ACC achieved satisfactory performance in 2011. Sales volume grew 5.9% to 21.29 million tonnes. Net sales increased 11.5% to Rs. 9,439 crore and operating EBITDA grew 17% to Rs. 3,027 crore. Profit before tax was Rs. 2,294 crore and profit after tax was Rs. 1,607 crore. The company continued to focus on improving plant operations, customer service, sustainability initiatives and community development programs. ACC received several awards recognizing achievements in manufacturing, energy efficiency and environment management.

![18 | ECONOMIC VALUE ADDED [EVA] - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

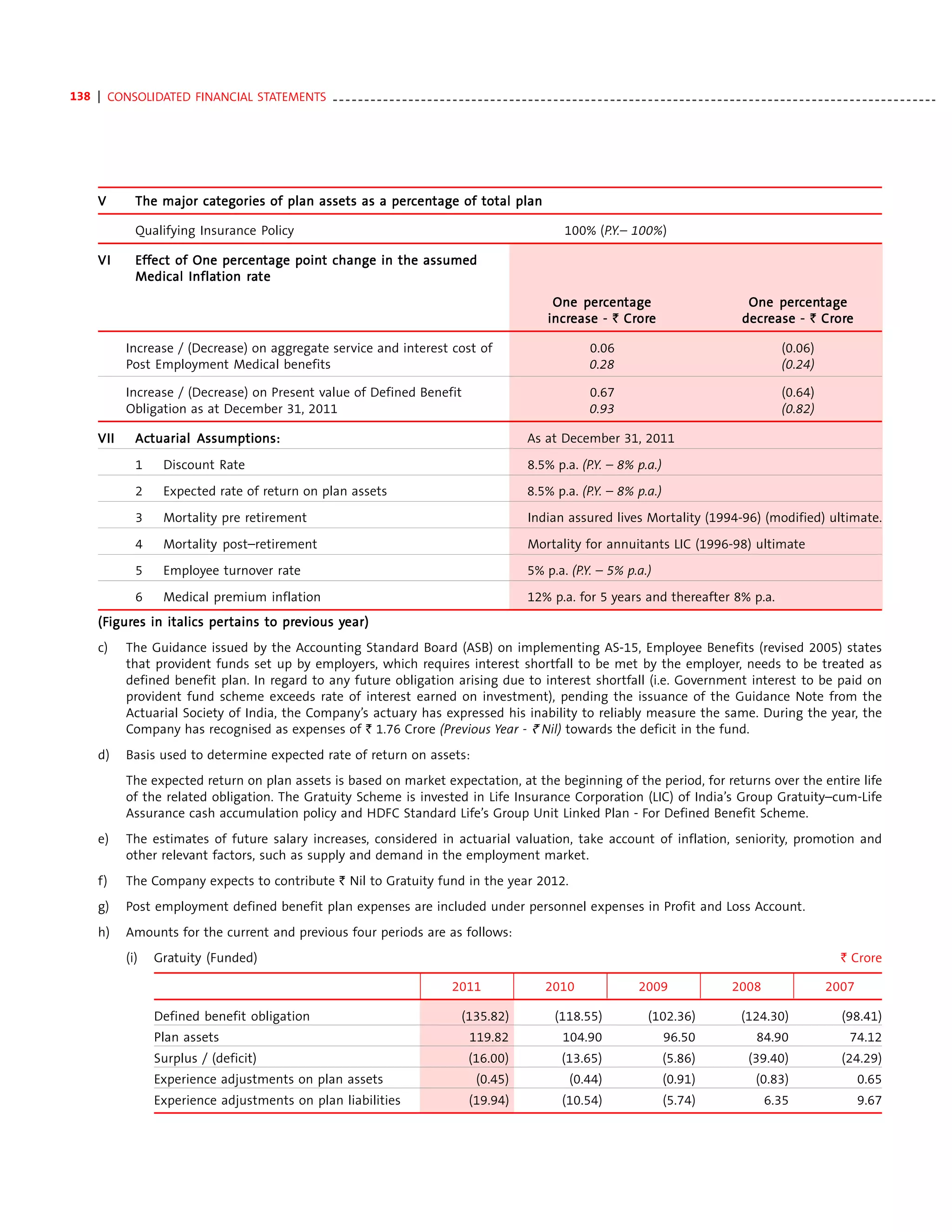

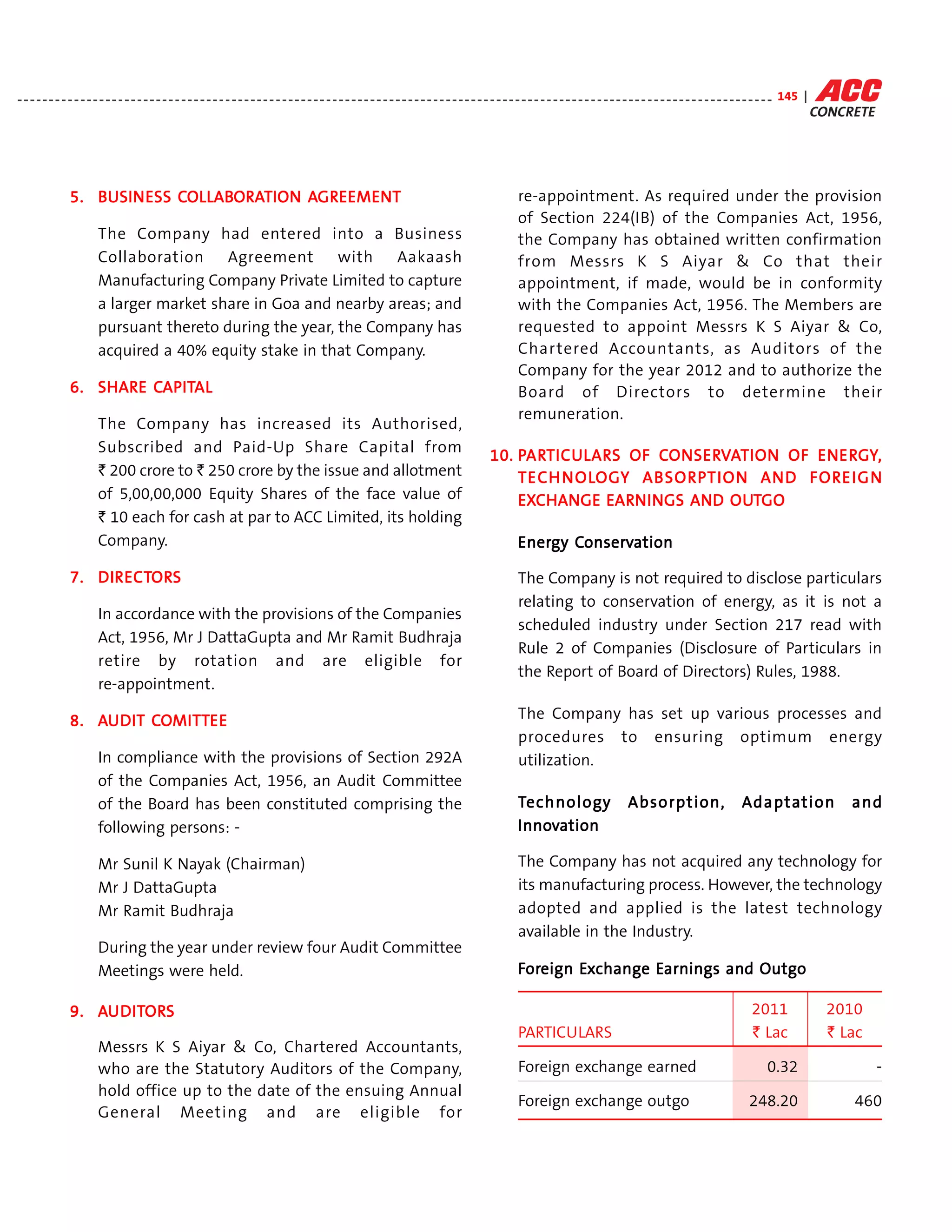

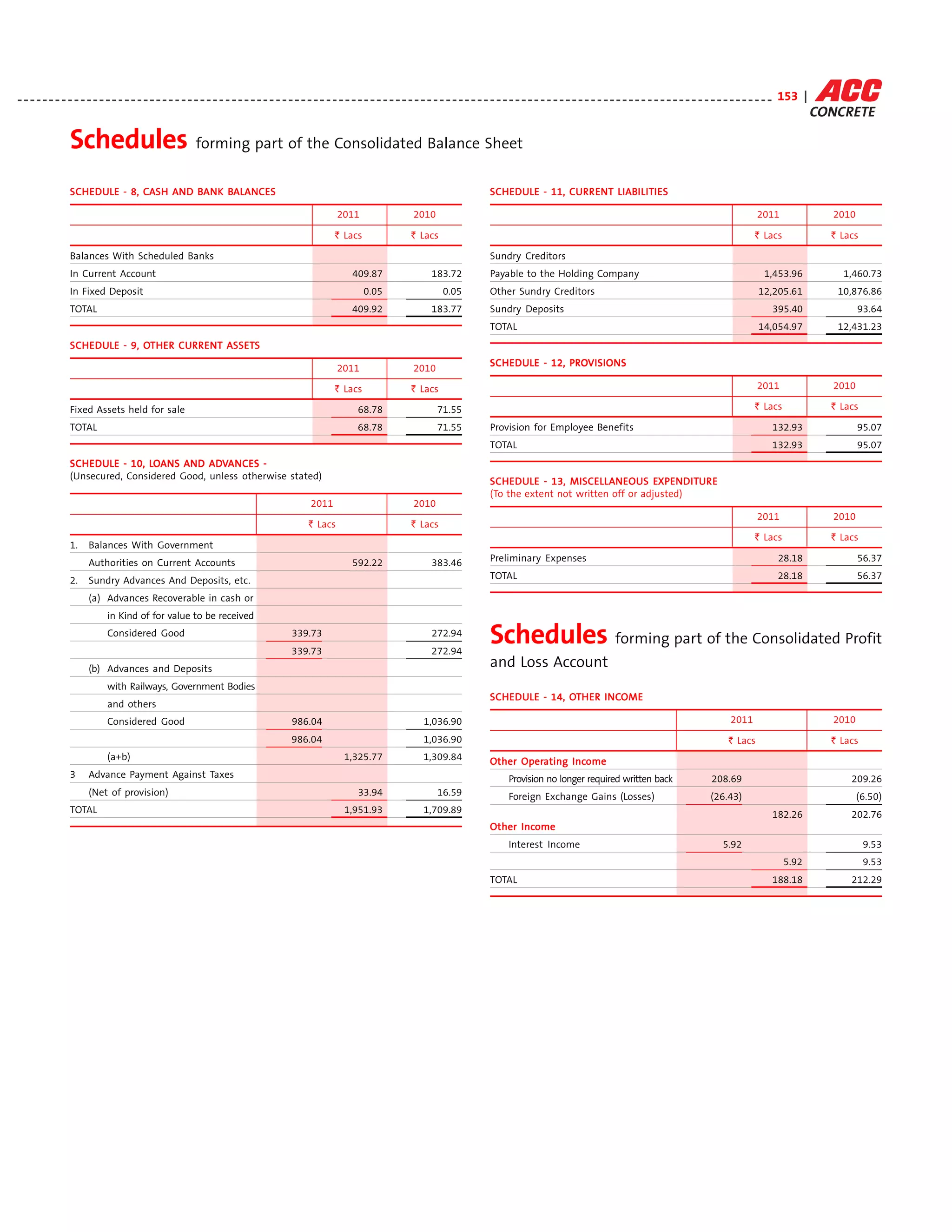

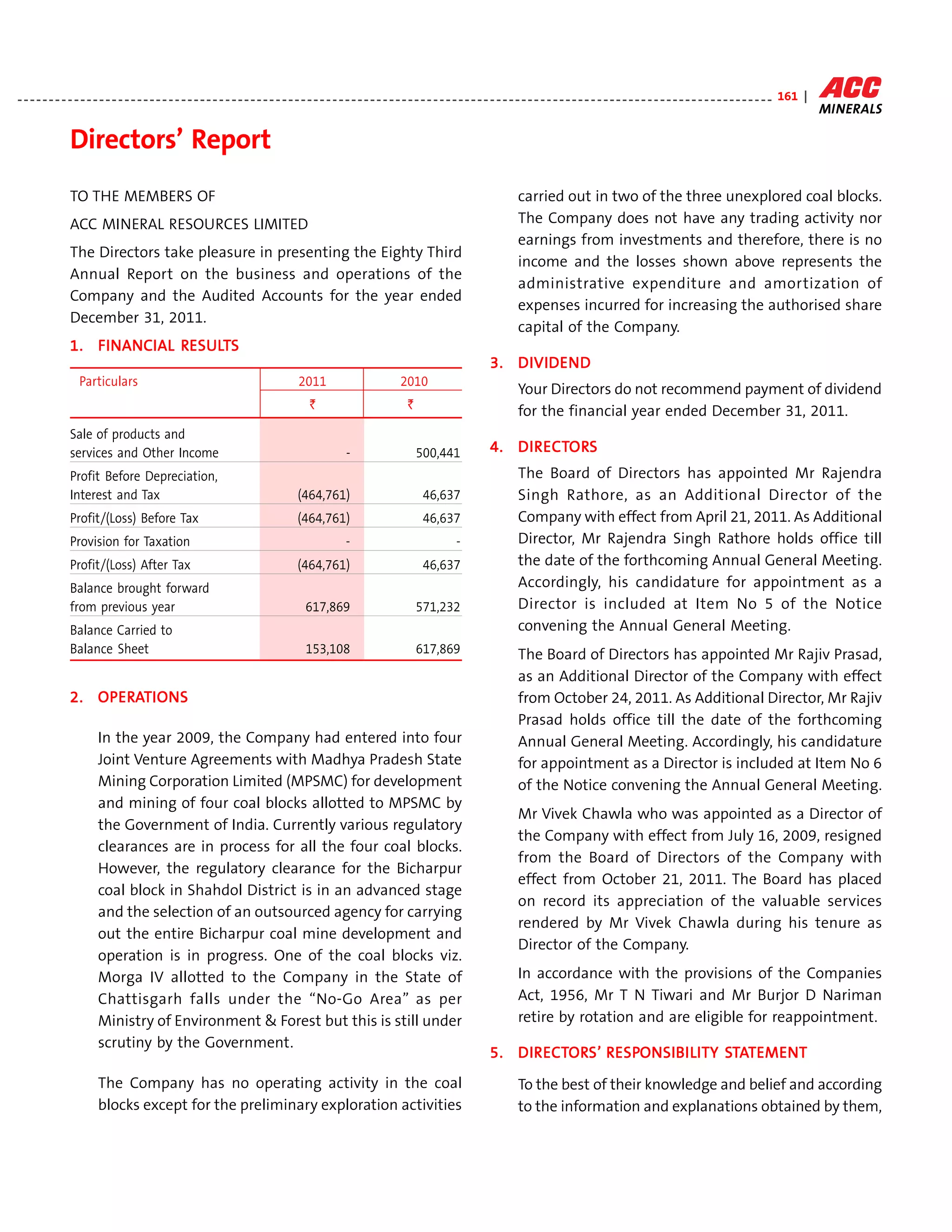

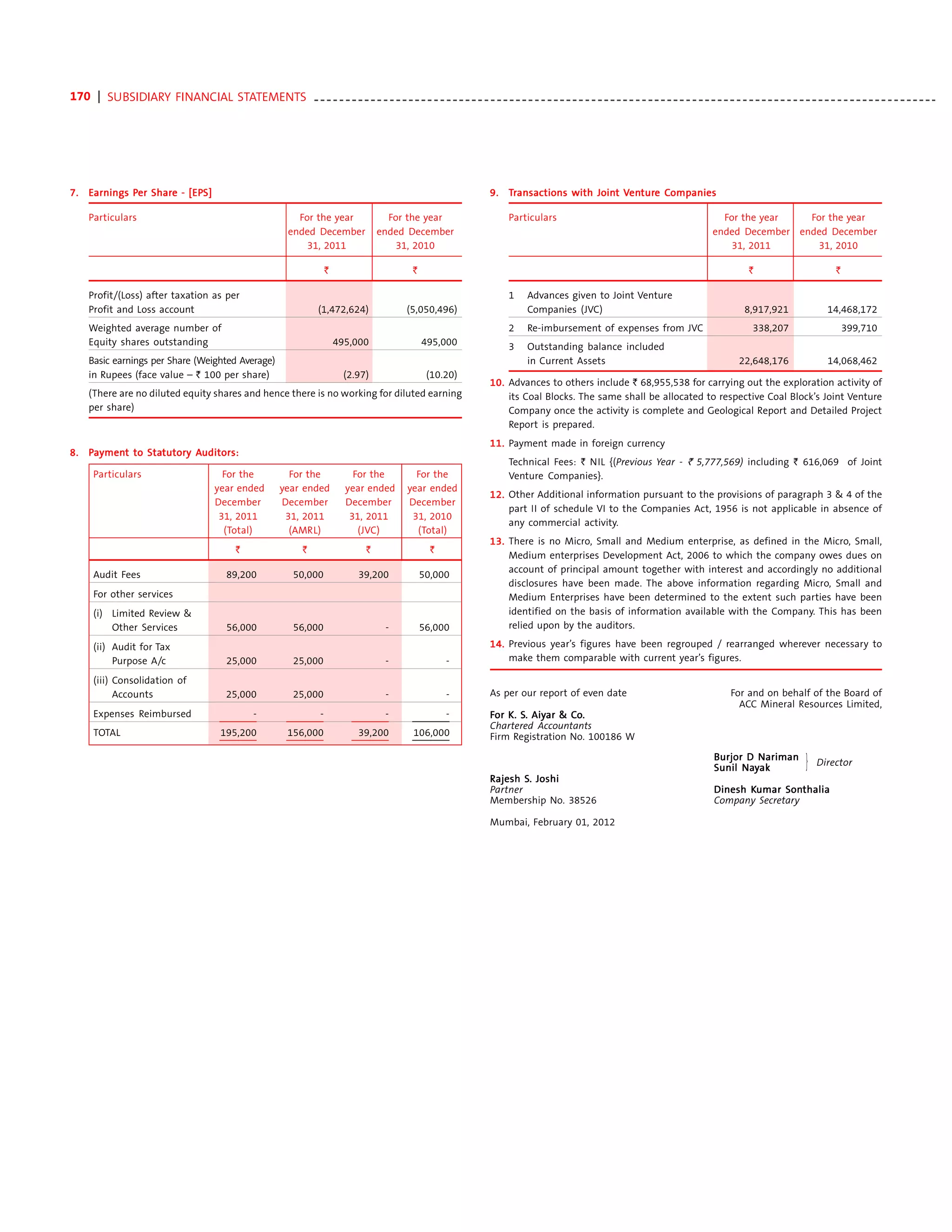

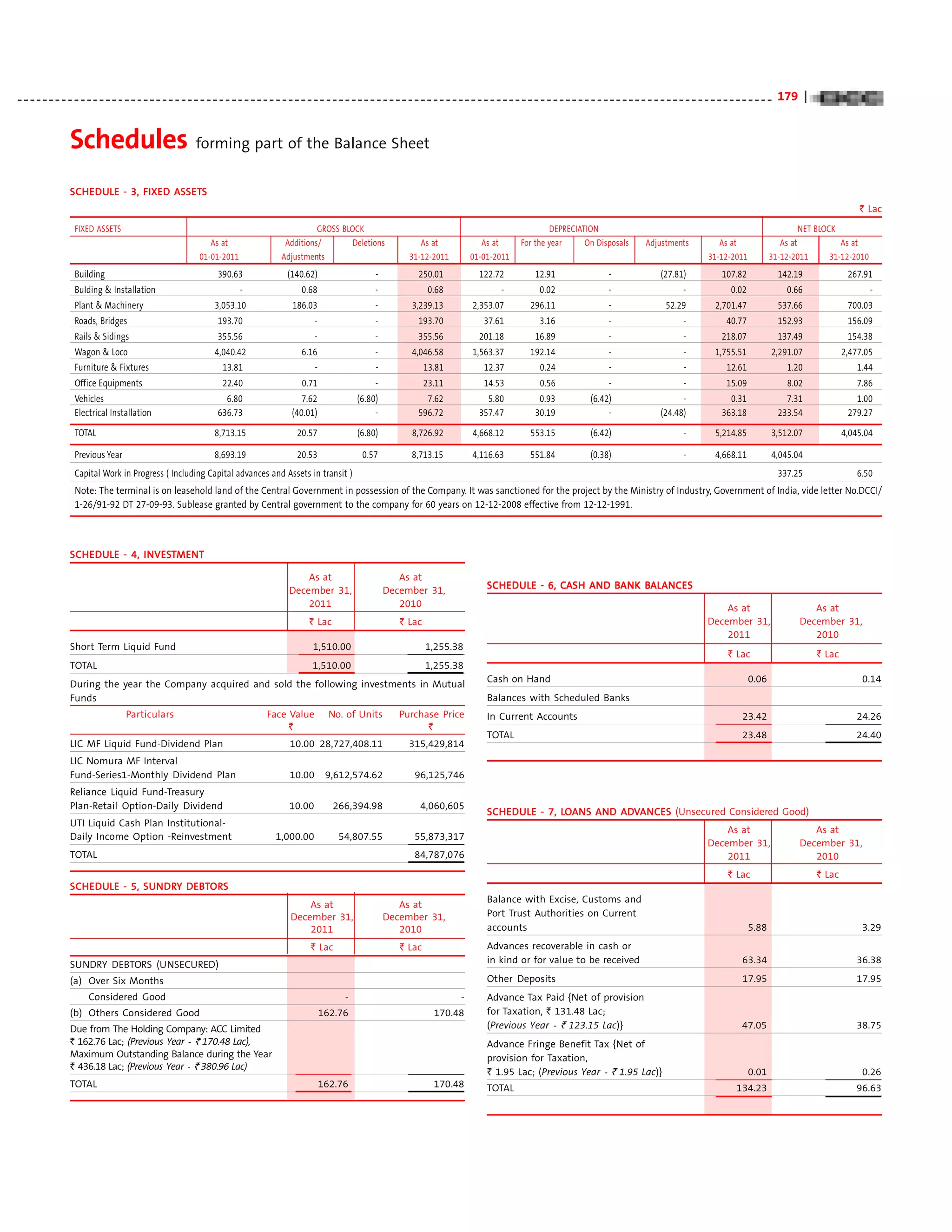

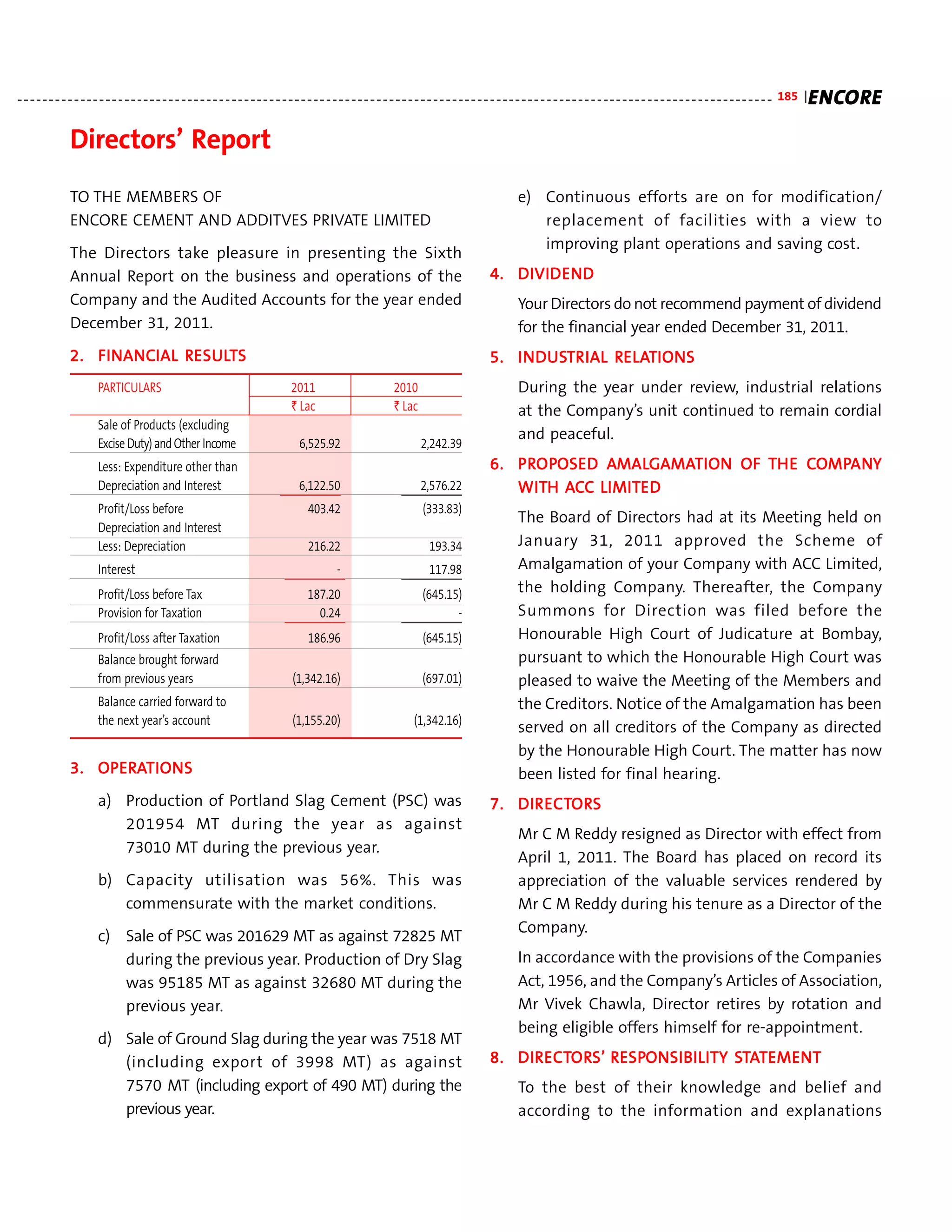

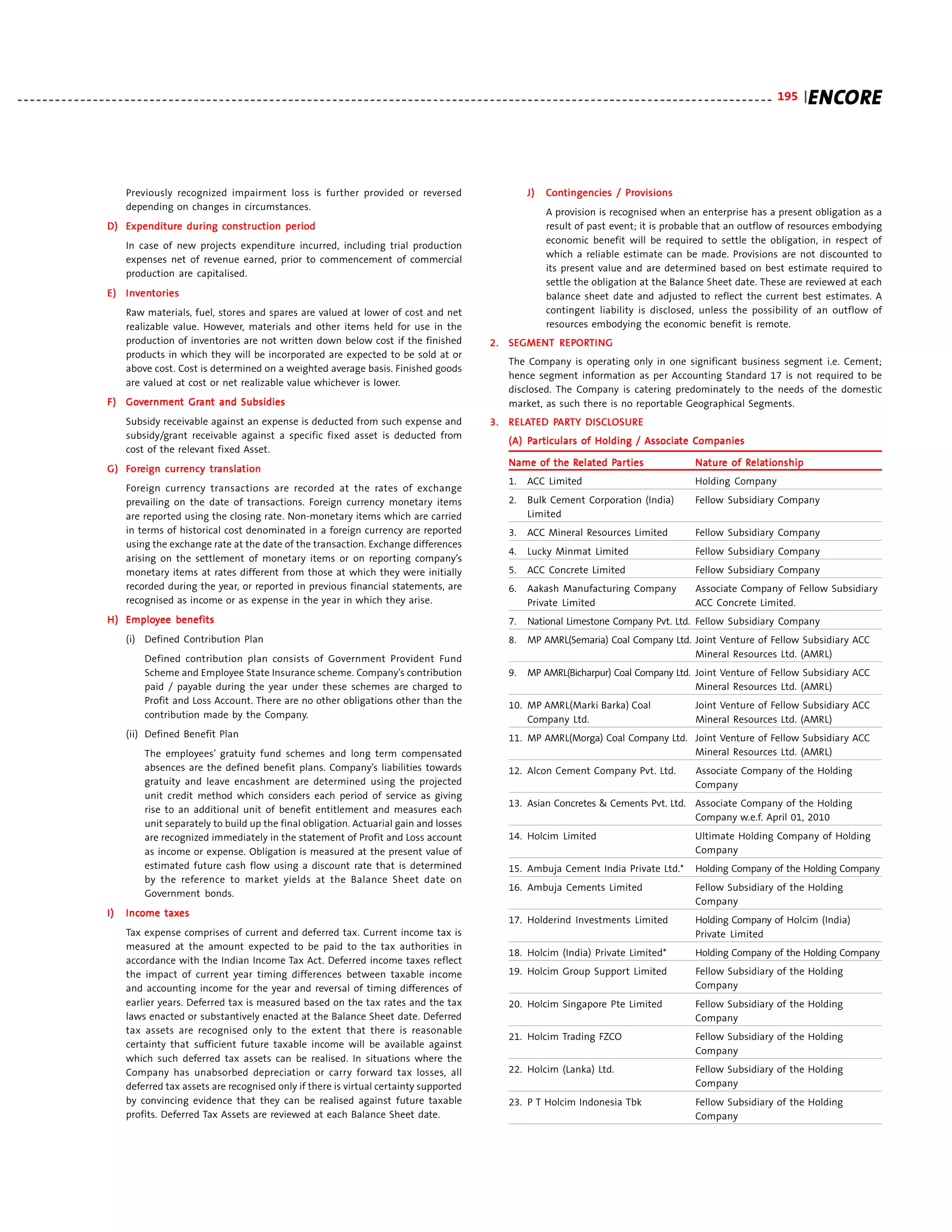

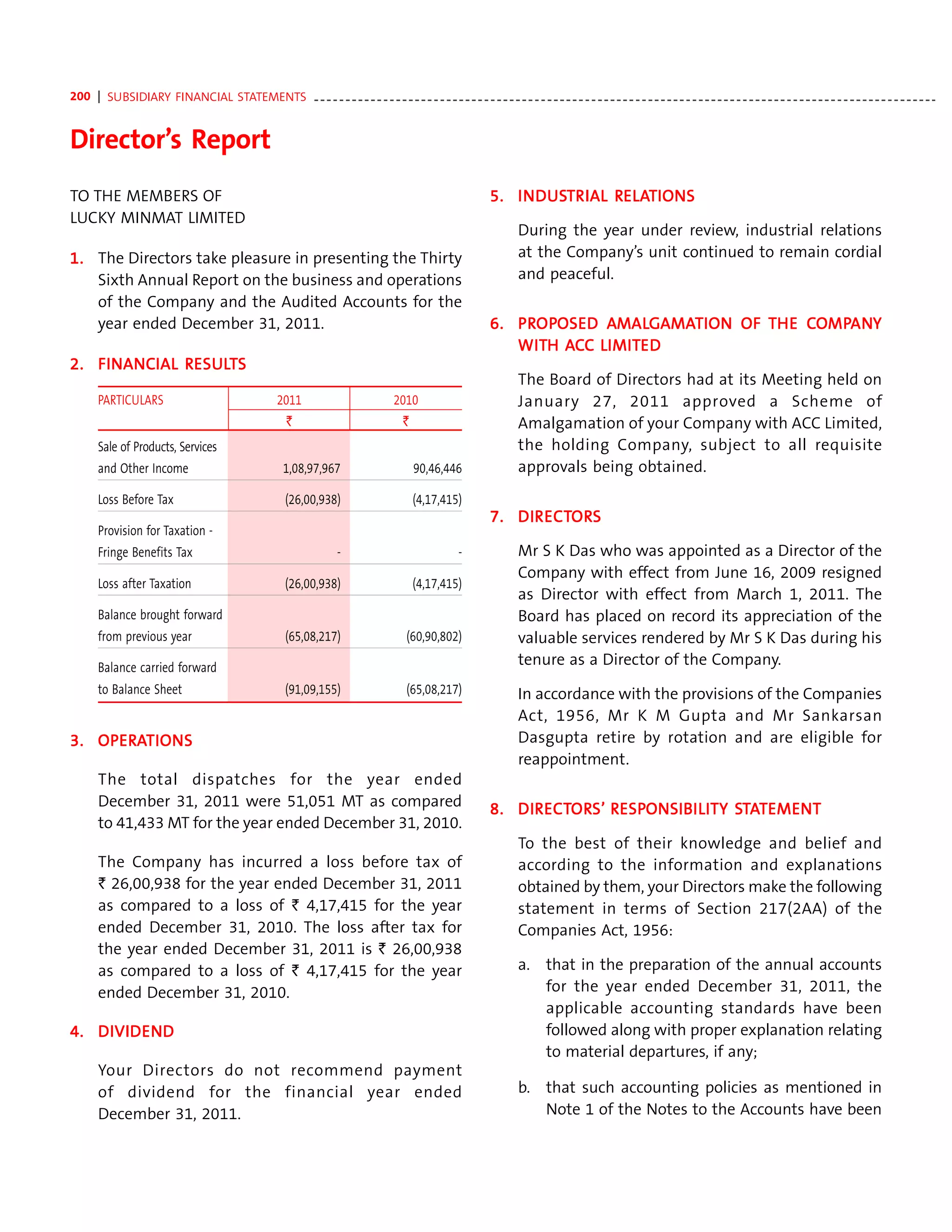

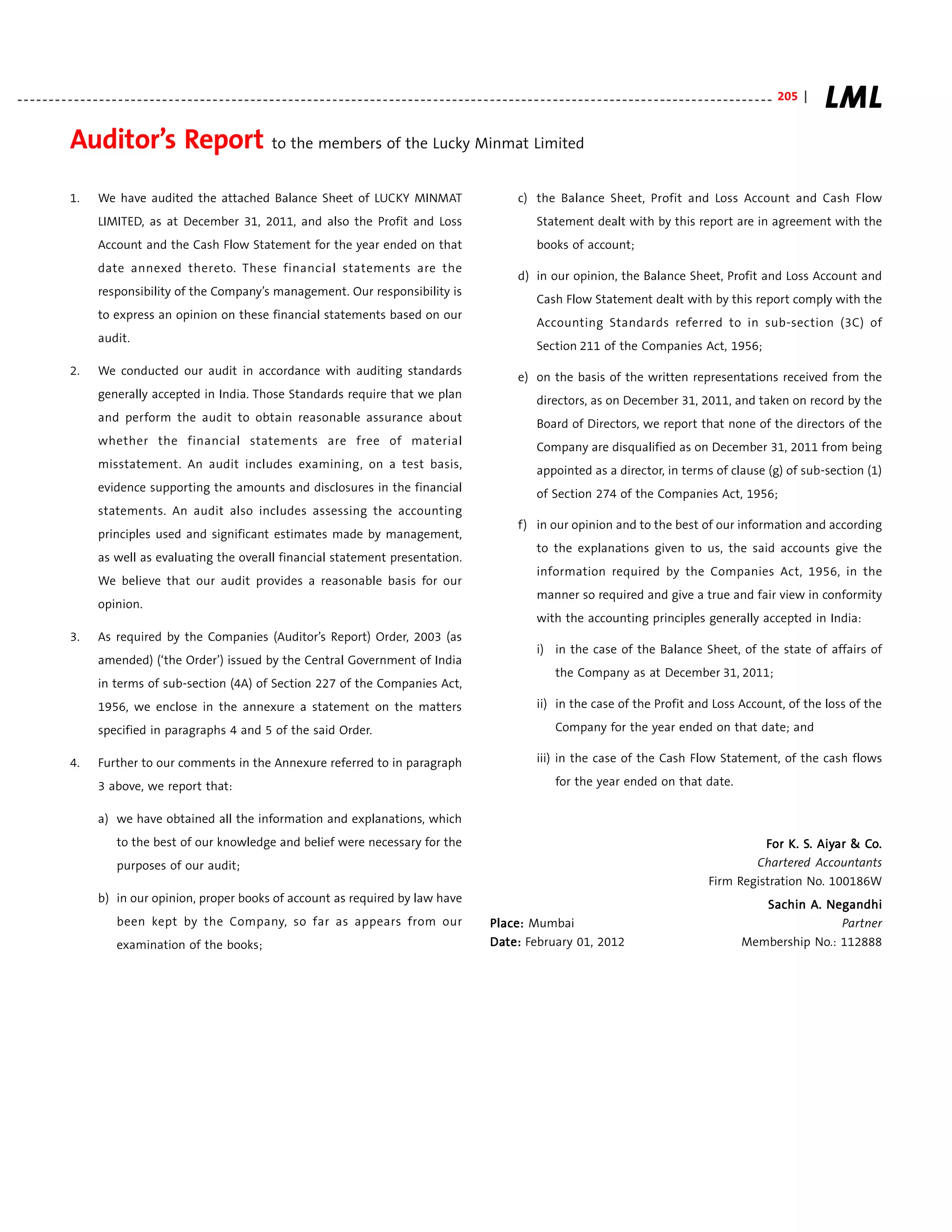

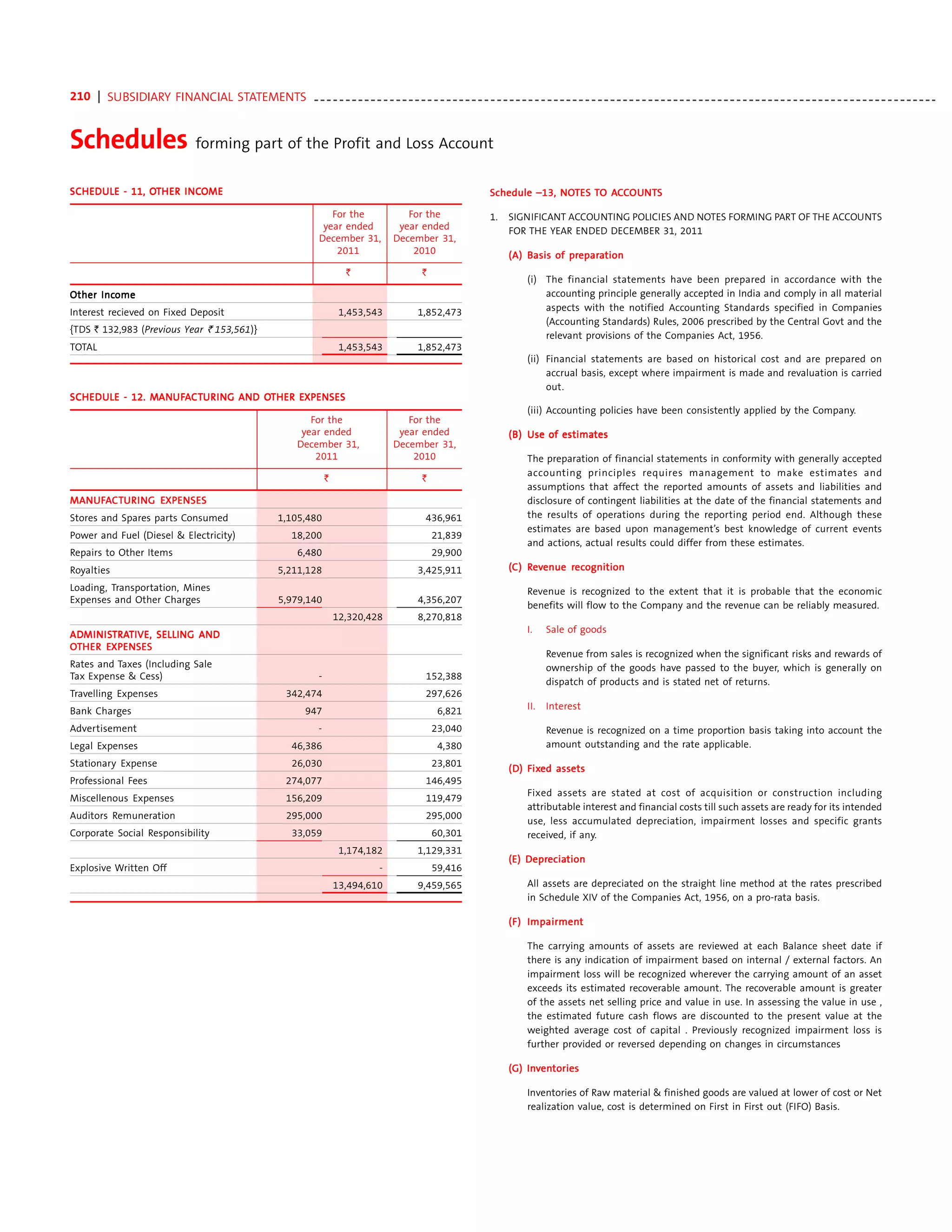

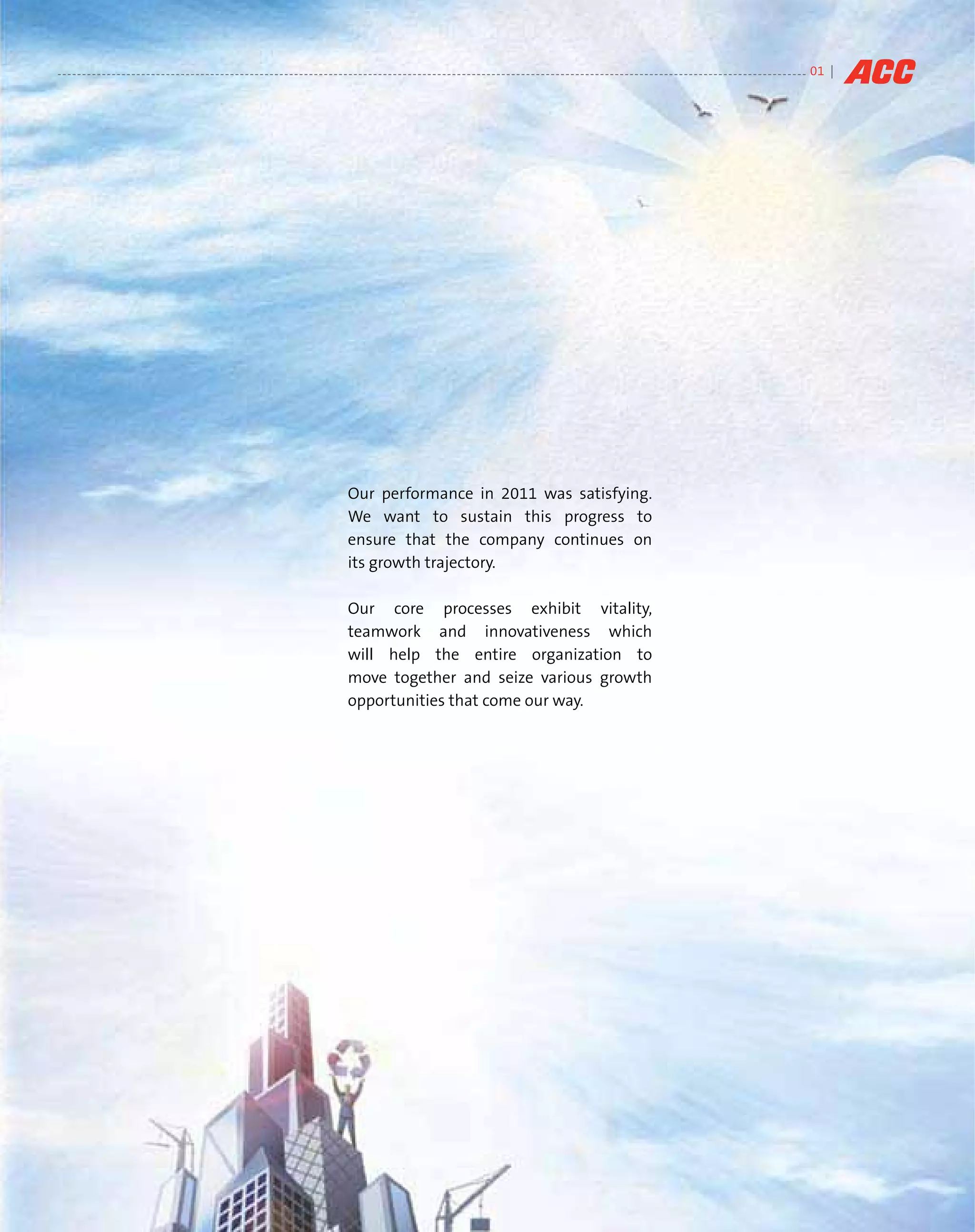

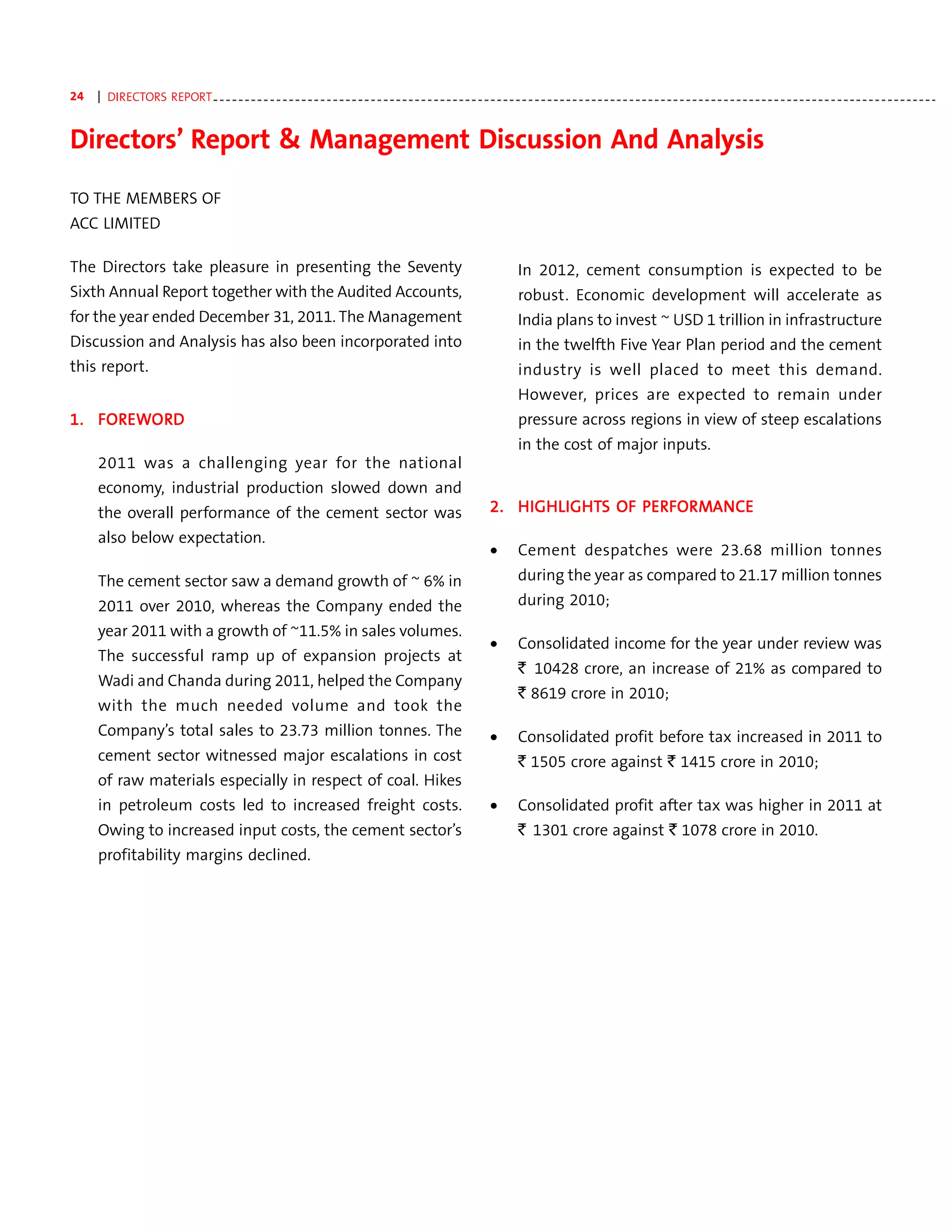

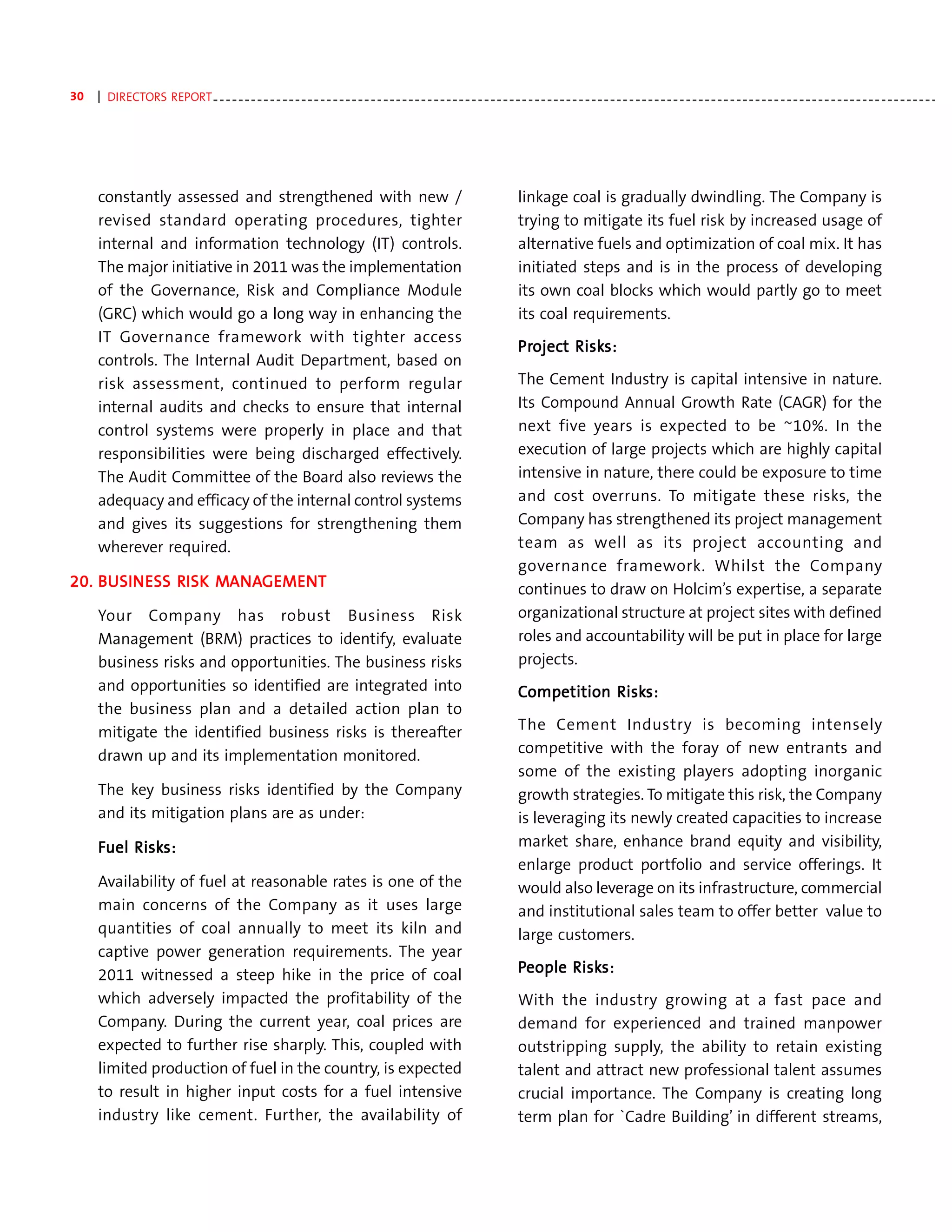

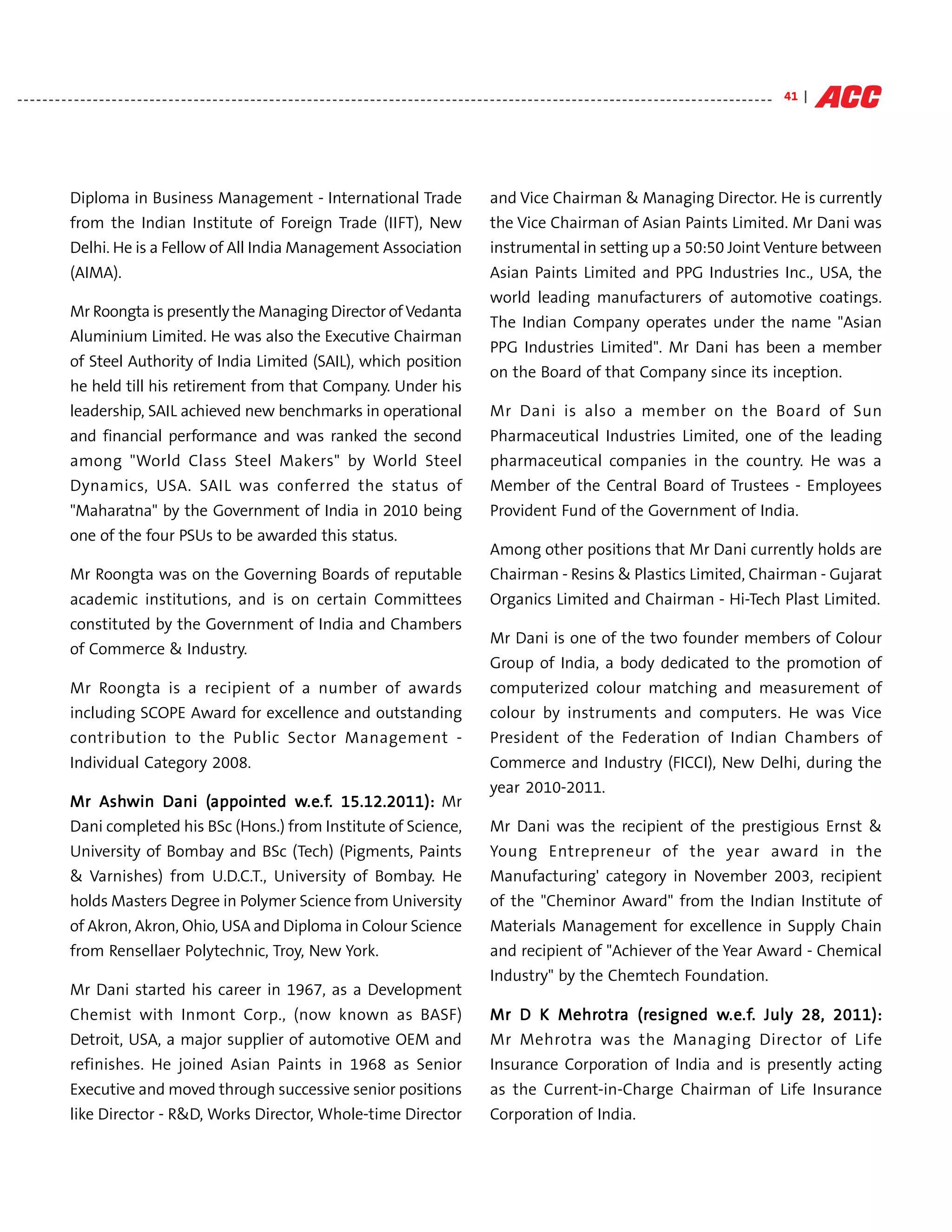

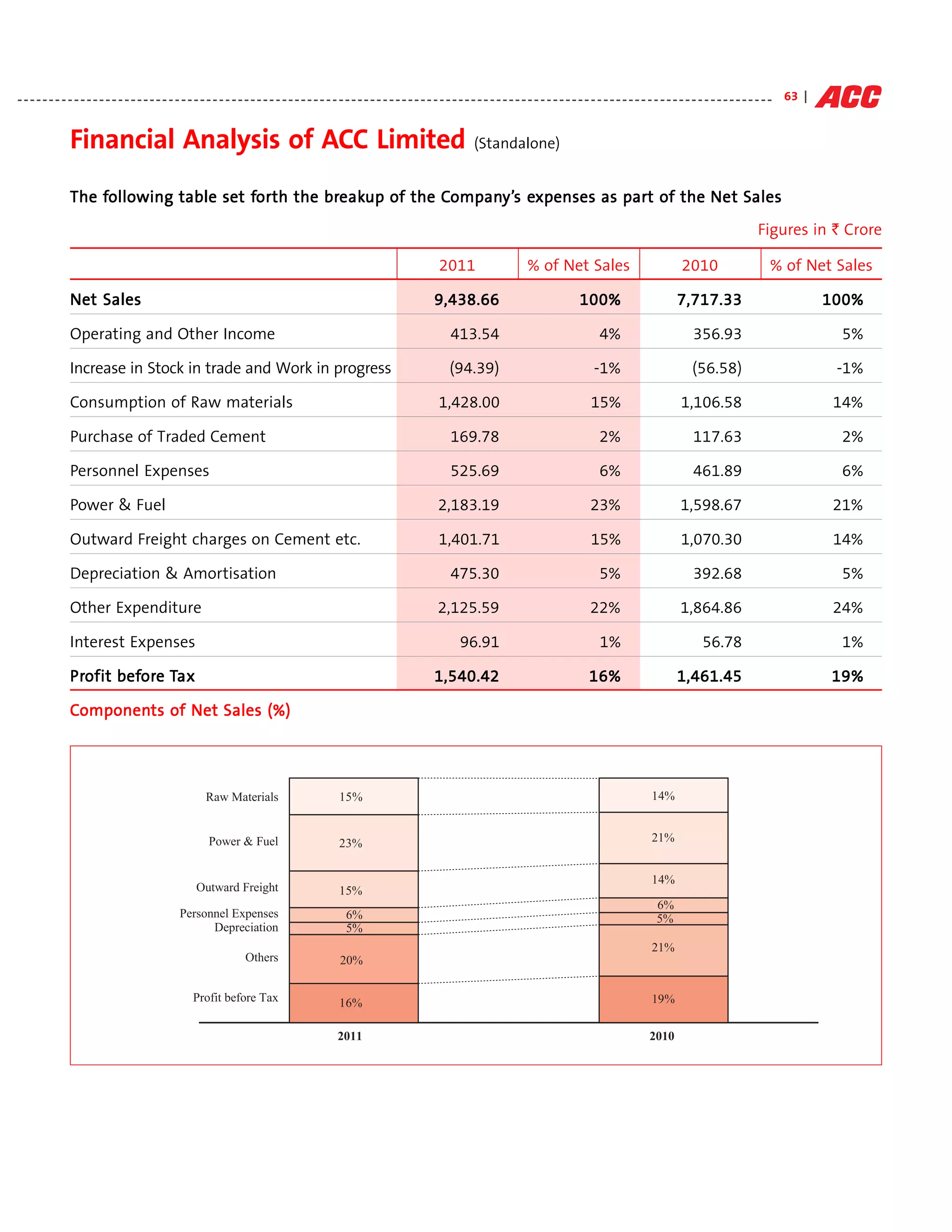

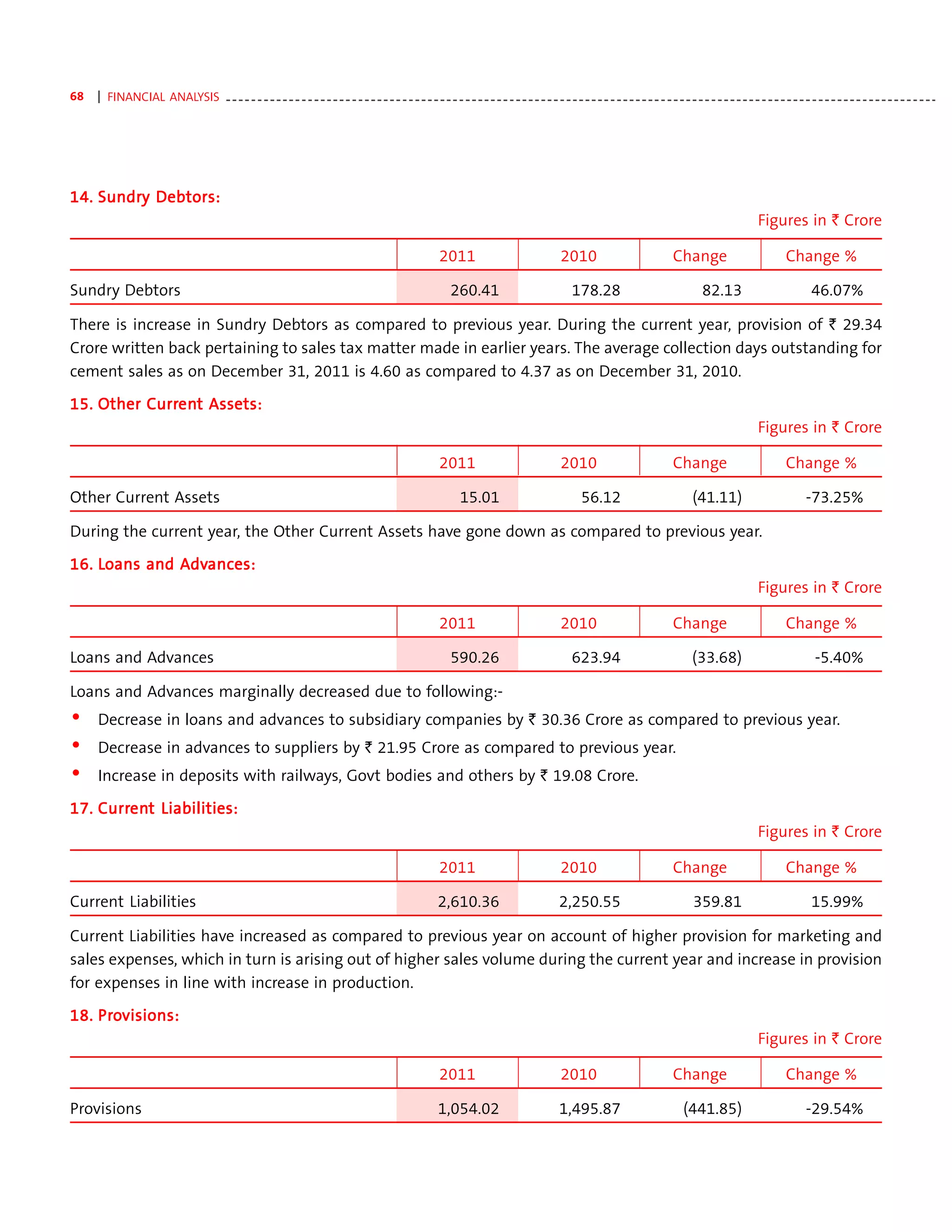

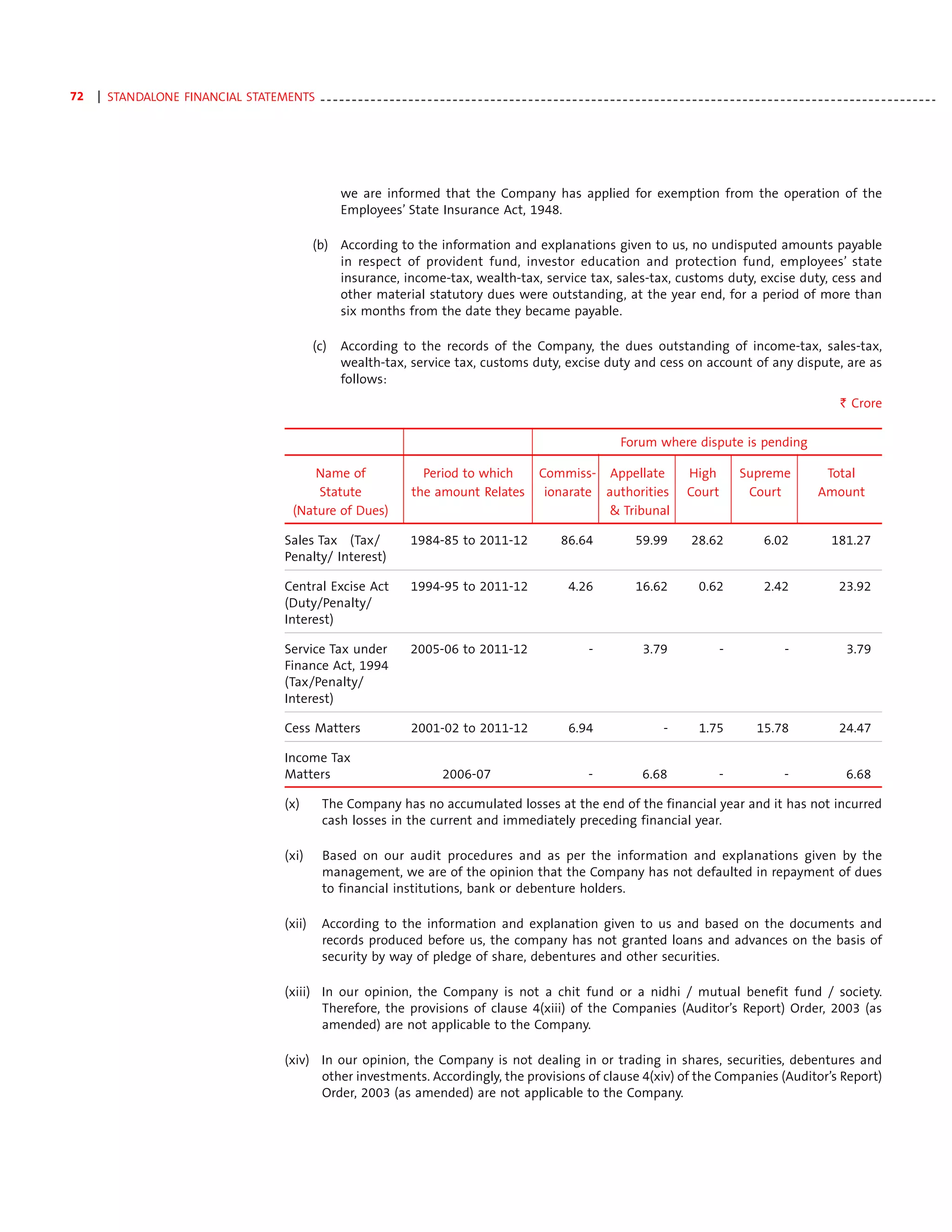

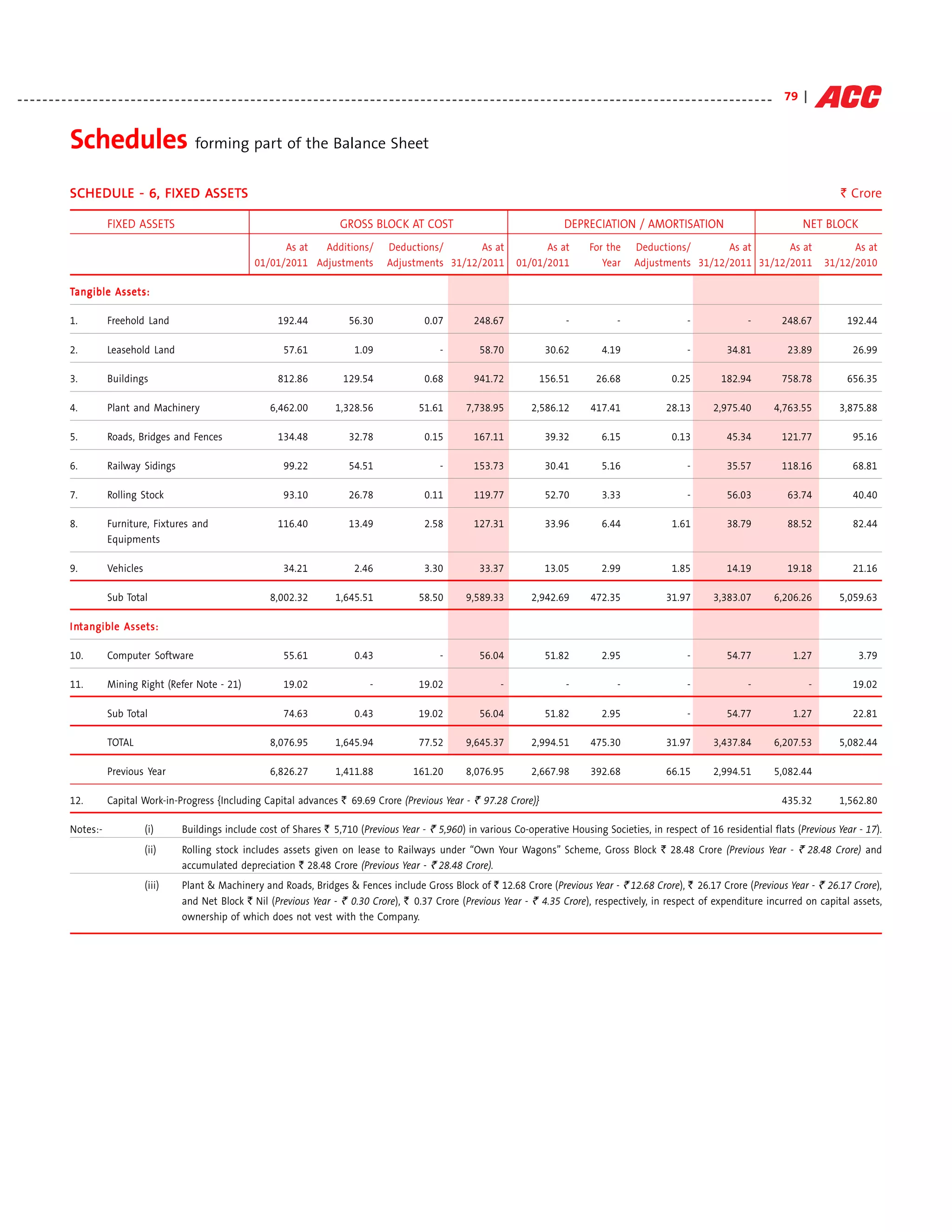

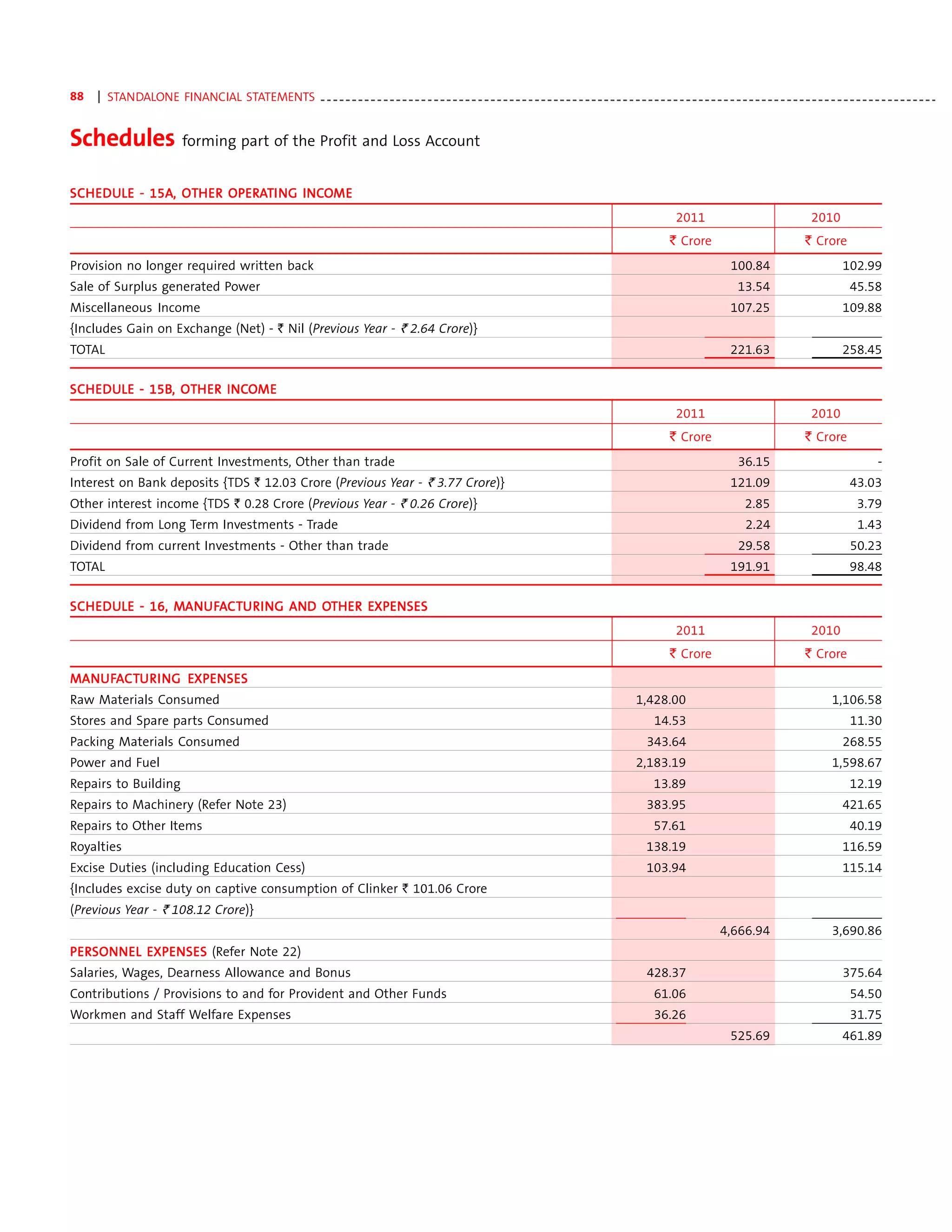

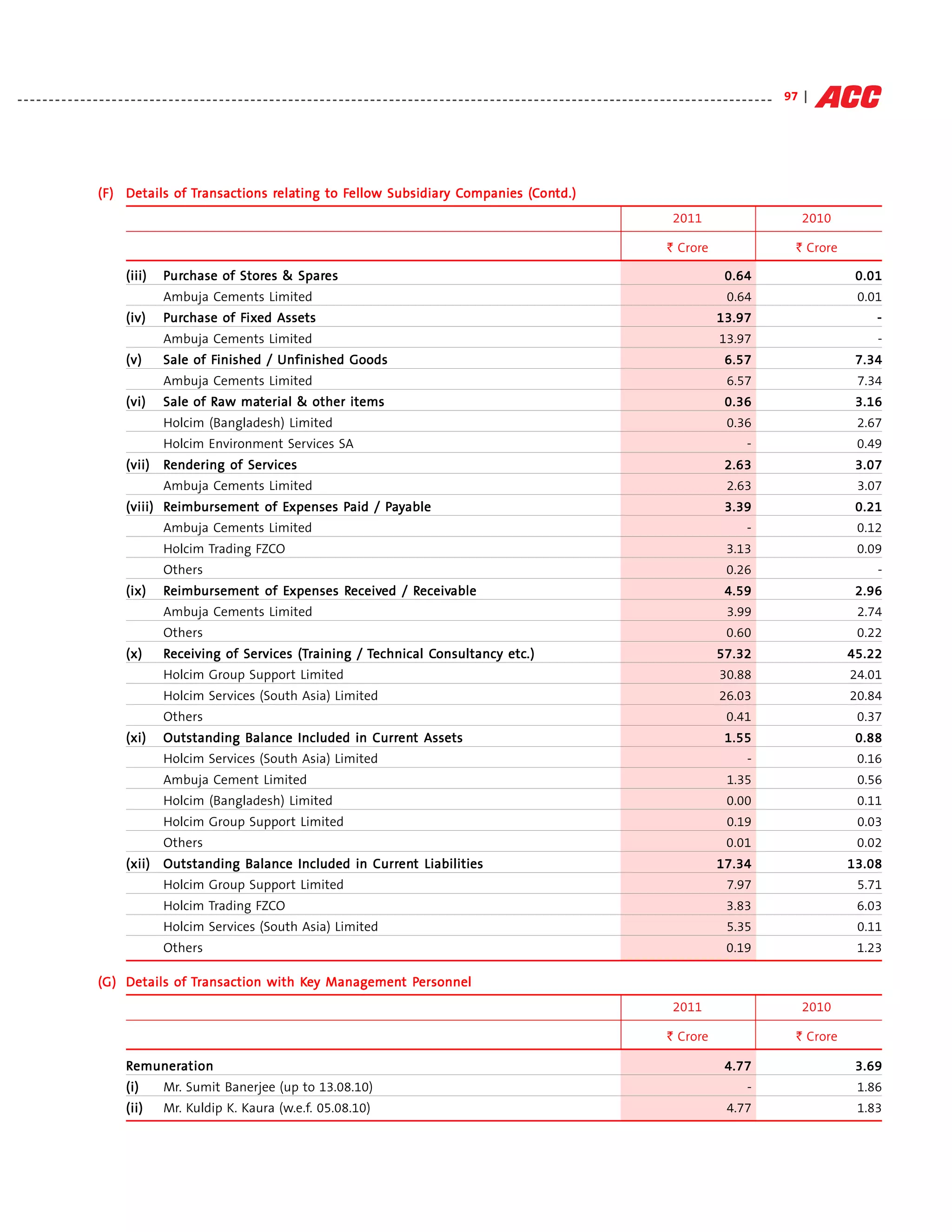

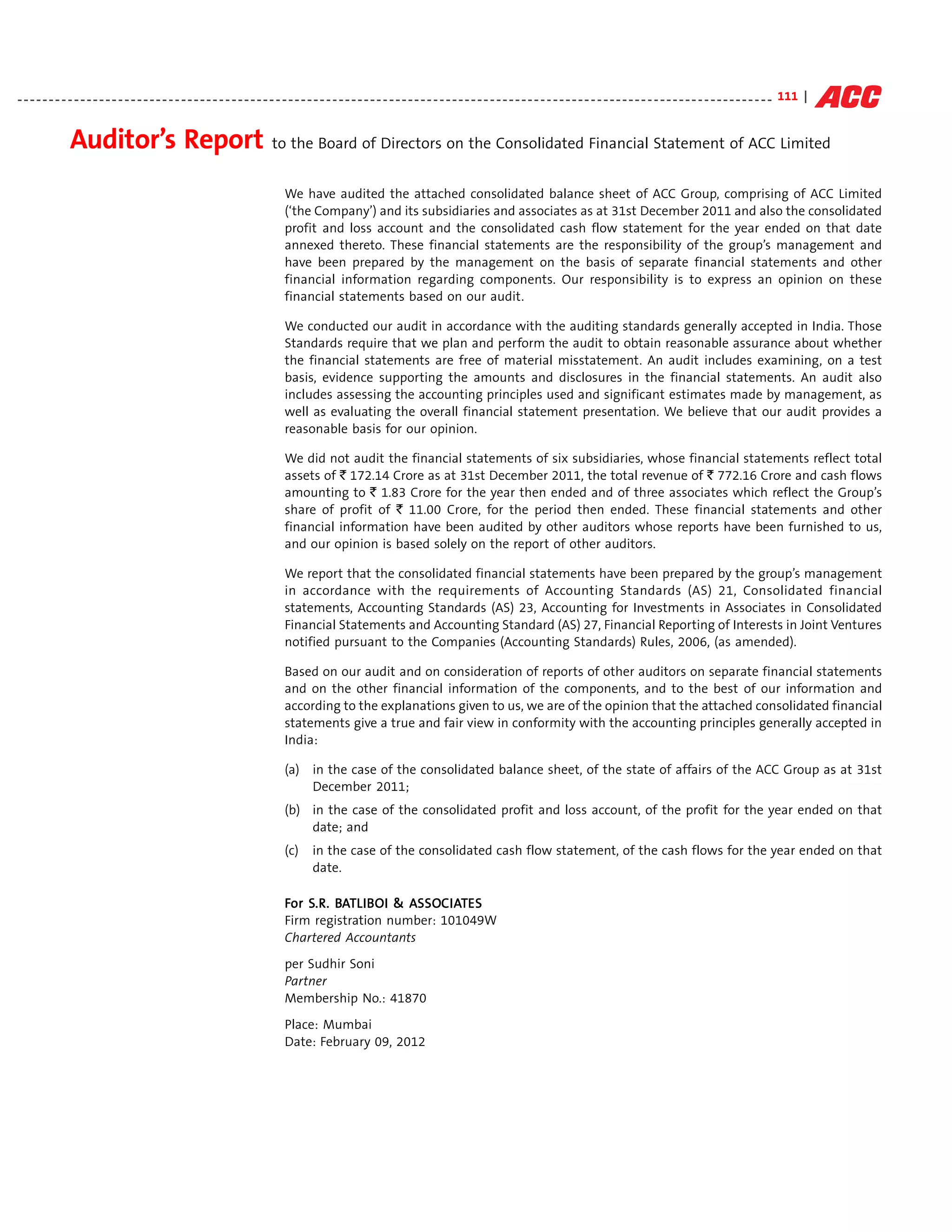

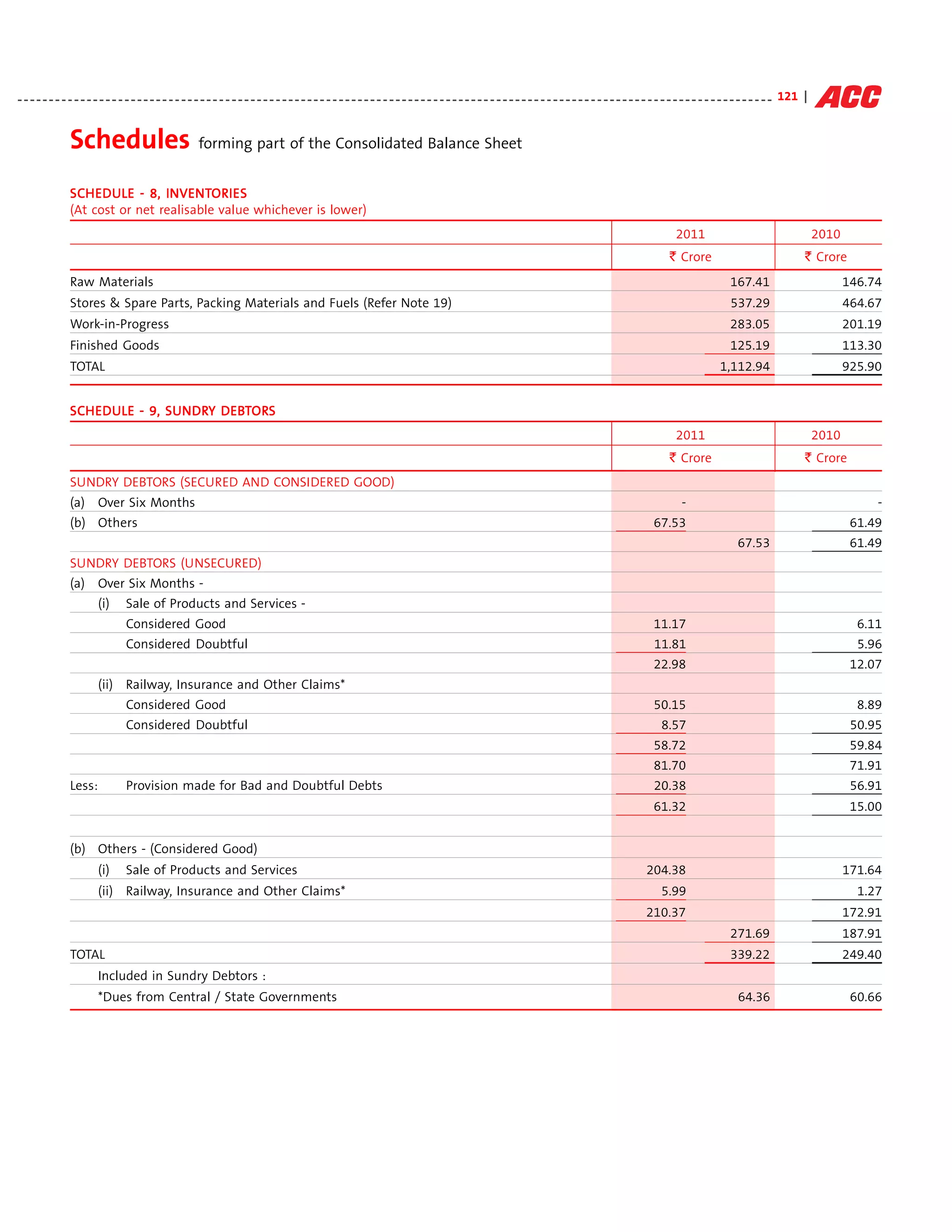

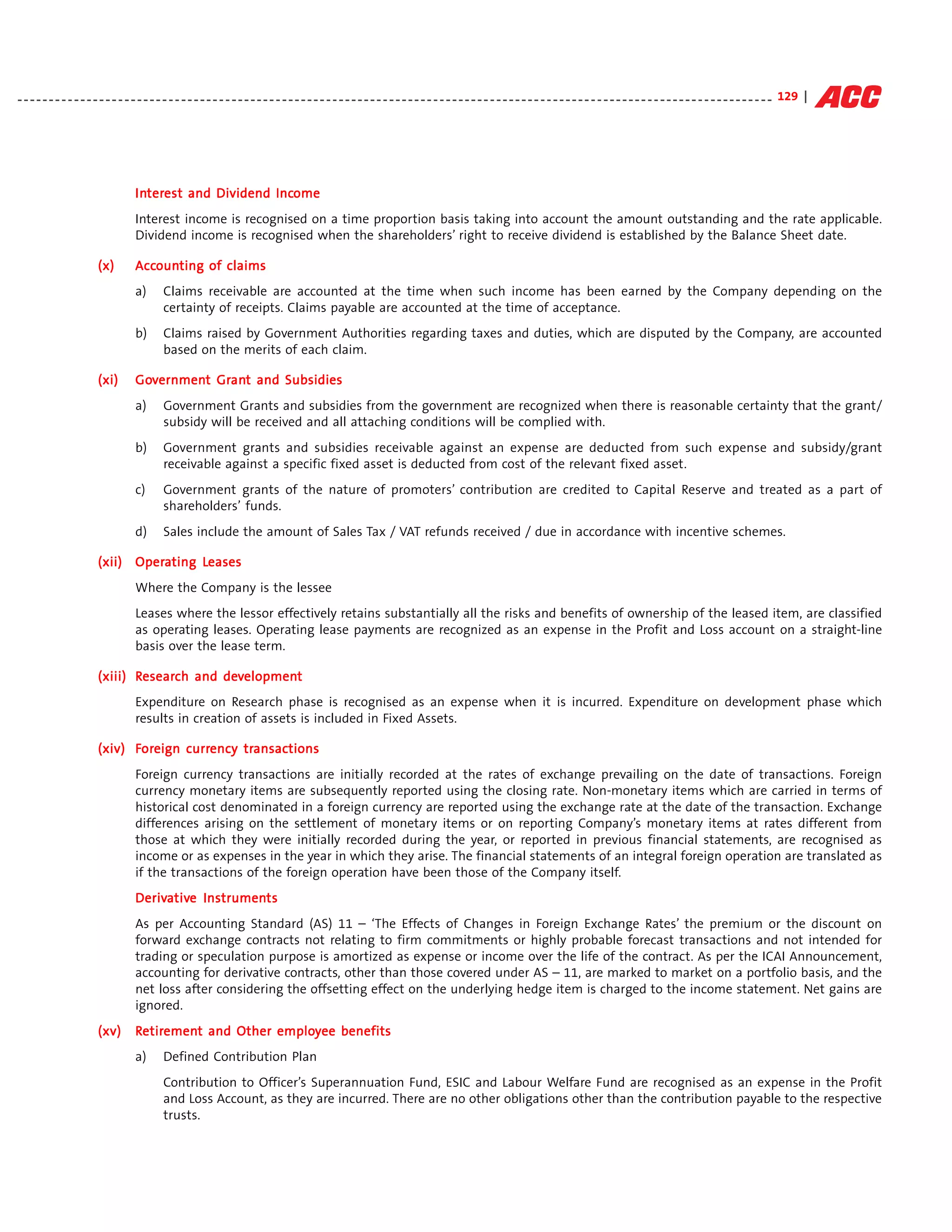

ECONOMIC VALU E ADDED [EVA] STATEMENT

ECONO

ONOMIC ALU [EV ST

` Crore

2011 2010 2009 2008 2007

Capital Employed 8,221 7,355 6,932 5,746 4,791

Avg. Capital Employed 7,788 7,144 6,339 5,268 4,512

EVA

Net Operating Profit after Taxes 1,325 1,120 1,607 1,213 1,439

Cost of Capital 950 821 694 643 538

EVA 375 299 913 570 901

Return on Capital Employed (%) 17.01 15.68 25.35 23.02 31.88

Weighted Average Cost of Capital (%) 12.20 11.49 10.95 12.20 11.92

EVA / Average Capital Employed (%)

Average Capital Employ 4.81 4.19 14.40 10.82 19.96

Enterprise Value

Enterprise

Market Capitalisation (As at December, 31) 21,345 20,194 16,362 9,012 19,228

Add: Debts 511 524 567 482 306

Less: Cash and Cash Equivalents 2,832 2,288 1,876 1,438 1,489

EV (Enterprise Value)

(Enterprise 19,024 18,430 15,053 8,056 18,045

EV / Yr. End Capital Employed (Times)

Capital Employ (Times) 2.31 2.51 2.17 1.40 3.77](https://image.slidesharecdn.com/accannualreport2011-121108234301-phpapp01/75/Acc-annual-report-2011-21-2048.jpg)

![98 | STANDALONE FINANCIAL STATEMENTS - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

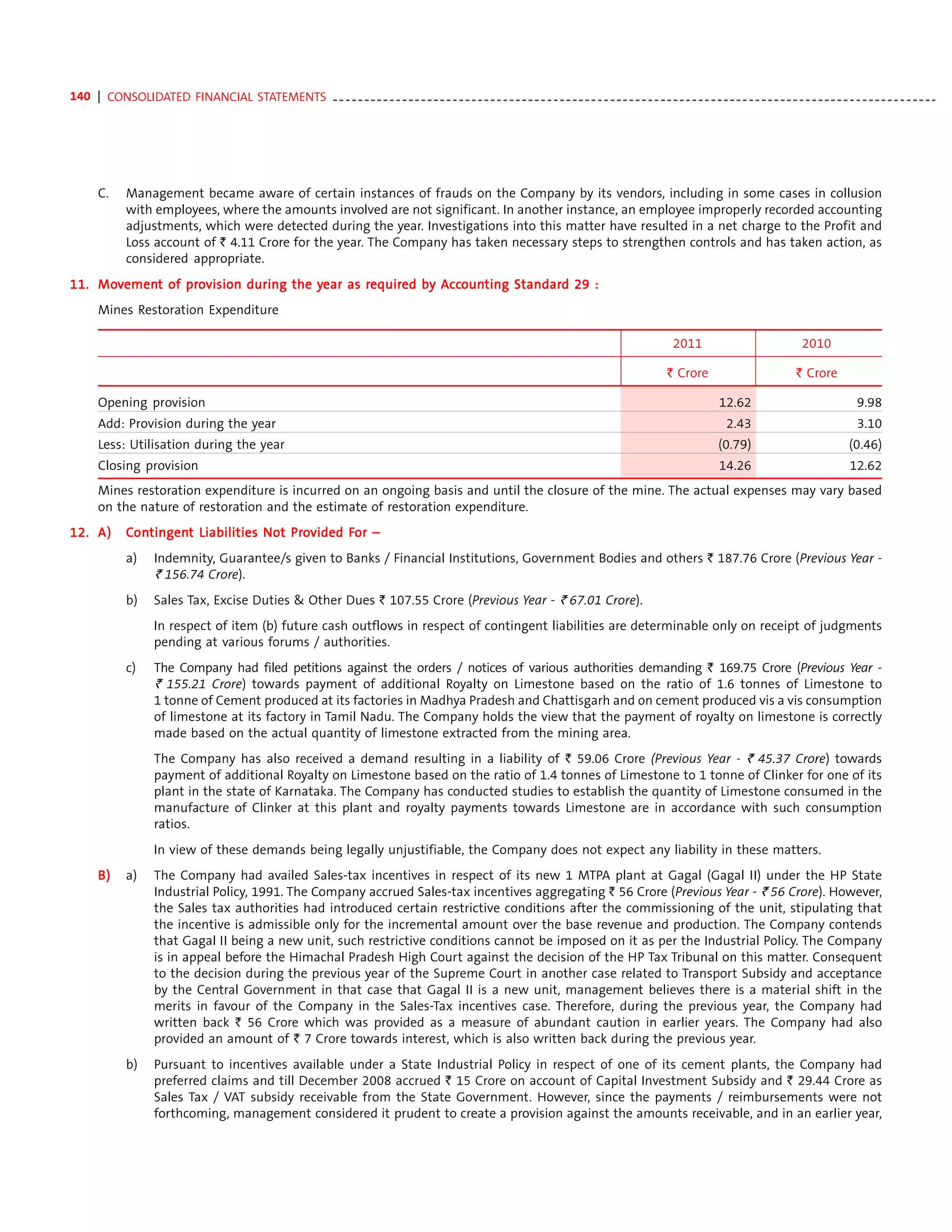

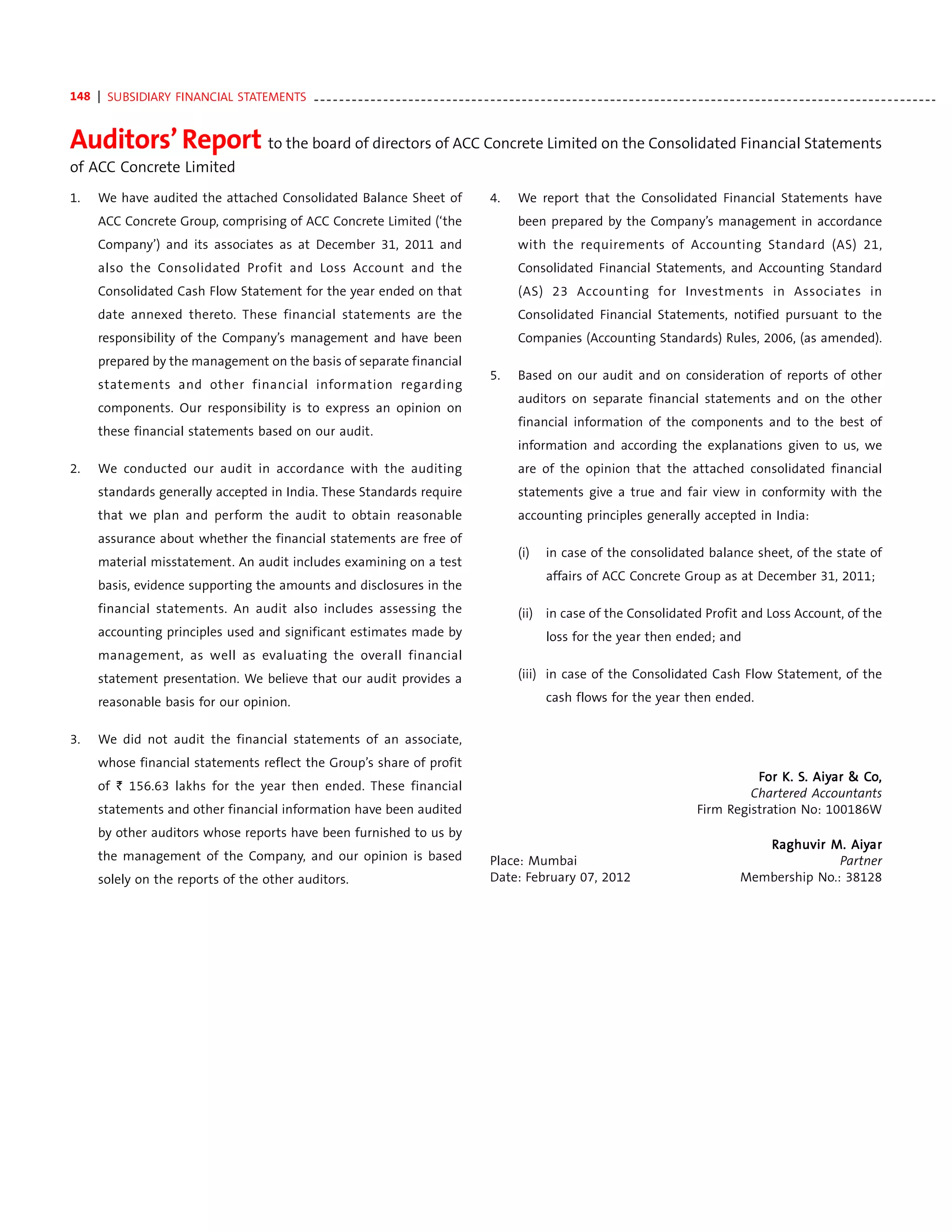

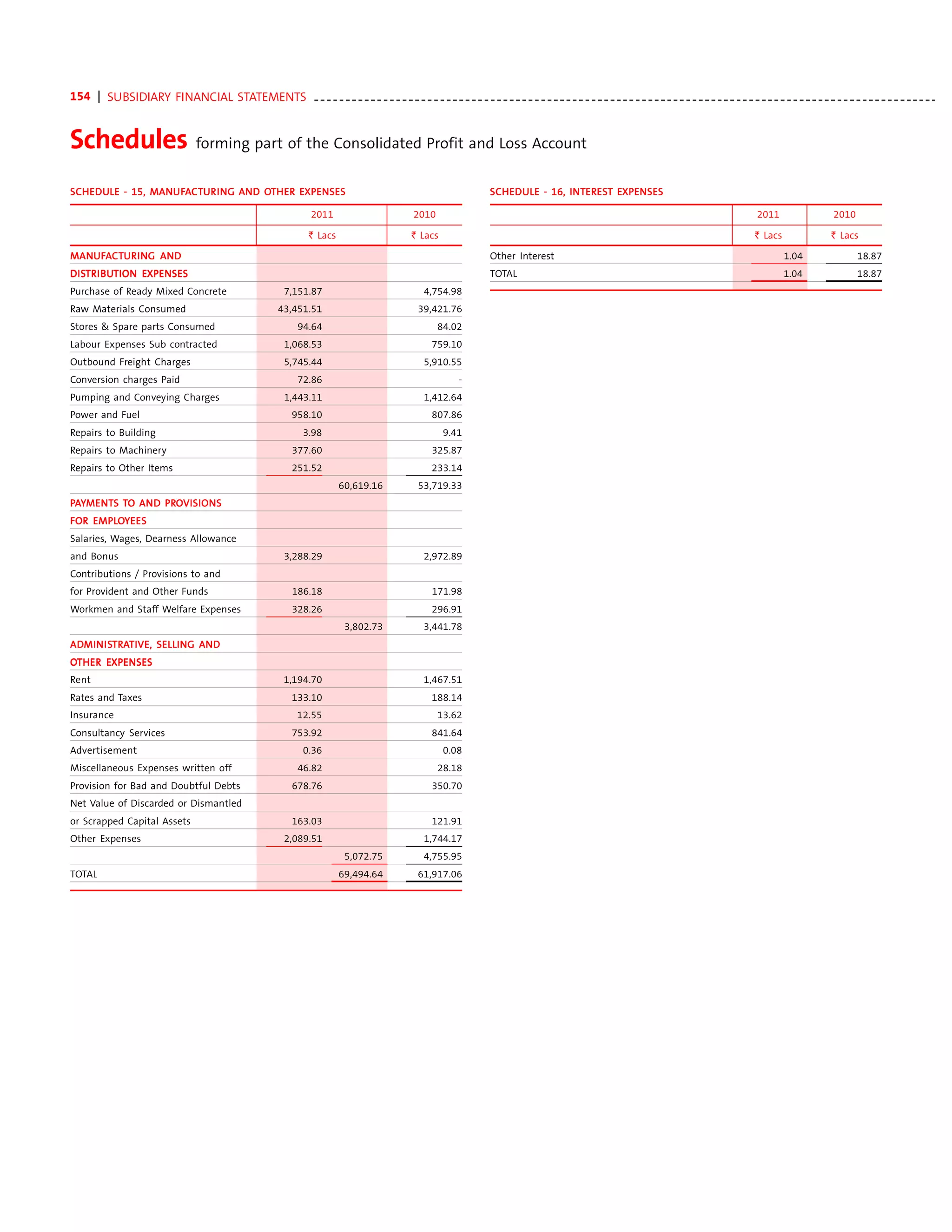

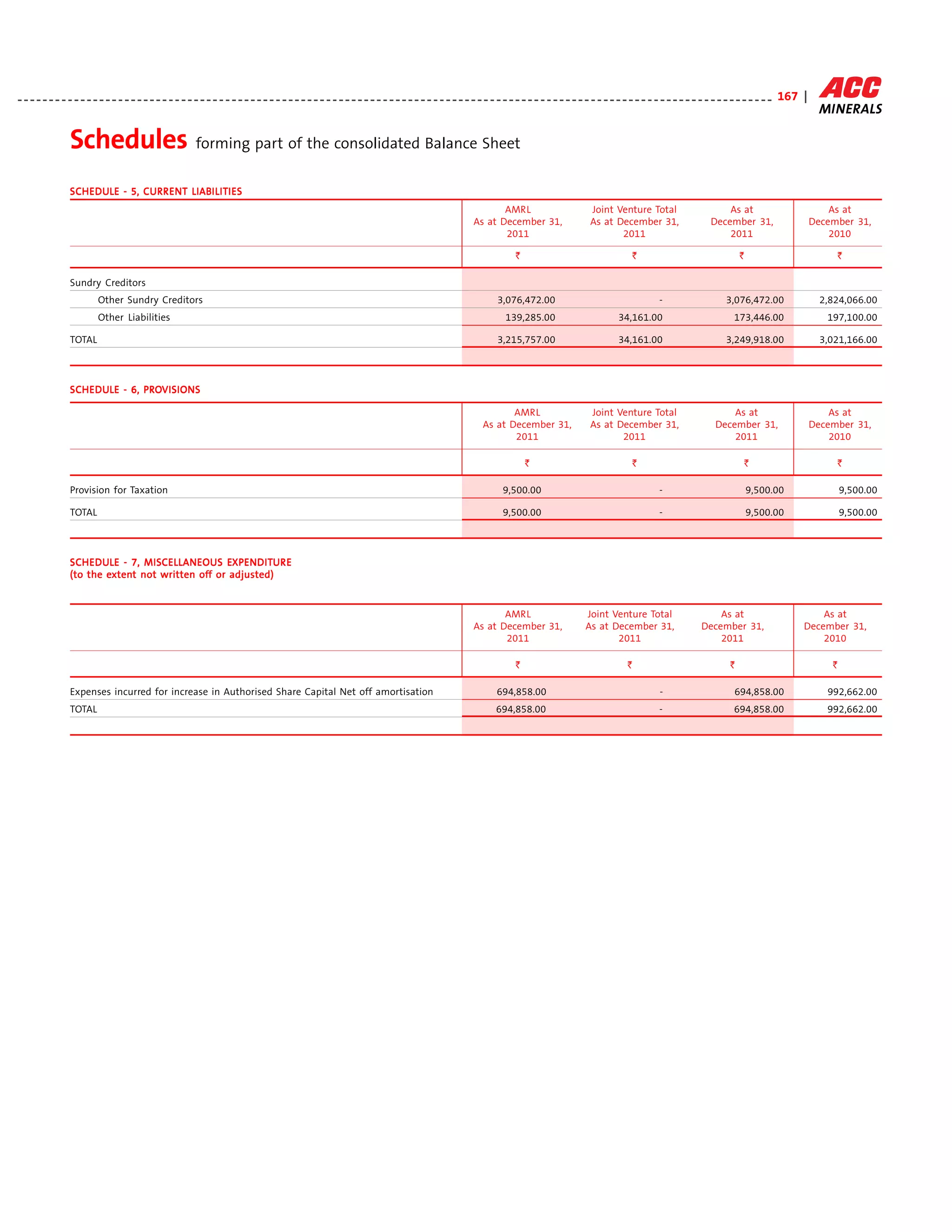

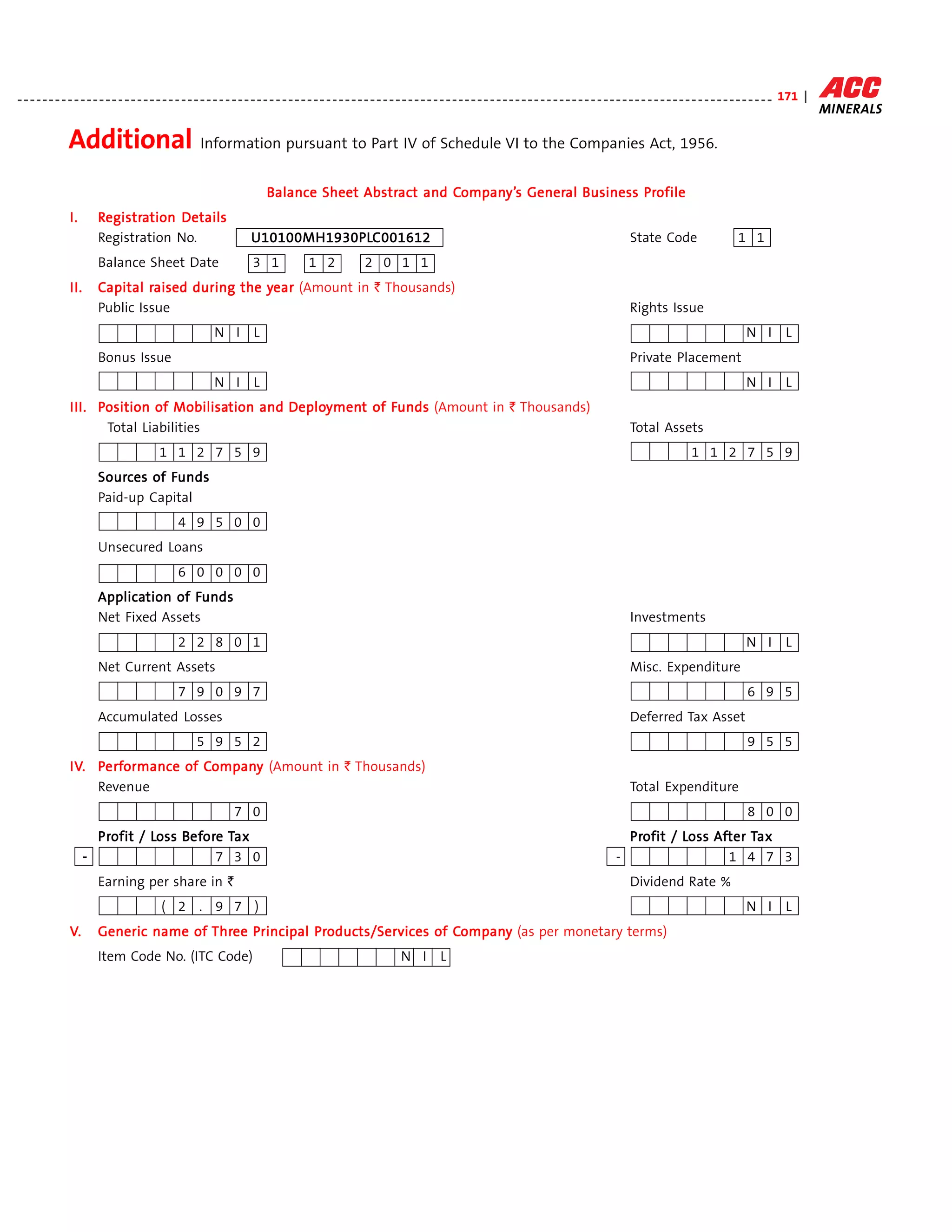

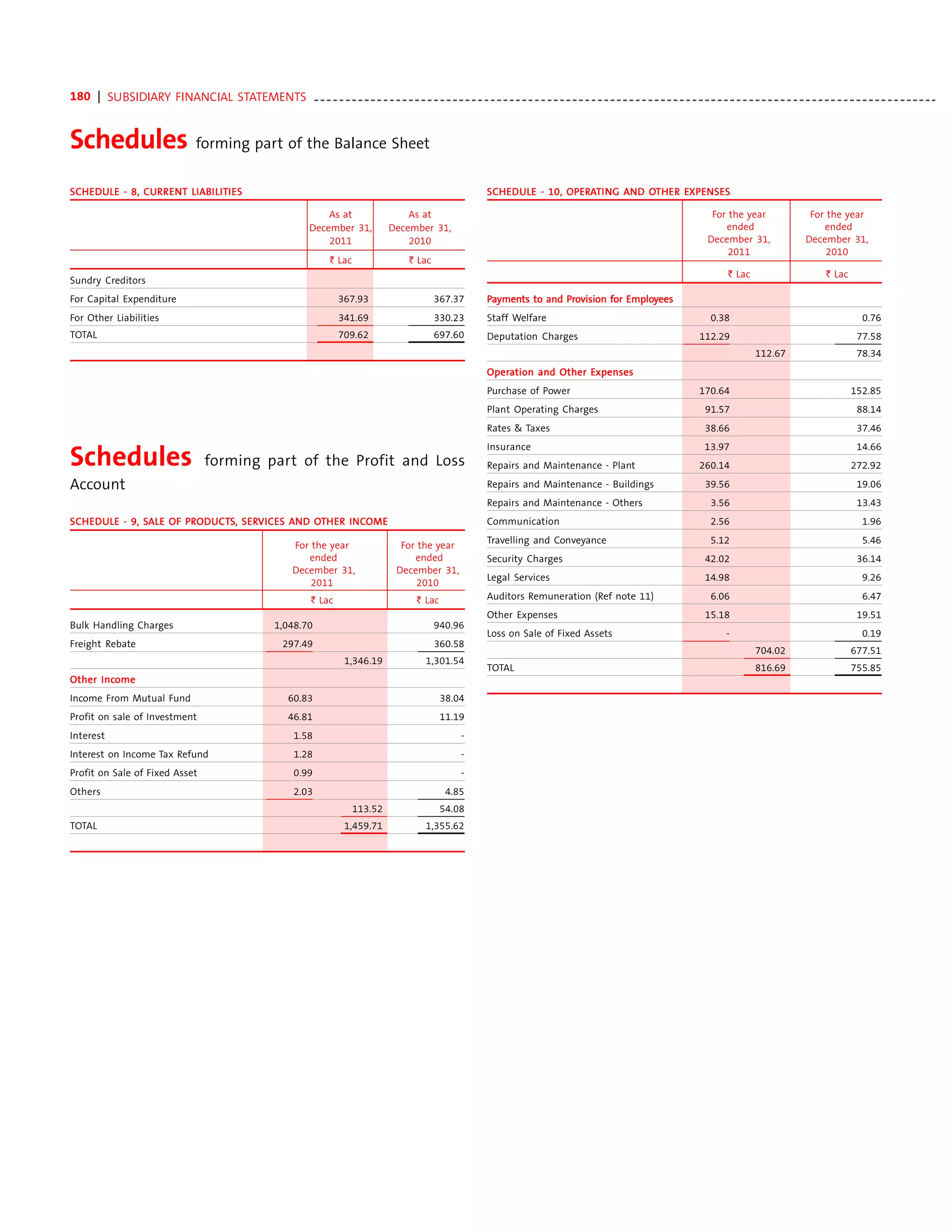

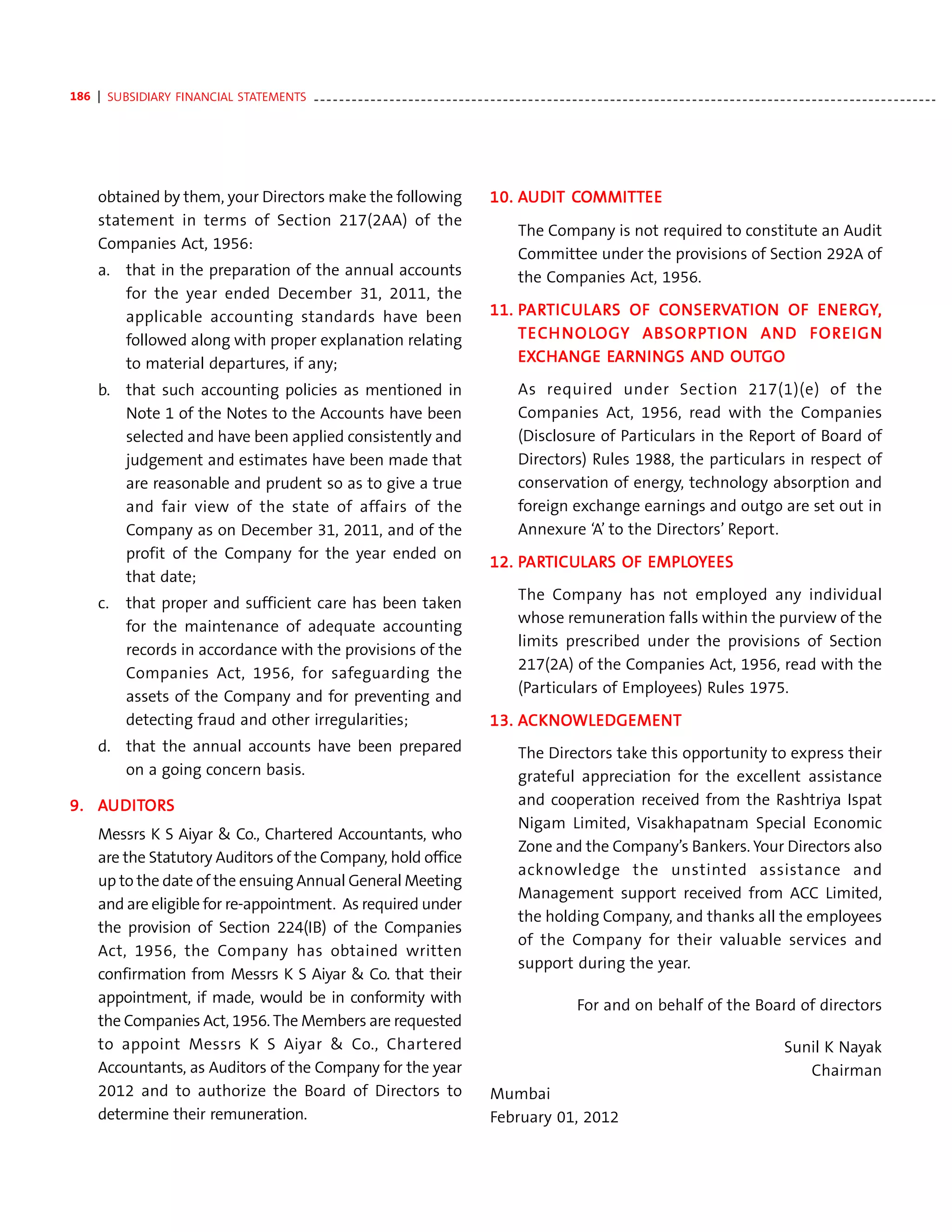

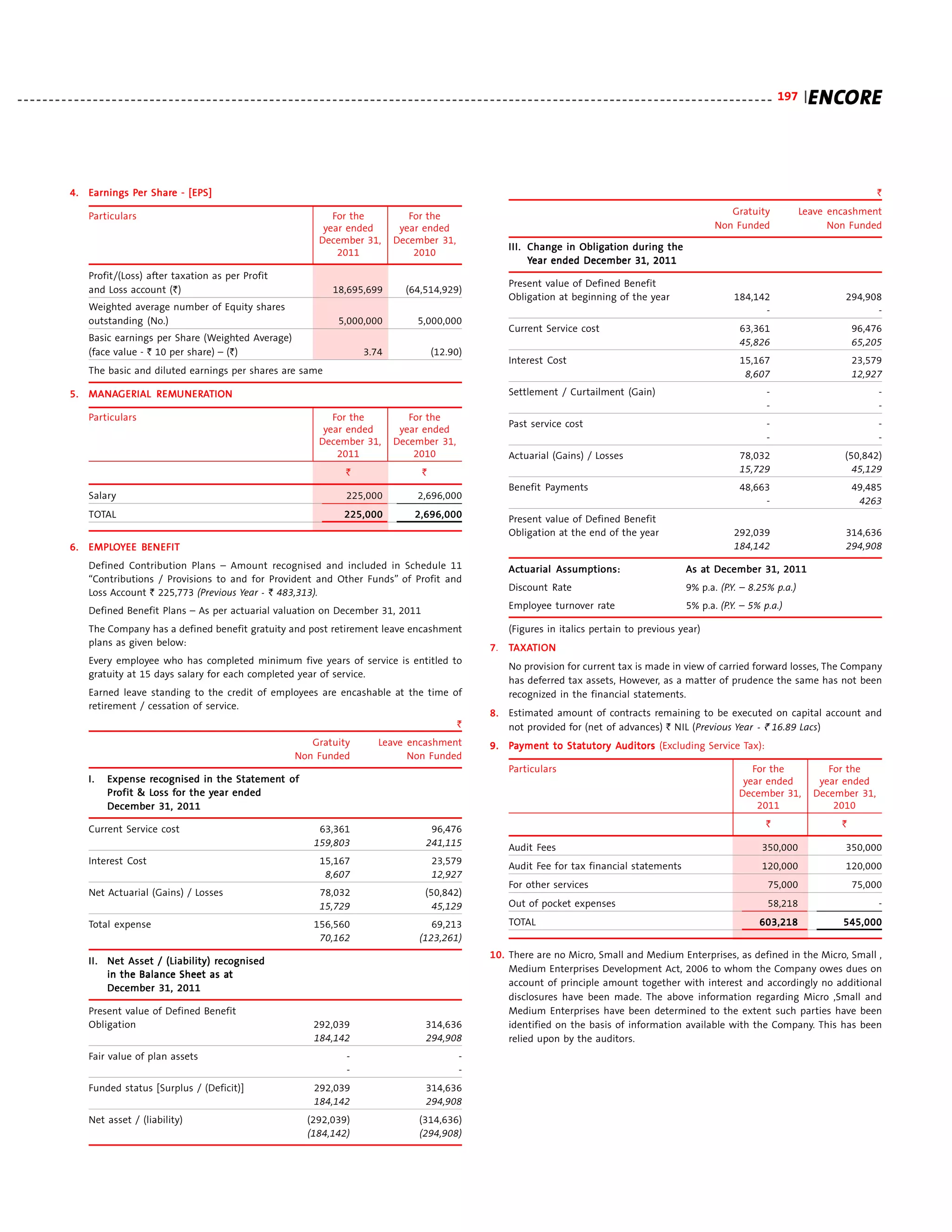

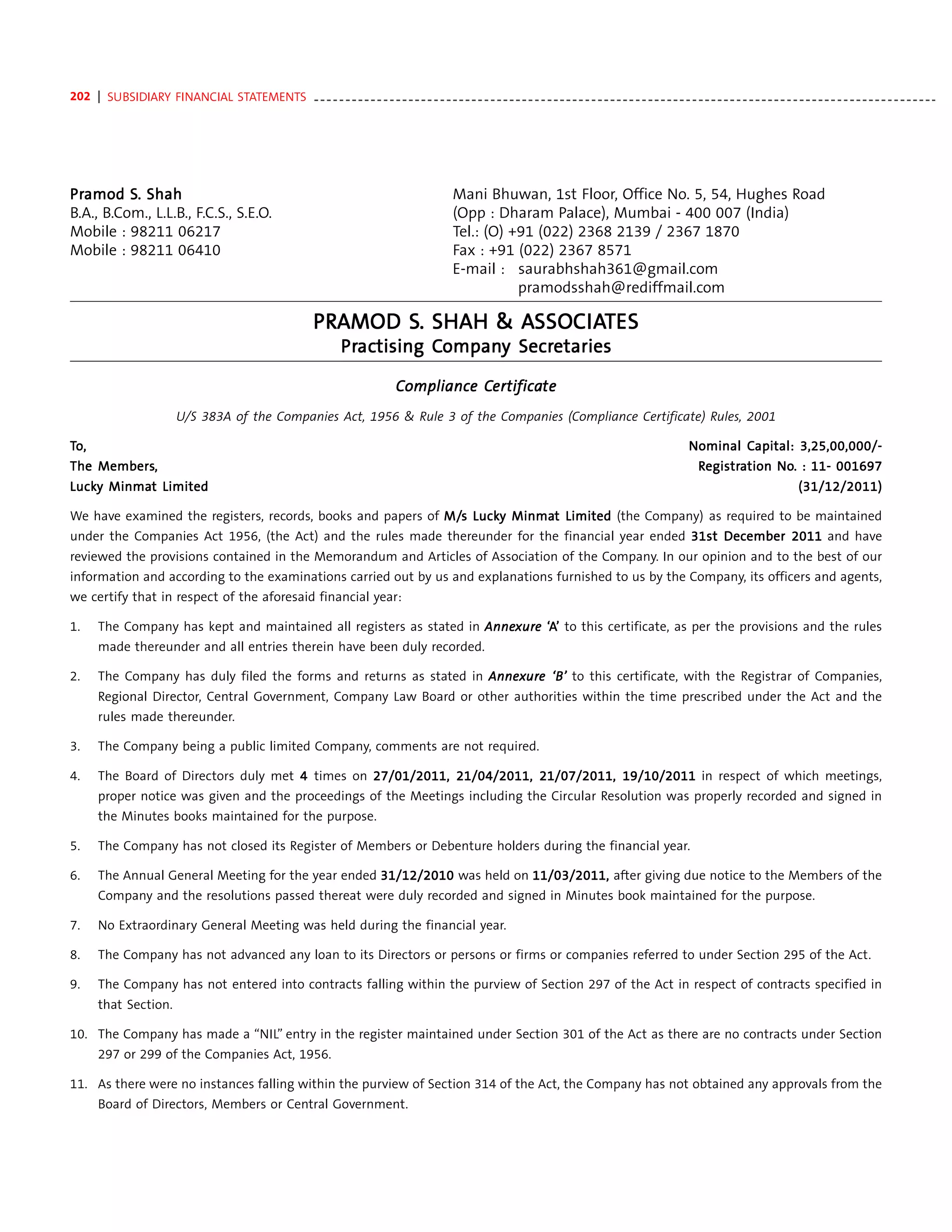

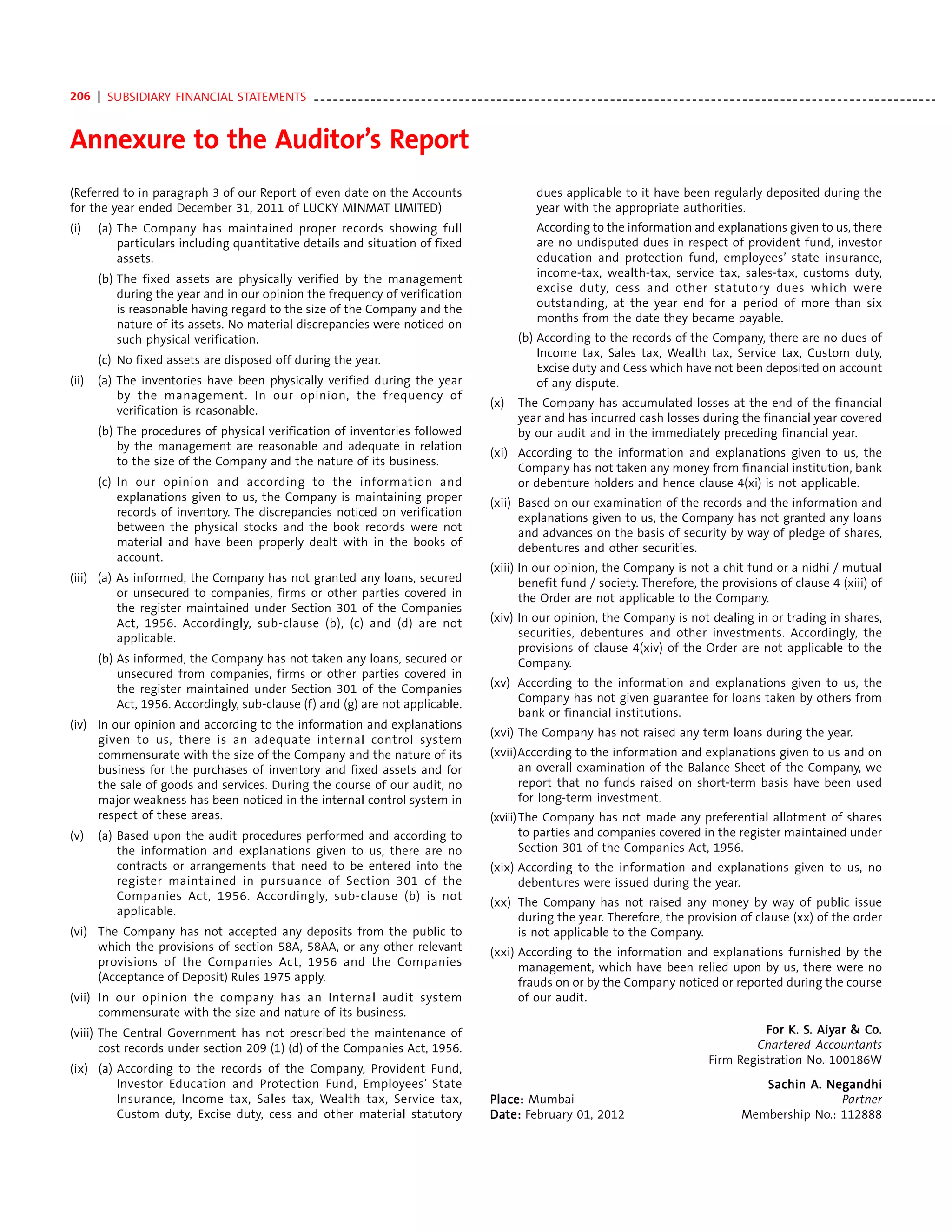

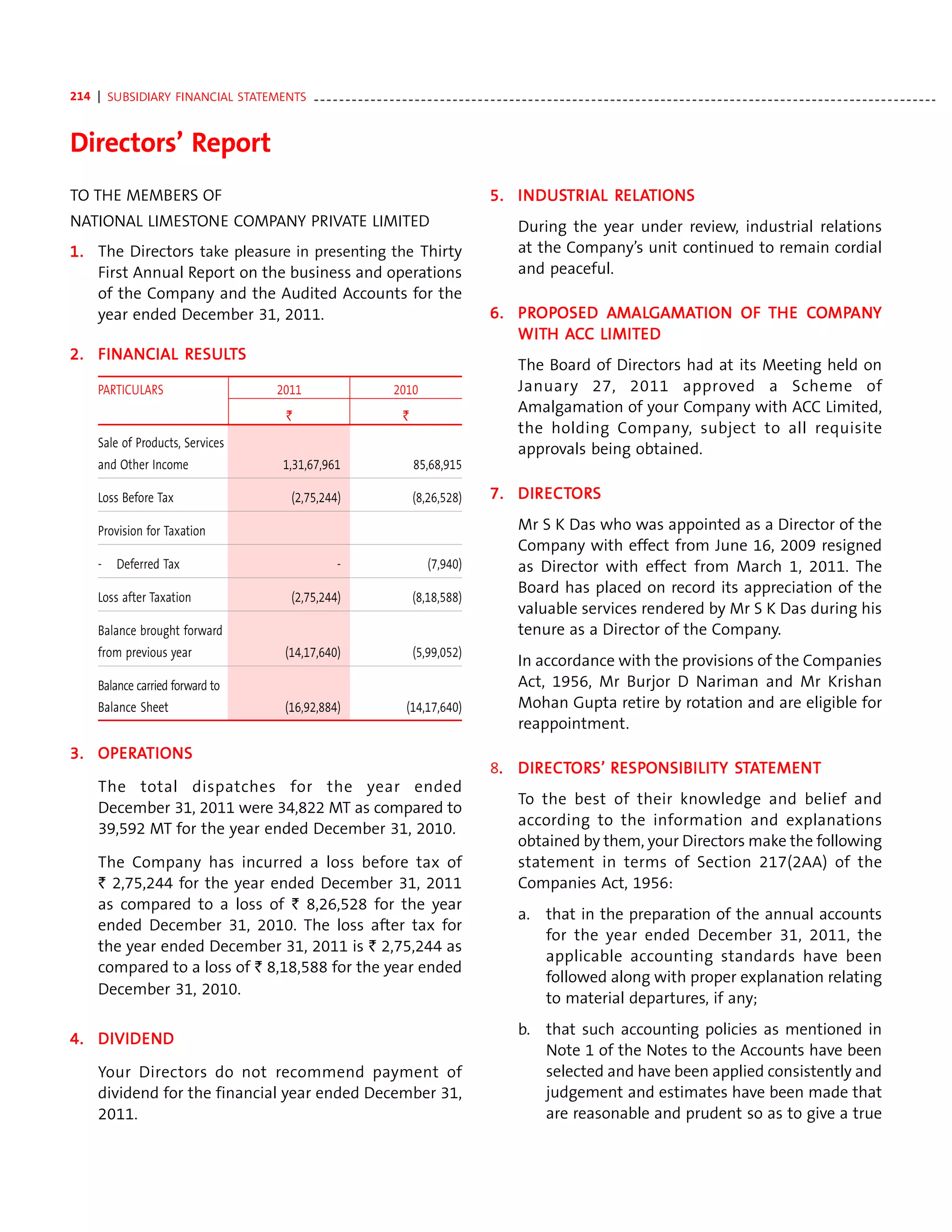

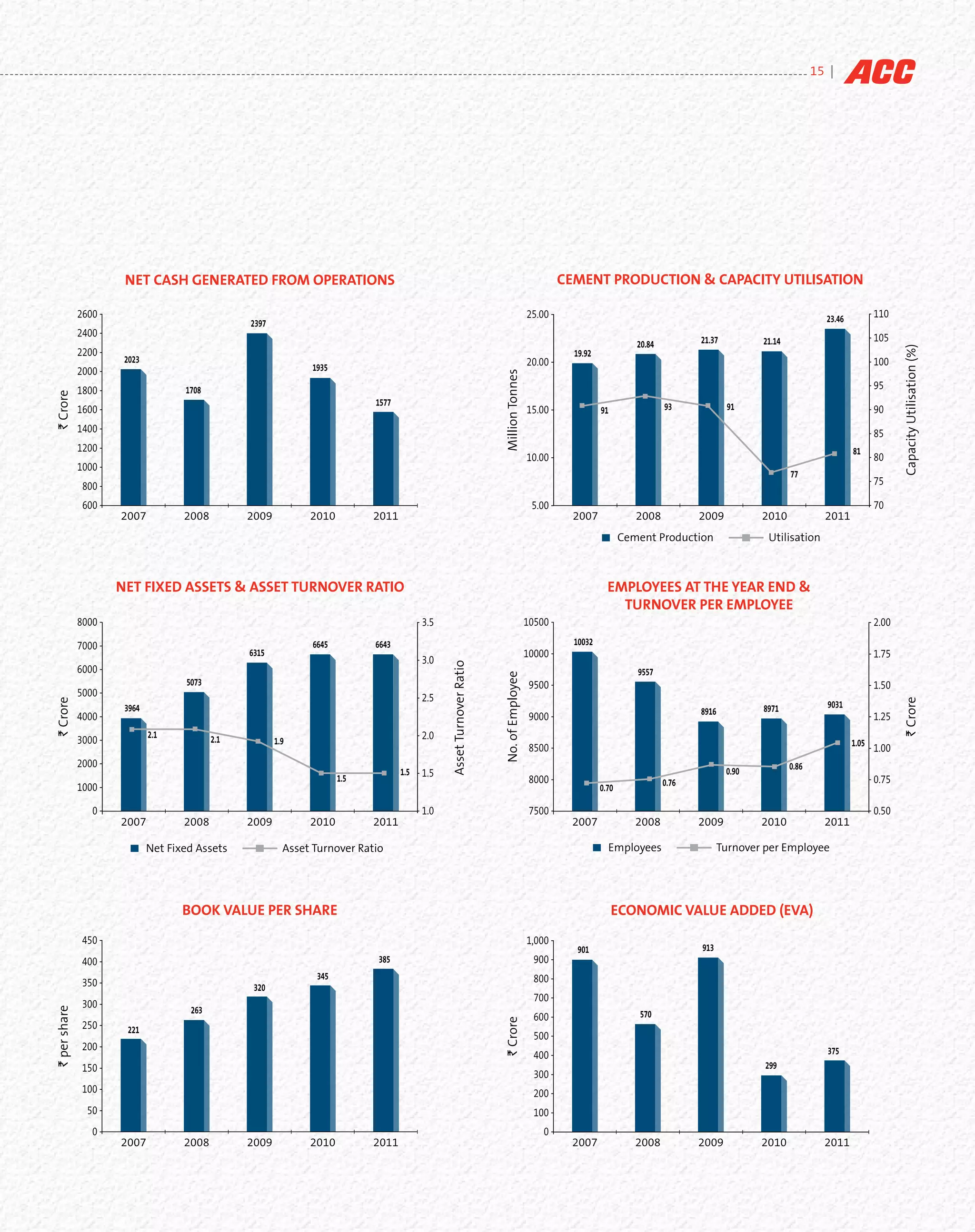

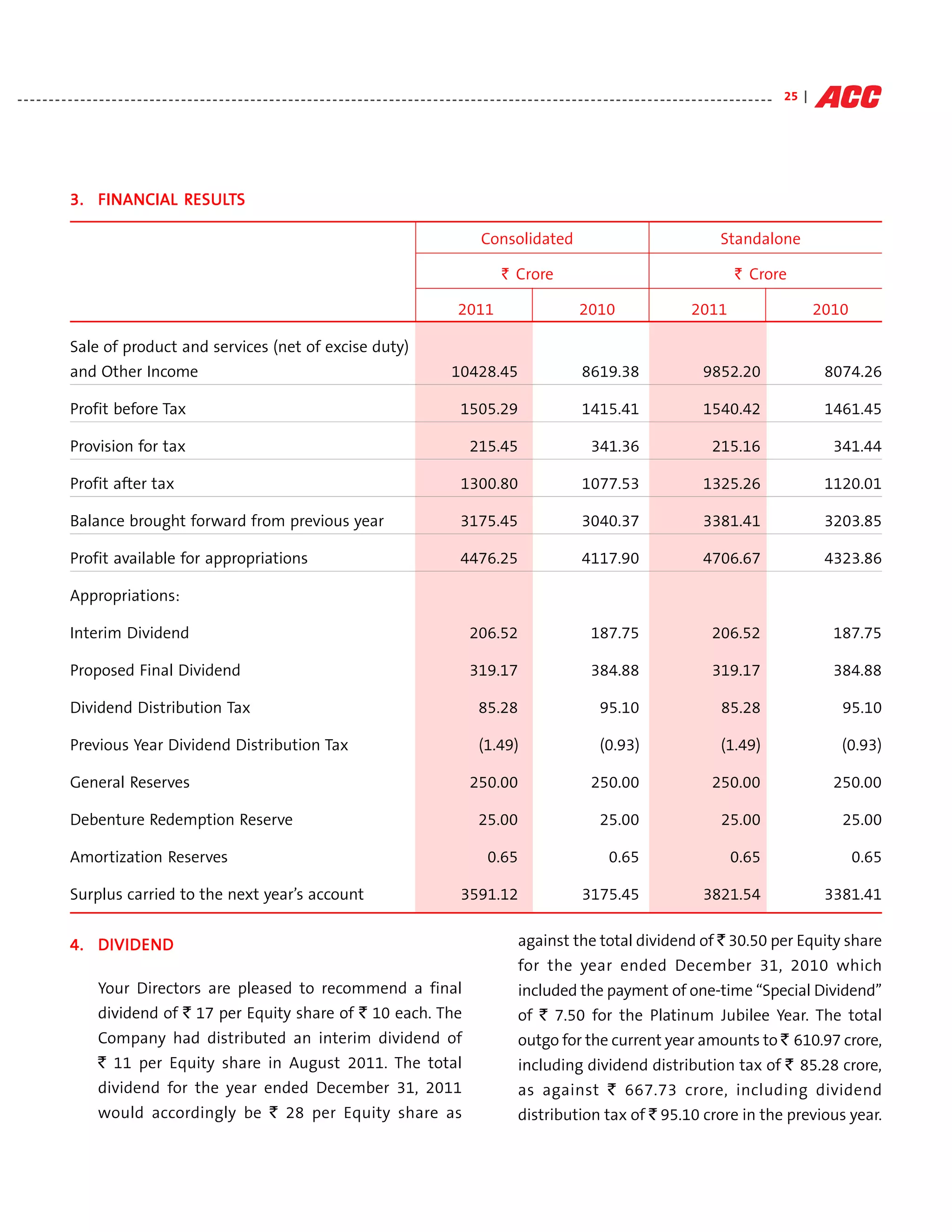

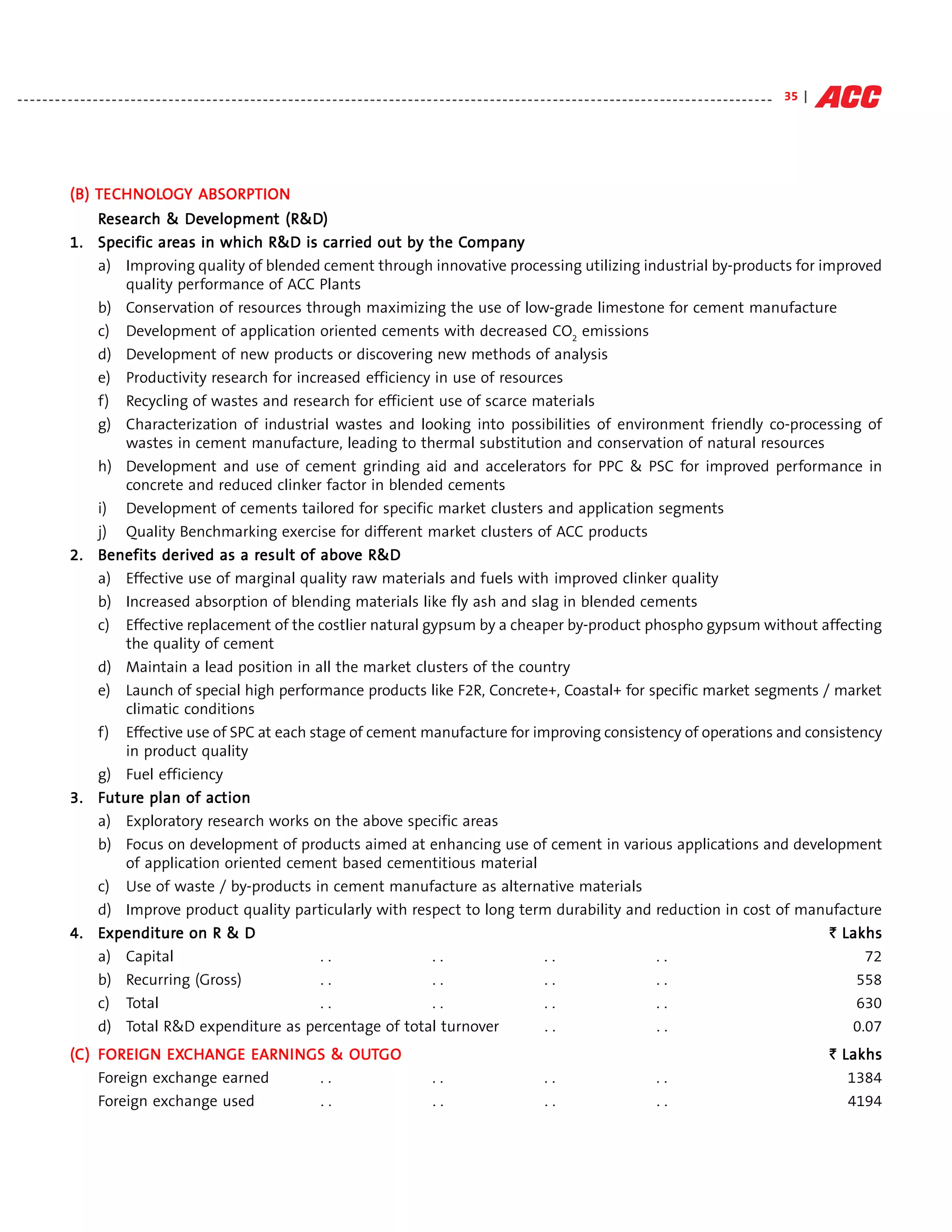

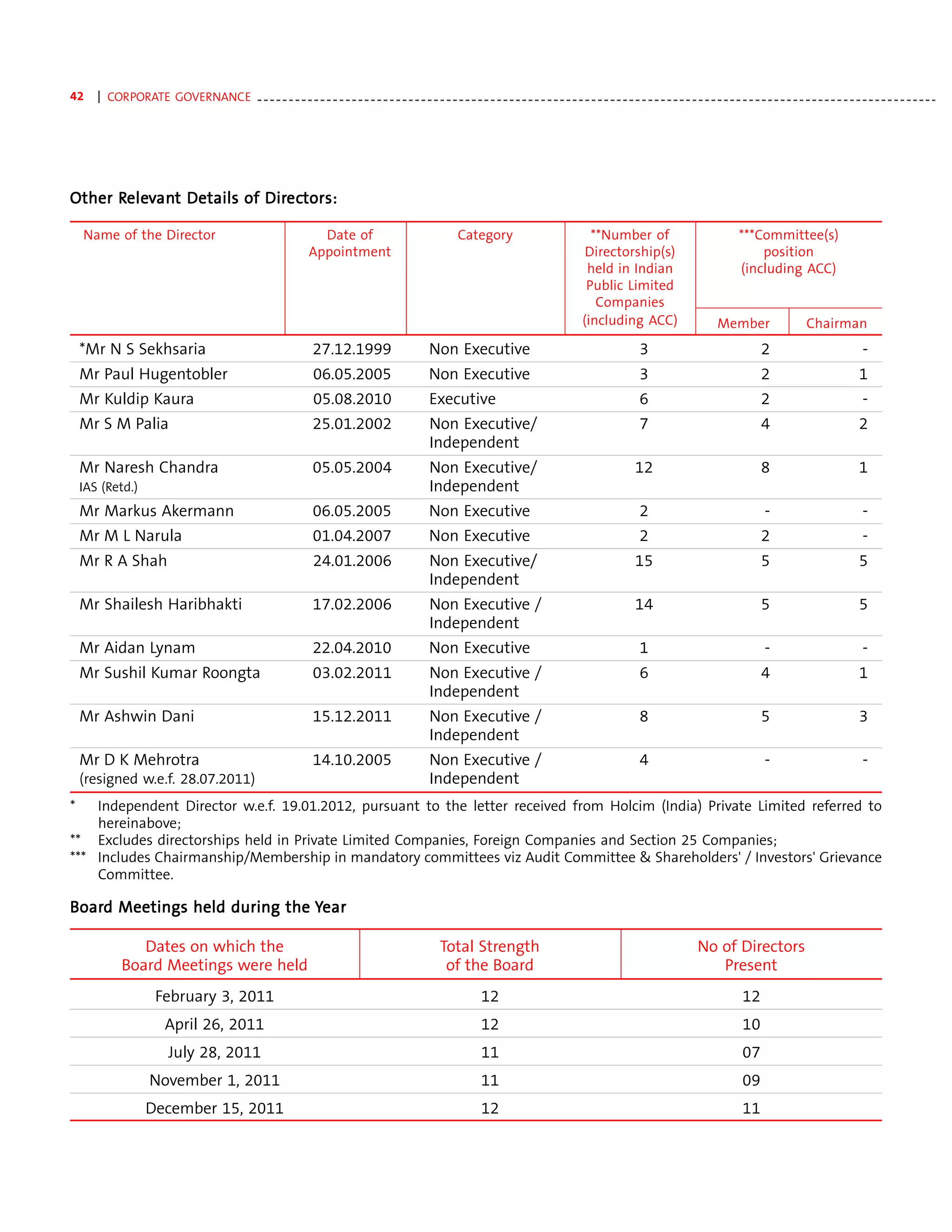

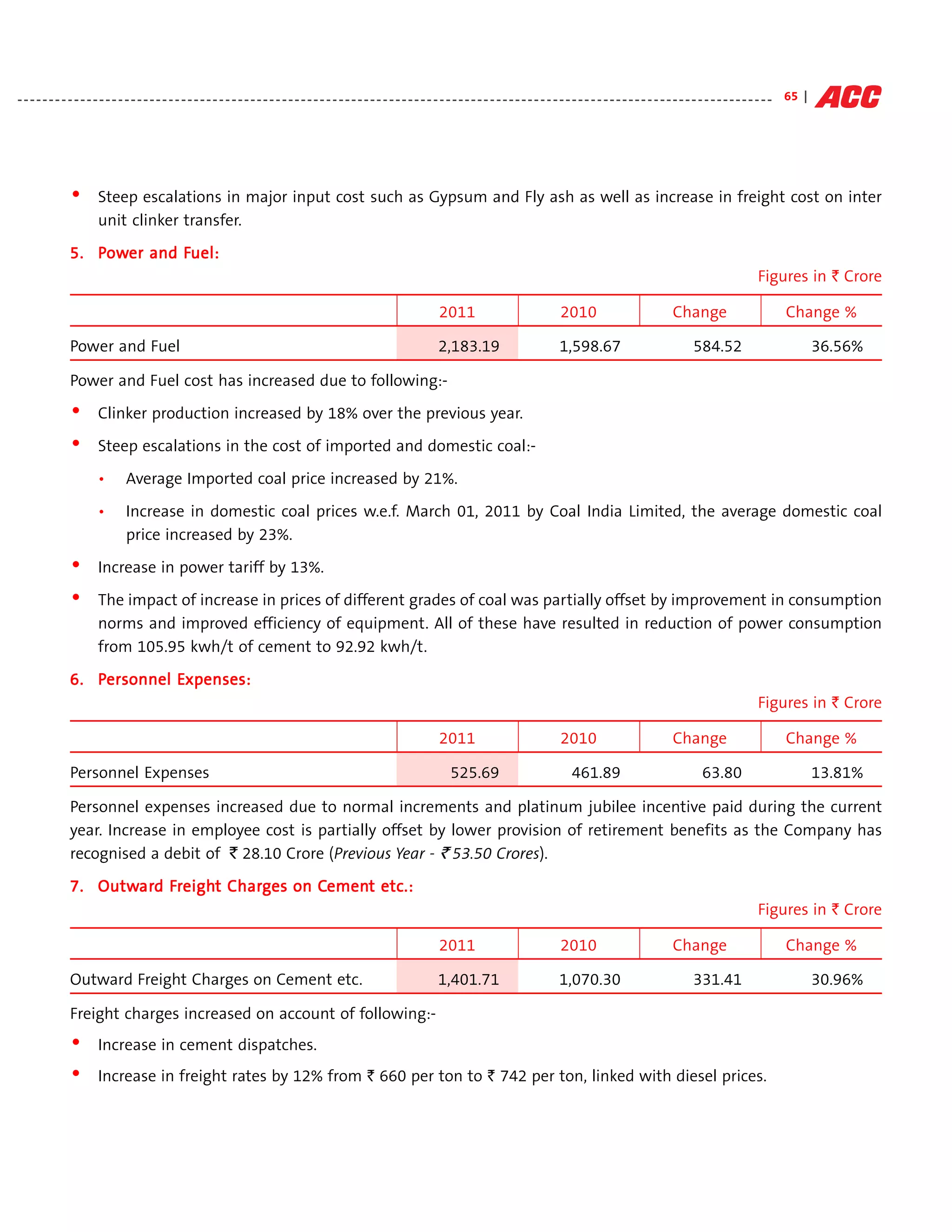

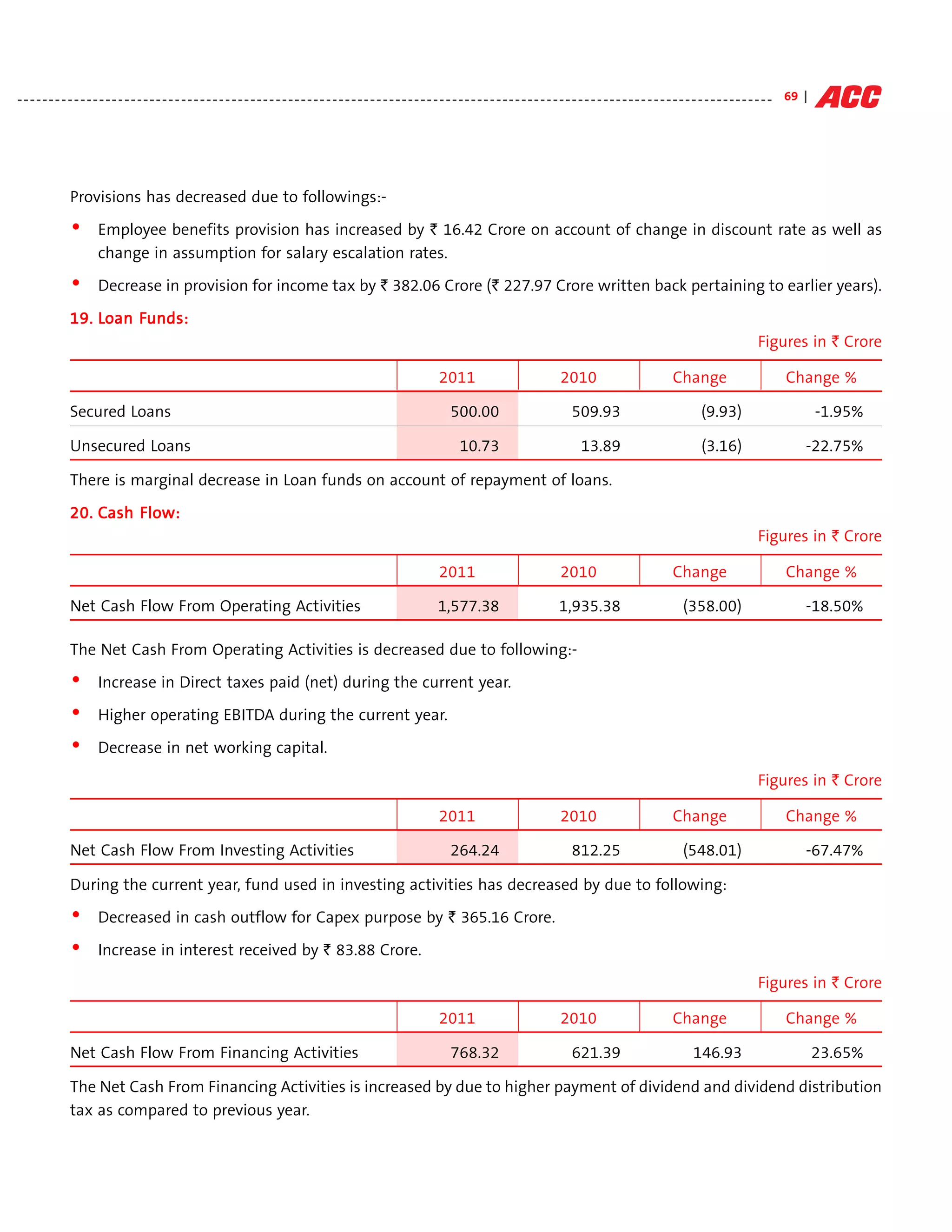

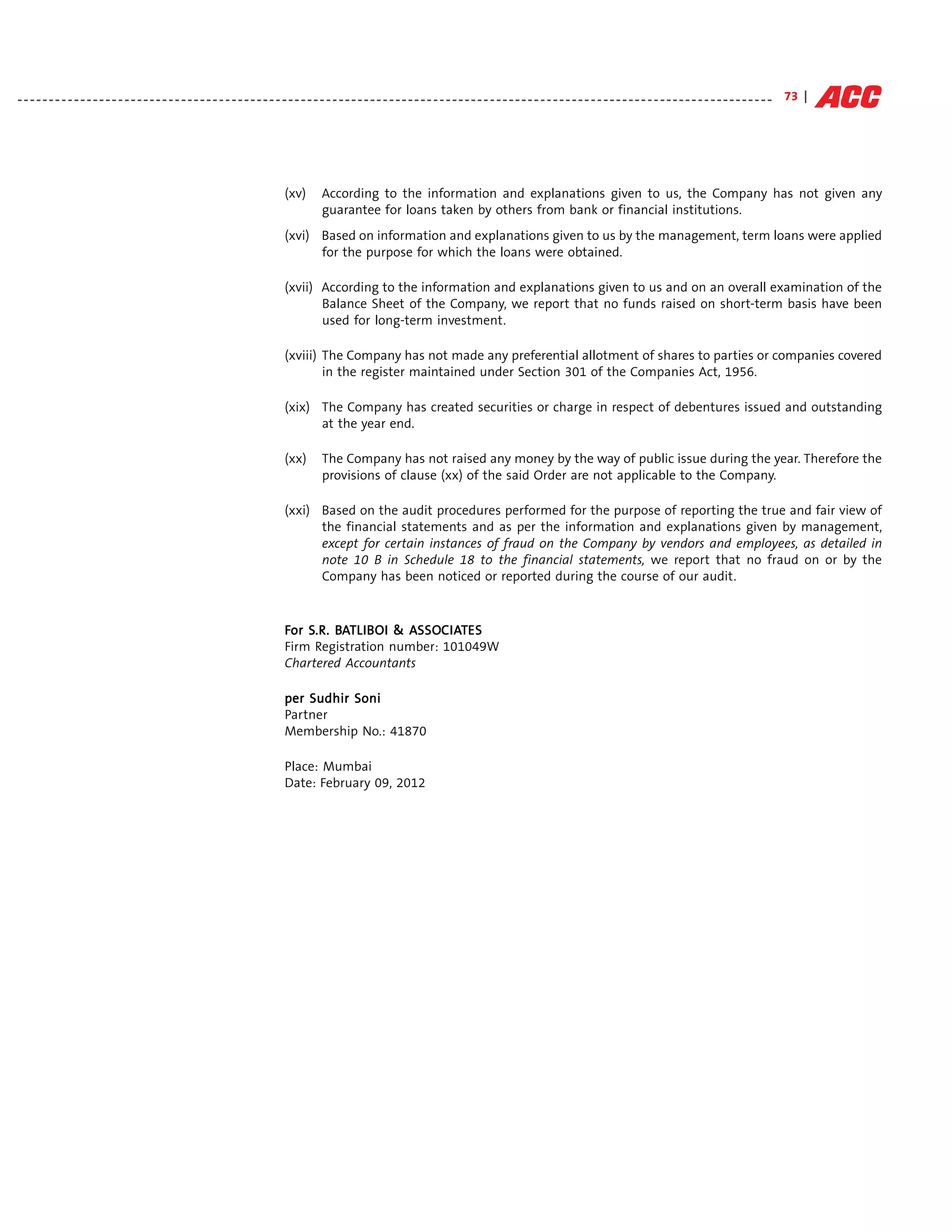

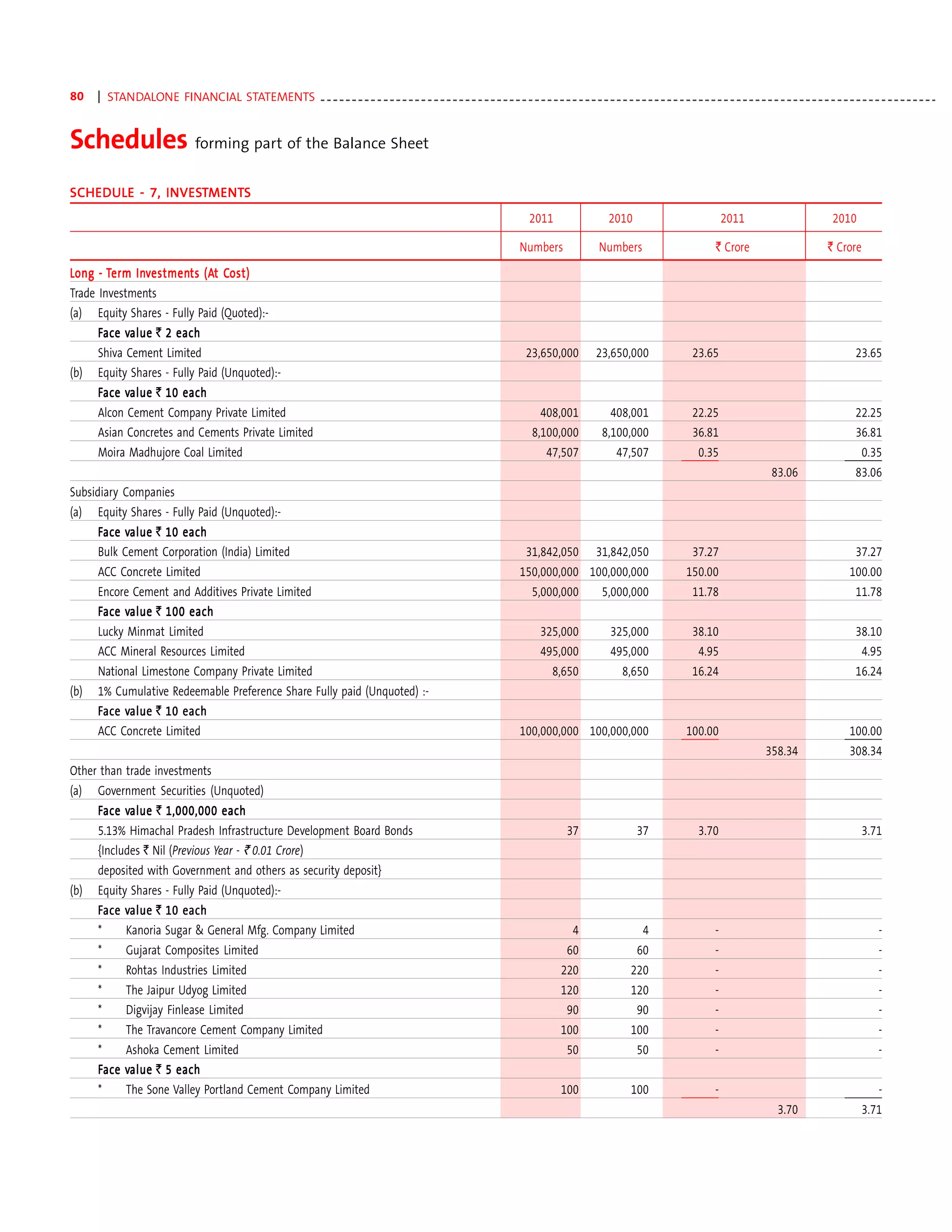

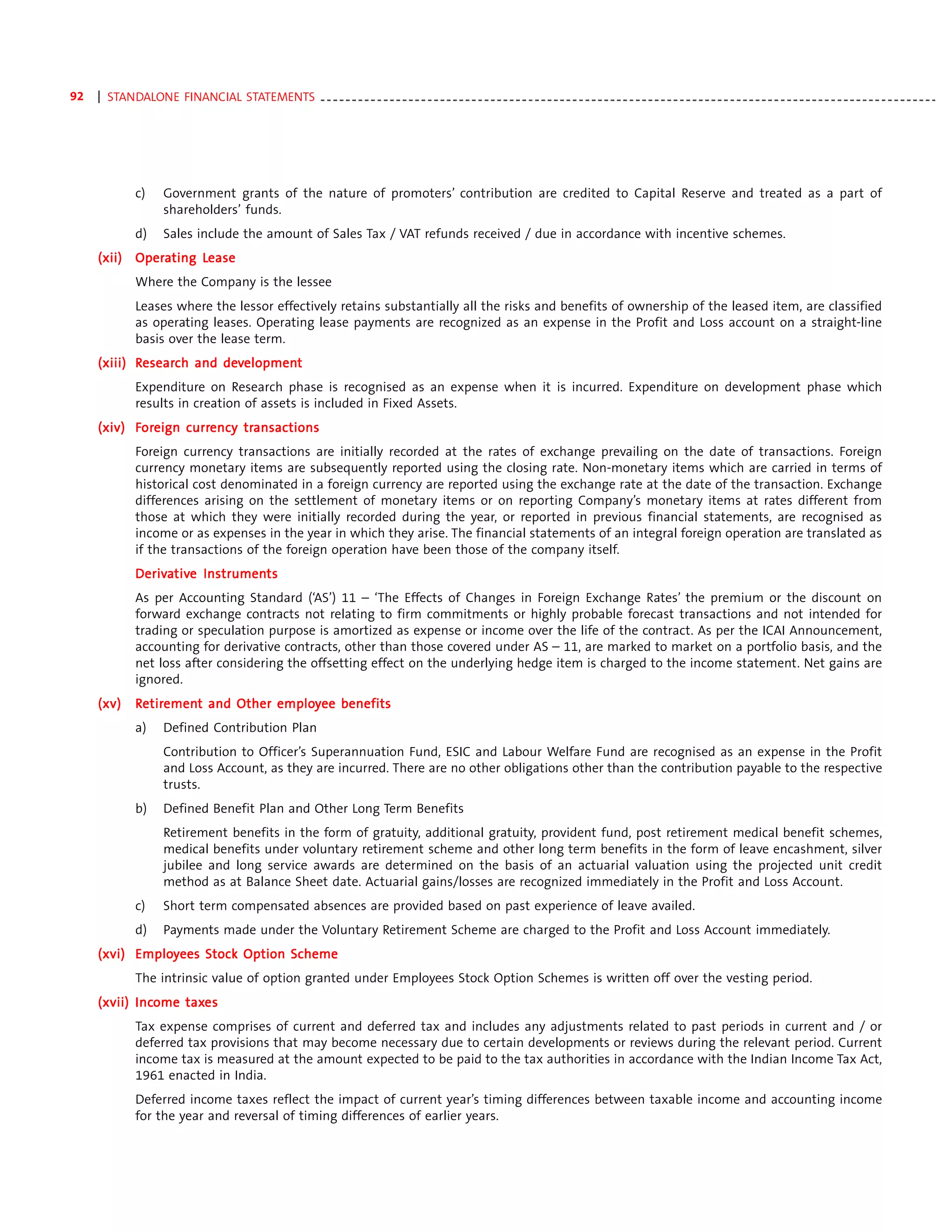

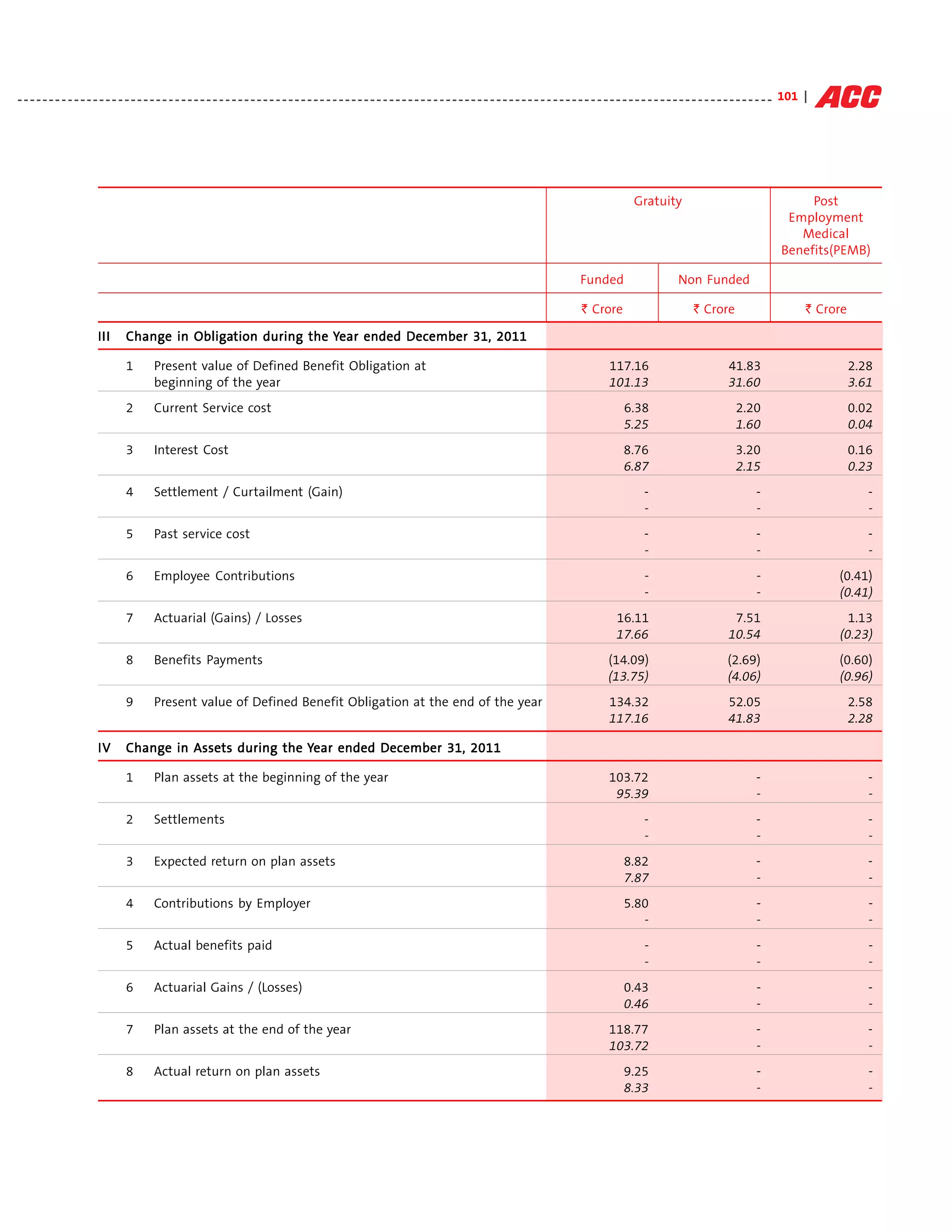

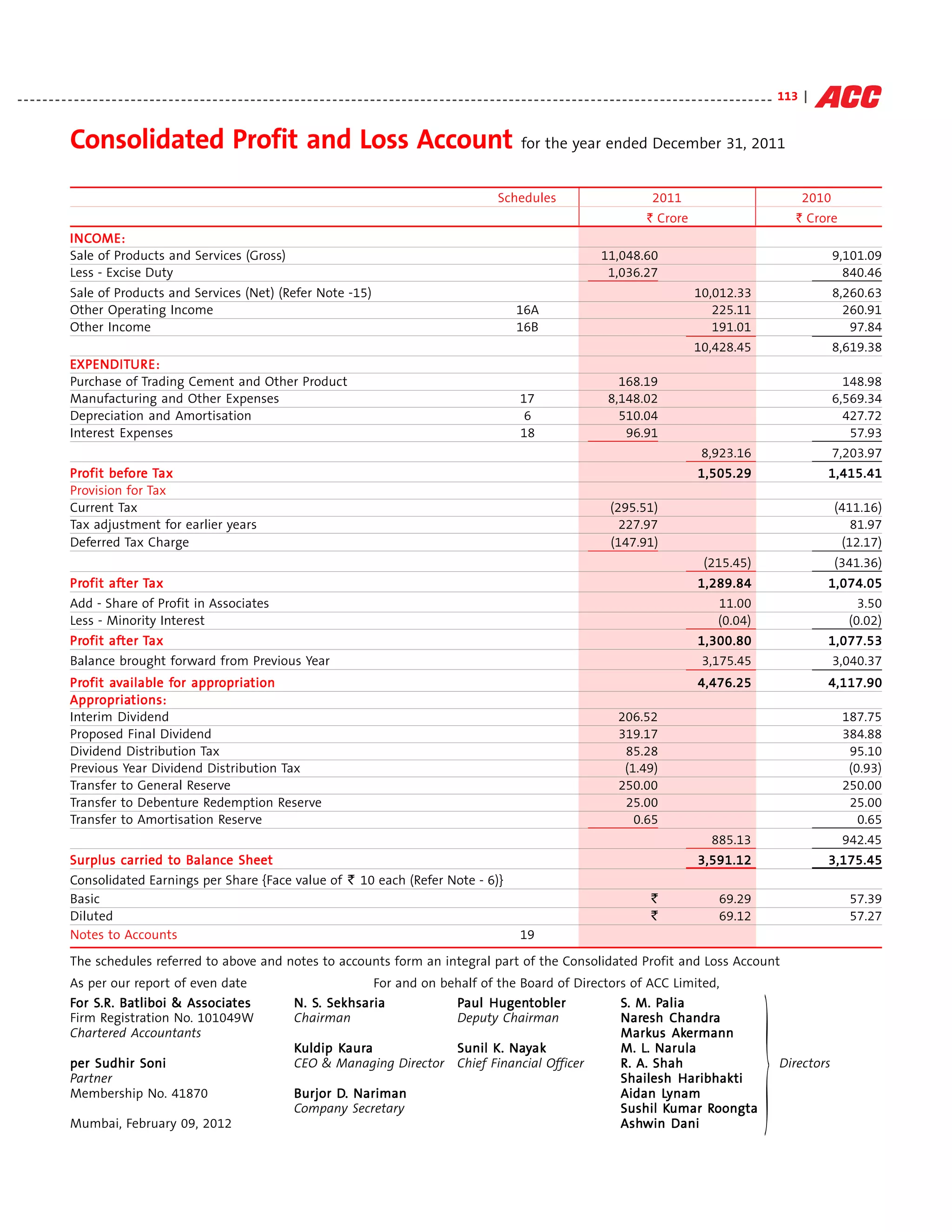

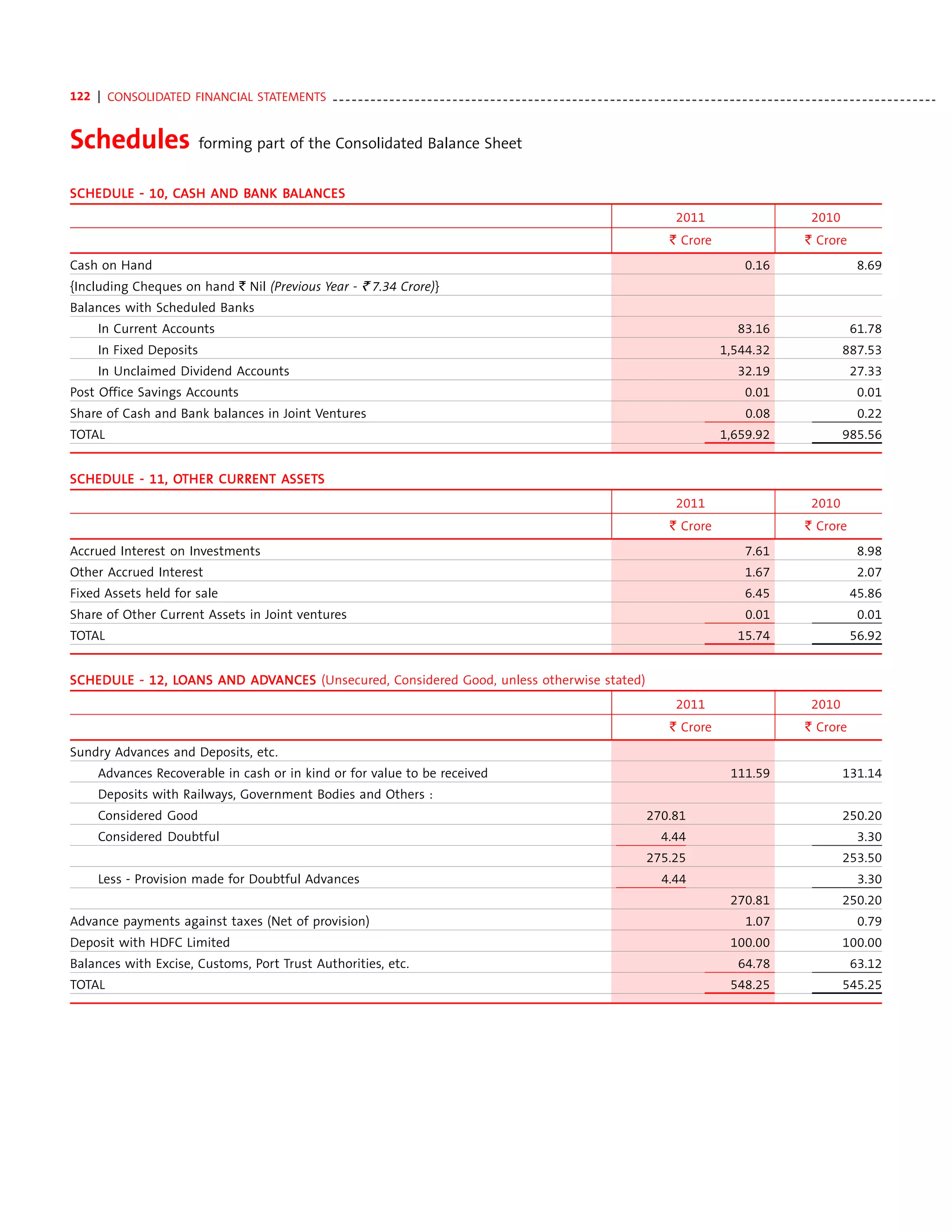

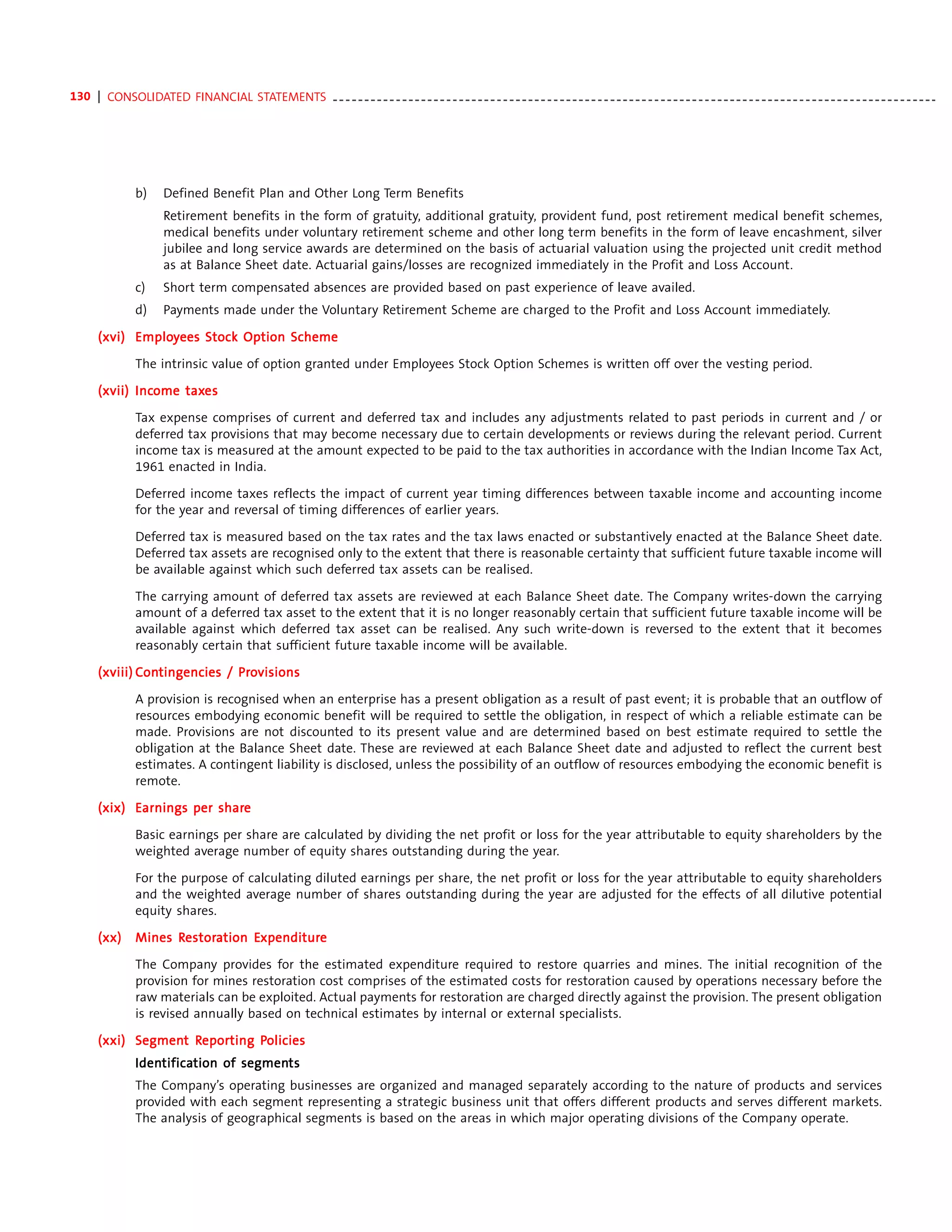

6. Earnings per Share - [EPS]

Share [EPS]

2011 2010

` Crore ` Crore

(I) Net Profit as per Profit and Loss Account 1325.26 1,120.01

(II) Weighted average number of equity shares for Earnings Per Share computation

Shares for Basic Earnings Per Share 18,77,45,356 18,77,44,727

Add: Potential diluted equity shares 4,39,316 4,16,549

Number of Shares for Diluted Earnings Per Share 18,81,84,672 18,81,61,276

(III) Earnings Per Share

Face value per Share ` 10.00 10.00

Basic ` 70.59 59.66

Diluted ` 70.42 59.52

7. Directors’ Remuneration

Direc

ectors’ Remuner

emunera

2011 2010

` Crore ` Crore

Managing Director*

Salaries and Performance Bonus 4.36 2.00

Perquisites - 1.40

Contributions to Provident and Superannuation Funds 0.41 0.29

4.77 3.69

Non–Executive Directors –

Commission 1.88 1.30

Sitting Fees 0.21 0.24

6.86 5.23

Provision for contribution to gratuity fund, leave encashment on retirement and other defined benefits which are made based on

actuarial valuation on an overall Company basis are not included above.

*Remuneration excludes cost of benefits under share based payments incurred and paid by Holcim Ltd., the ultimate holding company.

Computation of Net Profit under Section 349 of the Companies Act, 1956

2011 2010

` Crore ` Crore

Profit before tax as per Profit and Loss Account 1,540.42 1,461.45

Add -

Depreciation & amortisation as per Profit and Loss Account 475.30 392.68

Provision for Wealth Tax 0.15 0.71

Tax on Yanbu operations 0.39 2.08

Assets written off as per Profit and Loss Account 31.03 54.73

Provision for Doubtful Debts and advances written back (net) (35.43) (31.50)

Compensation under Voluntary Retirement Scheme 1.41 1.88

2,013.27 1,882.03](https://image.slidesharecdn.com/accannualreport2011-121108234301-phpapp01/75/Acc-annual-report-2011-101-2048.jpg)

![100 | STANDALONE FINANCIAL STATEMENTS - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Employ

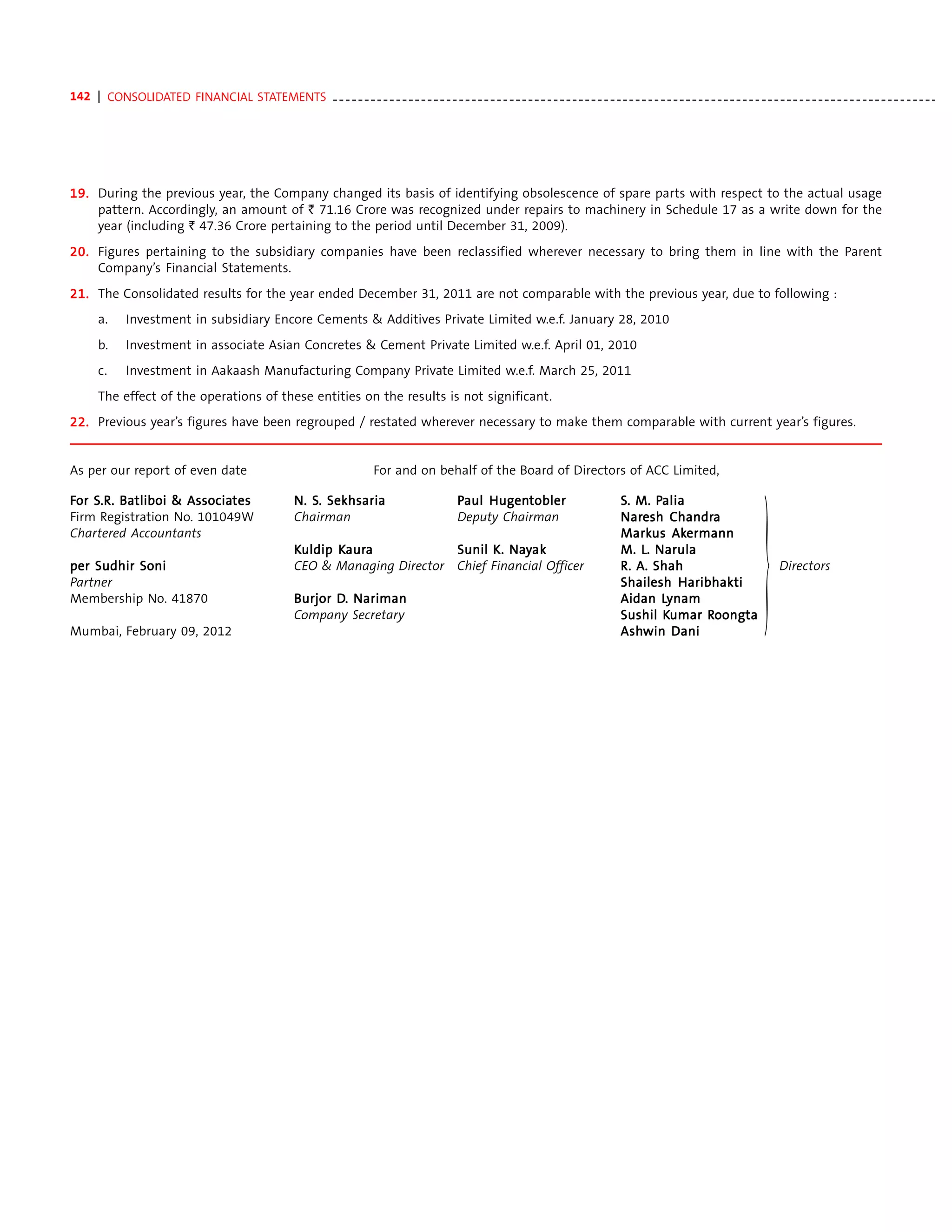

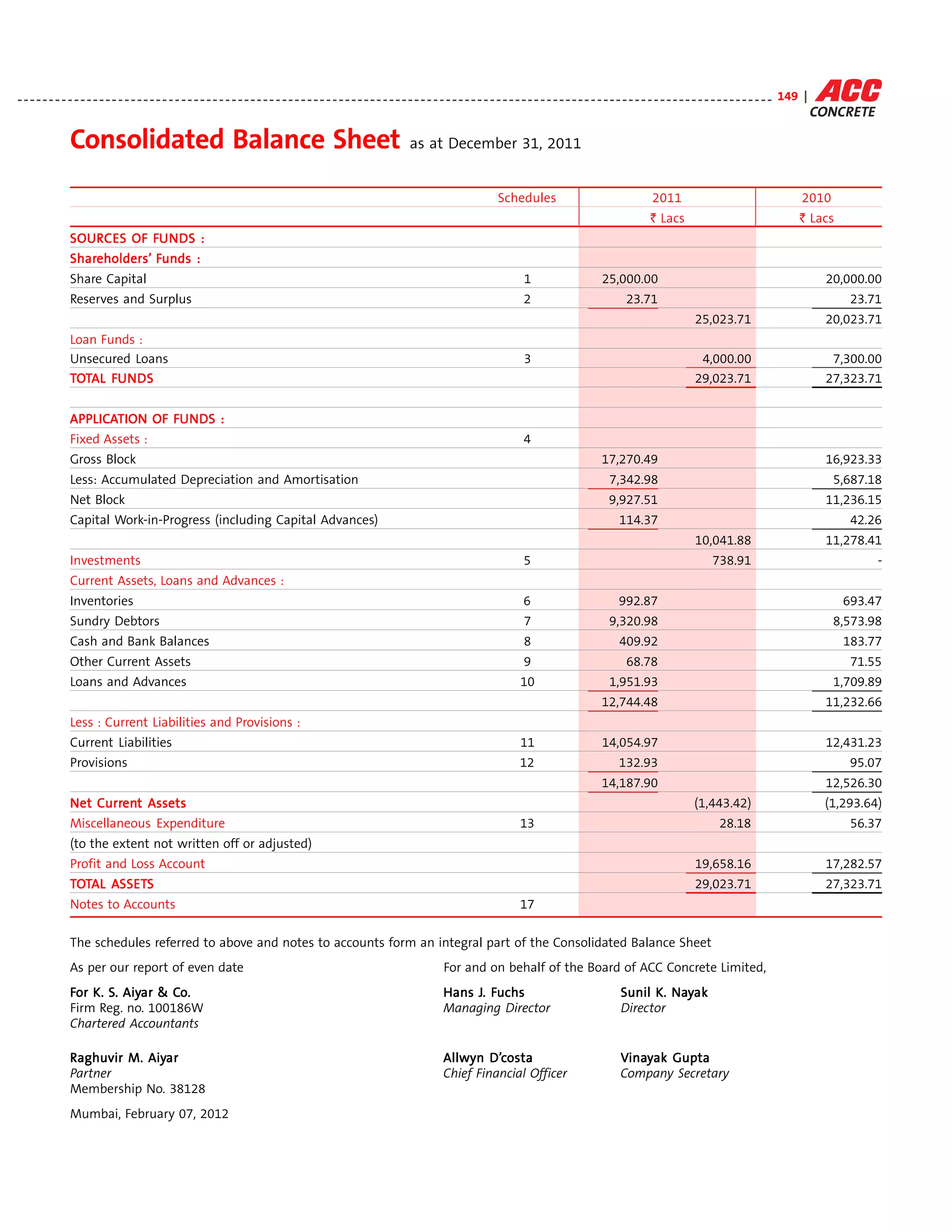

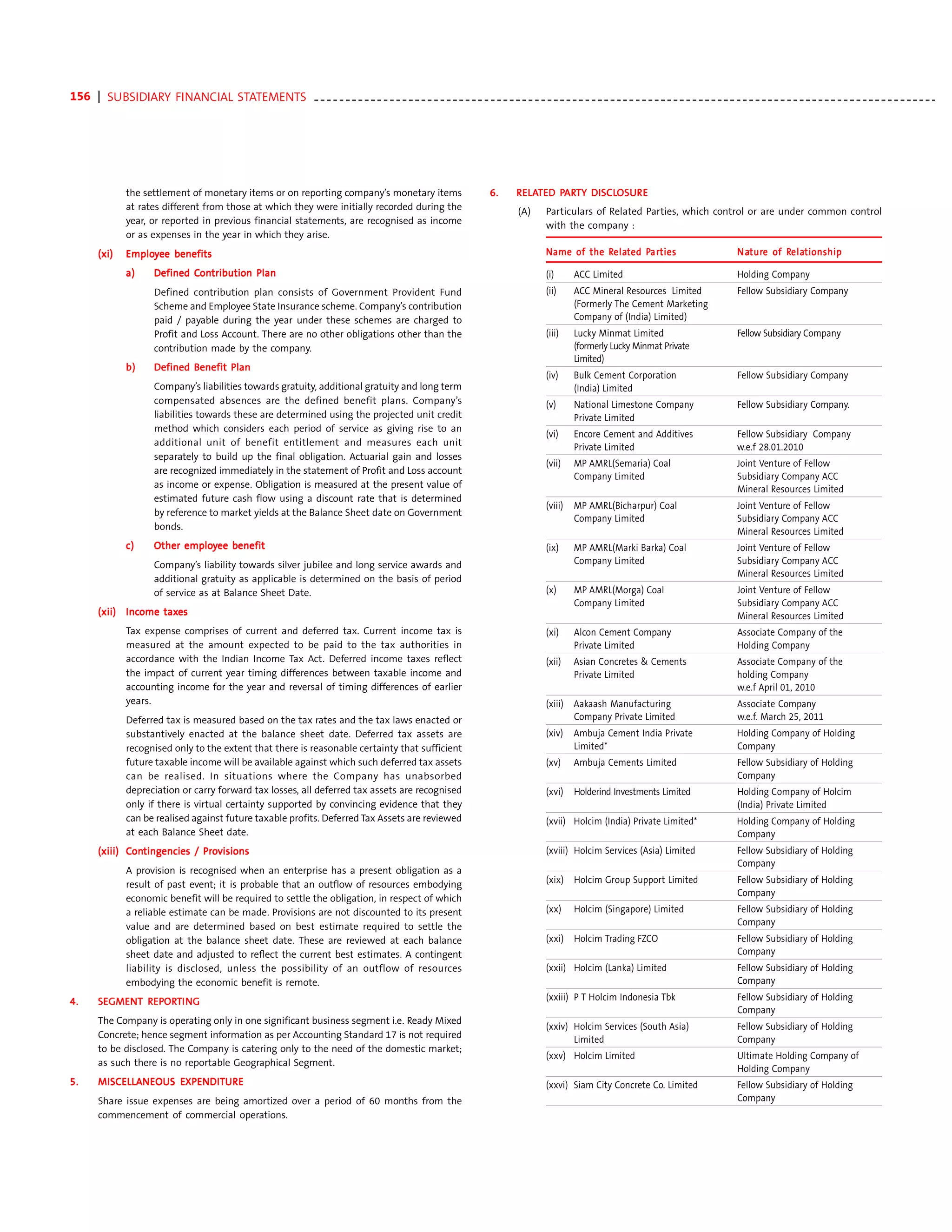

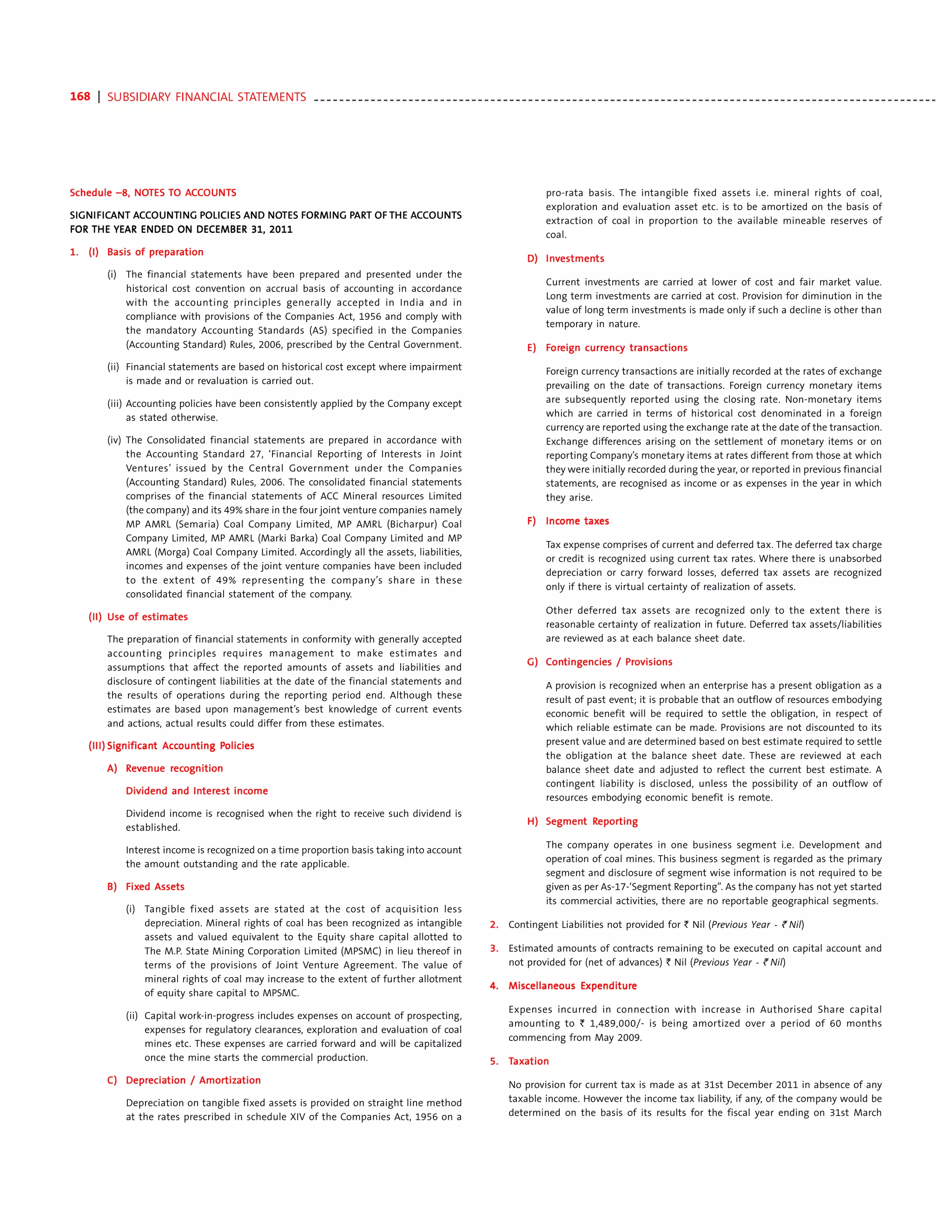

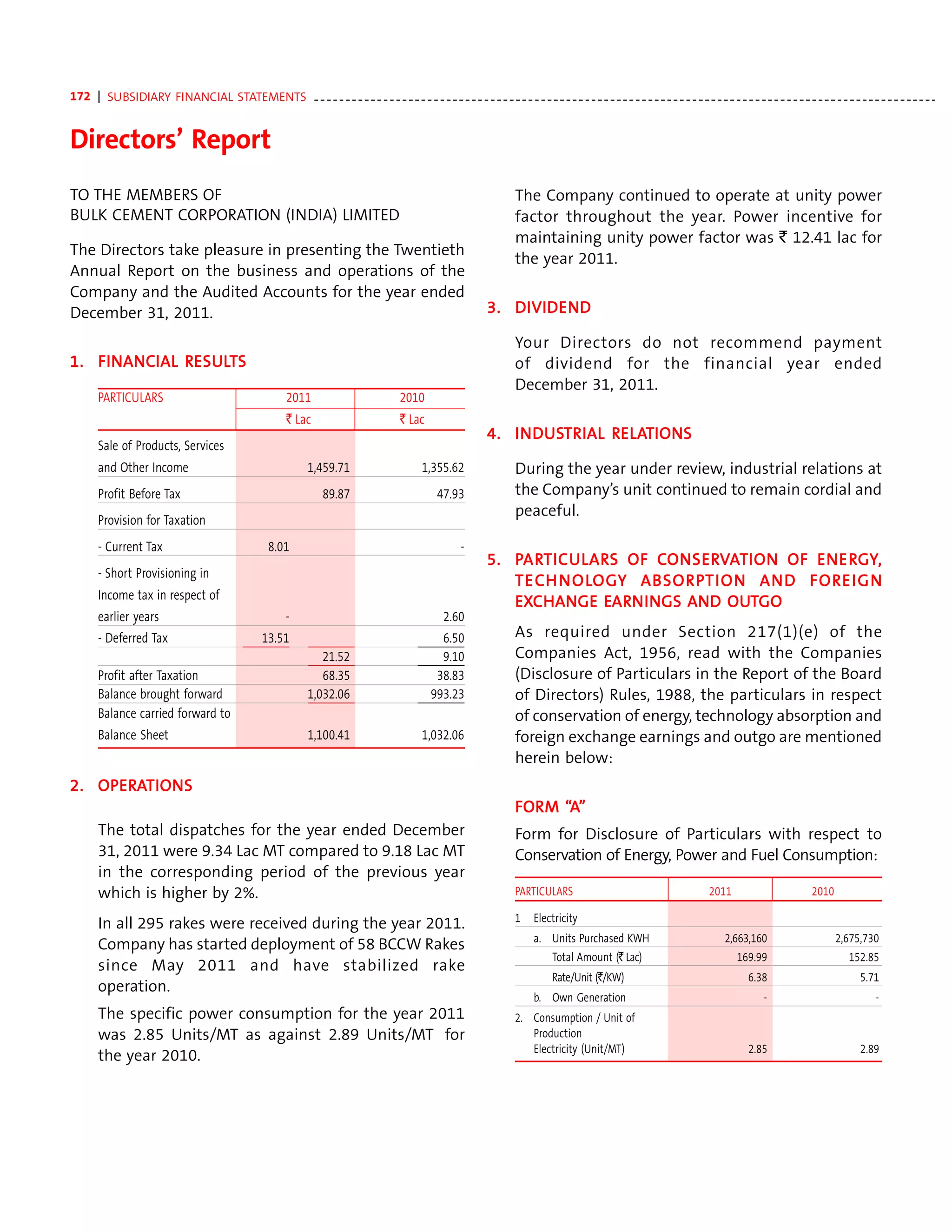

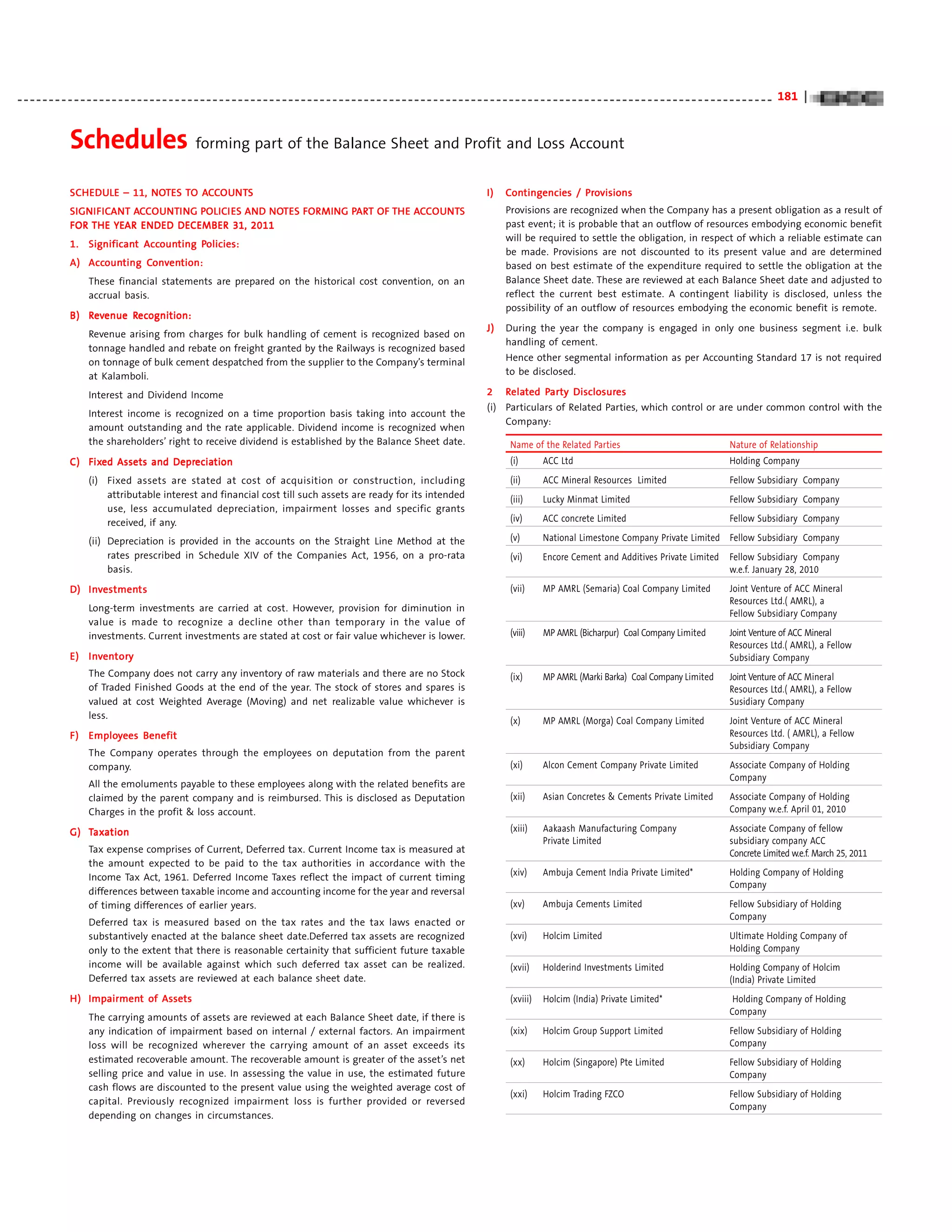

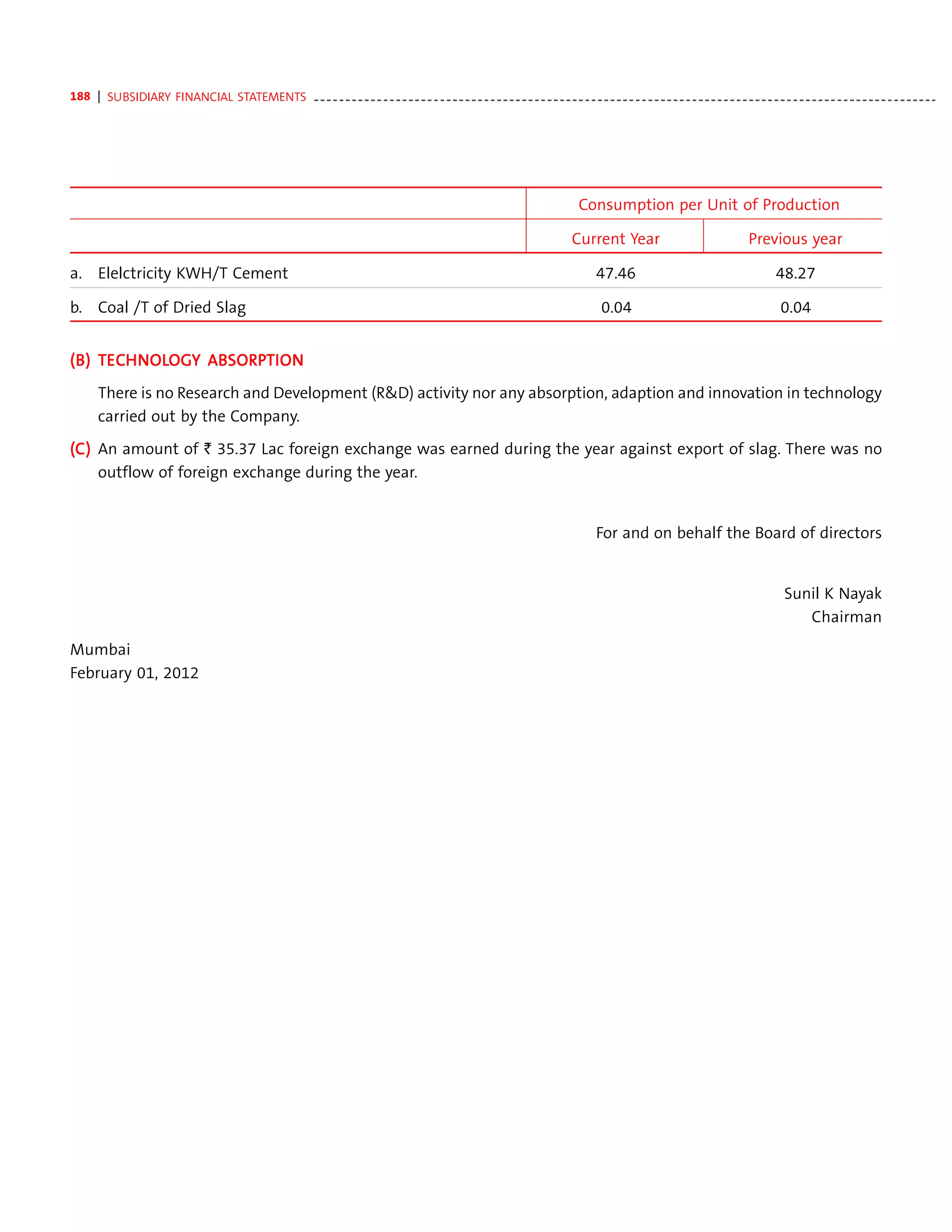

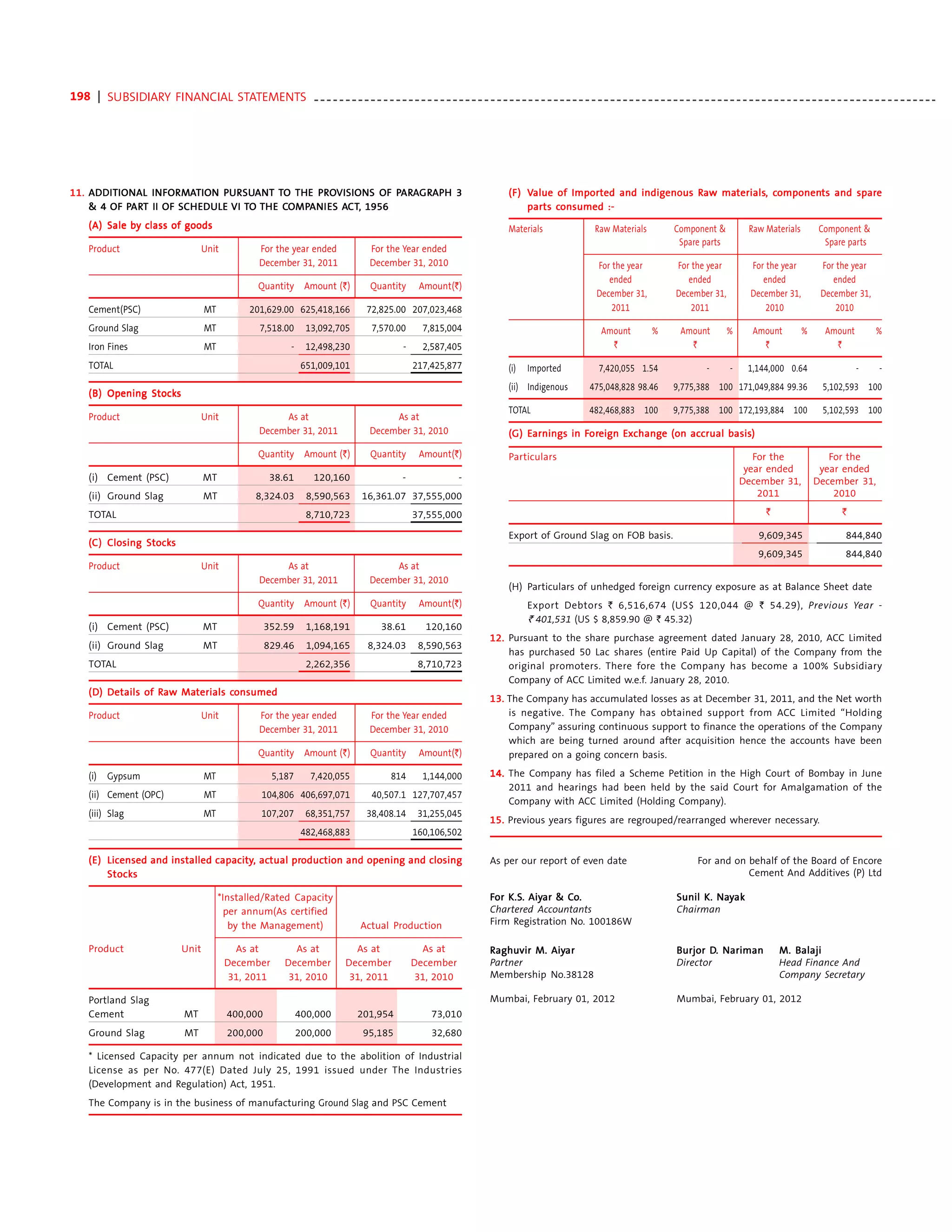

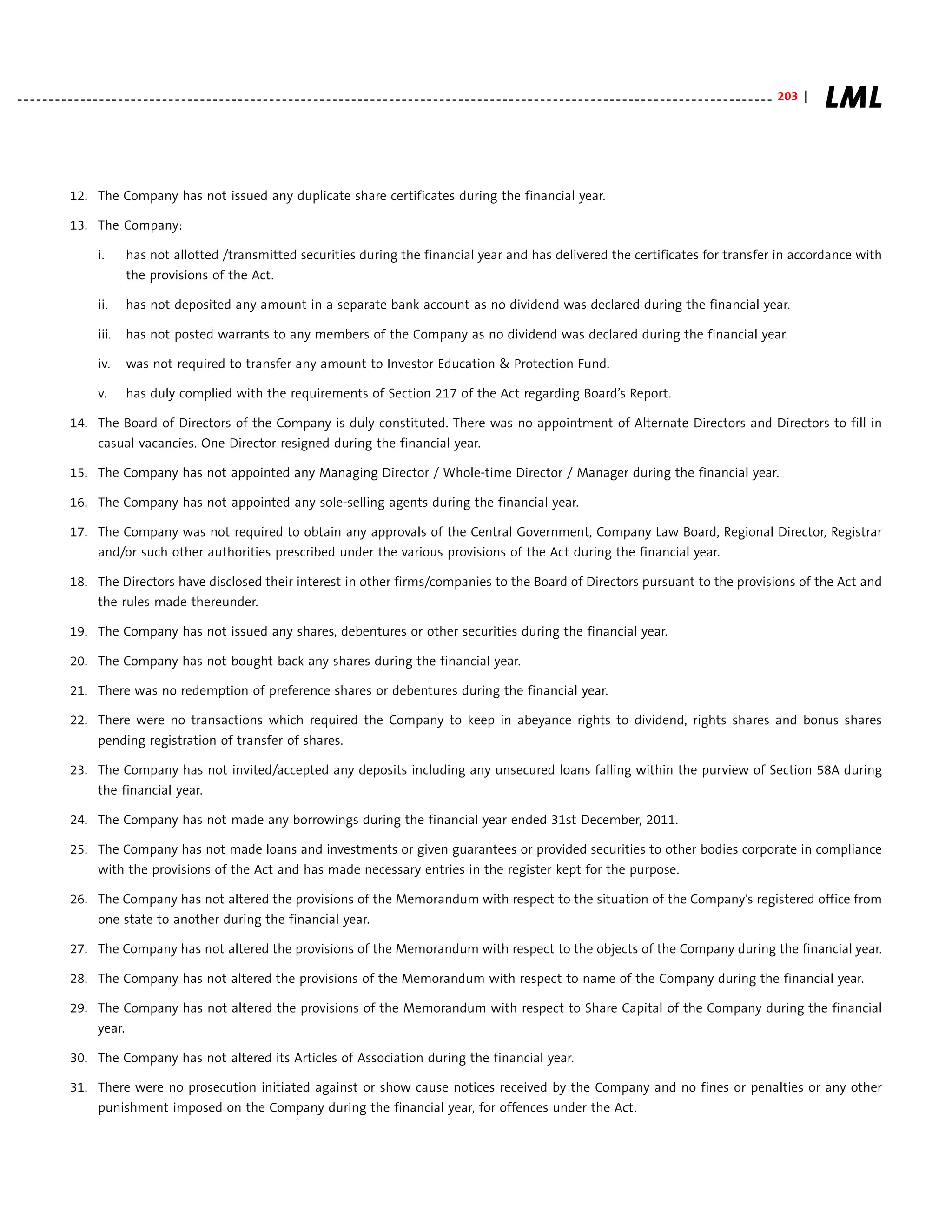

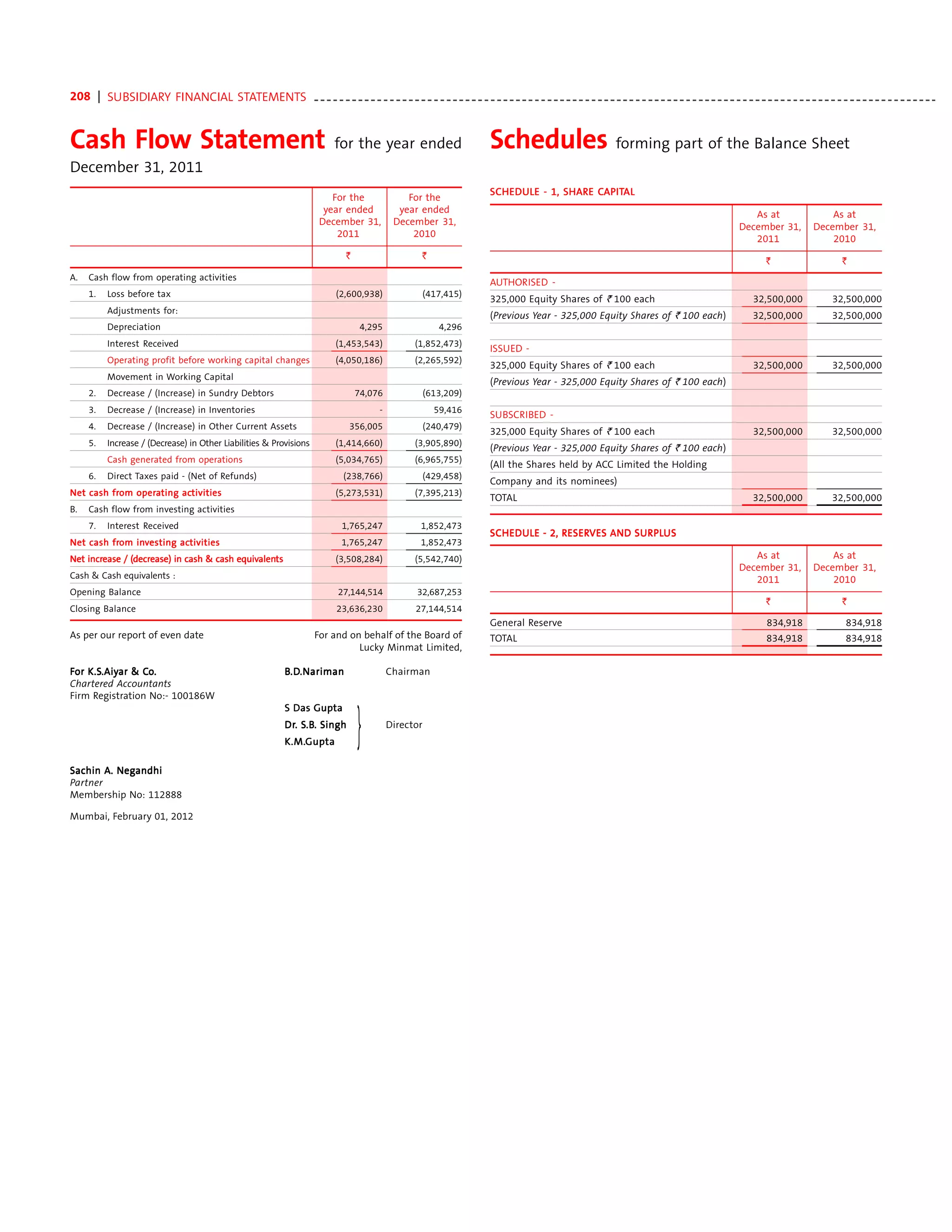

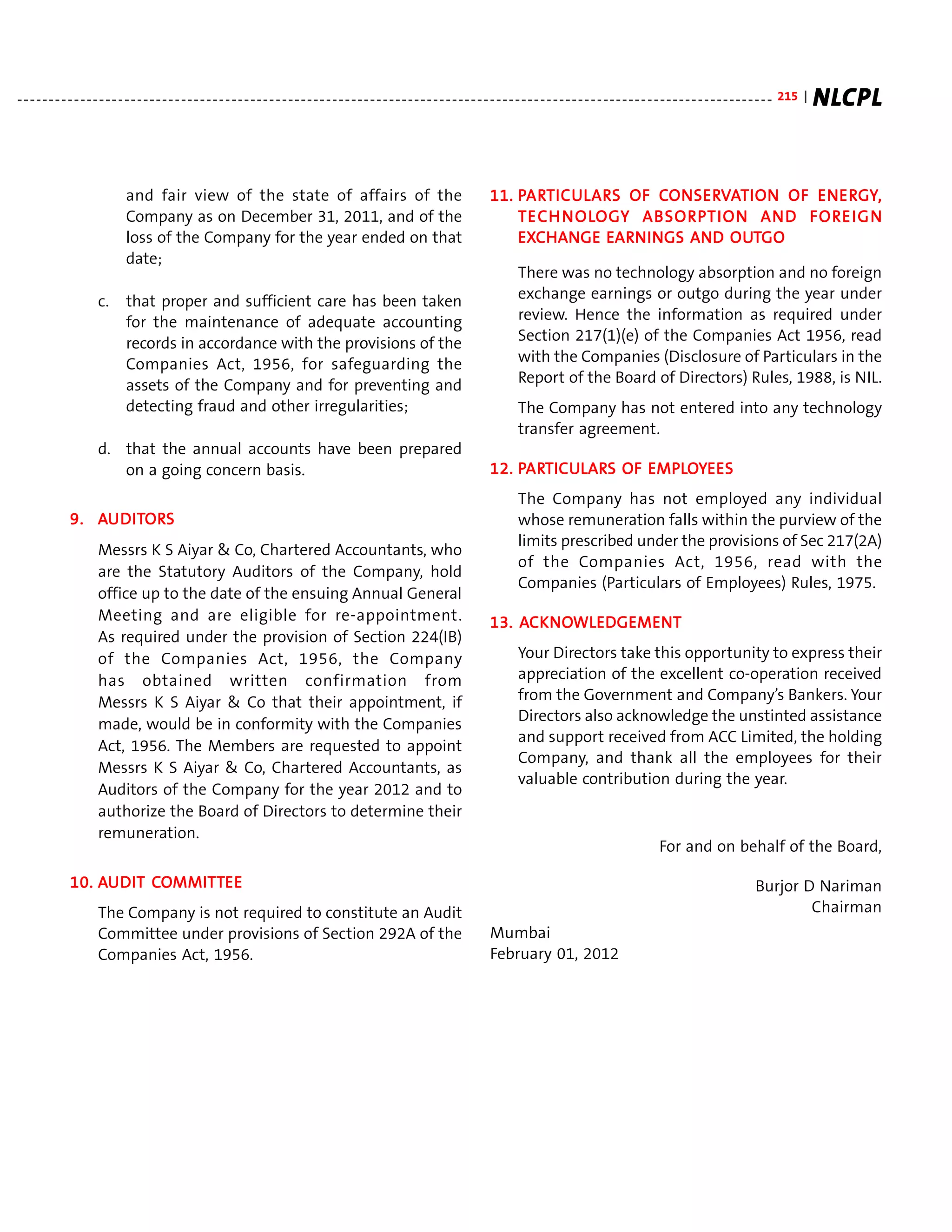

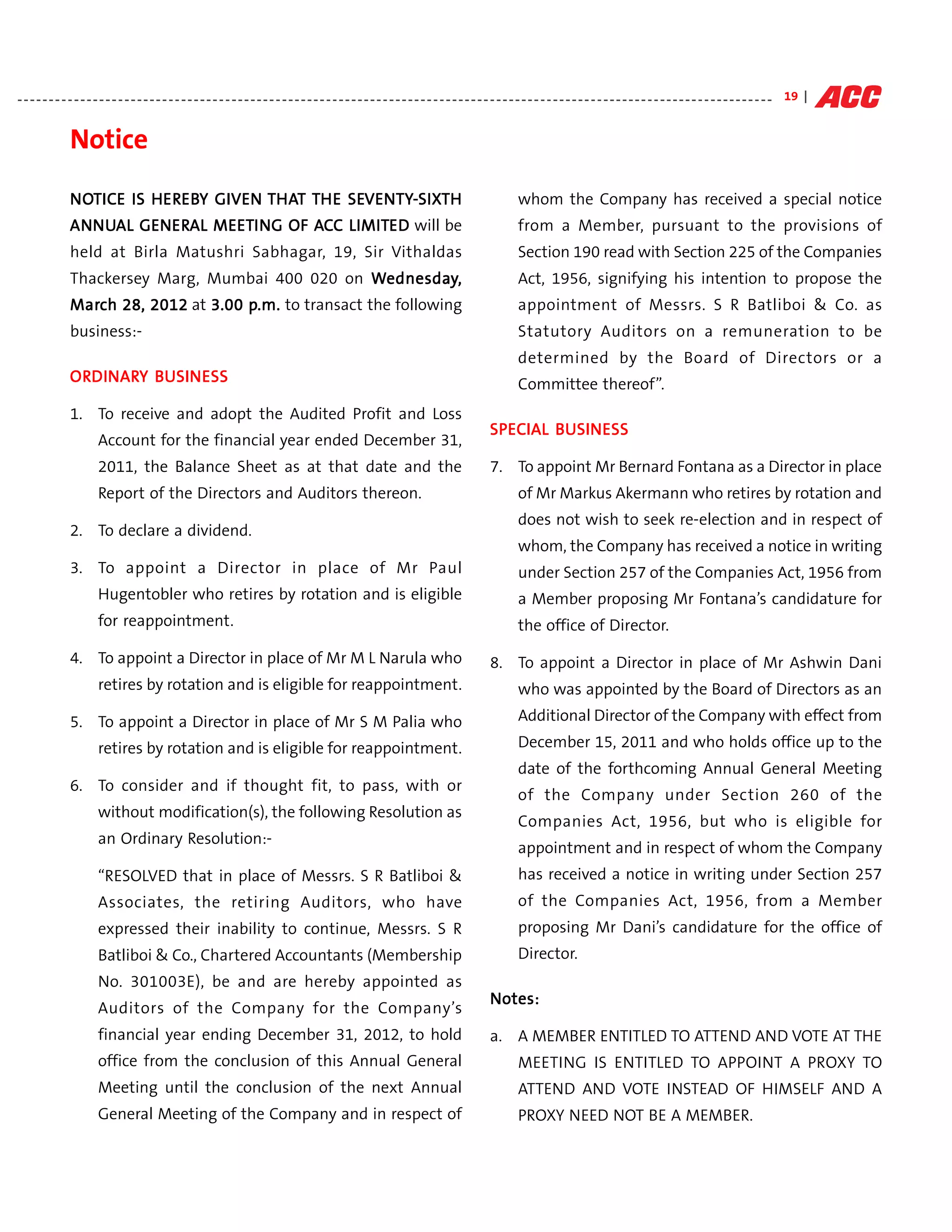

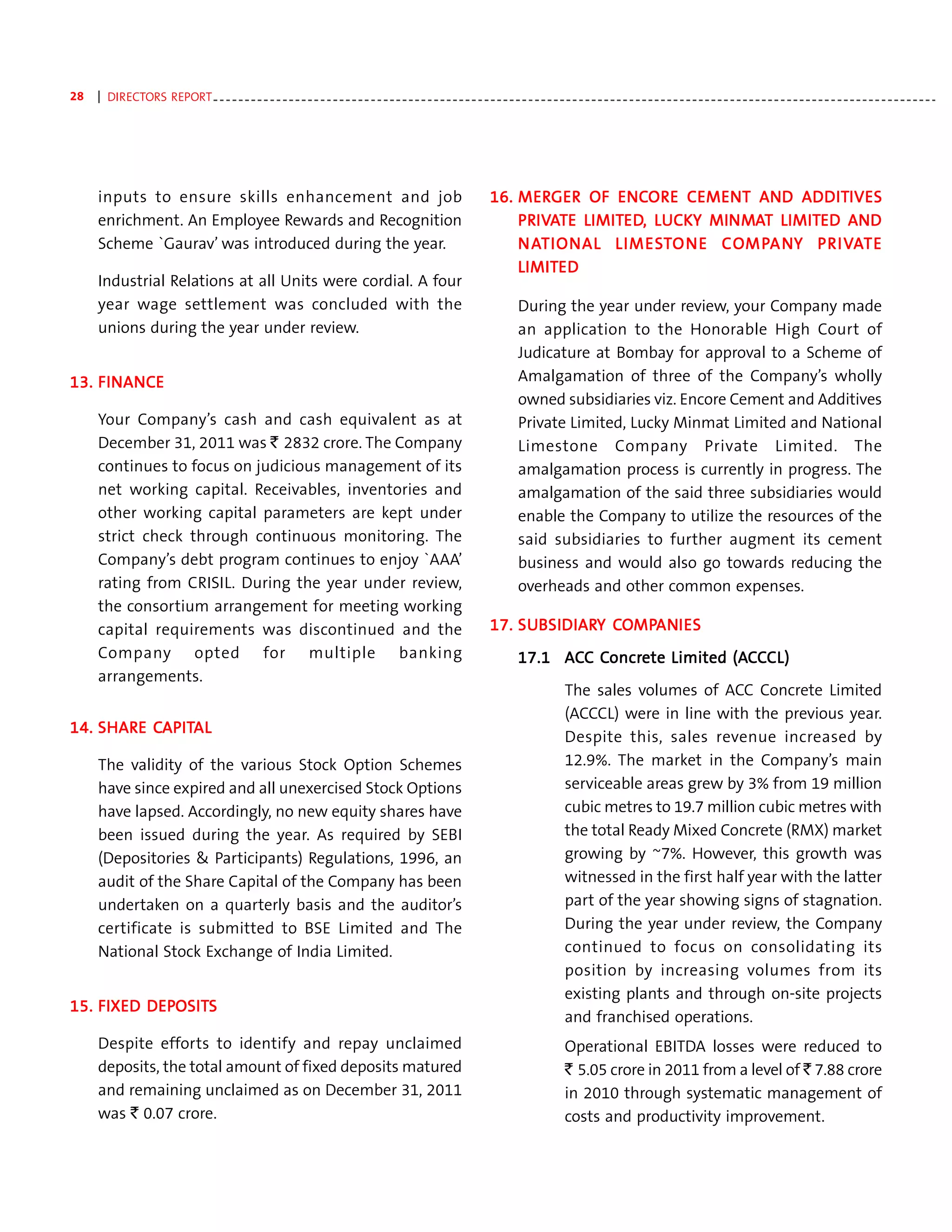

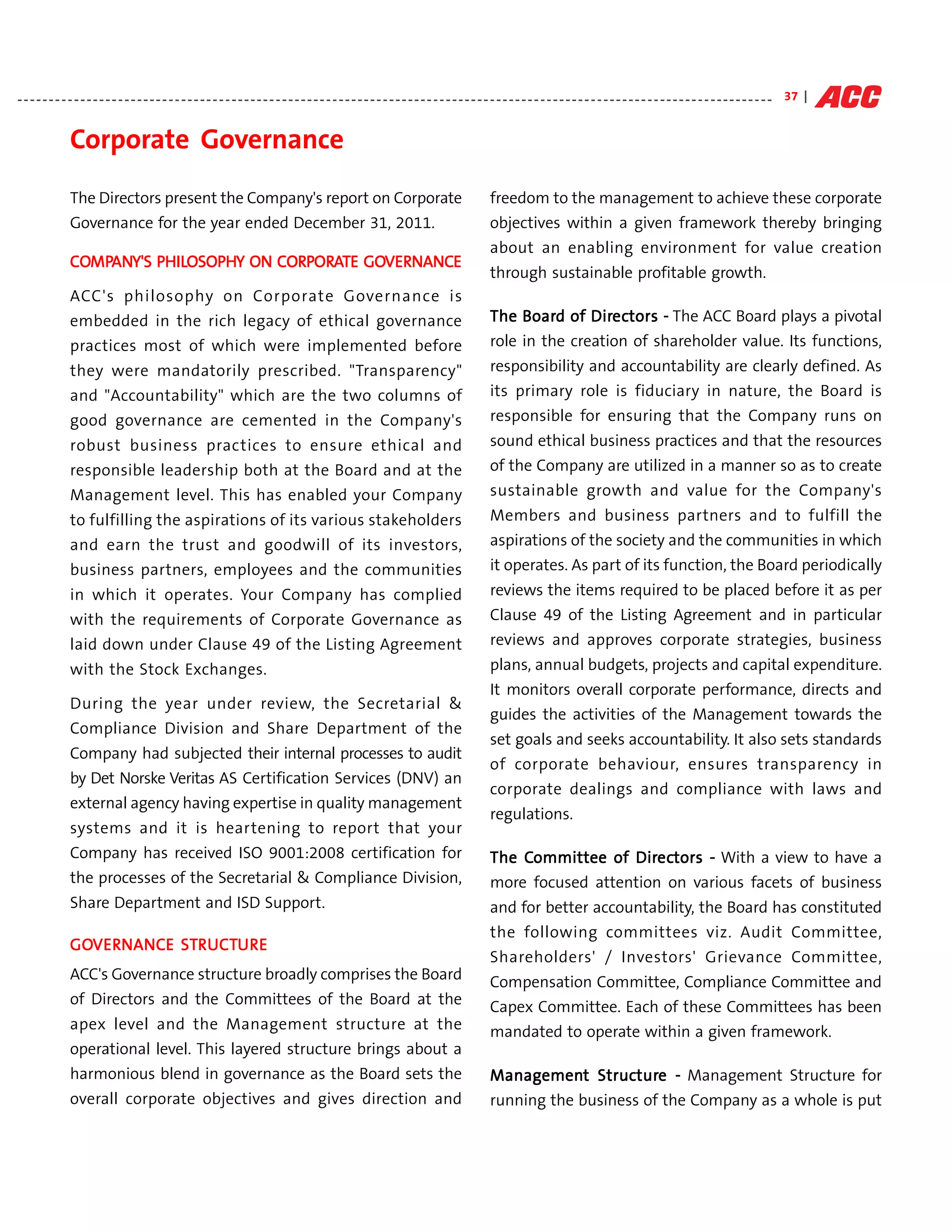

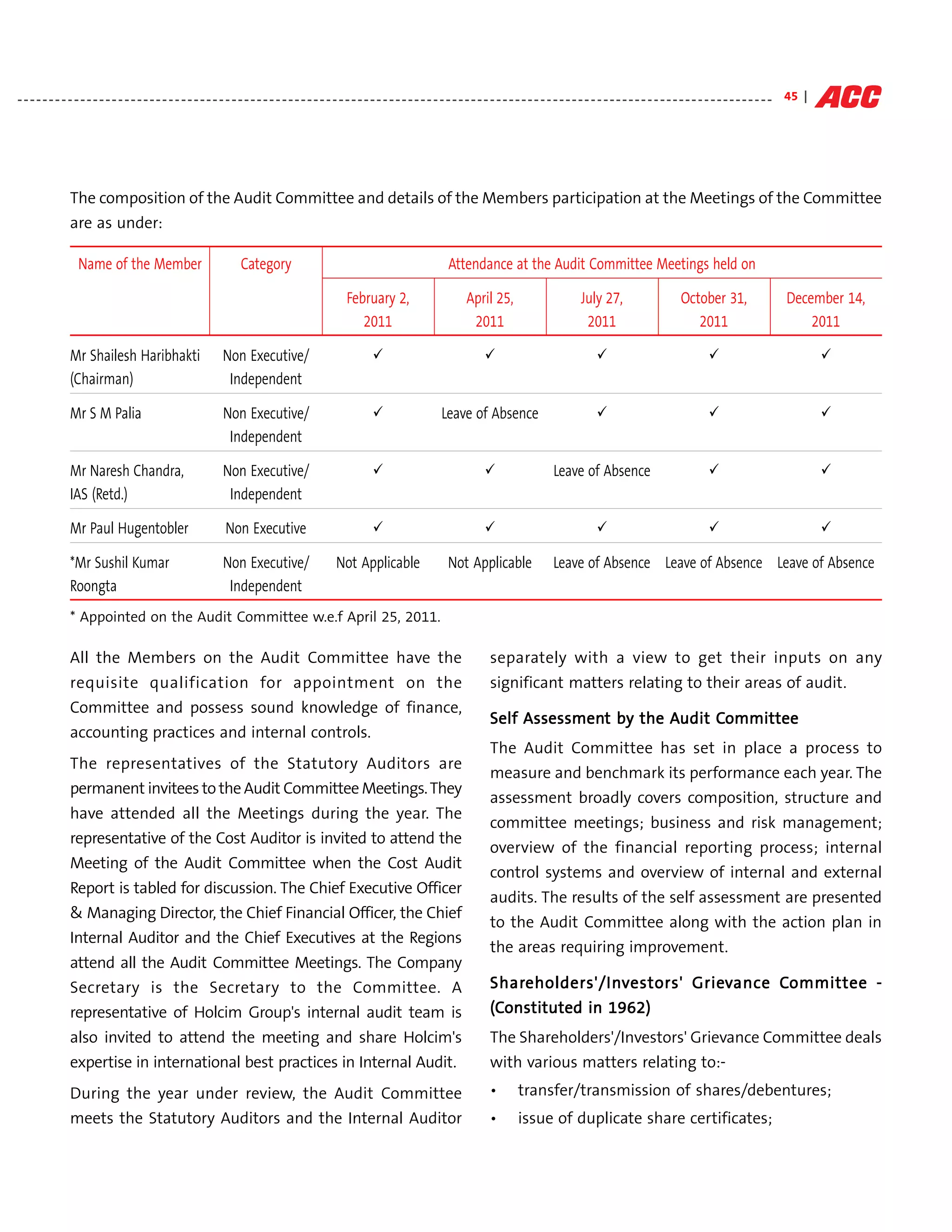

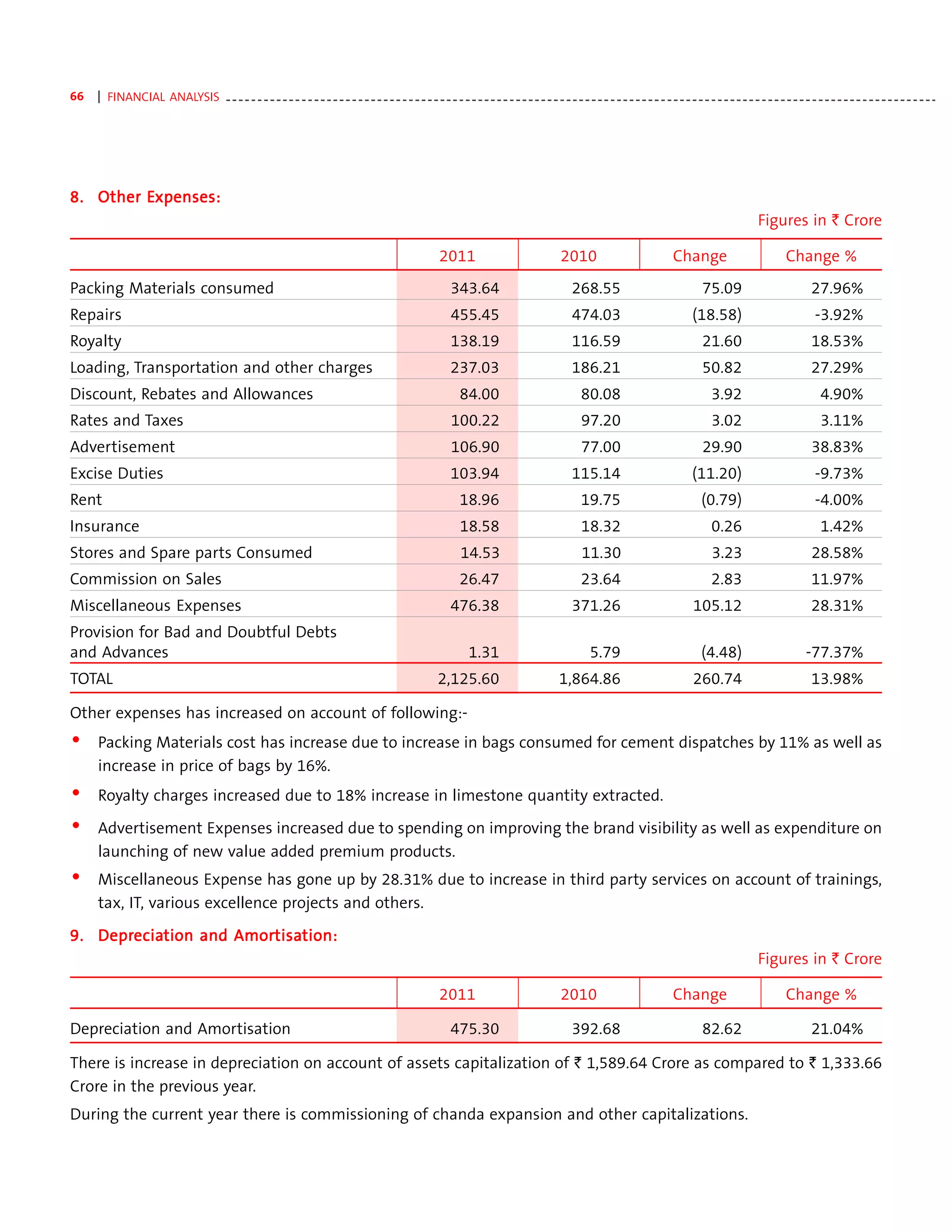

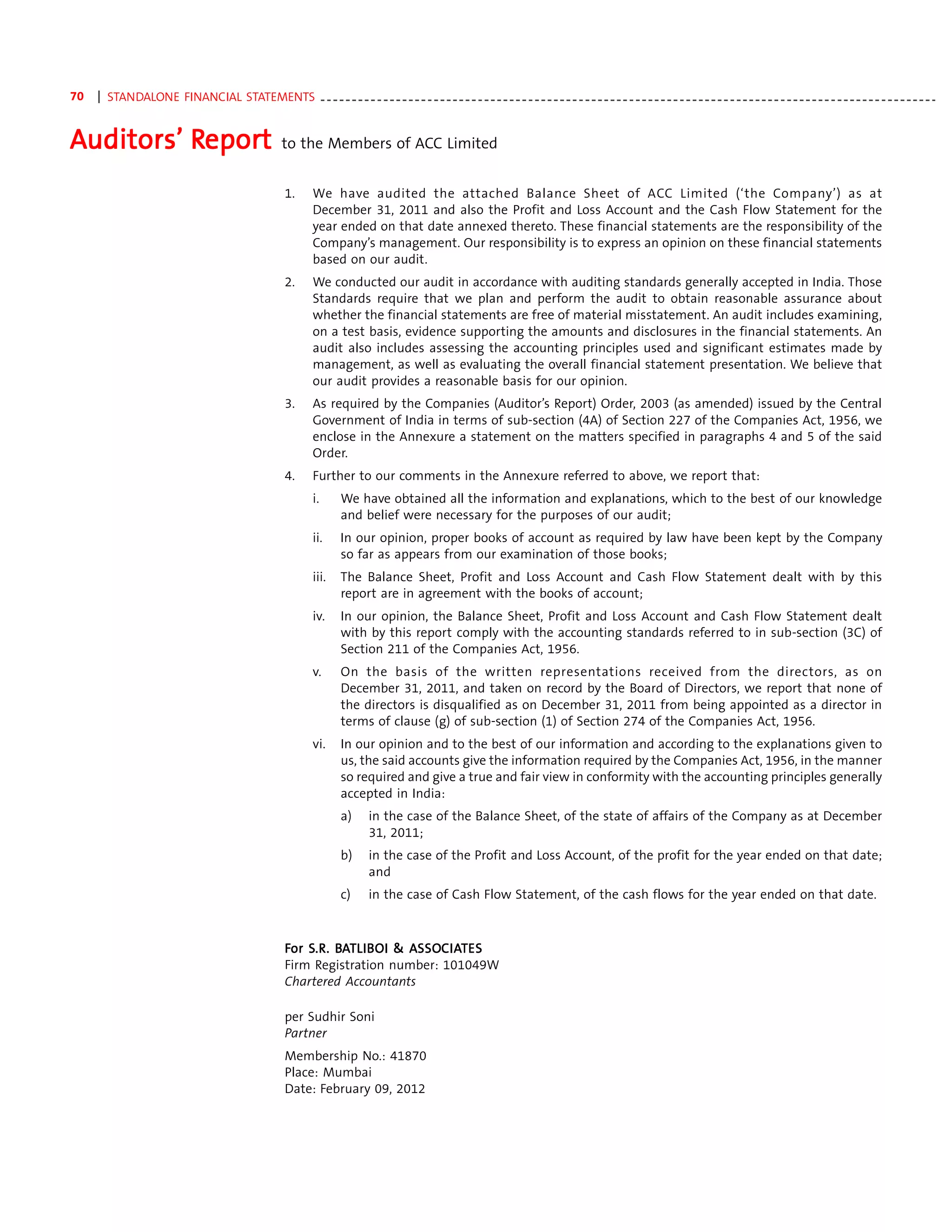

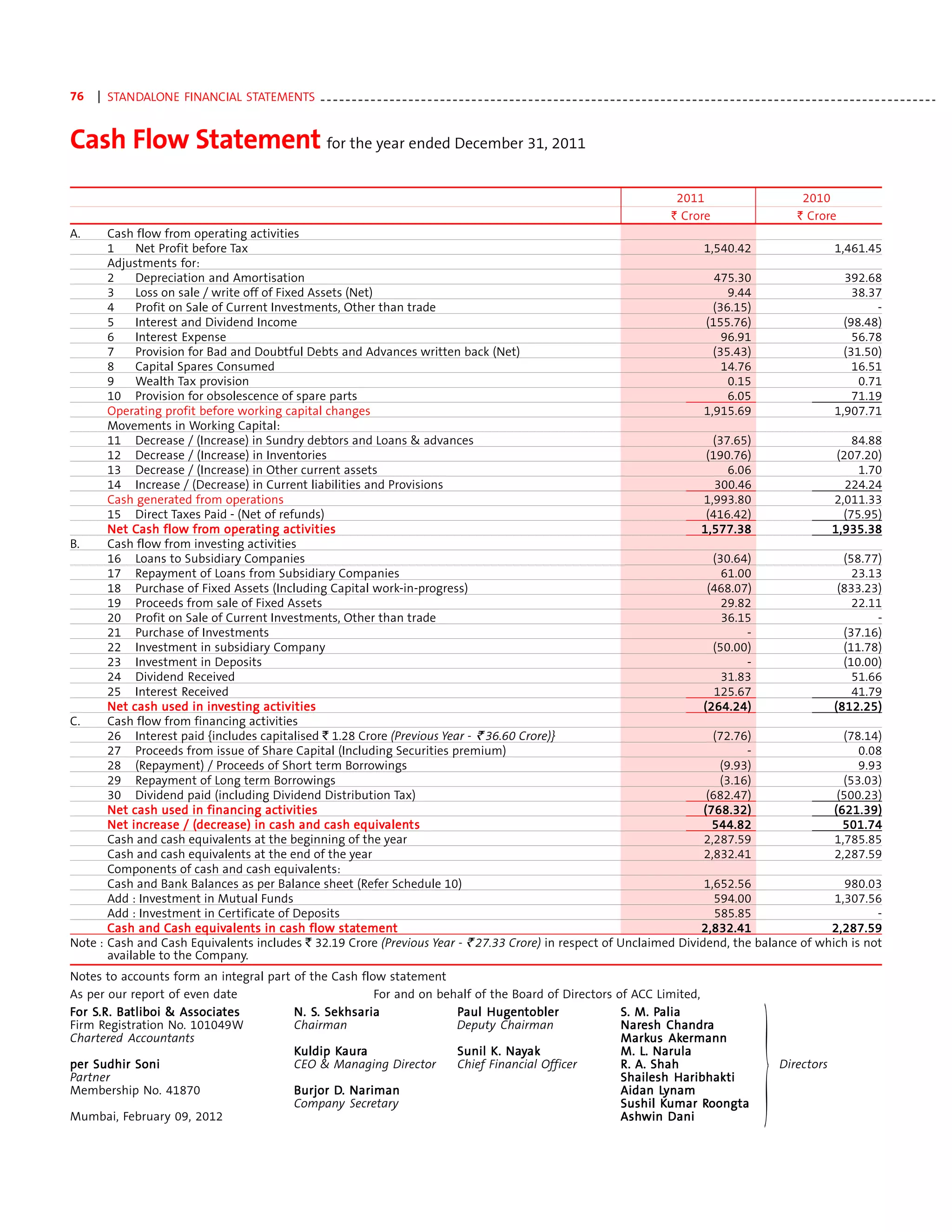

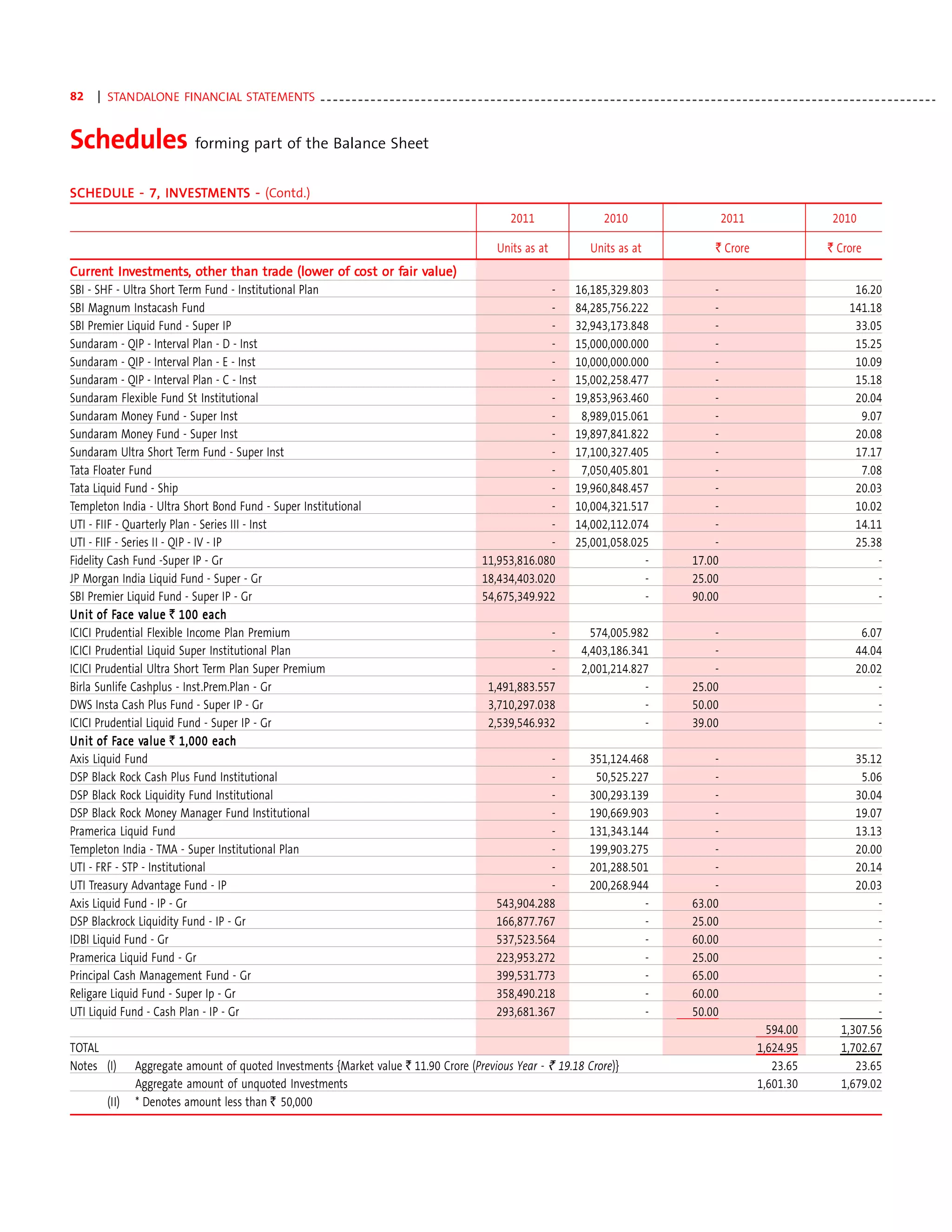

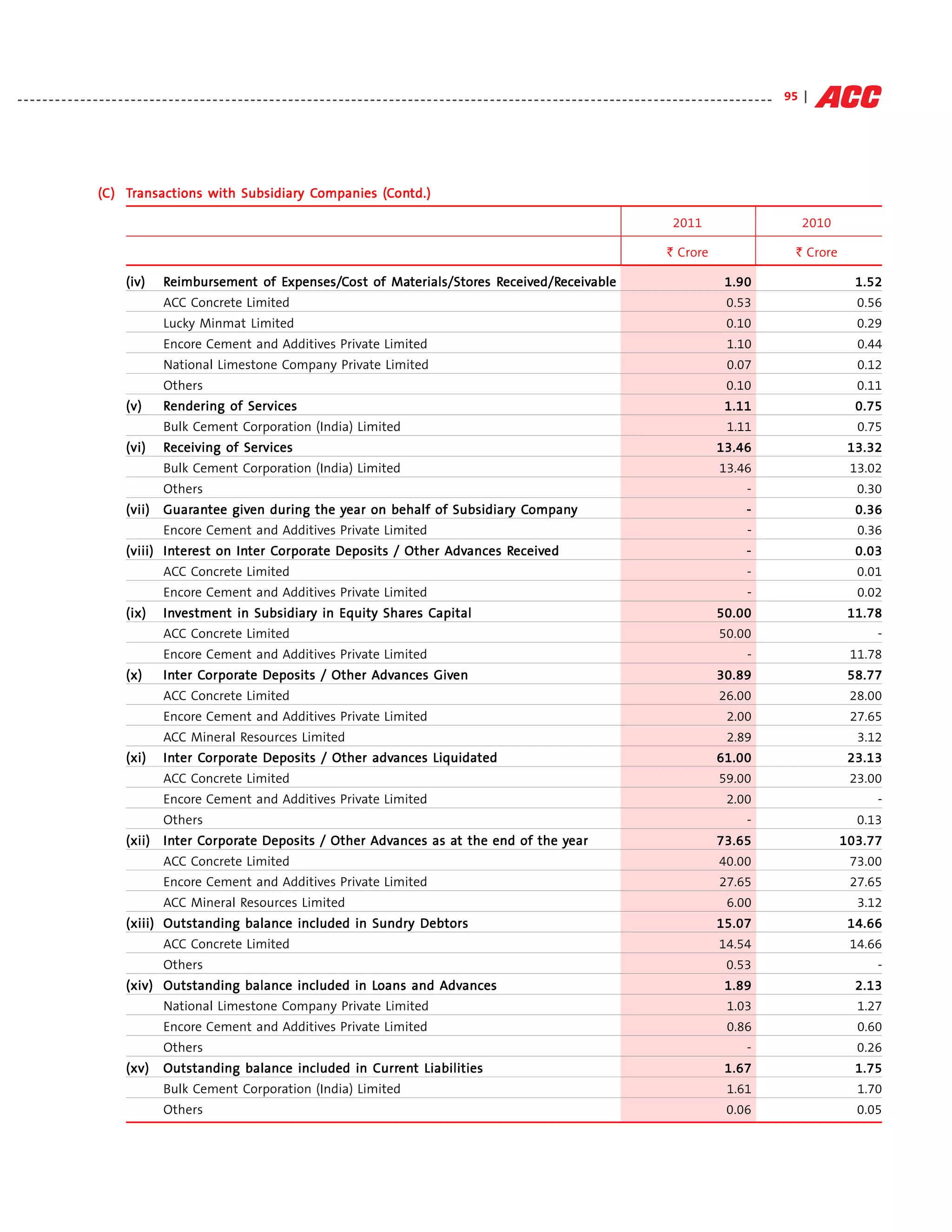

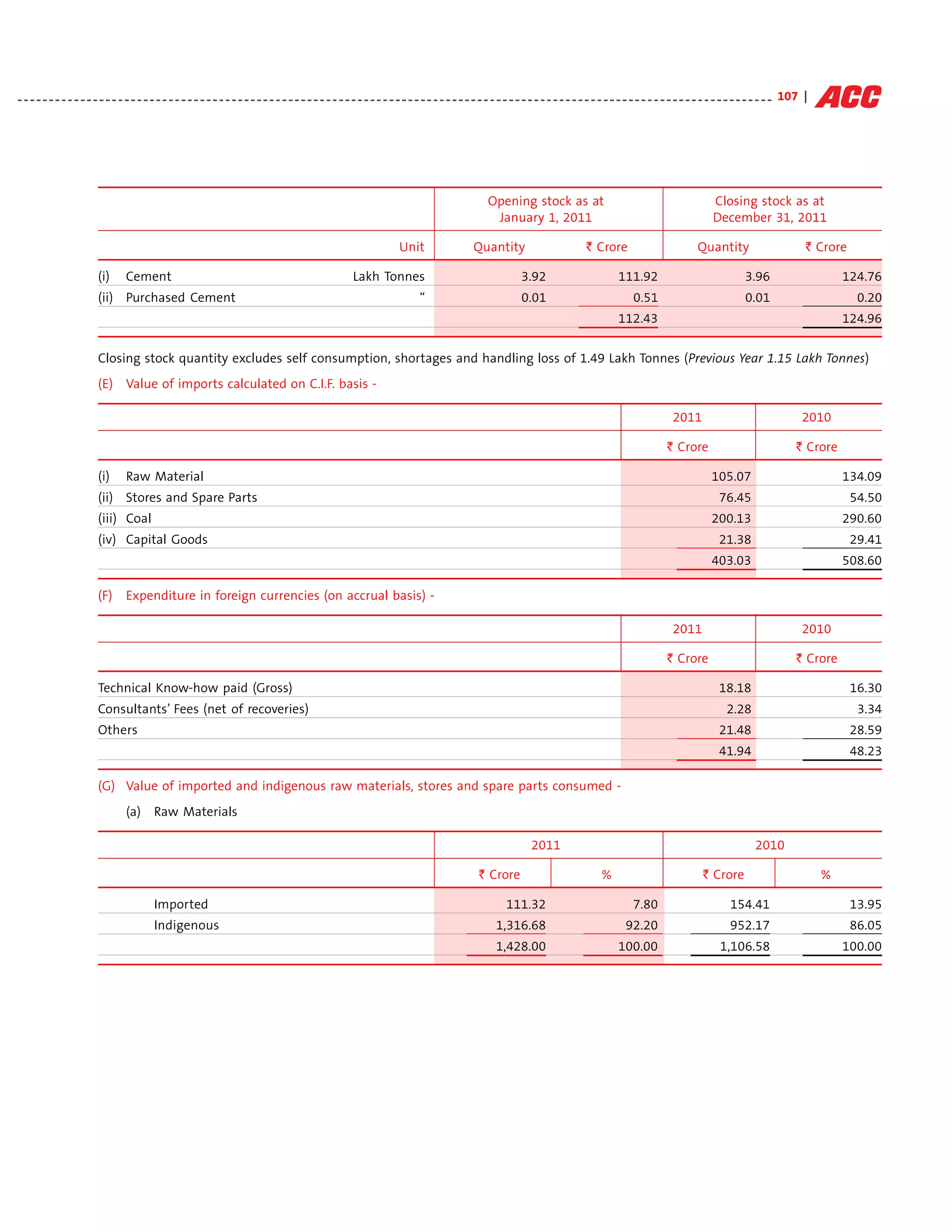

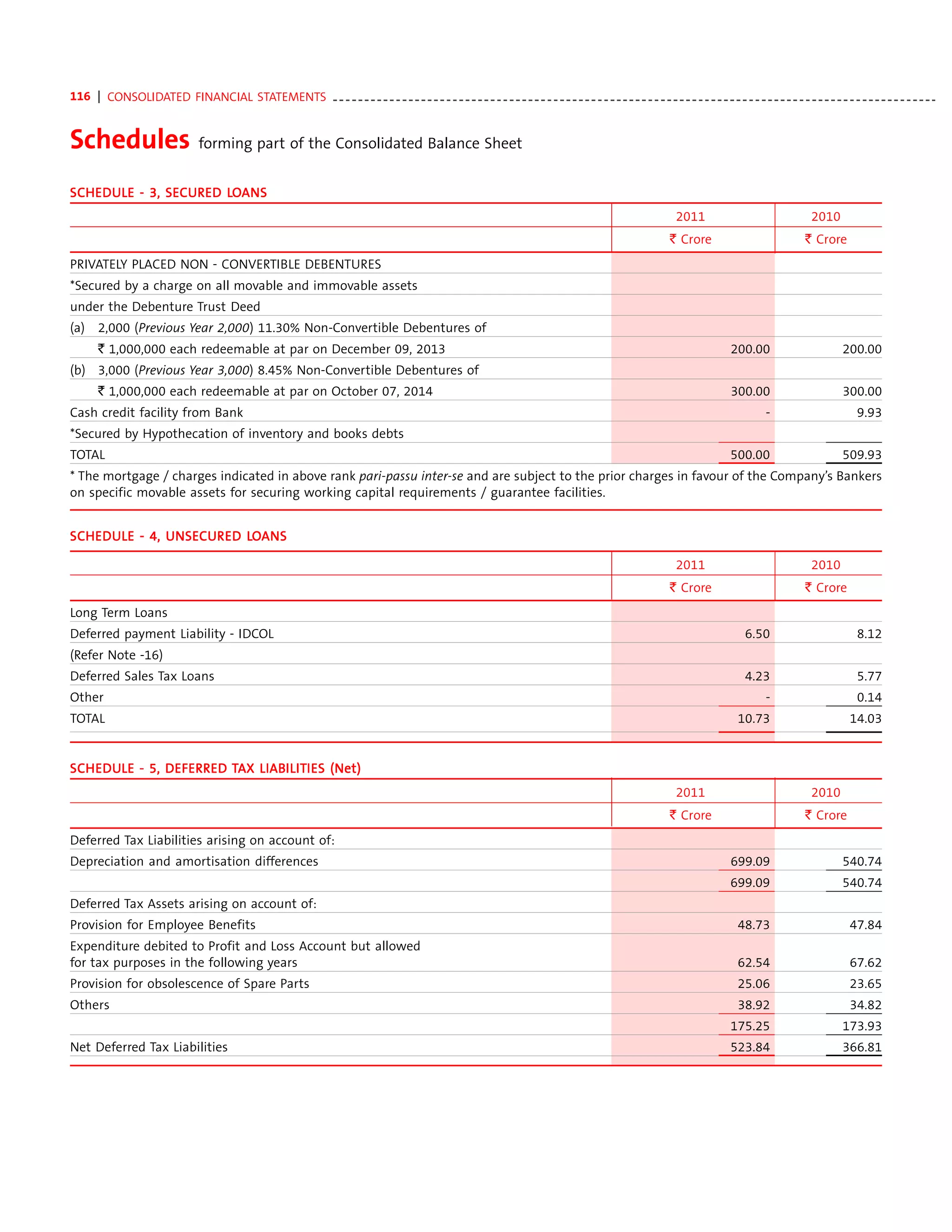

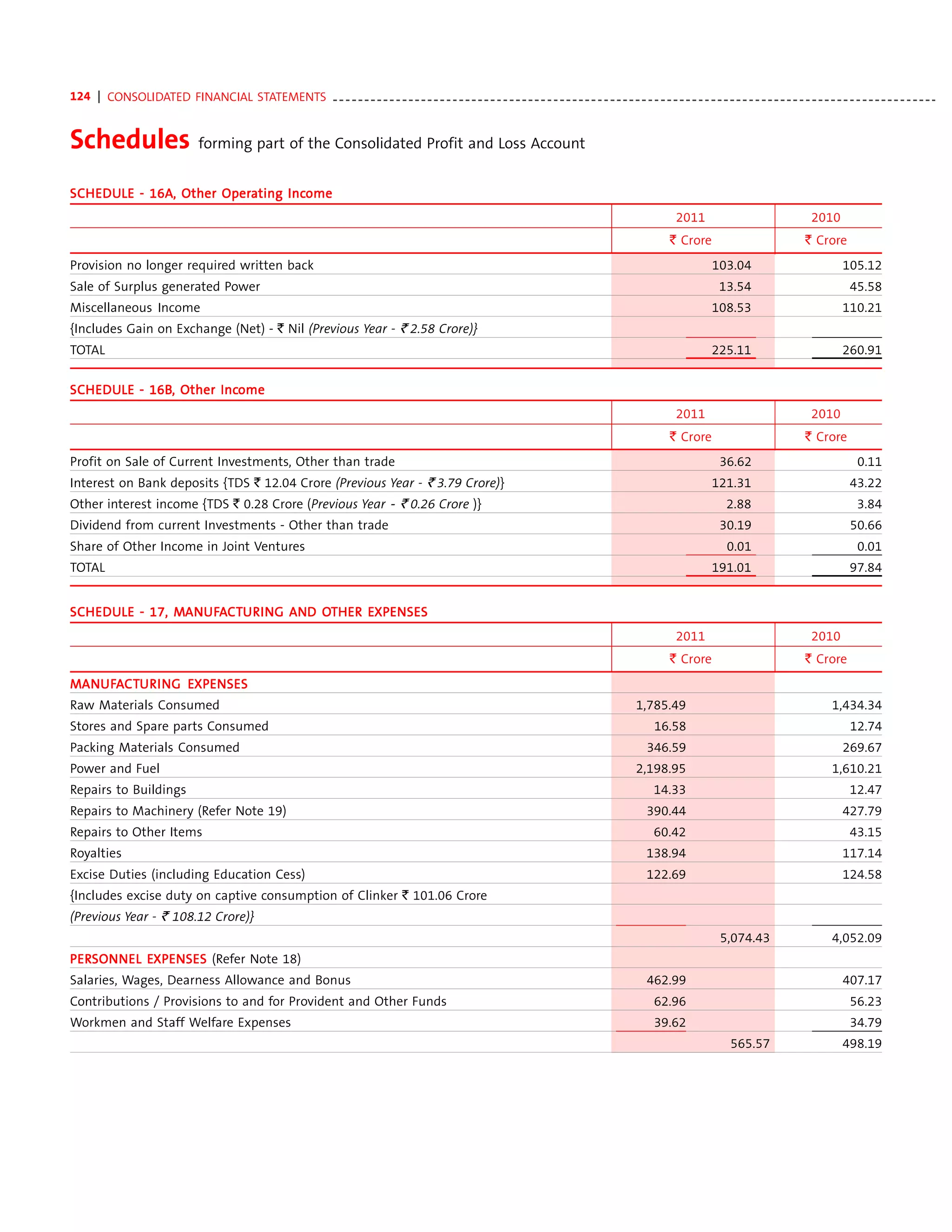

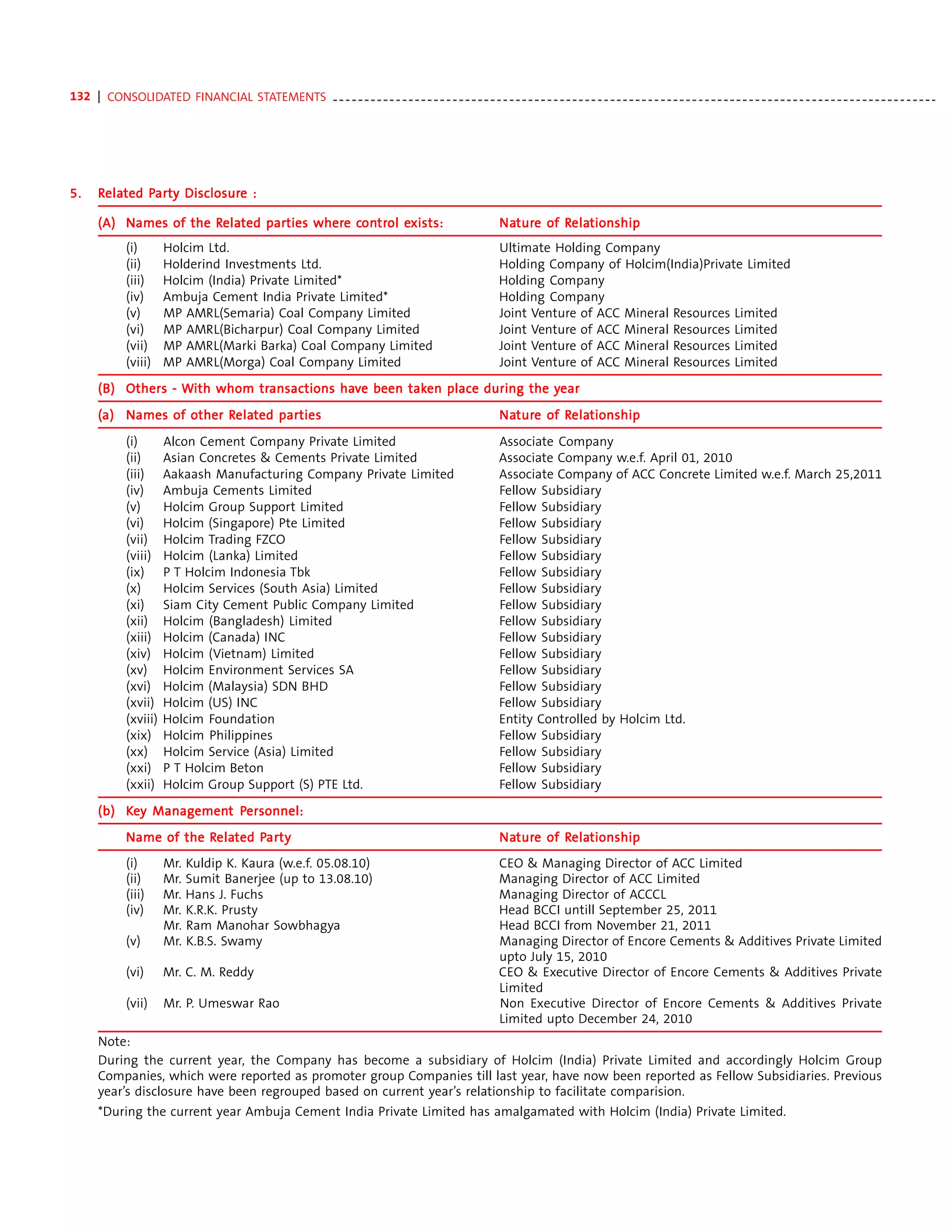

11. Employee Benefits:

a) Defined Contribution Plans – Amount recognised and included in Schedule 16 “Contributions / Provisions to and for Provident

and Other Funds” of Profit and Loss Account ` 7.59 Crore (Previous Year - ` 7.28 Crore).

b) Defined Benefit Plans – As per actuarial valuation on December 31, 2011

The Company has a defined benefit gratuity and post retirement medical benefit plans as given below:

i. Every employee who has completed minimum five years of service is entitled to gratuity at 15 days salary for each completed

year of services. The scheme is funded with insurance companies in the form of a qualifying insurance policy.

ii. Benefits under Post Employment medical Benefit plans are payable for actual domiciliary treatment / hospitalization for

employees and their specified relatives.

Gratuity Post

Employment

Medical

Benefits(PEMB)

Funded Non Funded

` Crore ` Crore ` Crore

I Expense recognised in the Statement of Profit & Loss

rec

ecognised Statemen

tement Profit Loss

year

for the year ended December 31, 2011

1 Current Service cost 6.38 2.20 0.02

5.25 1.60 0.04

2 Interest Cost 8.76 3.20 0.16

6.87 2.15 0.23

3 Employee Contributions - - (0.41)

- - (0.41)

4 Expected return on plan assets (8.82) - -

(7.87) - -

5 Net Actuarial (Gains) / Losses 15.68 7.51 1.13

17.20 10.54 (0.23)

6 Past service cost - - -

- - -

7 Settlement / Curtailment (Gain) - - -

- - -

8 Total expense 22.00 12.91 0.90

21.45 14.29 (0.37)

II Asset/(Liability) rec

ecognised

Net Asset /(Liability) recognised in the Balance Sheet

as at December 31, 2011

at

1 Present value of Defined Benefit Obligation (134.32) (52.05) (2.58)

(117.16) (41.83) (2.28)

2 Fair value of plan assets 118.77 - -

103.72 - -

3 Funded status [Surplus / (Deficit)] (15.55) - -

(13.44) - -

4 Net asset / (liability) (15.55) (52.05) (2.58)

(13.44) (41.83) (2.28)](https://image.slidesharecdn.com/accannualreport2011-121108234301-phpapp01/75/Acc-annual-report-2011-103-2048.jpg)

![136 | CONSOLIDATED FINANCIAL STATEMENTS - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

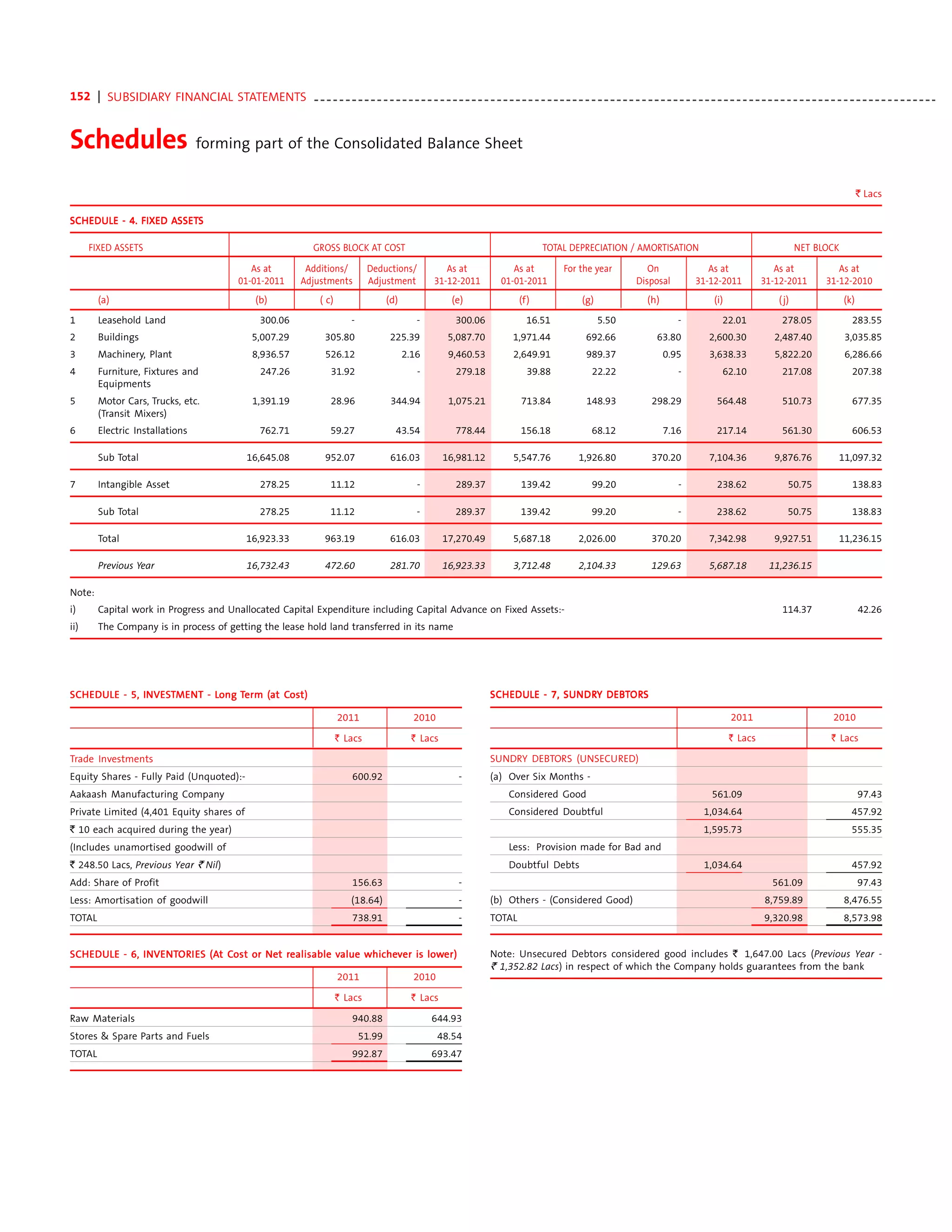

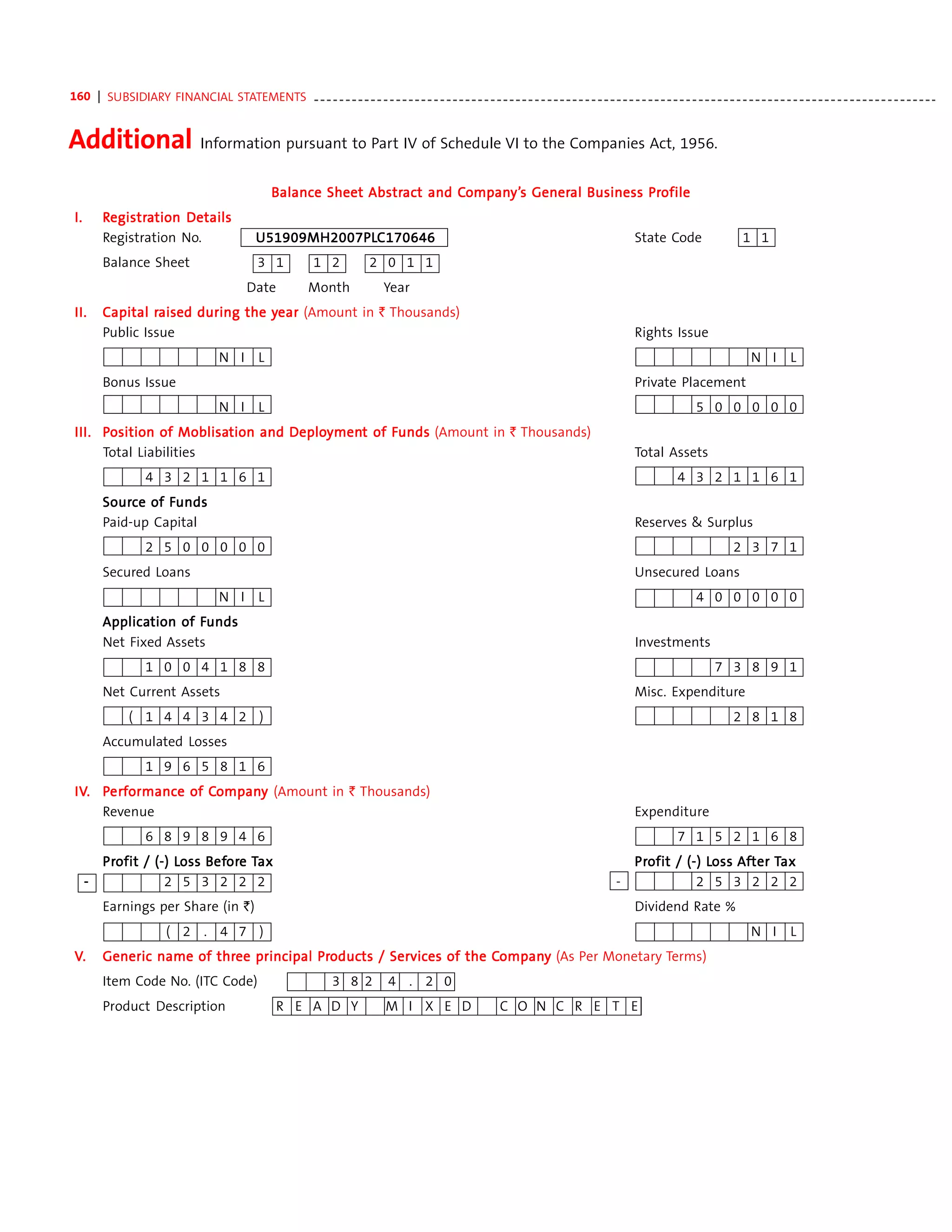

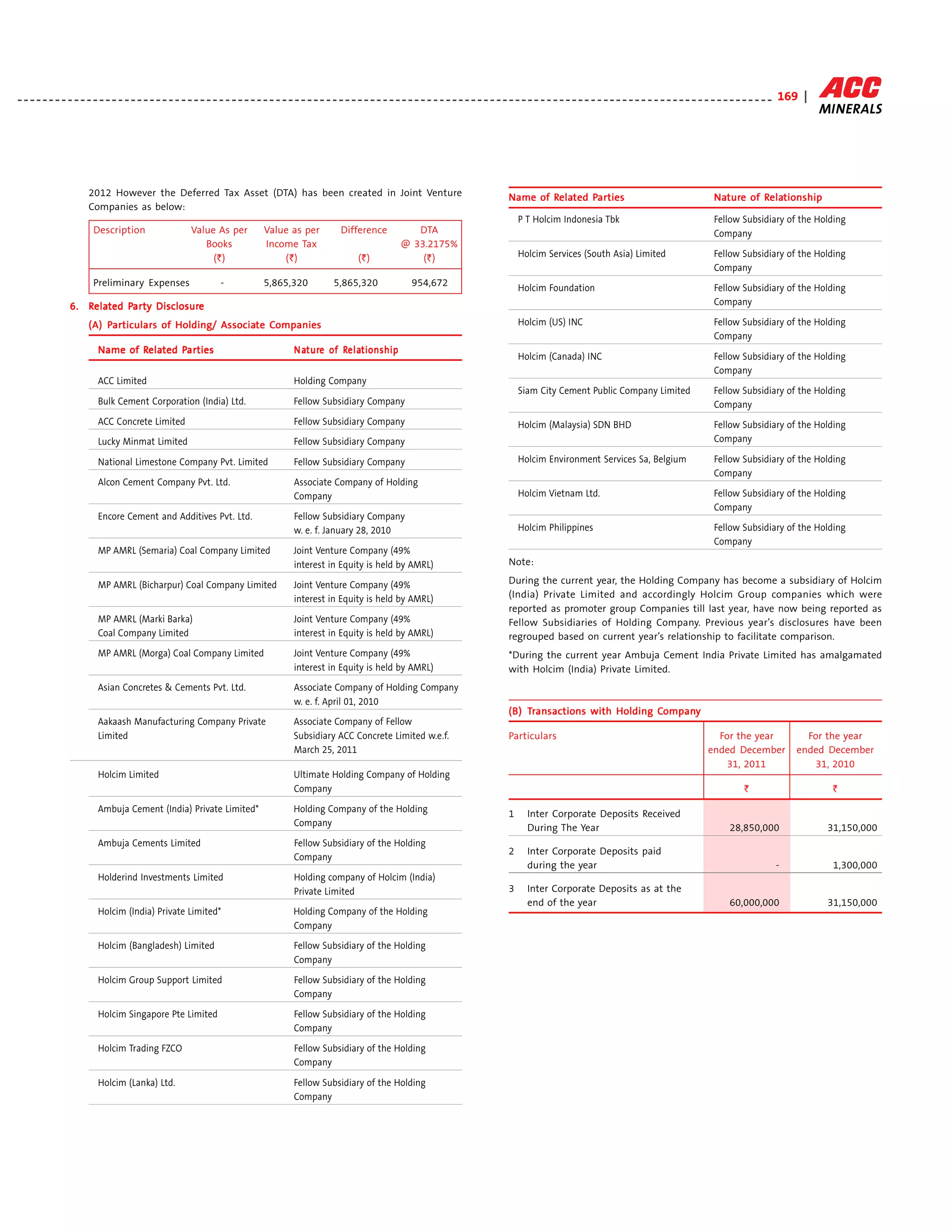

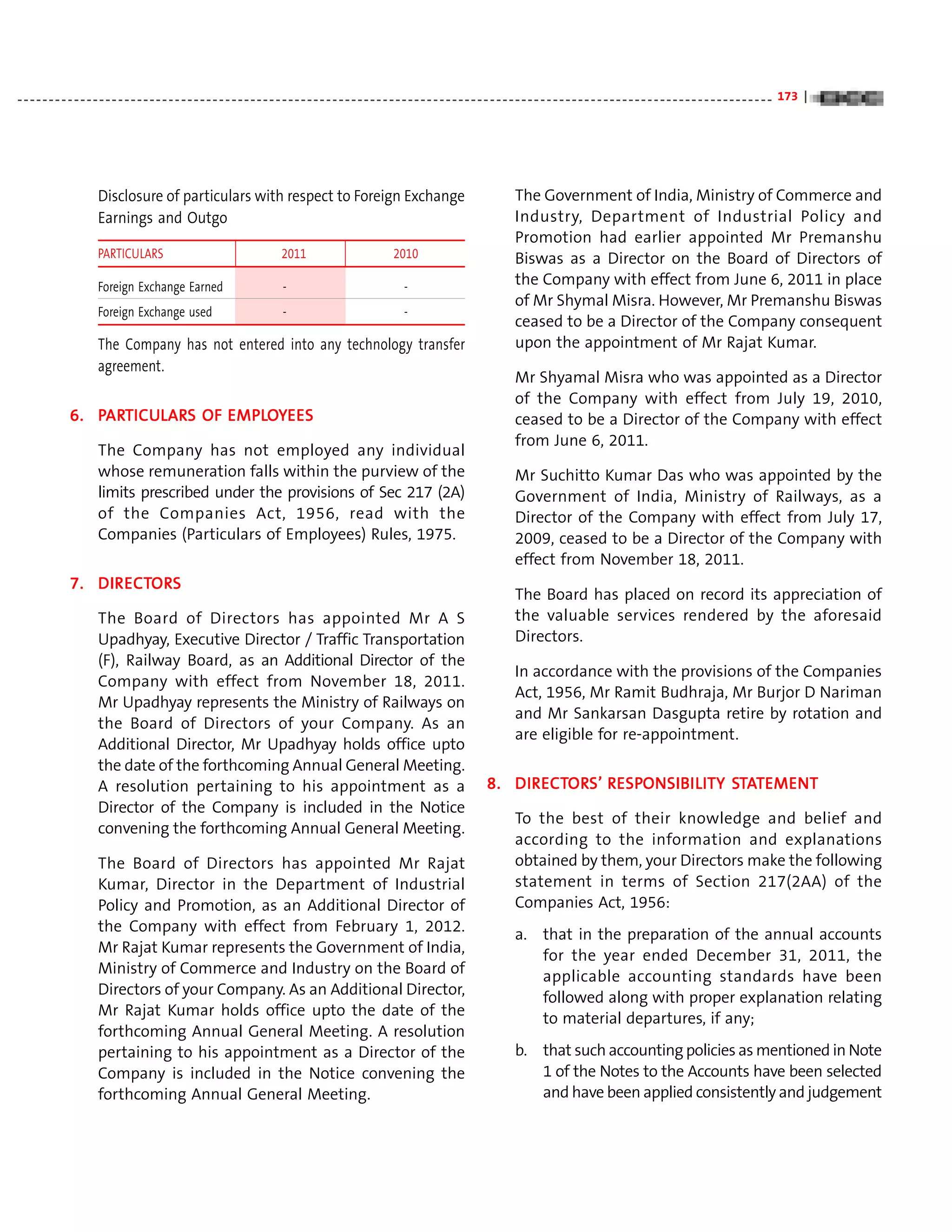

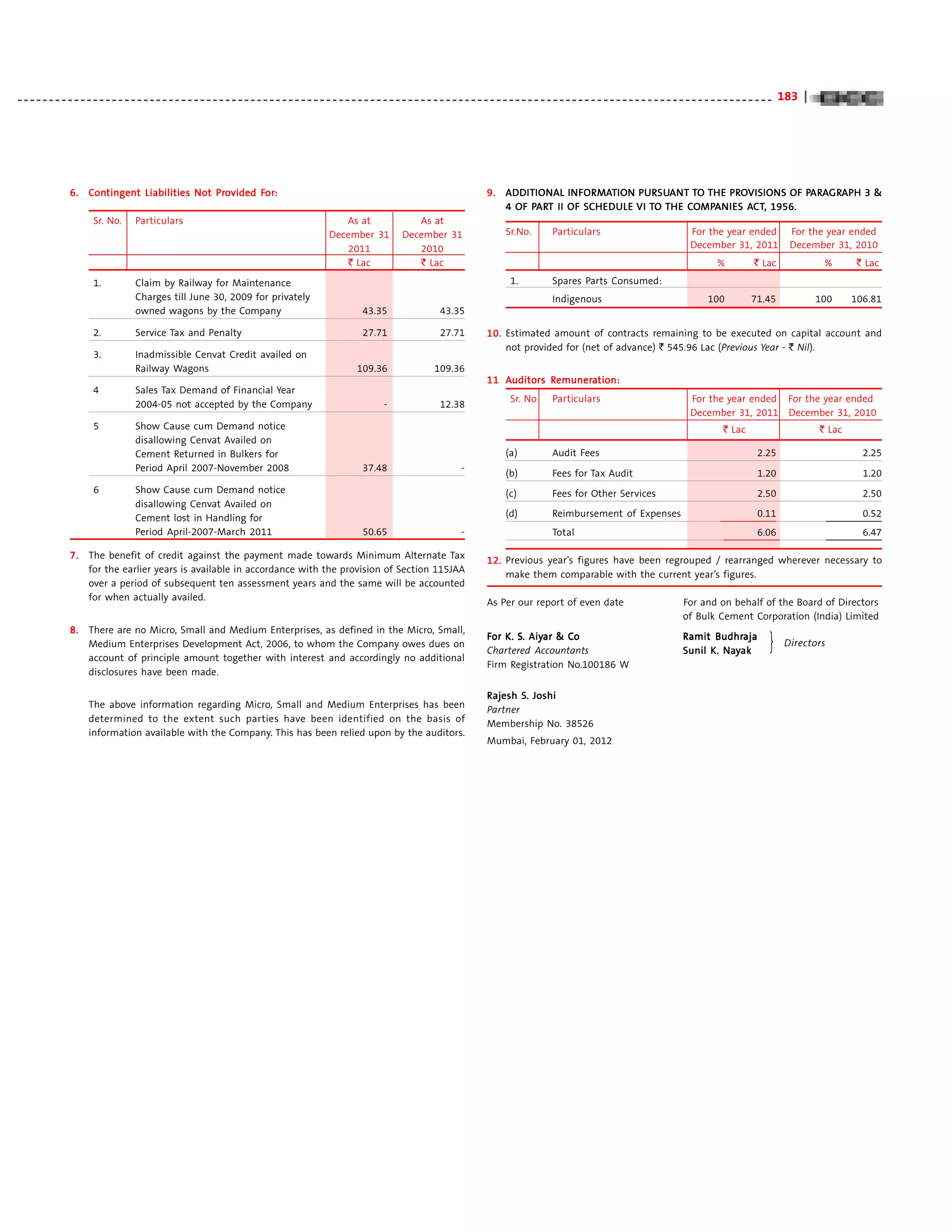

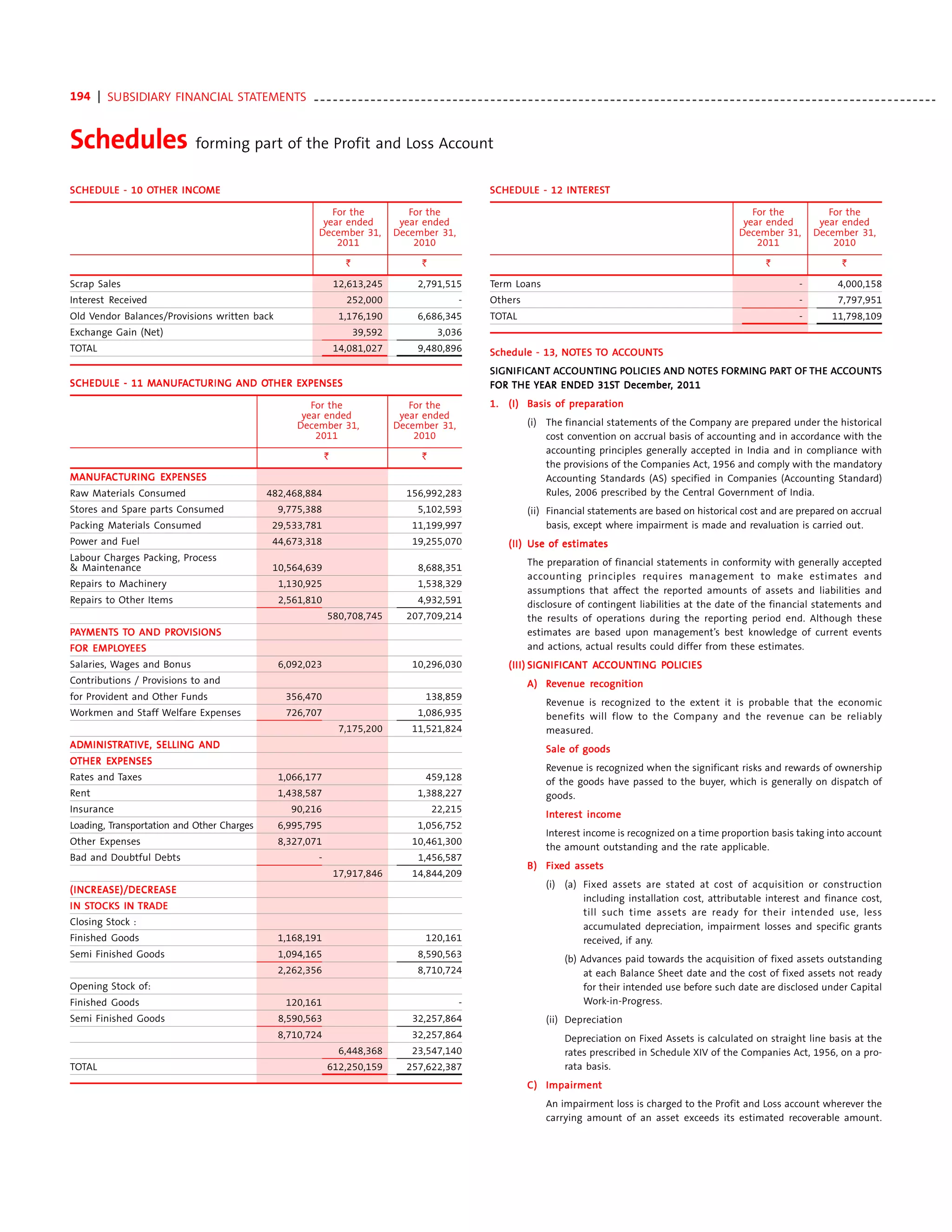

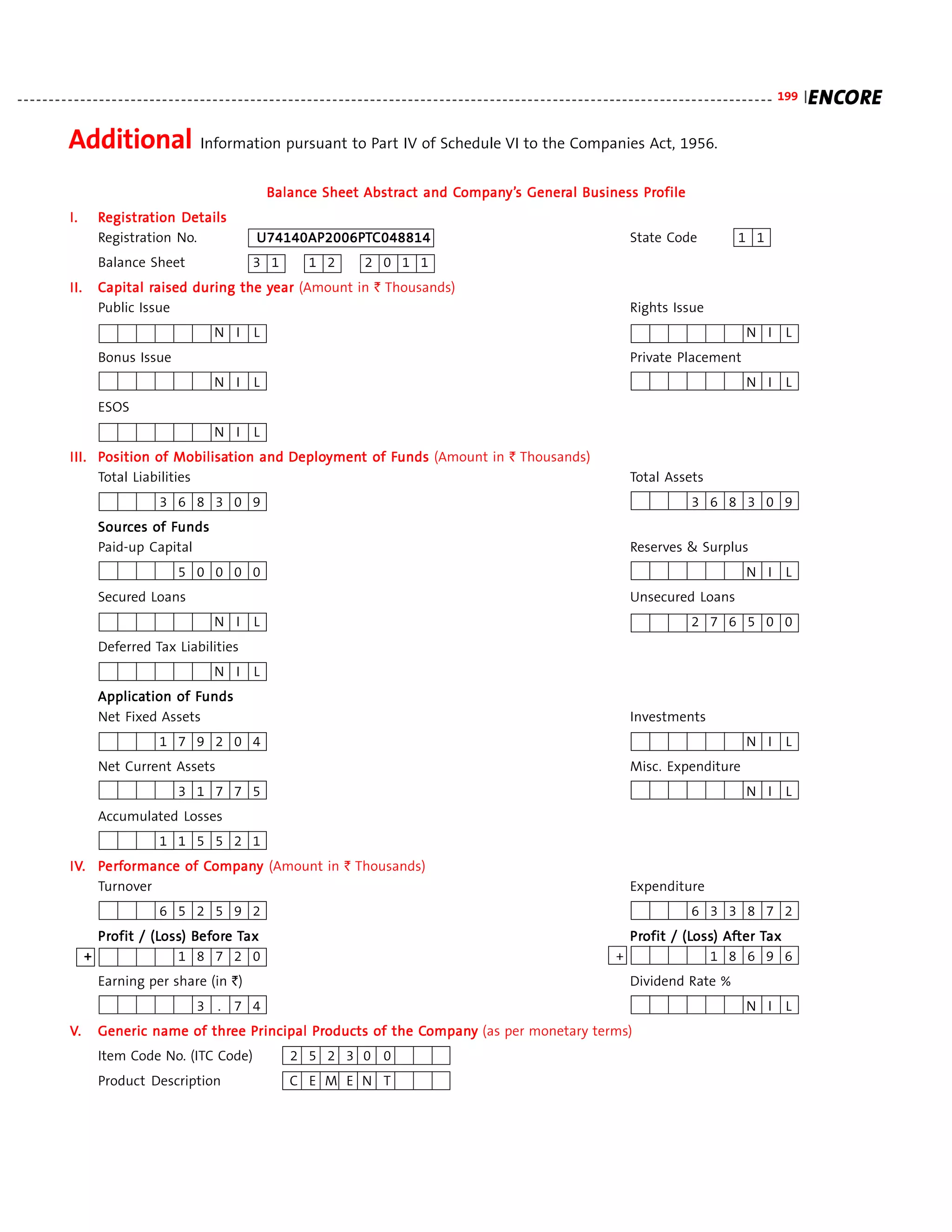

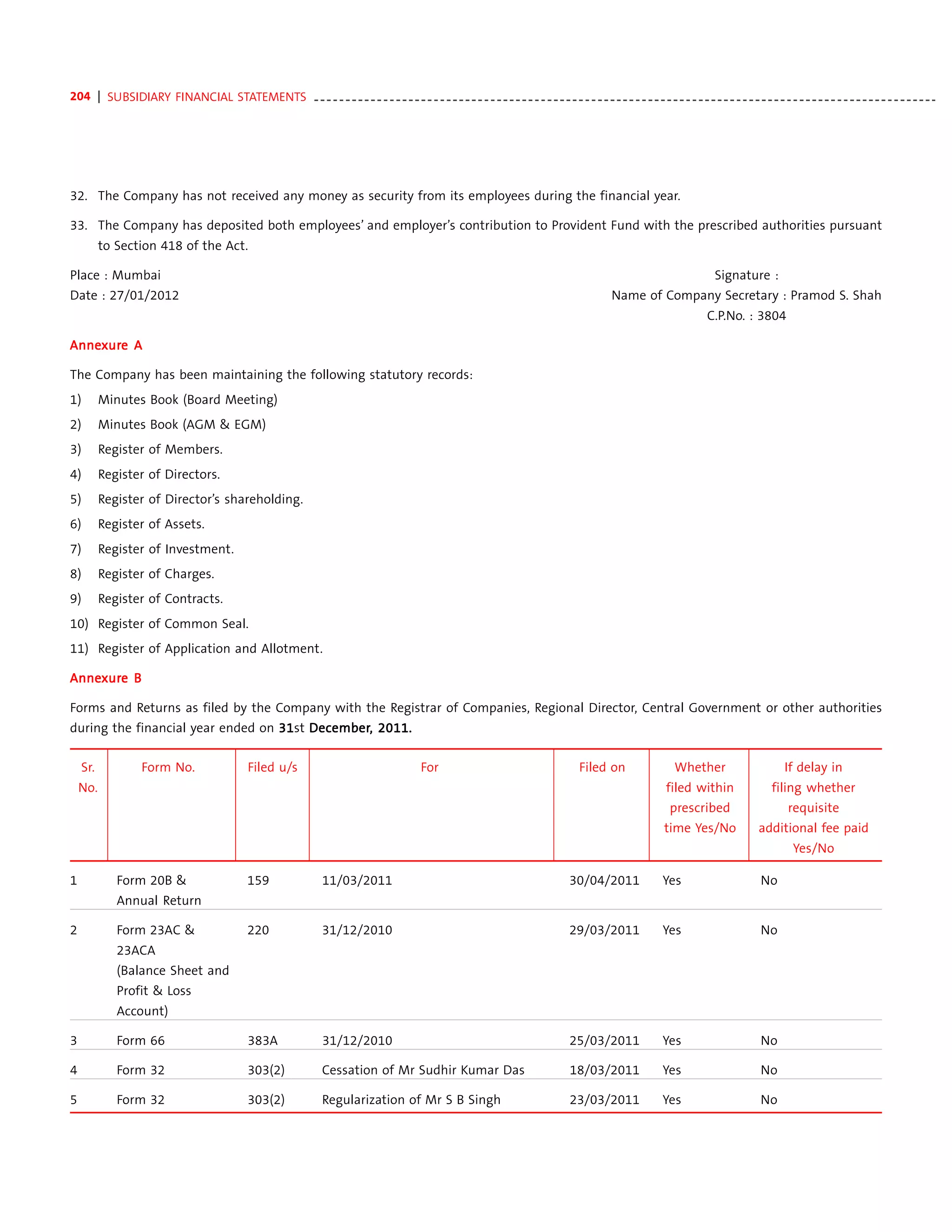

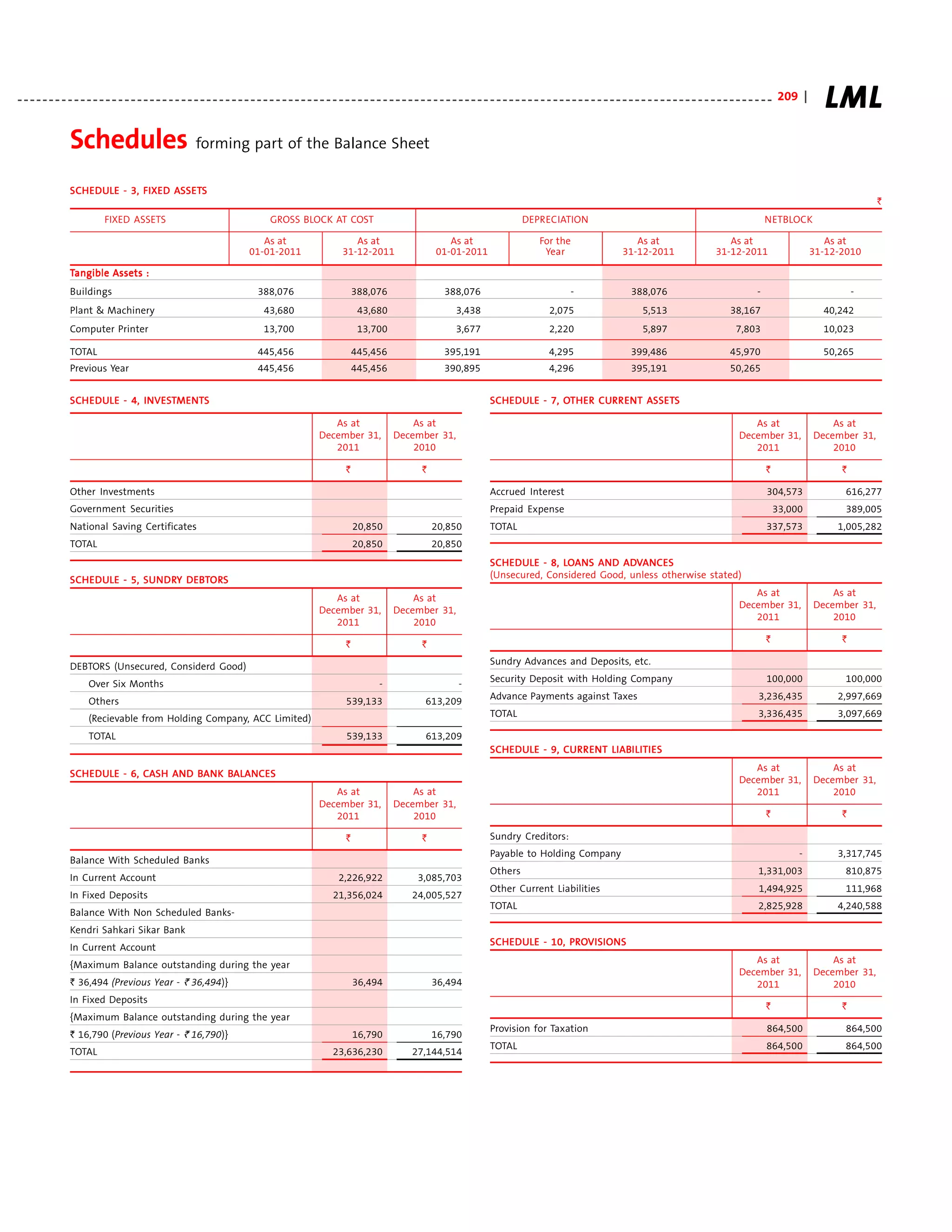

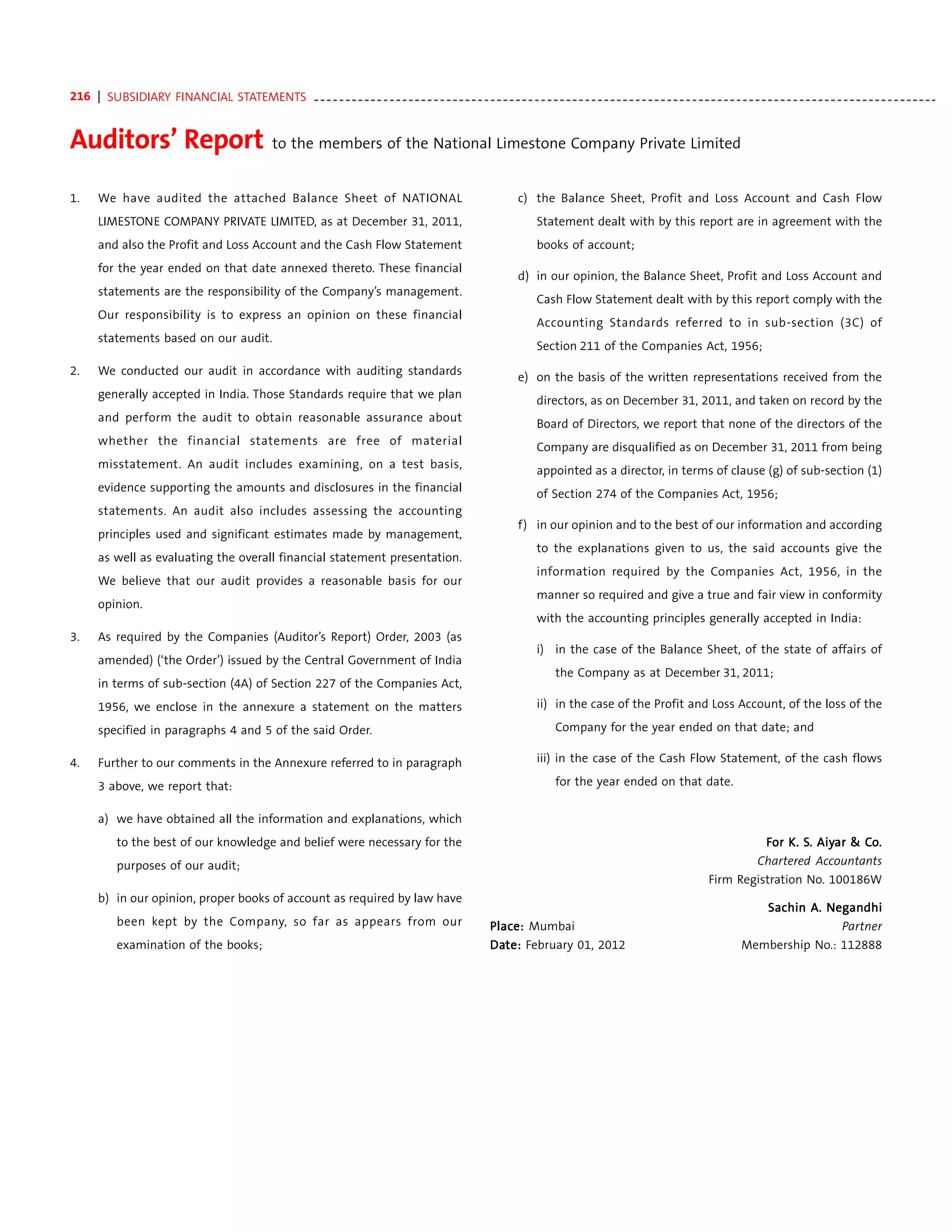

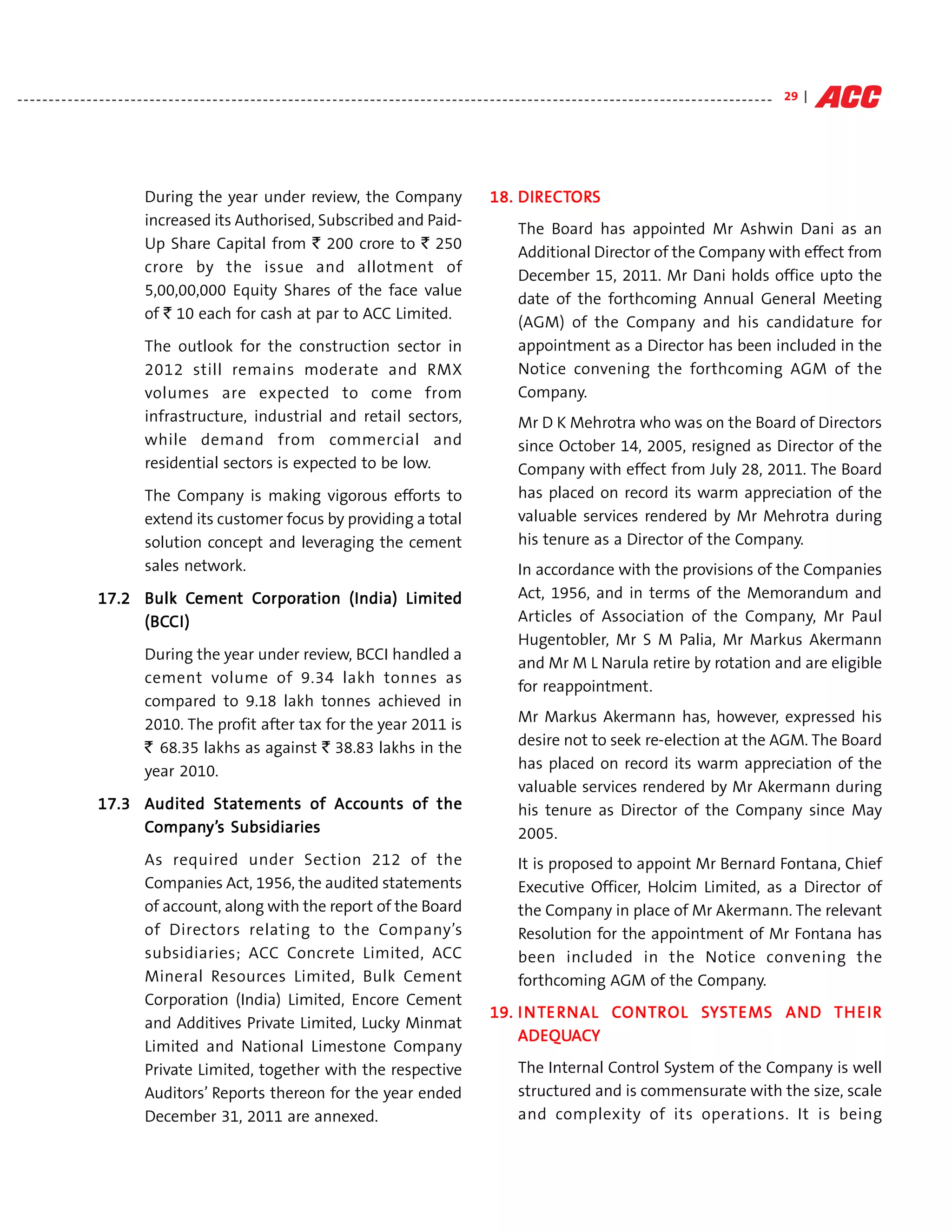

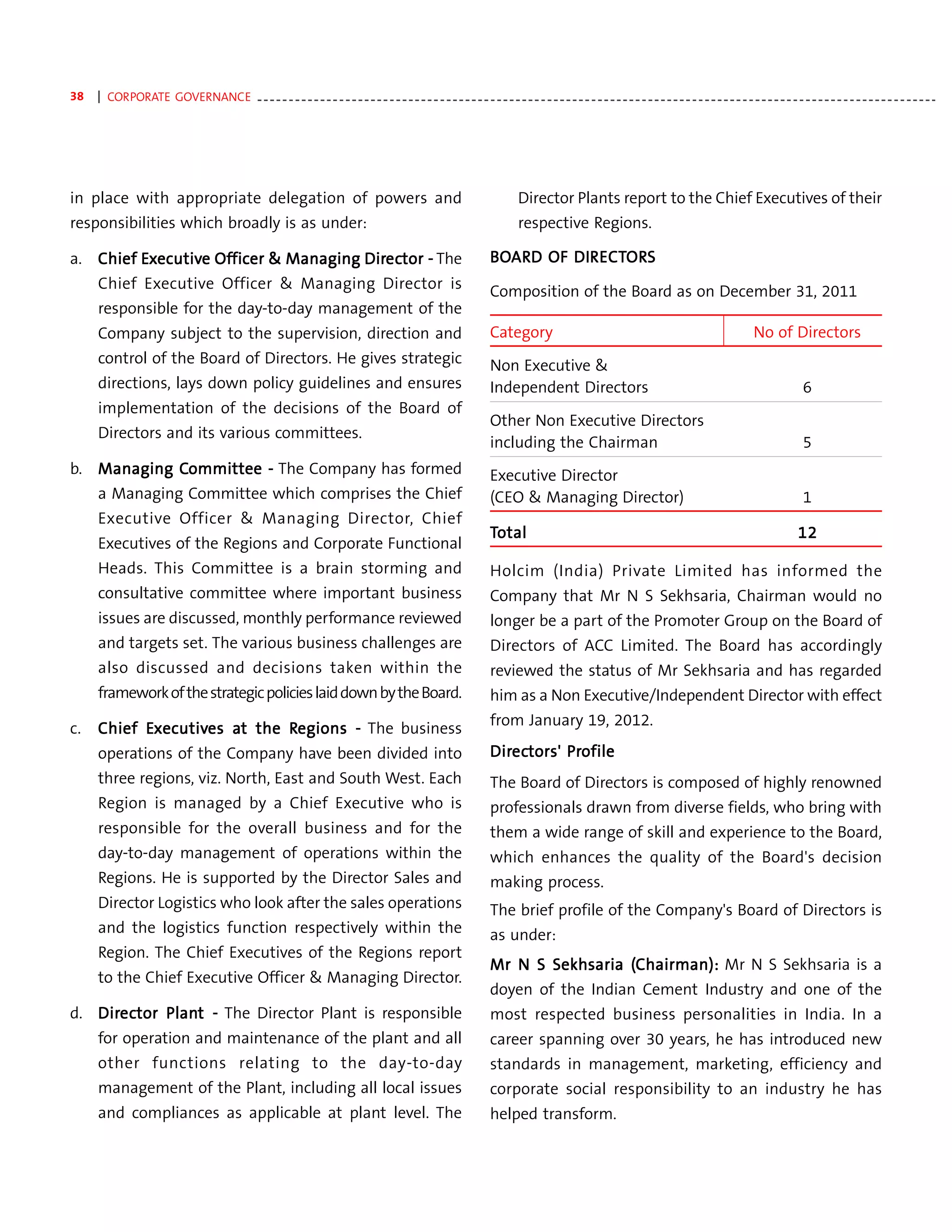

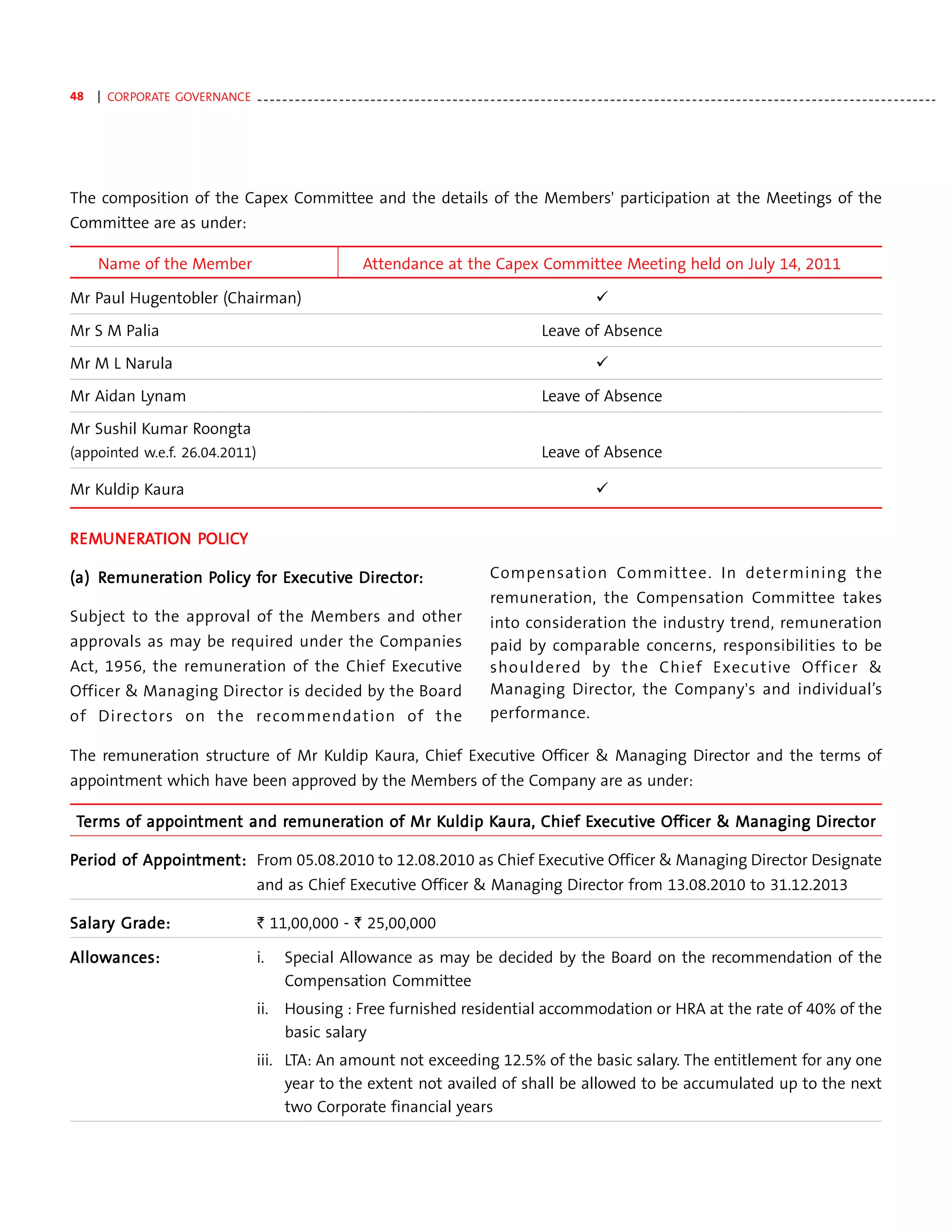

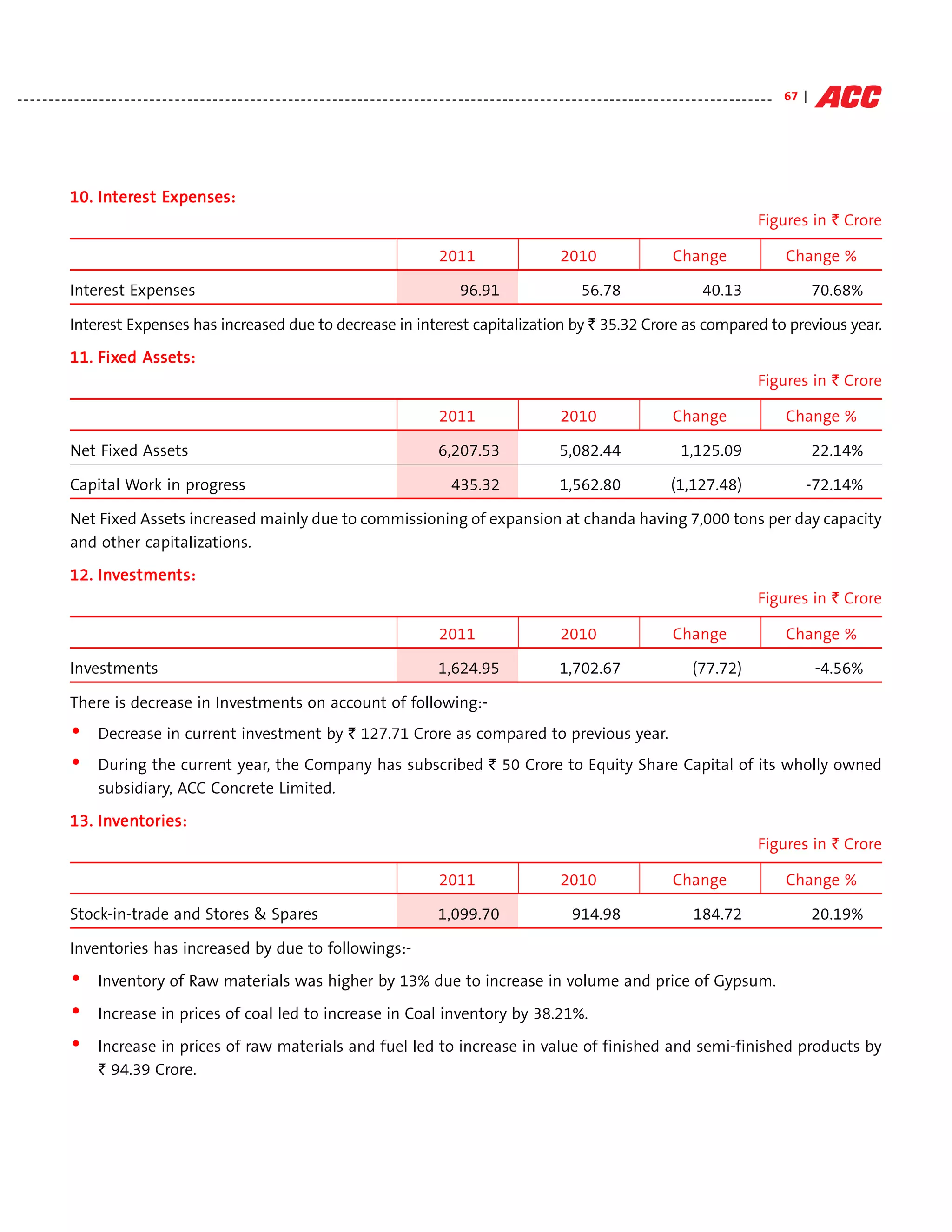

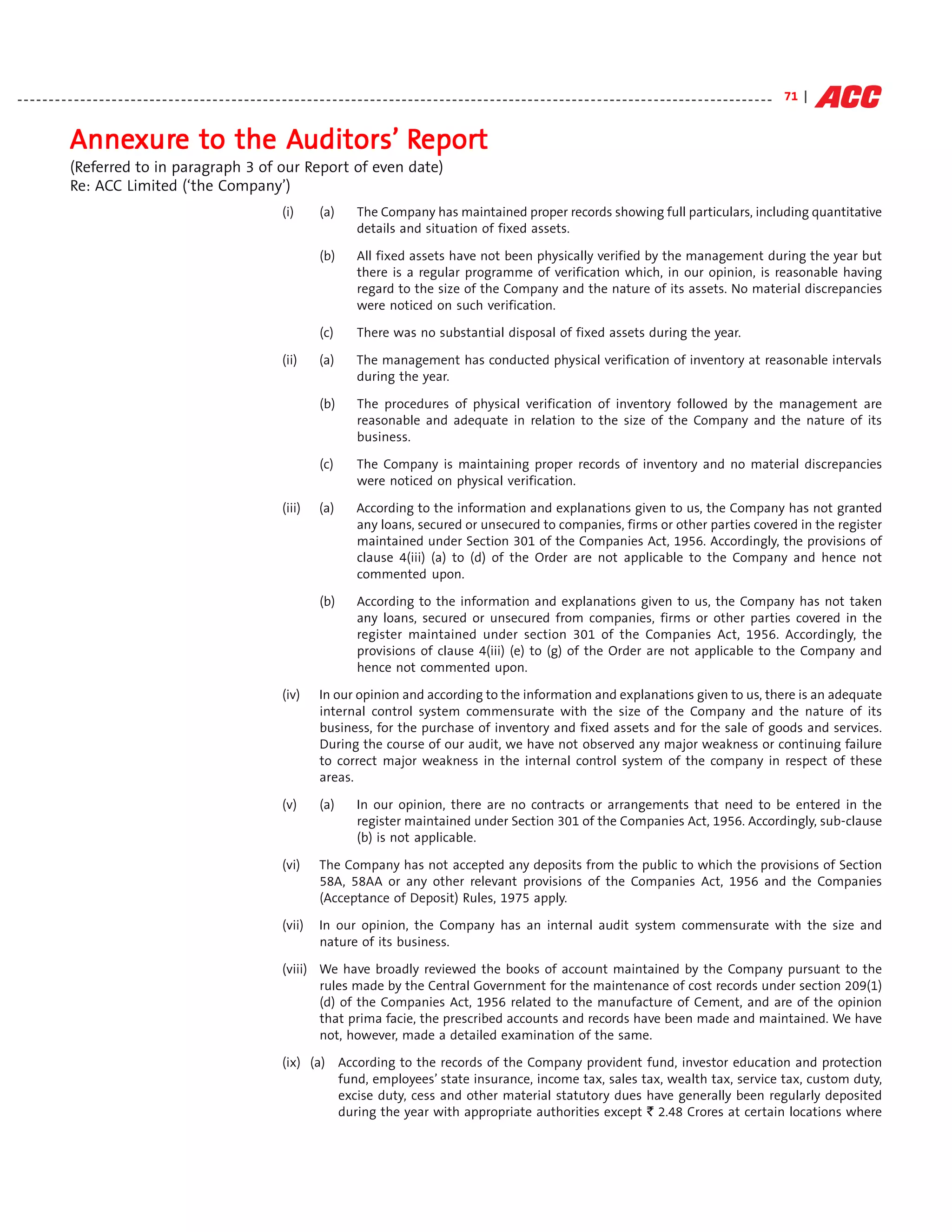

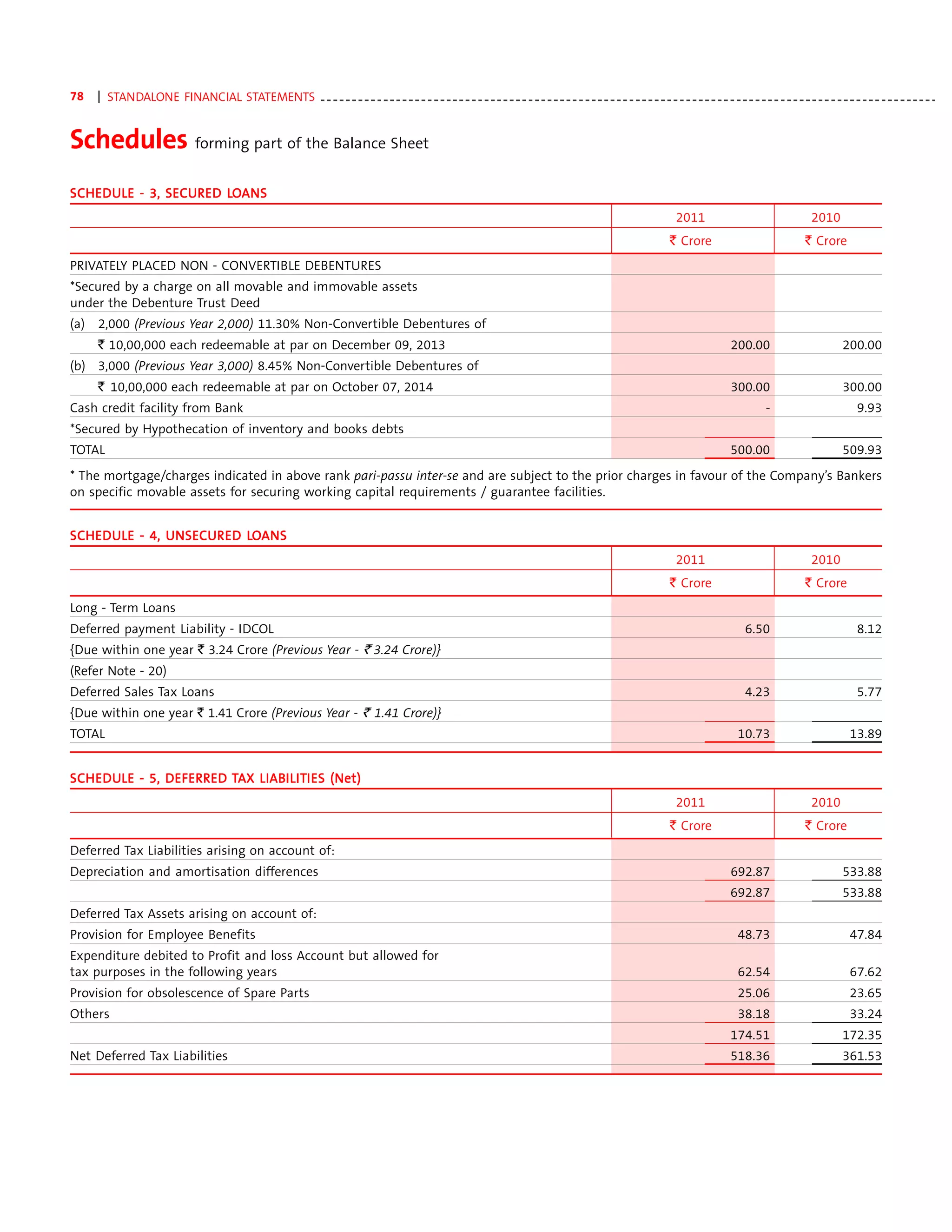

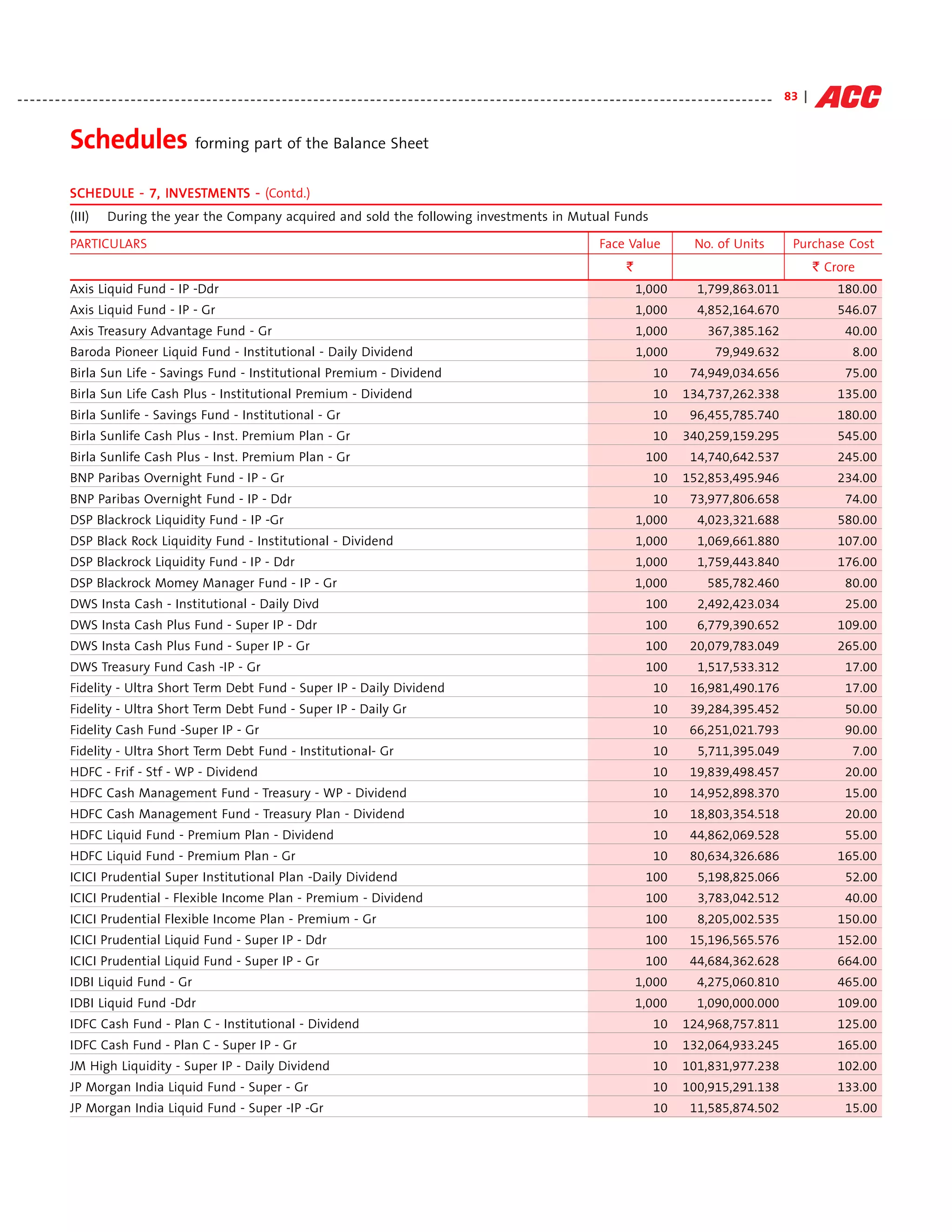

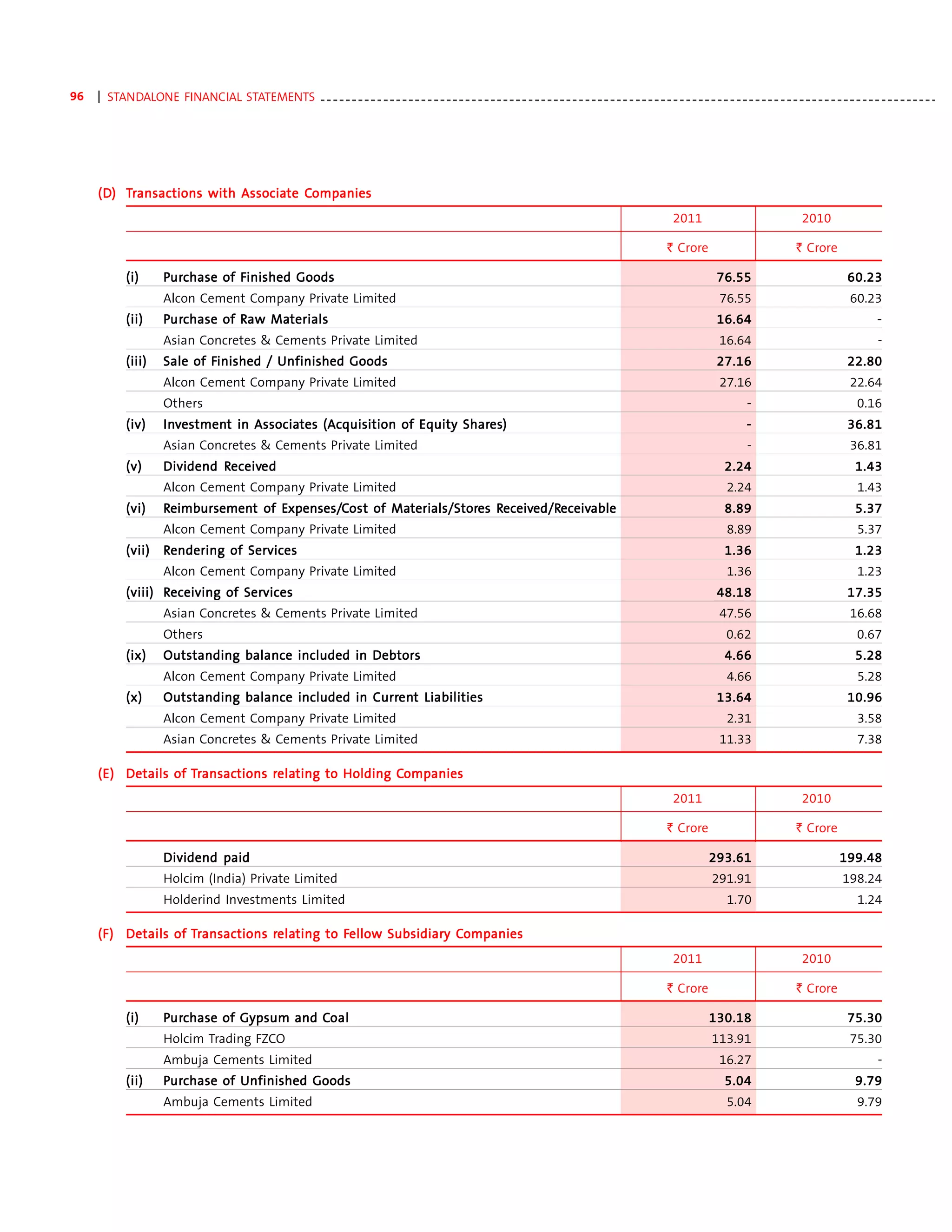

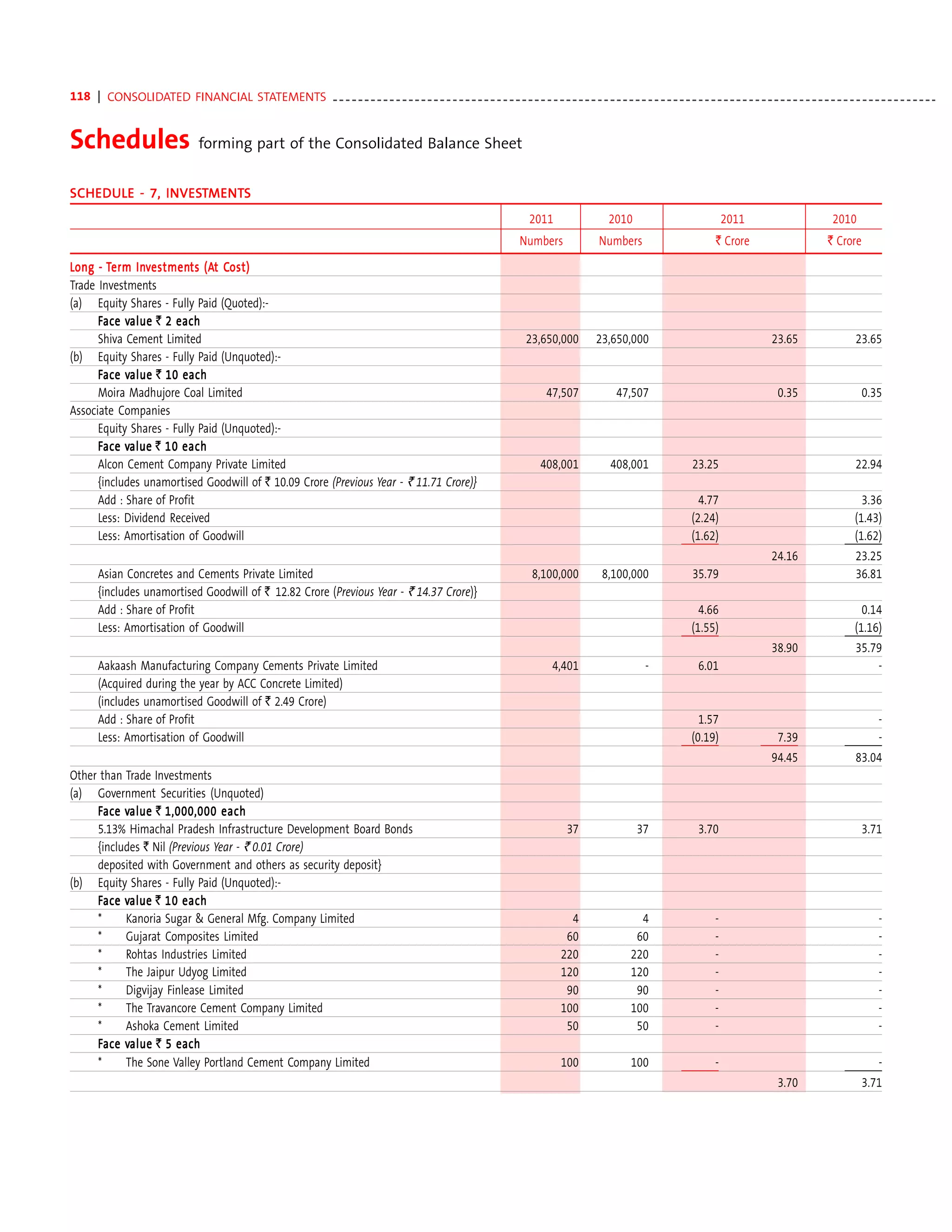

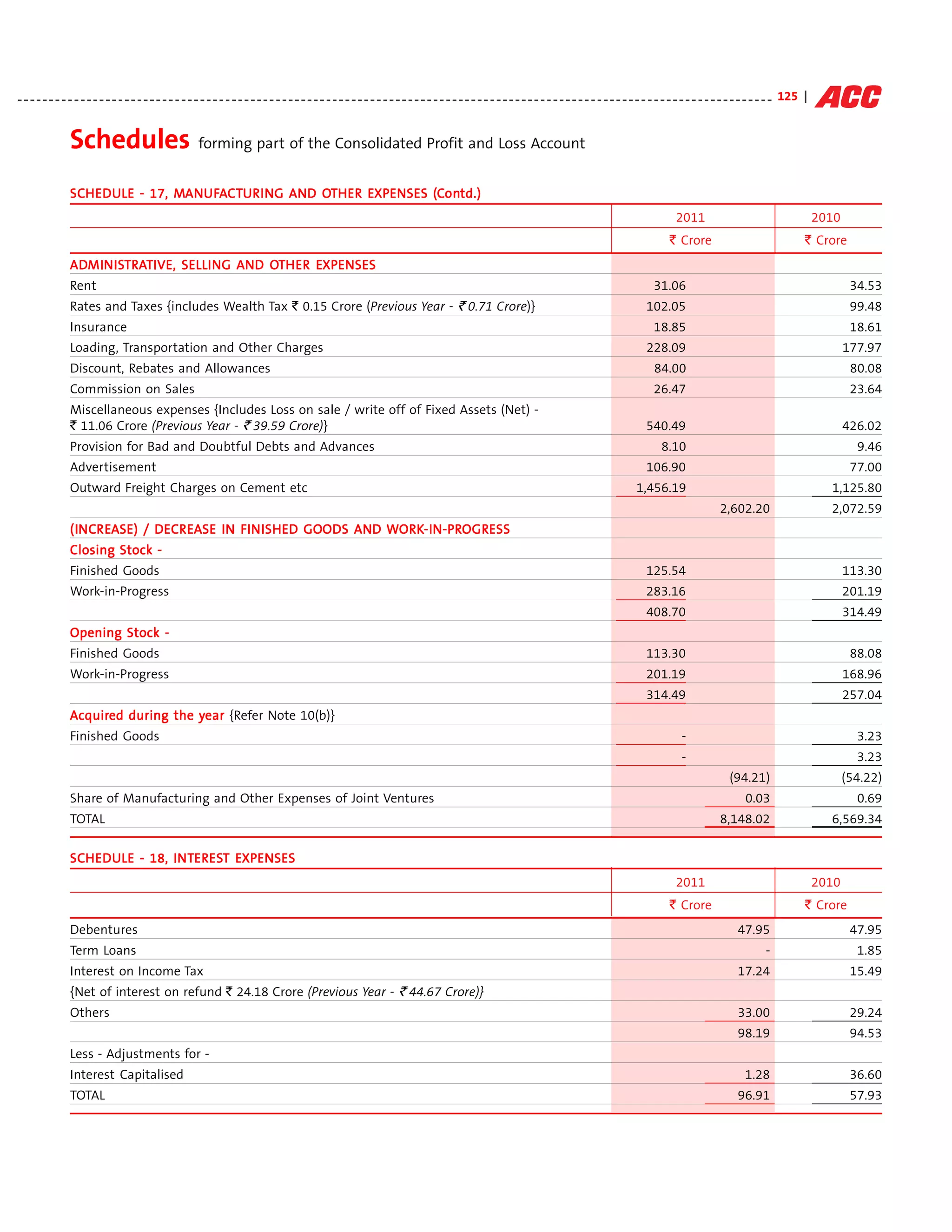

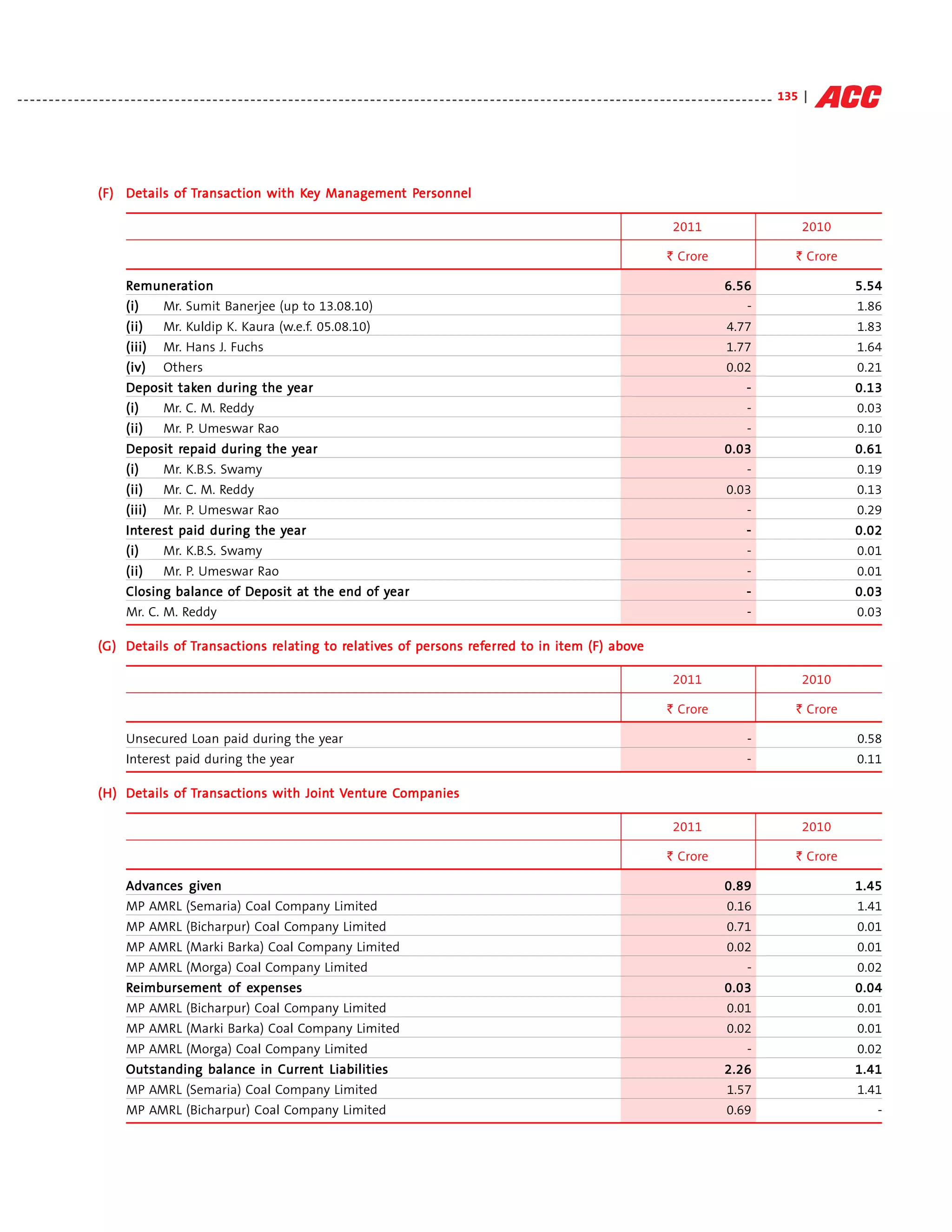

6. Consolidated Earnings per Share - [EPS]

onsolidated Earnings Share [EPS]

2011 2010

` Crore ` Crore

(I) Net Profit as per Consolidated Profit and Loss Account 1,300.80 1077.53

(II) Weighted average number of equity shares for Earnings per Share computation

Shares for Basic Earnings per Share 18,77,45,356 18,77,44,727

Add: Potential diluted equity shares 4,39,316 4,16,549

Number of Shares for Diluted Earnings per Share 18,81,84,672 18,81,61,276

(III) Earnings per Share

Face value per Share ` 10.00 10.00

Basic ` 69.29 57.39

Diluted ` 69.12 57.27

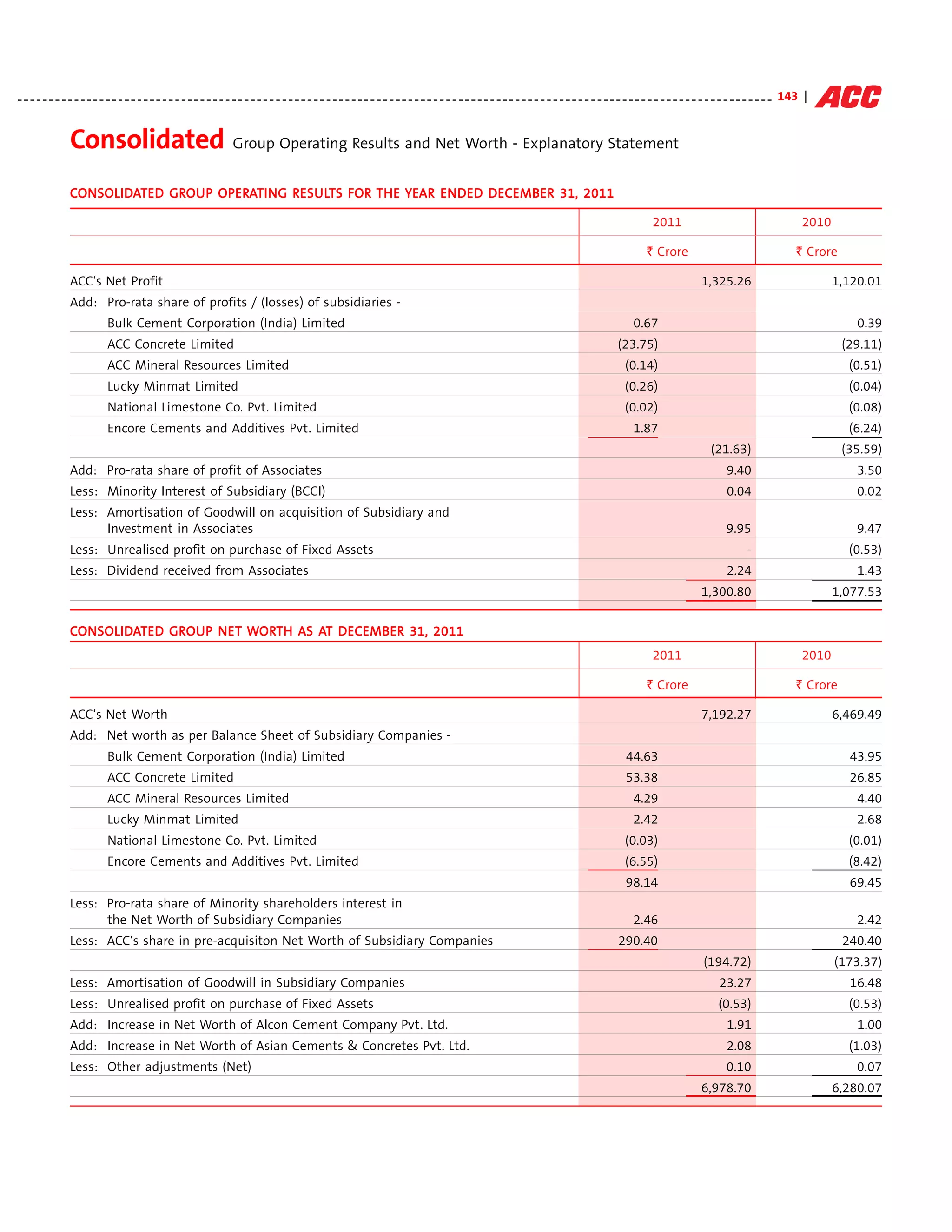

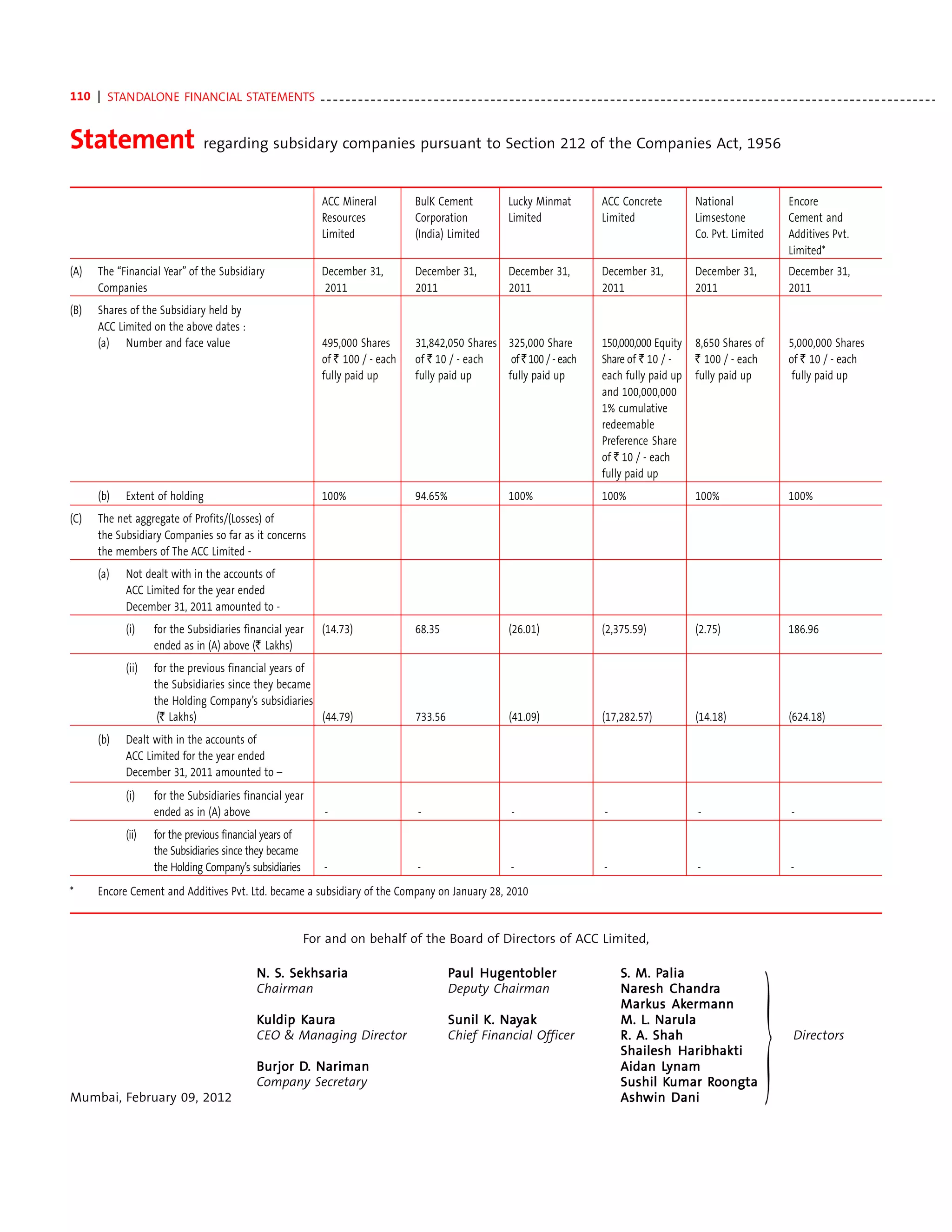

7. Employee Benefits:

Employ

a) Defined Contribution Plans – Amount recognised and included in Schedule 17 “Contributions / Provisions to and for Provident

and Other Funds” of Profit and Loss Account ` 7.63 Crore (Previous Year - ` 7.40 Crore).

b) Defined Benefit Plans – As per actuarial valuation on December 31, 2011

The Company has a defined benefit gratuity and post retirement medical benefit plans as given below:

i. Every employee who has completed minimum five years of service is entitled to gratuity at 15 days salary for each completed year

of service. The scheme is funded with insurance companies in the form of a qualifying insurance policy.

ii. Benefits under Post Employment medical Benefit plans are payable for actual domiciliary treatment / hospitalization for employees

and their specified relatives.

Gratuity Post

Employment

Medical

Benefits(PEMB)

Funded Non Funded

` Crore ` Crore ` Crore

I Expense recognised in the Statement of Profit & Loss for the

rec

ecognised Statemen

tement Profit Loss for

year ended December 31, 2011

1 Current Service cost 6.67 2.21 0.02

5.50 1.60 0.04

2 Interest Cost 8.85 3.21 0.16

6.94 2.15 0.23

3 Employee Contributions - - (0.41)

- - (0.41)

4 Expected return on plan assets (8.90) - -

(7.96) - -

5 Net Actuarial (Gains) / Losses 15.62 7.54 1.13

17.11 10.47 (0.23)

6 Past service cost - - -

- - -

7 Settlement / Curtailment (Gain) - - -

- - -

8 Total expense 22.24 12.96 0.90

21.59 14.22 (0.37)](https://image.slidesharecdn.com/accannualreport2011-121108234301-phpapp01/75/Acc-annual-report-2011-139-2048.jpg)

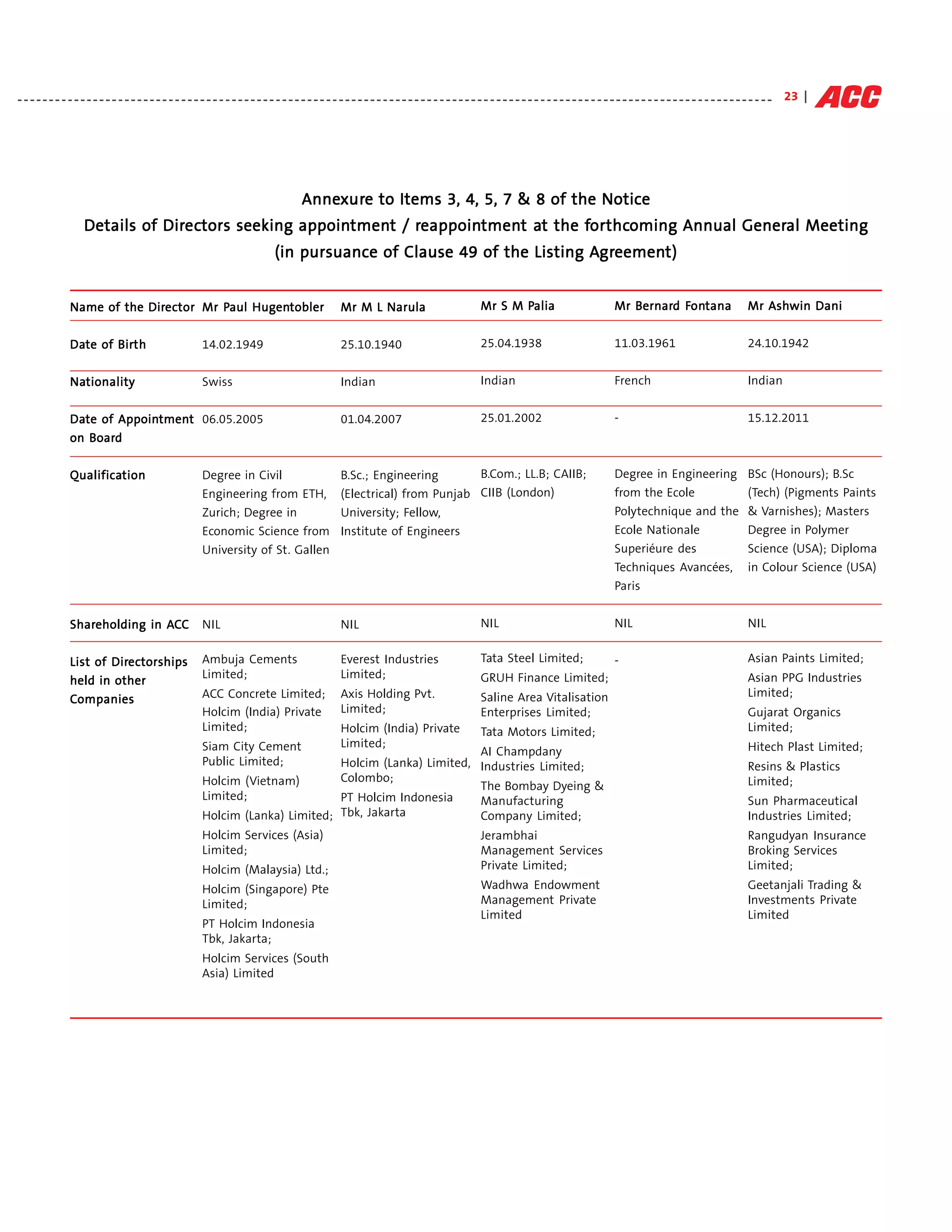

![- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 137 |

Gratuity Post

Employment

Medical

Benefits(PEMB)

Funded Non Funded

` Crore ` Crore ` Crore

II Asset/(Liability) rec

ecognised at

Net Asset/(Liability) recognised in the Balance Sheet as at December 31, 2011

1 Present value of Defined Benefit Obligation (135.82) (52.17) (2.58)

(118.55) (41.90) (2.28)

2 Fair value of plan assets 119.82 - -

104.90 - -

3 Funded status [Surplus / (Deficit)] (16.00) - -

(13.65) - -

4 Net asset / (liability) (16.00) (52.17) (2.58)

(13.65) (41.90) (2.28)

III Obligation

Change in Obligation during the Year ended December 31, 2011

1 Present value of Defined Benefit Obligation at beginning of the year 118.55 41.90 2.28

102.36 31.75 3.61

2 Current Service cost 6.67 2.21 0.02

5.50 1.60 0.04

3 Interest Cost 8.85 3.21 0.16

6.94 2.15 0.23

4 Settlement / Curtailment (Gain) - - -

- - -

5 Past service cost - - -

- - -

6 Employee Contributions - - (0.41)

- - (0.41)

7 Actuarial (Gains) / Losses 16.07 7.54 1.13

17.55 10.47 (0.23)

8 Benefit Payments (14.32) (2.69) (0.60)

(13.80) (4.07) (0.96)

9 Present value of Defined Benefit Obligation at the end of the year 135.82 52.17 2.58

118.55 41.90 2.28

IV Change in Assets during the Year ended December 31, 2011

1 Plan assets at the beginning of the year 104.90 - -

96.50 - -

2 Settlements - - -

- - -

3 Expected return on plan assets 8.90 - -

7.96 - -

4 Contributions by Employer 5.80 - -

- - -

5 Actual benefits paid (0.23) - -

- - -

6 Actuarial Gains / (Losses) 0.45 - -

0.44 - -

7 Plan assets at the end of the year 119.82 - -

104.90 - -

8 Actual return on plan assets 9.25 - -

8.33 - -](https://image.slidesharecdn.com/accannualreport2011-121108234301-phpapp01/75/Acc-annual-report-2011-140-2048.jpg)