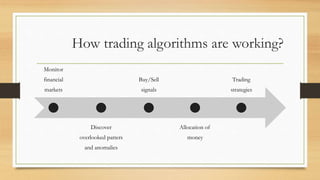

Algorithmic trading, which emerged in the 1970s, uses automated logic to execute trades, significantly impacting the Indian stock market since its introduction in 2008, with nearly 50% of trades being algorithmic by 2016. It improves market liquidity and efficiency while reducing volatility, but raises concerns like potential unethical practices and negative impacts on capital formation. Despite these concerns, algorithmic trading is seen as an inevitable evolution of the securities markets with the ability to enhance investment rewards.