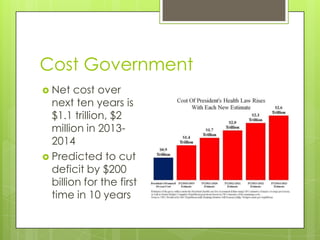

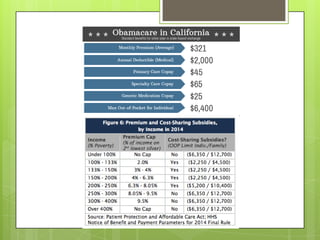

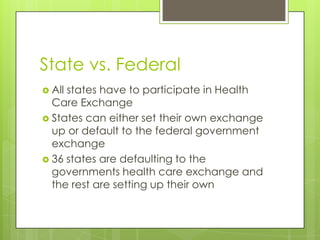

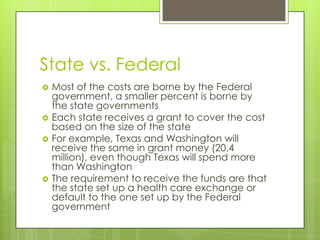

The Affordable Care Act, also known as Obamacare, was established on March 23, 2010 under President Barack Obama. It aims to expand access to affordable health insurance by opening state-run health insurance exchanges. While intended to increase access to healthcare, Obamacare remains controversial with Democrats generally supporting it and Republicans opposing it. Over the next ten years, the program is expected to cost the government $1.1 trillion but reduce the federal deficit by $200 billion.