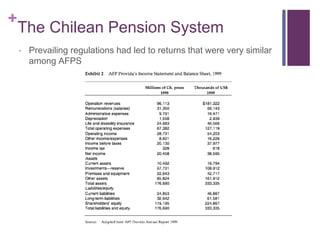

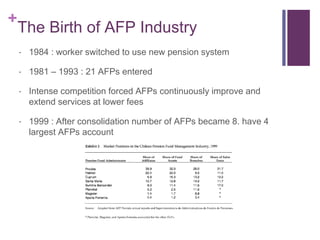

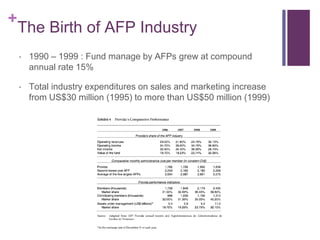

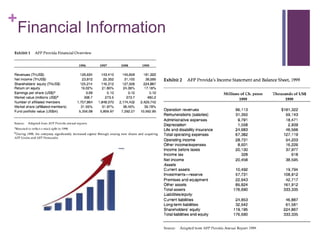

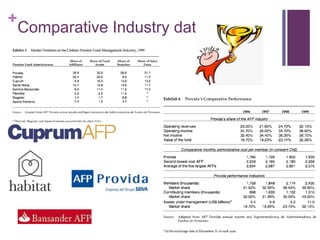

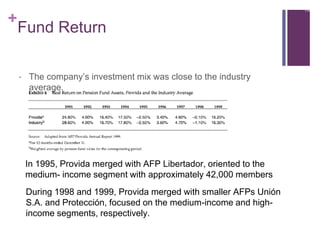

Chile reformed its pension system in 1981, shifting from a pay-as-you-go system to privately managed individual accounts. Workers now contribute 10% of salaries to pension fund administrators (AFPs) like AFP Provida. AFP Provida was an early entrant and achieved a 30% market share initially. It has since expanded its operations and services, including branches nationwide and online access, while merging with smaller AFPs. The Chilean pension system led to high investment returns and helped fuel the country's strong economic growth from 1990-1999.