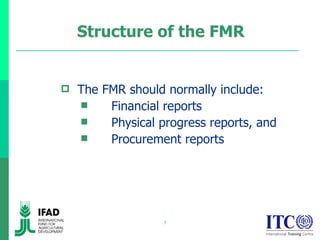

The document discusses Financial Monitoring Reports (FMR) that are required to be submitted to the World Bank Fund by projects receiving financing at regular intervals of no more than 6 months. The FMR provide fiduciary assurance to the Fund and use the borrower's own accounting/reporting systems. They include financial reports showing cash flows, expenditures by activity, physical progress reports linking costs to outputs, and procurement reports on status and performance compared to the plan. Key aspects that can be customized include format, content, frequency and indicators for monitoring progress.