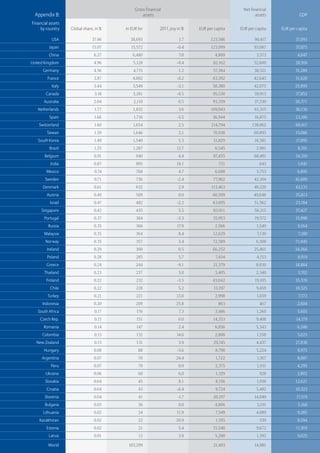

Global financial assets grew 1.6% in 2011 to surpass EUR 100 trillion for the first time, however this growth rate was the lowest since 2008. The euro crisis and stock market volatility negatively impacted household wealth, especially in southern Europe. Overall since 2000, global per capita financial assets have only grown at the average inflation rate due to recurring financial crises. Continued uncertainty and low interest rates have led savers to prioritize liquidity and security over returns. Meanwhile, the emerging markets catch-up process has continued despite challenges in developed nations.