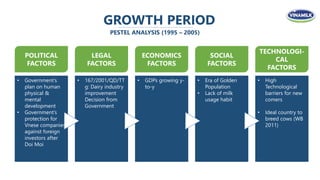

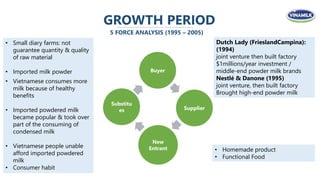

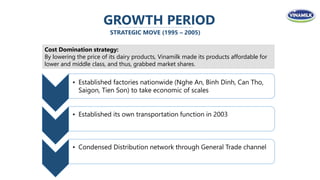

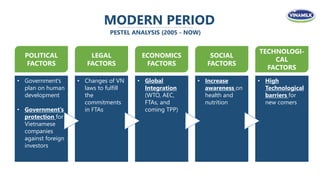

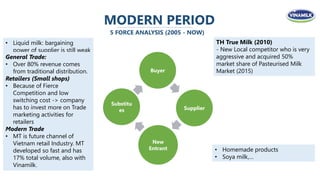

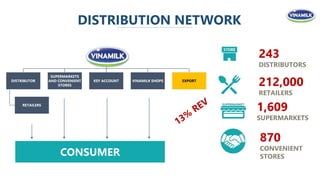

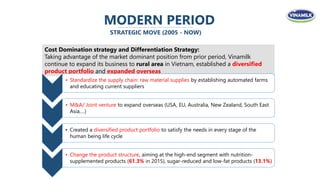

This document summarizes Vinamilk's story of success as Vietnam's largest dairy producer and distributor. It describes Vinamilk's growth from its founding in 1976 through two periods: a growth period from 1995-2005 when it established factories nationwide and expanded distribution to gain market share, and a modern period from 2005 to present when it continued expanding through acquisitions and a diversified product portfolio to target different consumer segments and markets overseas while maintaining its domestic market dominance. The document analyzes Vinamilk's competitive environment and strategies used during each period through PESTEL and Five Forces frameworks.