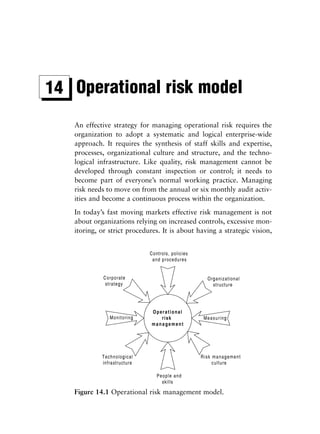

This chapter introduces the book and discusses the importance of managing operational risk in today's financial markets. It notes that globalization, technology advances, and industry consolidation have accelerated changes and increased competitive pressures. Effective risk management, including managing operational risk, is critical for financial institutions to deal with this challenging environment. The chapter traces the development of derivatives markets and risk management practices. It argues that as financial institutions become more integrated, decentralized, and technology-driven, managing operational and other non-market risks on an enterprise-wide basis is fundamental to their successful operations. Recent high-profile losses have highlighted the need to broaden risk management beyond just market and credit risks.

![7 Managing operational risk 101

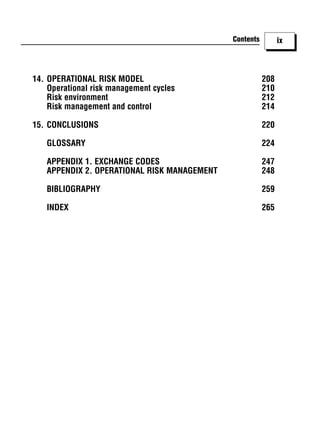

G-30 and Basle Committee reports on risk management

trolling risk should be consistent with the firm’s established poli-

cies and it should be independent of both the trading and admin-

istration functions. This independence should be reflected in the

organizational hierarchy of the institution as well as the firm’s

exposure-reporting system. The 1994 document has become the

definitive word on best practices in risk control for derivatives.

The Basle Committee’s increasing focus on sound internal controls

has resulted in the publication of the Framework for the

Evaluation of Internal Control Systems(1998) report. The

Committee notes,

An analysis of the problems related to the losses [incurred by

several banking organizations] indicates that they could prob-

ably have been avoided had the banks maintained effective

internal control systems. Such systems would have prevented

or enabled earlier detection of the problems that led to the

losses, thereby limiting damage to the banking organization.

The Committee noted that the control breakdowns typically seen

in recent problem bank situations could be grouped into five

broad categories:

1 Lack of adequate management oversight and accountability,

and failure to develop a strong control culture within the bank.

2 Inadequate assessment of the risk of certain banking activities,

whether on- or off-balance sheet.

3 The absence or failure of key control activities, such as segre-

gation of duties, approvals, verifications, reconciliations, and

reviews of operating performance.

4 Inadequate communication of information between levels of

management within the bank, especially in the upward com-

munication of problems.

5 Inadequate or ineffective audit programs and other monitoring

services.](https://image.slidesharecdn.com/a-110106221639-phpapp01/85/A-114-320.jpg)