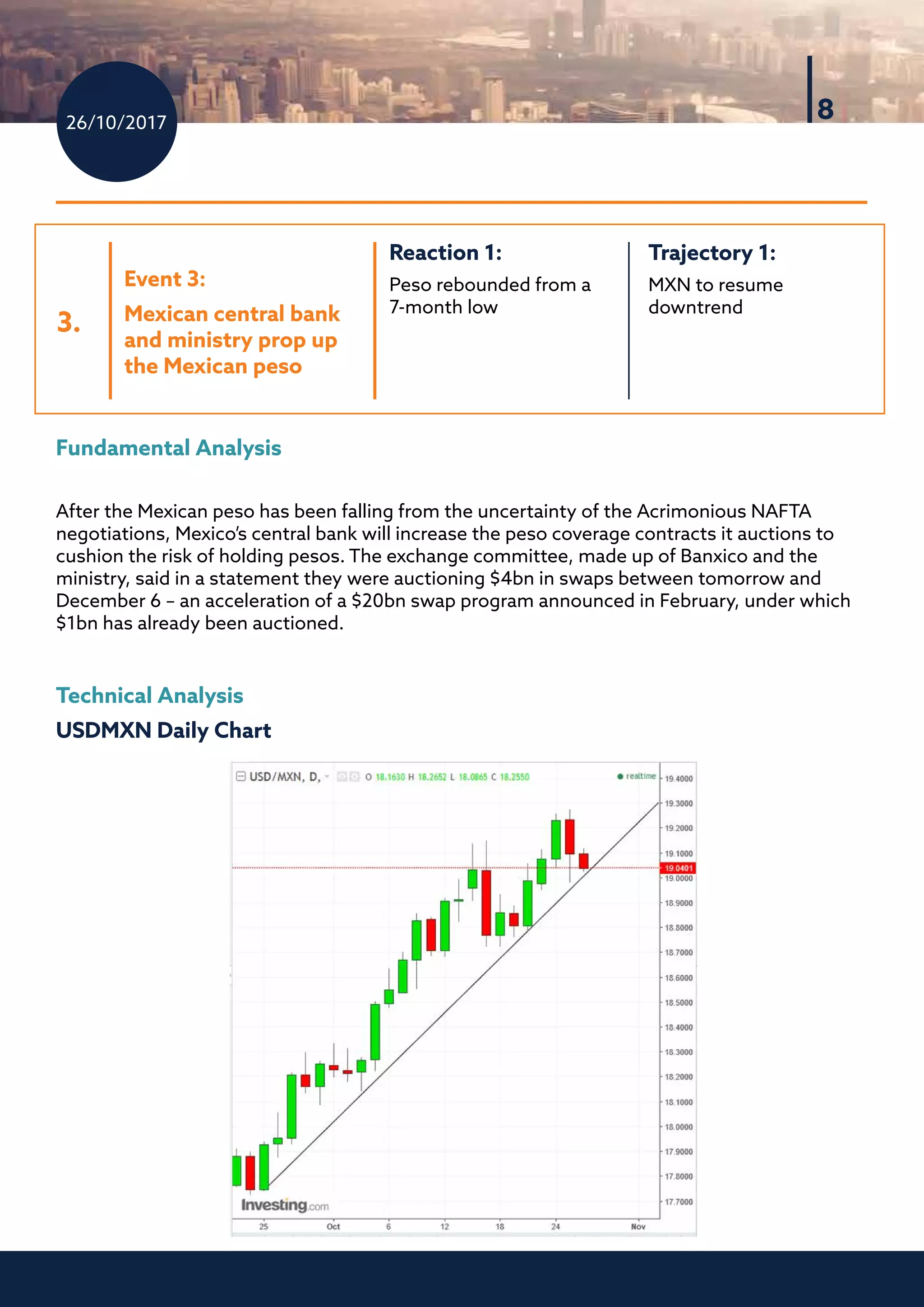

The document provides a daily market brief analyzing global stock market movements and currency trends. It summarizes recent events affecting markets, including mixed corporate earnings reports and political infighting over tax reform, which contributed to a fall in US stocks. It then analyzes specific trends in real estate stocks, the Canadian dollar, Mexican peso, and British pound. For each, it provides both a fundamental analysis of recent economic news and events influencing the asset, as well as a technical analysis of charts identifying trends and potential trading strategies.