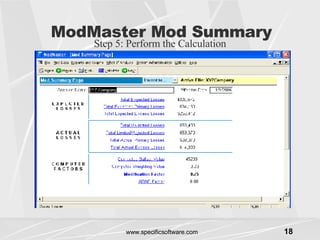

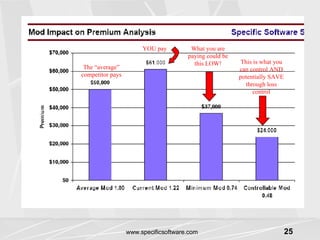

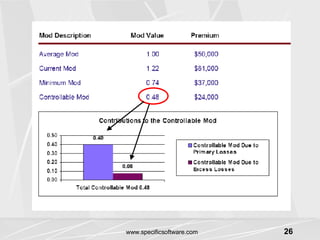

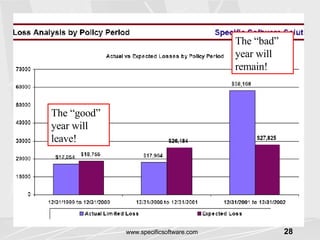

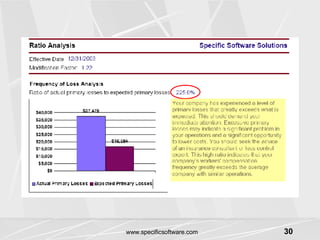

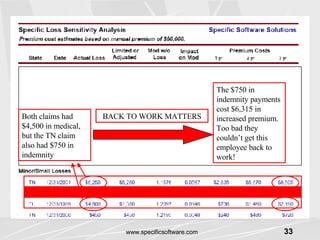

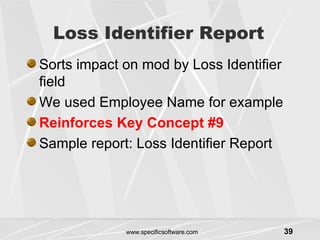

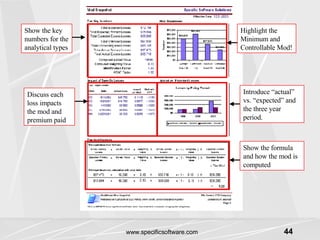

ModMaster is software that helps communicate key concepts of experience rating to clients by calculating workers' compensation modification factors and presenting reports. It makes experience rating easier to understand and anticipate changes. The document outlines nine key concepts of experience rating and how ModMaster can help explain each concept through various reports and analyses. This helps clients better understand how their losses and claims impact premiums.

![Help is available Priority support form on the web www.specificsoftware.com FREE online training videos CLICK ON “SUPPORT” Robust FAQ database Articles & Newsletters Toll free technical support 800-929-4052 x 201 E-mail support [email_address]](https://image.slidesharecdn.com/9-key-concepts2595/85/9-Key-Concepts-46-320.jpg)